Burn Care Centers Market Outlook:

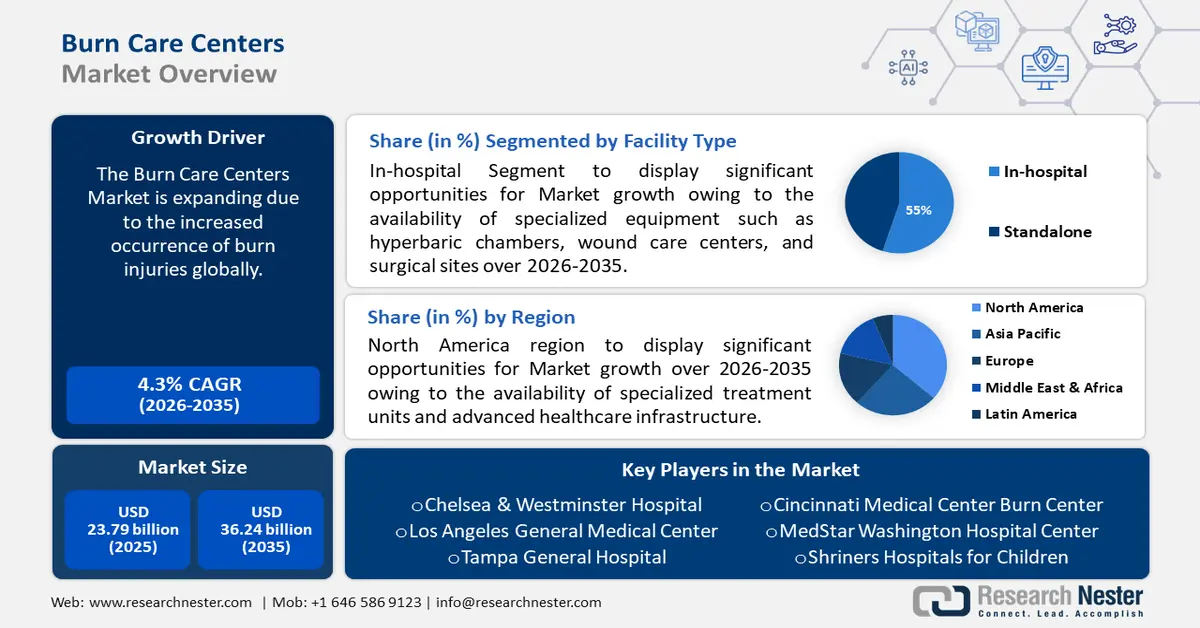

Burn Care Centers Market size was valued at USD 23.79 billion in 2025 and is expected to reach USD 36.24 billion by 2035, expanding at around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of burn care centers is evaluated at USD 24.71 billion.

The market is anticipated to be led by the increased occurrence of burn injuries globally. According to the World Health Organization, burns are a global public health issue, causing an estimated 180,000 fatalities per year. The major number of these cases occur in low- and middle-income countries, with over two-thirds occurring in the WHO African and South-East Asia regions.

Key Burn Care Centers Market Insights Summary:

Regional Highlights:

