Cancer Biopsy Market Outlook:

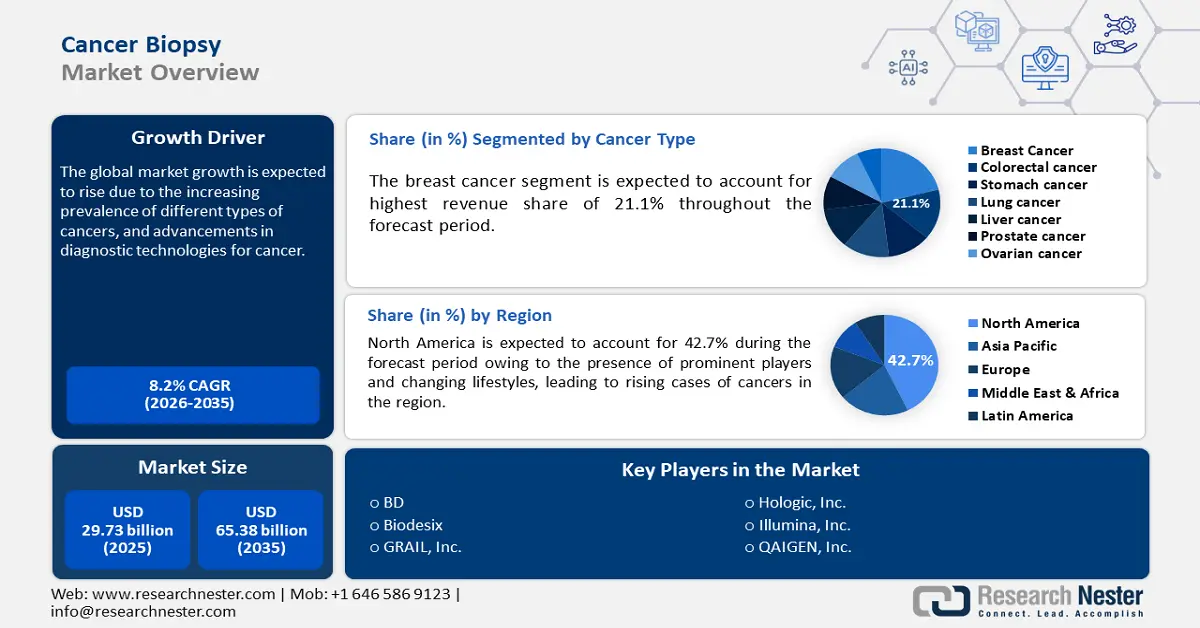

Cancer Biopsy Market size was over USD 29.73 billion in 2025 and is poised to exceed USD 65.38 billion by 2035, witnessing over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cancer biopsy is estimated at USD 31.92 billion.

Key drivers include increasing demand for minimally invasive procedures, the development of liquid biopsies, and the integration of molecular diagnostics that enable personalized treatment plans. Factors such as growing awareness of early cancer detection and supportive government initiatives for cancer screening are further fueling the market expansion.

For instance, as per the U.S. Embassy and Consulates, in September 2024, the U.S. Australia, India, and Japan announced the launch of the Quad Cancer Moonshot to strengthen the overall cancer care ecosystem in the Indo-Pacific. It aims to improve health infrastructure, expand research collaborations, build data systems, and provide greater support for the prevention, detection, treatment, and post-treatment care of cancer. As per the National Cancer Institute, new cancer cases per year are projected to reach 29.9 million, leading to 15.3 million cancer-related deaths, worldwide. Owing to these rising cases and advancements in therapies, the global cancer biopsy market is projected to witness a significant rise during the forecast period.

