Cannabis Extract Market Outlook:

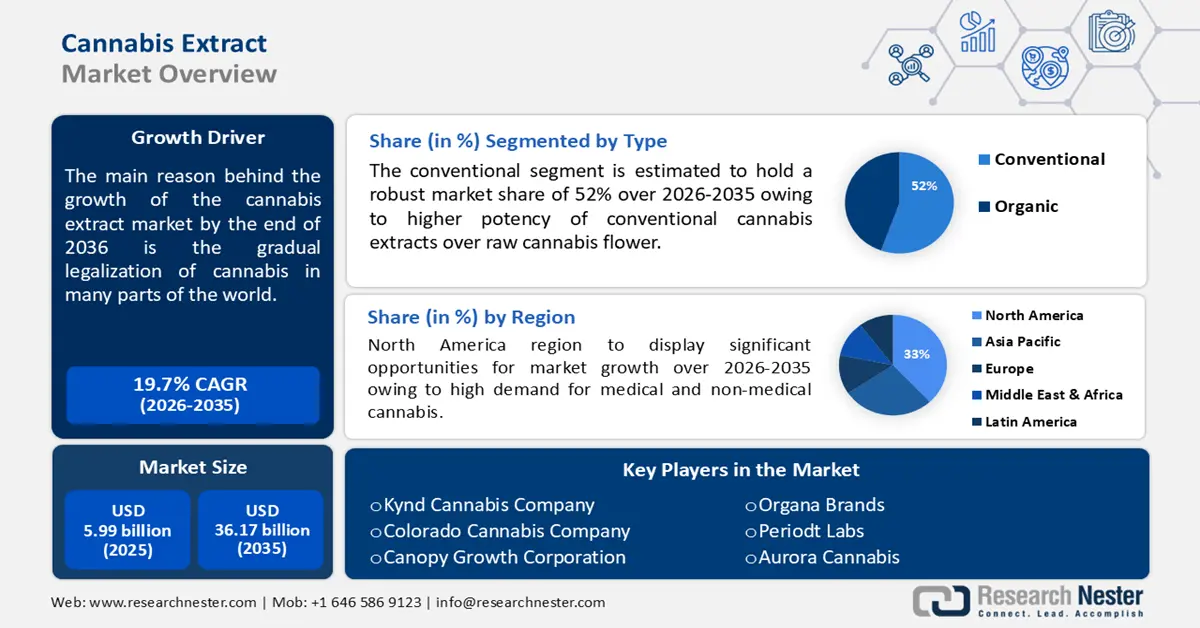

Cannabis Extract Market size was valued at USD 5.99 billion in 2025 and is set to exceed USD 36.17 billion by 2035, registering over 19.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cannabis extract is estimated at USD 7.05 billion.

The growth of the market is driven by the gradual legalization of cannabis in many parts of the world, thereby reducing stigma associated with cannabis use. Many countries are legalizing cannabis to eradicate the illicit procurement, increase tax revenue, lower gang-related drug violence, and enhance overall safety. According to the World Health Organization (WHO) records, about 147 million population consume cannabis products and the number has significantly increased over the years in developed economies including North America, Australia, and Western Europe. This has also resulted in increasing cultivation of cannabis and development of new products, thus opening new avenues for key players.

Key Cannabis Extract Market Insights Summary:

Regional Insights:

