Brain Monitoring Market Outlook:

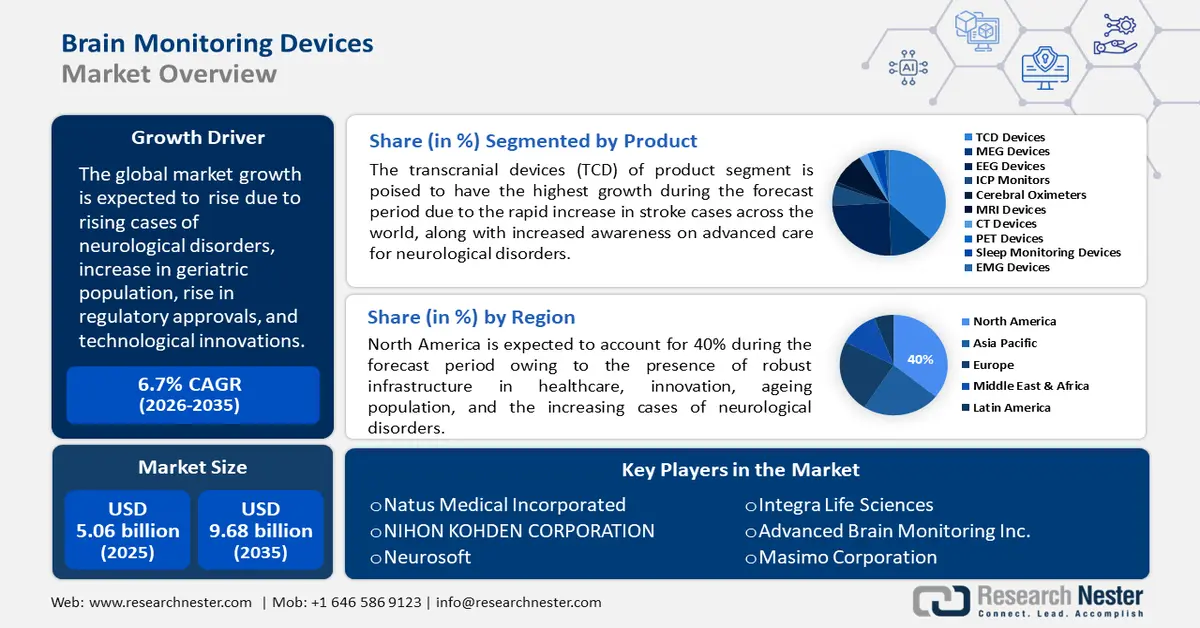

Brain Monitoring Market size was valued at USD 5.06 billion in 2025 and is expected to reach USD 9.68 billion by 2035, expanding at around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brain monitoring is evaluated at USD 5.37 billion.

The rising cases of traumatic brain injuries worldwide have resulted in high demand for brain monitoring. As per an October 2023 report published by the National Library of Medicine (NLM), there were 27.16 million new cases of traumatic brain injury globally in 2019. Brain monitoring are critical in checking any abnormalities in brain functions by running diagnostics. The devices can be used to monitor the blood flow in the brain. Diagnostics of brain functions through these devices can help healthcare professionals in predicting strokes, and epilepsy, and successfully diagnose neural conditions.

Manufacturers across the globe are focused on integrating machine learning (ML), artificial intelligence (AI), and cloud documentation to improve the accuracy of brain monitoring. For instance, in June 2024, the Food and Drug Administration (FDA) approved Zeto’s adjustable ONE headset that can monitor the electrical activity of the brain. The device has an intuitive LED feedback for adjustments of the electrodes and needs minimal instruction for healthcare professionals to use. Such innovations are conducive to the growth of the global market.