Key Cancer Biopsy Market Insights Summary:

Regional Highlights:

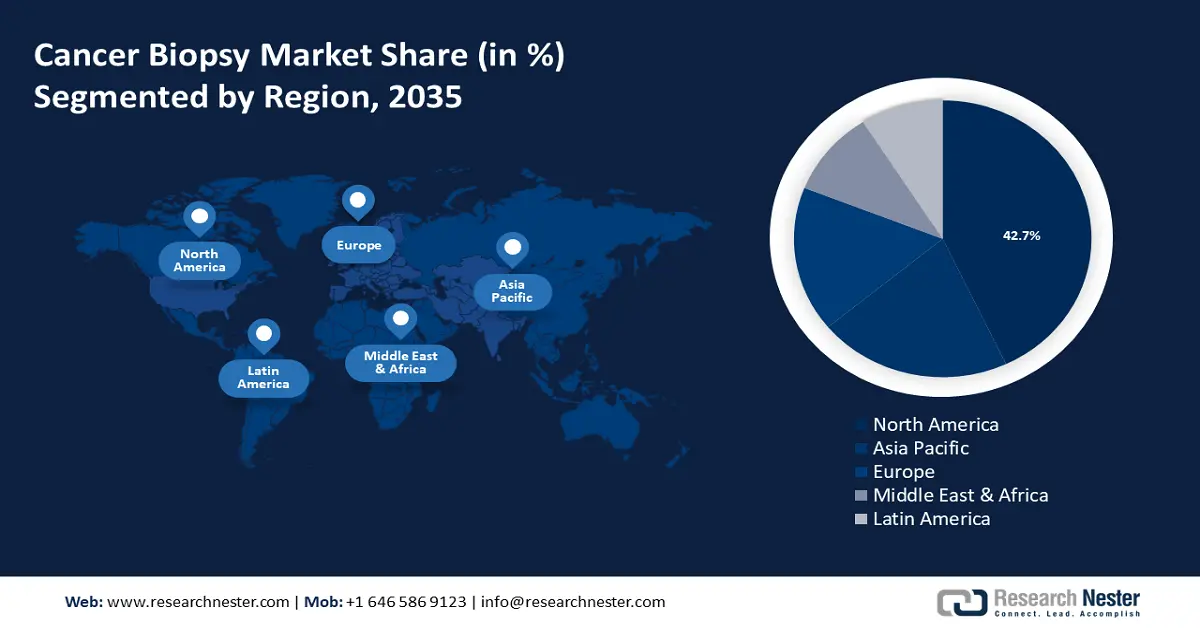

- North America leads the Cancer Biopsy Market with a 42.7% share, supported by the presence of leading players and ongoing acquisitions to expand capabilities in cancer diagnostics and treatments, ensuring growth through 2035.

- The APAC region is projected to witness significant growth in the Cancer Biopsy Market from 2026 to 2035, driven by increasing cancer cases, government screening initiatives, and the expansion of private healthcare facilities in APAC.

Segment Insights:

- The Breast Cancer segment is poised for substantial growth from 2026-2035, driven by the increasing incidence of breast cancer, especially among women.

Key Growth Trends:

- Advancements in liquid biopsy

- Expansion of research and development

Major Challenges:

- Risk of complications from invasive procedures

- Strict regulatory requirements

- Key Players: BD (Becton, Dickinson and Company), Biodesix (Integrated Diagnostics), Chronix Biomedical, Inc. (Oncocyte Corporation).

Global Cancer Biopsy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.73 billion

- 2026 Market Size: USD 31.92 billion

- Projected Market Size: USD 65.38 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Cancer Biopsy Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in liquid biopsy: These advances in cancer biopsy market enable circulating tumor DNA, RNA, and other biomarkers detection from a simple blood sample, allowing early cancer diagnosis, real-time monitoring of treatment response, and detection of minimal residual disease. Innovations in liquid biopsy techniques, such as improved sensitivity and the ability to identify a wide range of genetic mutations, have expanded their applications across multiple cancer types. For instance, in June 2023, Labcorp announced the launch of Labcorp Plasma Focus, which is a new liquid biopsy test enabling targeted therapy selection for patients with advanced or metastatic solid tumors. This test allows oncologists to evaluate circulating cell-free DNA released by tumor cells for better care management.