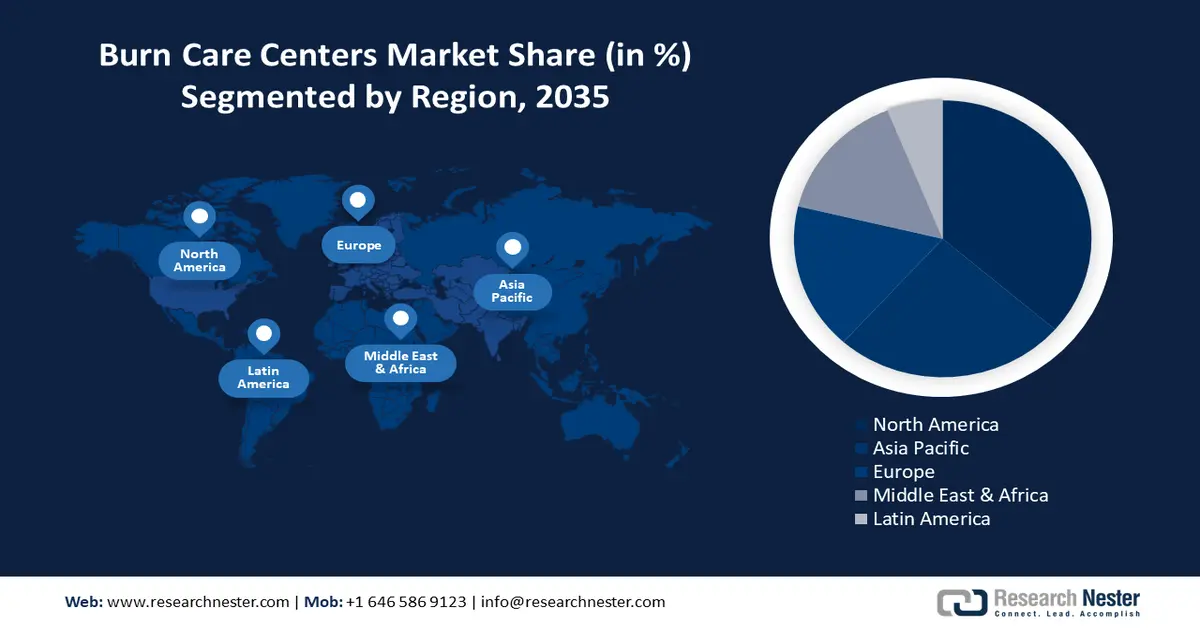

- North America burn care centers market will hold more than 43% share by 2035, driven by the availability of specialized treatment units and advanced healthcare infrastructure.

- Asia Pacific market will achieve significant CAGR during 2026-2035, driven by increasing number of burn patients and rising demand for specialty care.

Segment Insights:

- The in-hospital segment in the burn care centers market is expected to see substantial growth till 2035, driven by the availability of specialized burn treatment equipment and referral networks.

- The thermal segment in the burn care centers market is anticipated to witness notable growth till 2035, influenced by a significant surge in thermal burn incidences globally.

Key Growth Trends:

- Growing awareness regarding cosmetic and reconstructive surgeries

- Increased adoption of advanced wound care

Major Challenges:

- Higher cost of the treatment

- Stringent regulatory laws

Key Players: Chelsea & Westminster Hospital, Lac+Usc Medical Burn Center, Tampa General Hospital, Cincinnati Medical Center Burn Center, Burn and Reconstructive Centers of America, Lehigh Valley Health Network Regional Burn Center, Medstar Washington Hospital Center, Pediatric Burn Care Center, St. Barnabas Burn Center, The Grossman Burn Center.

Global Burn Care Centers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.79 billion

- 2026 Market Size: USD 24.71 billion

- Projected Market Size: USD 36.24 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Burn Care Centers Market Growth Drivers and Challenges:

Growth Drivers

-

Growing awareness regarding cosmetic and reconstructive surgeries - Patients are more proactive in obtaining specialized care and recognize the possible benefits of surgical interventions for improving look and function. Burn care centers that educate patients on treatment alternatives and provide personalized care plans are more likely to attract and keep patients in this competitive market.

Furthermore, as disposable income and healthcare expenditure rise, so does the desire for better and more efficient burn care therapies. According to a report, despite making up only 16% of the world's population, high-income countries spend 78% of their healthcare budget. -

Increased adoption of advanced wound care - The growing adoption of innovative wound care technology, such as bioactive and antimicrobial burn wood dressings, is a significant advancement in the burn treatment business, leading to expansion of burn care centers market. These products are intended to accelerate healing and prevent infection. For instance, in August 2023 Missouri S&T researchers are developing novel 3D-printed hydrogel bandages to help patients with second-degree burns heal faster and more effectively.

The researchers designed bandages with bioactive ingredients to better address the challenges that patients with burn injuries frequently experience. In addition, there is a growing interest in using natural and organic burn treatment solutions. These are more dependable and efficient than their synthetic counterparts. -

Growing geriatric population worldwide - Due to variables like reduced mobility, diminished sensory awareness, and medical issues needing sophisticated treatments, the elderly population is more vulnerable to burn injuries. Elderly people are more likely to sustain electrical burns from malfunctioning appliances, scald burns from hot liquids, and flame burns from culinary mishaps.

According to research led by the National Institute of Health, over the past ten years, there has been a 2.97% increase in the rate of burn injuries among older persons, with one in eight adult burn cases being above the age of 65. This high occurrence is predicted to result in increased growth of market.

Challenges

-

Higher cost of the treatment - The high expense of burn treatment is a significant barrier to the global burn care centers market. The cost of burn care can be high, especially in cases with serious burns that need prolonged medical care and rehabilitation. Access to sophisticated burn care may be hampered by the cost burden on individuals and healthcare systems, particularly in areas with scarce medical resources

-

Stringent regulatory laws - Strict laws, which differ from place to place, can make it difficult for market participants to comply, get product approvals, and maintain safety standards. Managing intricate regulatory environments may cause delays in product releases, which would impede the timely adoption of cutting-edge burn care technology and procedures.

Burn Care Centers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 23.79 billion |

|

Forecast Year Market Size (2035) |

USD 36.24 billion |

|

Regional Scope |

|

Burn Care Centers Market Segmentation:

Facility Type Segment Analysis

In-hospital segment is poised to hold burn care centers market share of more than 55% by 2035. The segment growth can be attributed to the availability of specialized equipment such as hyperbaric chambers, wound care centers, and surgical sites. Additionally, hospitals maintain close ties with suppliers and producers of burn treatment products. They can now access modern goods and technologies and negotiate advantageous prices. Furthermore, referral networks between emergency services and other healthcare practitioners are frequently created in hospitals.