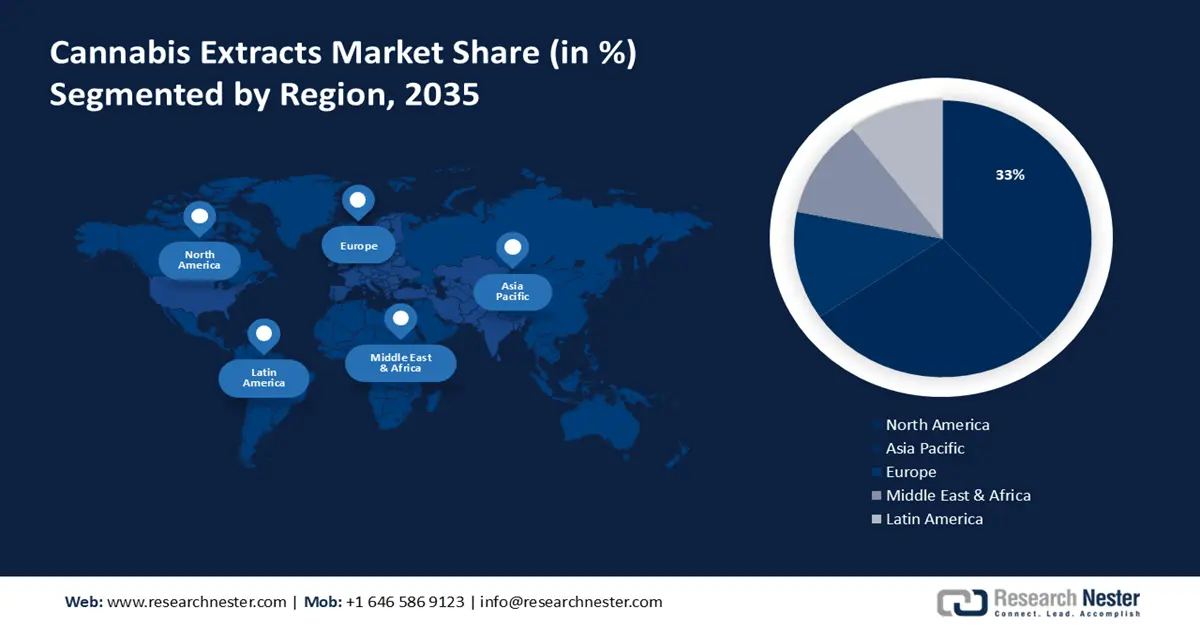

- By 2035, North America is anticipated to secure a 33% share in the cannabis extract market, attributed to escalating demand for medical and recreational cannabis extracts.

- Europe is set to witness a remarkable CAGR through 2026–2035, supported by the expanding cannabis-using population and progressive legalization measures across multiple nations.

Segment Insights:

- The conventional segment is projected to capture nearly 52% share by 2035 in the cannabis extract market, propelled by the stronger and more consistent efficacy of conventional cannabis extracts.

- By 2035, the hospital pharmacies segment is estimated to hold about 51.2% share, underpinned by broader patient access and growing utilization of cannabis-based therapeutics within healthcare settings.

Key Growth Trends:

- Growing Consumer Awareness and Government Support

- Product Innovation and Investments

Major Challenges:

- Stringent Regulatory Norms and Consumer Unawareness

- High Manufacturing Costs

Key Players: Kynd Cannabis Company, Organa Brands, Colorado Cannabis Company, Peridot Labs, Canopy Growth Corporation, Aurora Cannabis, Maricann Inc., Aphria Inc., Tikun Olam, The Cronos Group, Cannabis Science Inc., STENOCARE.

Global Cannabis Extract Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.99 billion

- 2026 Market Size: USD 7.05 billion

- Projected Market Size: USD 36.17 billion by 2035

- Growth Forecasts: 19.7%

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Germany, United Kingdom, Netherlands

- Emerging Countries: Luxembourg, Mexico, Australia, Thailand, Colombia

Last updated on : 1 December, 2025

Cannabis Extract Market - Growth Drivers and Challenges

Growth Drivers:

- Growing Consumer Awareness and Government Support: Individuals across the globe are steadily overcoming social stigma and accepting cannabis due to growing research on cannabis, media coverage, and personal testimonies. Many governments and NGOs are extending help in educating people about benefits of cannabis and responsible consumption. For instance, in September 2022, Governor Lamont announced the launch of education campaign to promote responsible use of cannabis by adults. Many countries are legalizing cannabis for medicinal and recreational use. Cannabis legalization provides an opportunity to keep regulations in place and minimize the potential harms. This has resulted in more number of people opting for cannabis extracts, thereby increasing the global demand.

Cannabis extracts enable effective and targeted delivery of specific cannabinoids that help in providing instant relief for several medical conditions. This has also encouraged healthcare professionals to use cannabis therapy. According to an article published in National Library of Medicine (NIH), many research groups and pharmaceutical companies are working on improving cannabinoid bioavailability and establish its therapeutic efficacy and dose range. - Product Innovation and Investments: Many leading companies and cannabis product manufacturers are heavily investing in R&D activities to develop novel formulations of cannabis extracts and products such as tinctures, oils, edibles, and even topical ointments to cater to the rising consumer demand. Some companies are also partnering with wellness firms and pharmaceutical companies to launch new products and expand their production capacities. For instance, in December 2023, GUNKUL partnered with DOD BioTech Public Company and Pacific Cannovation Group (PACCAN) to strengthen its position in the cannabis and hemp industry. Another instance where Blue Sky Hemp Ventures Ltd, acquired True North, a Canadian hemp-based CBD product company in 2022 as its technology aligns with Blue Sky’s focus on utilizing whole plant for hemp foods and extracts.

Challenges:

- Stringent Regulatory Norms and Consumer Unawareness- Consumption of cannabis for recreational or medical use is still illegal in many developing economies. This can lower the sales of cannabis extract and hamper overall market growth going ahead. Along with this, many consumers are unaware of various types of extracts available which can alter purchasing behaviour and market growth.

- High Manufacturing Costs: Manufacturing of cannabis extracts is expensive as it requires advanced extraction facilities and high-quality cannabis. Moreover, there is dearth of skilled labor capable of handling the equipment effectively. This can result in low-quality production and affect the market growth.