-

Expansion of research and development: R&D in the cancer biopsy market is accelerating the development of innovative diagnostic techniques and enhancing the accuracy and efficiency of cancer detection. Ongoing investments in molecular diagnostics, liquid biopsy technologies, and genetic profiling, R&D efforts are enabling the identification of specific cancer biomarkers. It also enables the identification of cancer mutations for targeted therapies and personalized treatment plans. In October 2023, UCLA Jonsson Comprehensive Cancer Center and the UCLA School of Dentistry received a five-year $4.6 million grant from the National Cancer Institute. The grant aimed to help develop and advance liquid biopsy technologies for early detection of lung cancer, which is the leading cause of cancer death in the U.S. for both men and women.

Challenges

-

Risk of complications from invasive procedures: Traditional tissue biopsies can lead to potential side effects such as bleeding, infection, and tissue damage. These risks can deter patients from undergoing biopsy procedures, especially when tumors are located in hard-to-reach or sensitive areas. The possibility of complications can also increase healthcare costs due to the need for additional care or interventions. This may further lead some clinicians to opt for less invasive diagnostic alternatives, potentially impacting the demand for conventional biopsy methods, impacting the cancer biopsy market growth.

-

Strict regulatory requirements: This further adds another level of complexity to the cancer biopsy market as companies must navigate rigorous approval processes to bring new biopsy techniques and products to the market. These requirements can vary significantly across regions, leading to delays in commercialization and added costs associated with compliance and clinical validation. The need to demonstrate safety, efficacy, and reproducibility for novel biopsy methods, such as liquid biopsies can also present barriers to adoption. This further slows down the introduction of innovative technologies that could otherwise enhance cancer diagnosis and treatment.

Cancer Biopsy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 29.73 billion |

|

Forecast Year Market Size (2035) |

USD 65.38 billion |

|

Regional Scope |

|

Cancer Biopsy Market Segmentation:

Cancer Type (Breast, Colorectal, Stomach, Lung, Liver, Prostrate, Ovarian, And Other Cancer Types)

In cancer type, the breast cancer segment in the cancer biopsy market is projected to register the highest share of 21.1% by the end of 2035. According to the American Cancer Society, 310,720 new cases of invasive breast cancer are projected to be diagnosed in women in 2024, causing as many as 42,250 deaths, among women. It further predicts that nearly 2,790 men will also be diagnosed with breast cancer by the end of 2024, registering approximately 530 deaths from the disease. Owing to the rising amount of breast cancers especially among women, the segment is anticipated to garner the highest growth rate in the upcoming years, in the cancer biopsy market.

End user (Hospitals, Cancer Research Centers, Diagnostic Centers, and Research and Academics)

Hospitals are projected to dominate the end user segment primarily due to their comprehensive healthcare services and advanced diagnostic capabilities. The hospitals are equipped with state-of-the-art imaging and laboratory facilities, facilitating a wide range of biopsy procedures, including surgical and minimally invasive techniques. The increasing number of cancer cases and the need for timely diagnosis and treatment further strengthen hospital’s positions as primary providers of biopsy services. As healthcare continues to evolve, hospitals are likely to remain at the forefront of the cancer biopsy market.

Our in-depth analysis of the cancer biopsy market includes the following segments:

|

Biopsy Type |

|

|

Products & Services |

|

|

Cancer Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cancer Biopsy Market Regional Analysis:

APAC Market Statistics

North America industry is anticipated to hold largest revenue share of 42.7% by 2035. Cervical cancer remains to be one of the most commonly diagnosed cancers worldwide even though it is highly preventable. It is referred to as a disease of inequity with a very low screening coverage of 4% in the Western Pacific and 18% in Southeast Asia, which is far below the WHO recommendation of 70% screening coverage of eligible women. These factors are projected to boost the Asia Pacific cancer biopsy market growth during the forecast period.