Therapy Type Segment Analysis

Surgeries segment in the burn care centers market is predicted to register lucrative CAGR till 2035. The segment is growing because surgical interventions can enhance the healing process. Burn care facilities with advanced surgical capabilities and skilled plastic surgeons can offer various surgical treatments customized to meet the specific requirements of each patient, making these surgeries a crucial aspect of burn care. For patients with serious burns, burn care institutions that specialize in surgical treatments excel at precisely and successfully excising wounds and placing skin grafts.

Burn Type Segment Analysis

In burn care centers market, thermal segment is estimated to dominate revenue share of around 40% by the end of 2035. The segment growth can be credited to the significant surge in thermal burn incidences globally. According to the National Institute of Health, the majority of burn injuries, accounting for around 86% of patients in need of burn center admission, are thermal burns.

Furthermore, thermal burns are frequently linked to serious tissue damage and systemic side effects, especially in situations of deep or extensive burns. Thermal burns continue to dominate the market because burn care clinics that are capable of handling complex cases of thermal burns draw patients looking for all-encompassing treatment choices.

Our in-depth analysis of the global market includes the following segments:

|

Facility Type |

|

|

Therapy Type |

|

|

Burn Type |

|

|

Burn Severity |

|

|

Service Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Burn Care Centers Market Regional Analysis:

North America Market Insights

North America industry is likely to dominate majority revenue share of 43% by 2035. The growth is driven by several factors including the availability of specialized treatment units and advanced healthcare infrastructure. The expansion of the burn care center industry in this region is also dependent on the reimbursement rules in the region. The availability of top-notch care, particularly in wound care, alternatives for reconstructive and cosmetic surgery, rehabilitation, and post-healing are some of the drivers driving the market's overall expansion.

The United States market is expanding as more people become aware of how critical it is to treat burns quickly and effectively. For burn care, Americans are also embracing telemedicine and telehealth alternatives. According to the Centers for Disease Control and Prevention, the use of telemedicine rose with age and was more common in women (42.0%) than in men (31.7%) in the US. This is probably going to help the market expand in the next years.

Prominent burn facilities in Canada are at the forefront of clinical research and technology development, advancing burn care therapies and enhancing patient outcomes. For instance, in July 2022, a burn surgeon who wanted to heal patients with severe burns using stem cells and 3D-printed skin became a professor of surgery at McMaster University. To create a new burn research program inside the Thrombosis and Atherosclerosis Research Institute at McMaster and HHS, McMaster worked with HHS.

APAC Market Insights

APAC burn care centers market is estimated to showcase significant growth rate through 2035, owing to the increasing number of burn patients. The market in this region is expanding largely due to an increase in the demand for specialty care. The market for burn treatment facilities is expanding as a result of rising healthcare costs.

The Chinese government has launched a number of programs to support burn treatment and prevention in various nations. For instance, under a UN proposal, China's MEBO International inaugurated a program in Egypt on Tuesday to assist Egyptian hospitals in treating burn patients who are women and children. In addition to government initiatives, the middle class in China is becoming more affluent, which has increased demand for premium burn care products. As a result, there are now more private healthcare facilities across the country providing specialized burn treatment goods and services.

Japanese burn hospitals are renowned for their superior acute burn care, skill in surgery, and specially designed rehabilitation plans for burn patients. The widespread adoption of minimally invasive surgical techniques is impacting the demand in the region.

Burn Care Centers Market Players:

- Chelsea & Westminster Hospital

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Los Angeles General Medical Center

- Tampa General Hospital

- Cincinnati Medical Center Burn Center

- Burn and Reconstructive Centers of America

- Lehigh Valley Health Network Regional Burn Center

- MedStar Washington Hospital Center

- Shriners Hospitals for Children

- Massachusetts General Hospital

- The Grossman Burn Center

Better wound care and dressing alternatives for patients are two ways that specialized care facilities and treatment units are always improving patient care and helping patients heal more quickly. Competing considerations among market players include treatment quality, innovation, customer service, regulatory compliance, and price tactics. These facilities set the bar for patient outcomes with their innovative technologies, multidisciplinary care teams, and specialty therapies.

Recent Developments

- Tampa General Hospital (TGH), the primary teaching hospital for the USF Health Morsani College of Medicine and the only Level I trauma center in west central Florida has announced the opening of its newly renovated regional Burn Center, which includes a connected, specialized Burn Intensive Care Unit (ICU) for critically ill burn patients.

- UC Health's University of Cincinnati Medical Center Burn Center has received coveted American Burn Association (ABA) recognition, confirming its status as the region's leading adult burn center. The ABA verification is a rigorous procedure that assesses burn centers based on a wide range of criteria, including medical staff experience, cutting-edge infrastructure, and evidence-based practice implementation.

- Report ID: 6212

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Burn Care Centers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.