Cannabis Market Outlook:

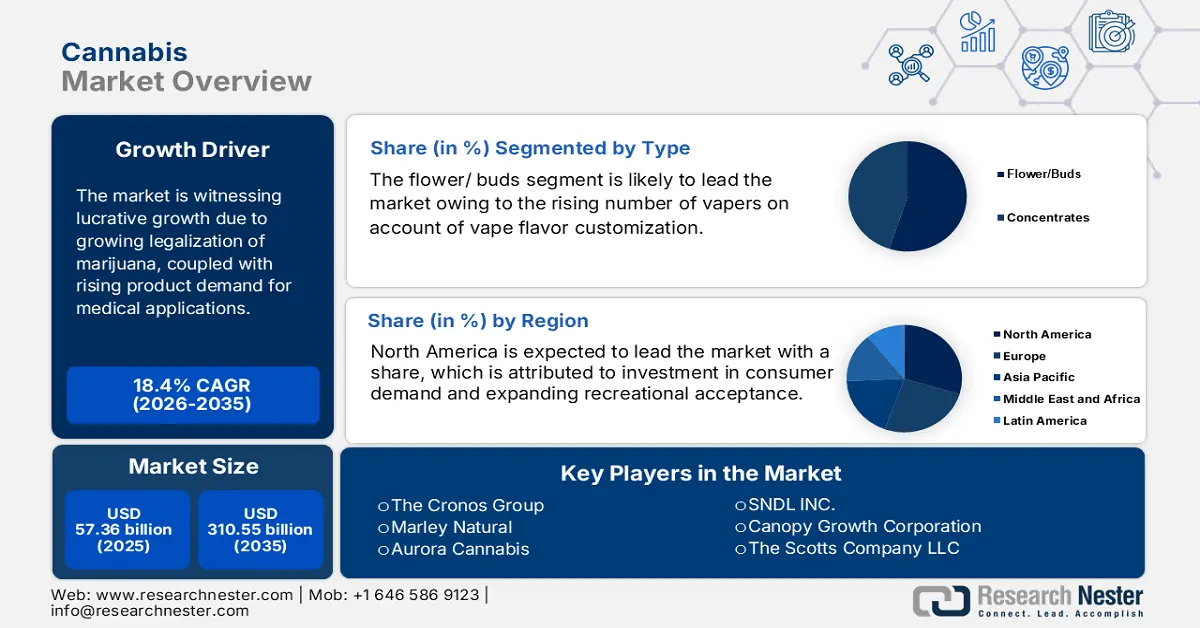

Cannabis Market size was valued at USD 57.36 billion in 2025 and is likely to cross USD 310.55 billion by 2035, expanding at more than 18.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cannabis is assessed at USD 66.86 billion.

This market expansion is encouraged by the growing consumption of drugs across the globe. The last 30 years have seen a steady rise in the use of cannabis since numerous nations and states have taken steps to decriminalize and even fully legalize these drugs.

As per the World Health Organization (WHO), approximately 147 million individuals, or 2.5% of the global population, use cannabis annually, compared to 0.2% who use cocaine and 0.2% who use opiates.

Key Cannabis Market Insights Summary:

Regional Highlights:

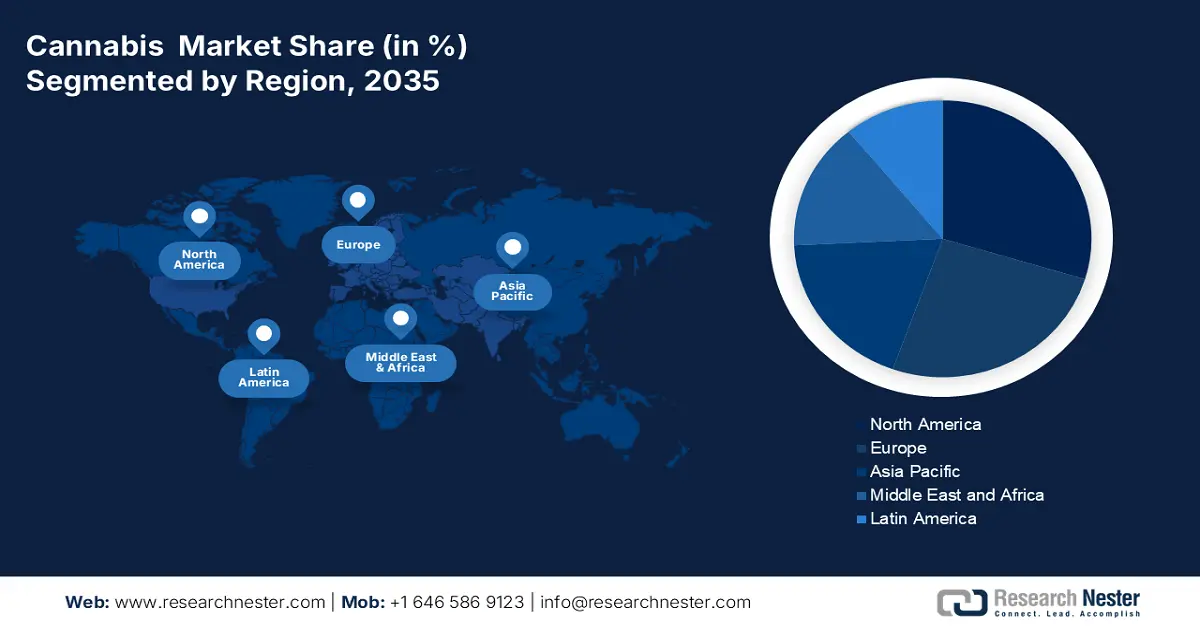

- North America cannabis market will secure over 30% share by 2035, driven by the legalization of recreational drugs and progressive cannabis legislation.

Segment Insights:

- The flower/buds segment in the cannabis market is expected to see significant growth till 2035, fueled by increasing vapers attracted to cannabis flavors.

- The thc-dominant segment in the cannabis market is projected to hold a significant share by 2035, driven by the increasing prevalence of chronic pain.

Key Growth Trends:

- Rising importance of cannabis

- Growing geriatric population

Major Challenges:

- Strict rules and regulations

- Adverse effects

Key Players: The Cronos Group, Marley Natural, Aurora Cannabis, Cara Therapeutics, ARUMA LABS HOLDINGS PTY LIMITED, Medcan Australia, SNDL INC., Canopy Growth Corporation, The Scotts Company LLC, Aphria Inc., VIVO Cannabis Inc.

Global Cannabis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.36 billion

- 2026 Market Size: USD 66.86 billion

- Projected Market Size: USD 310.55 billion by 2035

- Growth Forecasts: 18.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, Netherlands, United Kingdom

- Emerging Countries: United States, Canada, Germany, United Kingdom, Australia

Last updated on : 17 September, 2025

Cannabis Market Growth Drivers and Challenges:

Growth Drivers

- Rising importance of cannabis – Strategies such as health education are being implemented to lessen the stigma attached to medical marijuana, which has increased the usage of cannabis rapidly as stigma has decreased.

- Growing geriatric population - The use of cannabis-derived products is rising among the elderly since it provides comfort from age-related pains and sleeplessness in particular to treat depression and anxiety.

For instance, more than 770 million individuals worldwide were 65 years of age or older in 2022, making up around 9% of the world's population. - Increasing burden of stress-related disorders - Many people, particularly those with social anxiety disorder, dysfunctional families, unfavorable life experiences, and traumatic stress use cannabis to decrease anxiety.

Challenges

- Strict rules and regulations - Cannabis usage for adult or medical purposes is permitted by laws and regulations to close current gaps, promote safe cannabis usage, and lessen negative effects.

The legalization of cannabis for purposes other than medical use is subject to stringent rules and regulations, nonetheless, each state has its regulations, which may impede the market demand. - Adverse effects - Not everyone has a positive experience with marijuana, the body can react to it in a variety of ways.

Short-term effects of cannabis include lightheadedness, altered sensations, and memory impairment, and it can have both immediate and long-term effects, such as changed perception and elevated heart rate.

Marijuana is the illicit substance most commonly linked to impaired driving and has been associated with criminal activity, unemployment, increased need for social assistance, poorer income, and decreased life satisfaction.