Increasing government cancer screening initiatives, growth of private healthcare facilities with advanced diagnostic technologies, and rising medical tourism are some of the driving factors for the India cancer biopsy market. In February 2024, Continental Hospitals announced the launch of the Early Detection Liquid Biopsy Test. The test provides capabilities of early detection, personalized care recommendations, and hands-on health management strategies based on a person’s genetic profile.

China cancer biopsy market is expanding significantly driven by the rising prevalence of multiple cancer types and a growing emphasis on early detection. As per the National Library of Medicine article published in March 2022, there were over 4 million cancer cases in China in 2022. These rising cases are expected to boost the cancer biopsy market in China during the forecast period. Additionally, China’s burgeoning biotech sector is accelerating the development of innovative biopsy techniques, catering to the demand for personalized cancer therapies.

North America Market Analysis

North America cancer biopsy market is boosted by the presence of prominent players in the region. These players engage in several competitive strategies to meet the rising demand for advanced therapies. In June 2023, Quest Diagnostics announced the completion of the Haystack Oncology acquisition. Quest aims to incorporate Haystack’s MRD technology into the development of new blood-based clinical lab services for solid tumor cancers. Market activities such as these are projected to further drive the industry’s growth significantly in the region.

As per an article by the National Cancer Institute, an estimated of over 2 million new cases of cancer will be diagnosed in the United States, causing nearly 611,720 deaths from the disease, in U.S. Companies headquartered in the country are also participating in several acquisitions and collaborations, to maintain competition in the market. For instance, Agilent Technologies, Inc. announced the acquisition of Resolution Bioscience, aiming to expand Agilant’s capabilities in NGS-based cancer diagnostics and serve the fast-growing precision medicine market requirements.

According to an article by the Canadian Cancer Society, cancer-related deaths are expected to rise from 86,700 in 2023 to 88,100 in 2024 in Canada. The rising cancer cases, growing demand for personalized medicines, and advanced healthcare system are boosting the cancer biopsy market growth in the country. Furthermore, significant investments in R&D activities in the country are also promoting various developments in terms of advanced treatment therapies. Strong governmental support is another factor boosting the industry’s growth.

Key Cancer Biopsy Market Players:

- ANGLE plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BD (Becton, Dickinson and Company)

- Biodesix (Integrated Diagnostics)

- Chronix Biomedical, Inc (Oncocyte Corporation )

- Devicor Medical Products, Inc.

- GRAIL, Inc.

- Hologic, Inc.

- Illumina, Inc.

- IZI Medical Products

- Lucence Health Inc.

- Myriad Genetics, Inc.

- Oncimmune Holdings PLC

- Personal Genome Diagnostics Inc.

- QIAGEN N.V.

Companies are adopting a wide range of strategies to remain competitive in the market. This includes development and innovations, majorly in tissue biopsies, liquid biopsies, and advanced molecular diagnostics. For instance, in September 2023, Mermaid Medical launched M∙Biopsy semi-automatic and fully automatic biopsy needles, for soft tissue biopsy solutions. Collaborations and partnerships with research institutions, diagnostic labs, and pharmaceutical companies are also common, allowing firms to expand their technological capabilities. Regulatory approvals are also explored strategically by these prominent players for obtaining certifications and meeting global standards.

Some of the prominent players in the market include:

Recent Developments

- In September 2024, Strand Life Sciences announced the launch Somatic Advantage 74 Liquid Biopsy (SA74 LB) Test that detects circulating tumor DNA in cancer patients’ blood samples. The test offers a comprehensive analysis of 74 clinically relevant genes, providing invaluable insights for cancer treatment.

- In November 2023, Illumina Inc. announced the launch of a new generation of its distributed liquid biopsy assay for genomic profiling, TruSight Oncology 500 ctDNA v2. It enables noninvasive comprehensive genomic profiling (CGP) of circulating tumor DNA from blood in the absence of tissue testing.

- In March 2023, Pfizer announced the acquisition of Seagen for a total enterprise value of approximately $43 billion intending to enhance Pfizer’s position as a leading company in Oncology.

- Report ID: 6572

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cancer Biopsy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.