Cannabis Extract Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.7% |

|

Base Year Market Size (2025) |

USD 5.99 billion |

|

Forecast Year Market Size (2035) |

USD 36.17 billion |

|

Regional Scope |

|

Cannabis Extract Market Segmentation:

Type Segment Analysis

Conventional segment is estimated to account for around 52% cannabis extract market share by 2035, due to higher potency of conventional cannabis extracts in comparison with raw cannabis flower. This particular property makes them more effective for both recreational and medical use, providing stronger and consistent effects. Conventional cannabis extracts are widely used to manage medical chronic conditions and are preferred due to fewer doses.

Application Segment Analysis

The pharmaceutical segment in cannabis extract market is expected to hold significant revenue share throughout the forecast period. Cannabis products and extracts such as CBD and THC are widely used in treatment of chronic pain, multiple sclerosis, epilepsy, and anxiety. Epidiolex, Marinol, Cesmate and Syndros are some of the commonly used drugs approved by the U.S. FDA. In addition to this, many companies are investing in R&D projects to launch new and effective drugs. For instance, in March 2024 Sanctuary Medicinals partnered with Real Isolates to utilize its patented Smokenol cannabis extraction process to infuse in certain Sanctuary products.

Distribution Channels (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)

By 2035, hospital pharmacies segment is projected to account for around 51.2% cannabis extract market share, due to direct access to a larger patient base. Growing hospital admissions have enabled hospital pharmacies to promote and dispense more products. These pharmacies contain prescription medicines and vaporizers that contain THC, CBD or psychoactive substances found in cannabis. Factors such as rising patient base, high usage of cannabis in healthcare and hospitals, and government permits to dispense cannabis in many developed economies are expected to drive segment revenue growth over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Extraction Method |

|

|

Application |

|

|

Distribution Channels |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cannabis Extract Market - Regional Analysis

North America Market Insights

North America industry is likely to account for largest revenue share of 33% by 2035, due to high demand for cannabis extracts for recreational and medical purposes. legalization of recreational and medical cannabis across various states in the U.S. and nationwide in Canada. As of January 2021, 36 states and District of Columbia (DC) have legalized medical cannabis usage while 14 states and DC have legalized recreational cannabis.

Moreover, there is a growing research on use of cannabis extracts for treating medical conditions such as chronic pain, anxiety, epilepsy, multiple sclerosis as well as cancer. Healthcare institutes and leading companies are working together to develop and launch these products. This has also resulted in increasing demand for cannabis extracts. For instance, in June 2024, Prodigy Processing Solutions partnered with Refined Processes LLC to stablish first-of a kind GMP-complaint medical cannabis extraction facility in the US while Naturae expanded their brand and product base in 2023 with the launch of Jumbodose. Jumbodose is a full-spectrum cannabis oil tinctures line available in different varieties to induce distinct cognitive effects.

The United States has some of the largest cannabis companies along with 15,000 cannabis dispensaries. The sales of cannabis extracts in Canada have rapidly increased in the recent past due to high demand for recreational and medical cannabis. In October 2018, Canada become the second country after Uruguay to legalize cannabis for recreational use and the first major industrialized country to provide legal and regulated cannabis for non-medicinal purposes.

Europe Market Insights

The Europe cannabis extract market is expected to register a staggering CAGR over the forecast period due to rising number of cannabis users. According to a recent survey by European Union Drugs Agency 2024, cannabis use among EU population between 15 to 34 years is at 15%. Legalization of cannabis is another important factor, driving market growth in Europe. In July 2023, the government of Luxembourg legalized use of marijuana in private and permitted home is growing, while in February 2024, Germany legalized home growing of cannabis and non-profit cannabis growing clubs. This has also resulted in increasing number of licensed cultivators.

Other factors such as increasing aging population, growing awareness about its potential benefits, and expanding medical applications of cannabis extracts are expected to drive market growth in Europe going ahead.

Cannabis Extract Market Players:

- Kynd Cannabis Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Organa Brands

- Colorado Cannabis Company

- Peridot Labs

- Canopy Growth Corporation

- Aurora Cannabis

- Maricann Inc.

- Aphria Inc.

- Tikun Olam

- The Cronos Group

- Glow LifeTech Corp

- Cannabis Science Inc.

- STENOCARE

The global cannabis extract market is quiet competitive, comprising key players operating at global and regional levels. As there is steady legalization of cannabis in certain countries, manufacturers are inclining towards partnering for cultivation, extraction and distribution of cannabis extracts. These companies are focused on expanding their product base and strengthening their positing in the market by adopting several strategies such as collaborations, joint ventures, partnerships, and product launches.

Some of the key players in the market include:

Recent Developments

- In May 2024, STENOCARE announced the launch of its innovative next-generation medical cannabis product 6 months ahead of schedule. The product is a cannabis oil featuring a patented oil technology, enhancing the bioavailability of the active ingredients present.

- In Aug 2023, Glow LifeTech Corp, received the first product listing and initial purchase orders for its newly launched MOD THC Berry drops from Ontario Cannabis Store. MOD THC Berry drops are naturally flavored water-soluble drops prepared using Glow’s proprietary MyCell Technology.

- Report ID: 6278

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cannabis Extract Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.