Cannabis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.4% |

|

Base Year Market Size (2025) |

USD 57.36 billion |

|

Forecast Year Market Size (2035) |

USD 310.55 billion |

|

Regional Scope |

|

Cannabis Market Segmentation:

Type Segment Analysis

Flower/buds segment is set to dominate around 55% cannabis market share by the end of 2035. The segment growth can be attributed to the rising number of vapers due to enjoyable flavoring in products such as cannabis.

For instance, there were more than 10 million vapers throughout the globe in 2011, and this figure increased to an estimated 86 persons globally in 2023.

Vaping is one of the two ways to inhale cannabis flowers since it has a higher potency than smoking them and is considered a cheap and safe way for senior citizens to take their medication.

To consume cannabis flowers the plant's terpenes and cannabinoids are released into a breathable vapor by slowly heating the dried buds which are then inhaled by using a vaporizer (or vape) as they are easy to use, less damaging to the lungs, and guarantee that the prescription has the most therapeutic effect possible.

Application Segment Analysis

In the coming years, the recreational segment is expected to register the highest CAGR due to an increase in the young population. More than 23% of people on the planet are under the age of 15, and around 9% are older than 65.

Researchers discovered that youth, between the ages of 12 and 20, had a higher likelihood of using cannabis recreationally, and as a coping mechanism.

Cannabis is a recreational drug that is psychotropic and alters the mind as it typically contains both THC and CBD which seems to reduce anxiety, while at higher concentrations, it seems to increase anxiety.

Component Segment Analysis

By the end of 2035, the THC-dominant in the cannabis market segment is predicted to have a significant revenue share. The growing prevalence of chronic pain is the primary driver of the segment's growth. Over 15% of adults worldwide are thought to have pain, and more than 5% receive a new diagnosis of chronic pain each year.

One of the numerous cannabinoids found in the cannabis plant is THC, which is used more often to treat pain and sleep disorders. When pain is severe, THC-dominant therapy is more likely to be advised because it produces a higher level of intoxication and is rated more favorably by patients than CBD-dominant concentrate.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Crop Variety |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cannabis Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate majority revenue share of 30% by 2035. The market growth in the region is also expected on account of the legalization of recreational drugs. North America is one of the most progressive regions in the globe because it established some of the first cannabis legislation for both medical and recreational use.

For instance, more than 70% of Americans reside in a state where marijuana is permitted.

Legalizing cannabis has become a popular movement in the United States, which has increased its consumption.

In 2022, almost 21% of people in the United States reported using cannabis in the previous 12 months.

Moreover, sales of recreational cannabis in Canada totaled more than USD 3 billion in 2023, up from 2022. Besides this, thousands of recreational cannabis retail locations may be found in more than 8 provinces and three territories in Canada, a country of over 35 million people.

European Market Insights

The Europe region will also encounter huge growth for the cannabis market during the forecast period and will hold the second position owing to the increasing consumption of tobacco with cannabis in this region. In Europe, cannabis is often combined with tobacco and smoked to consume a lot of nicotine.

According to a survey in Europe, over 85% of cannabis users smoke it in conjunction with tobacco.

Germany currently has among of the most permissive cannabis legislation in all of Europe, which has led to the creation of private, nonprofit "cannabis clubs" that can cultivate and sell cannabis to their members.

Nowadays, cannabis is allowed for medical use in, Italy, however, there are stringent regulations.

Cannabis Market Players:

- Tilray Brands, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Cronos Group

- Marley Natural

- Aurora Cannabis

- Cara Therapeutics

- ARUMA LABS HOLDINGS PTY LIMITED

- Medcan Australia

- SNDL INC.

- Canopy Growth Corporation

- The Scotts Company LLC

- Aphria Inc.

- VIVO Cannabis Inc.

The cannabis market consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Tilray Brands, Inc. a leading global lifestyle and consumer packaged goods company announced that it has received approval for the first medical cannabis extract, Tilray Oral Solution THC 5 CBD 20, in Portugal which will provide people with specific medical disorders throughout Portugal with new therapy choices, and has also been found to be beneficial in numerous crucial domains of patient care.

- Calmosis a startup introduced medical cannabis products to the Indian market last year to provide doorstep delivery of goods such as oils and extracts for medical use.

- Report ID: 6113

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cannabis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.