Key Brain Monitoring Market Insights Summary:

Regional Highlights:

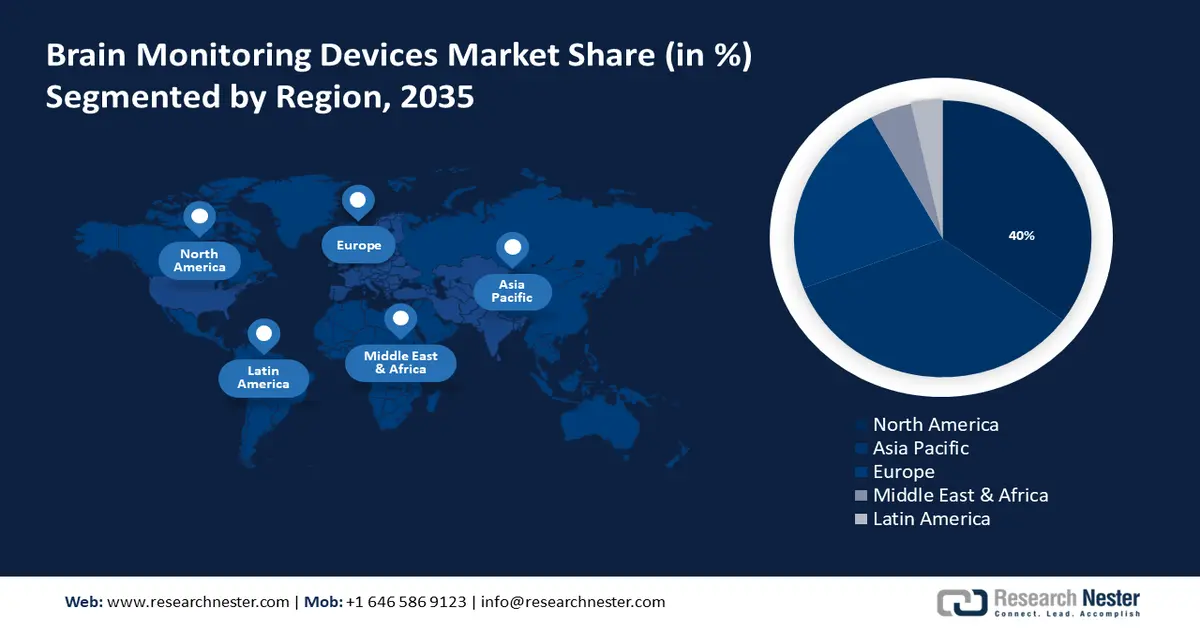

- The North America brain monitoring market will secure over 40% share by 2035, driven by high healthcare investment and increasing geriatric population.

Segment Insights:

- The hospitals segment in the brain monitoring market is anticipated to experience significant growth till 2035, attributed to increased investments in neurological care and high patient footfall for brain-related disorders.

- The tcd devices segment in the brain monitoring market is expected to experience the highest growth till 2035, driven by the rising incidence of stroke and increasing use of sound wave-based brain blood flow monitoring.

Key Growth Trends:

- Rising awareness for advanced care of neurological conditions

- Increased regulatory approvals

Major Challenges:

- High cost of treatments

- High rate of complexity of the devices

Key Players: Medtronic plc, Natus Medical Incorporated, Nihon Kohden Corporation, Philips Healthcare, Compumedics Limited, Elekta AB, NeuroWave Systems Inc., Cadwell Industries, Inc., BrainScope Company, Inc., Advanced Brain Monitoring, Inc.

Global Brain Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.06 billion

- 2026 Market Size: USD 5.37 billion

- Projected Market Size: USD 9.68 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Brain Monitoring Market Growth Drivers and Challenges:

Growth Drivers

- Rising awareness for advanced care of neurological conditions: The rising awareness for neurological disorders has resulted in the need for brain monitoring. According to a report published by the Lancet Neurology in 2021, more than 3 million people globally are diagnosed with a neurological condition. In 2022, the World Health Assembly, adopted the Neurology Action Plan to foster research and innovation in neurological care. Due to the progressive nature of neurological conditions, the requirement for brain monitoring will continue to grow steadily going ahead.

- Increased regulatory approvals: There has been a positive trend of approvals for brain monitoring in recent years. In February 2022, the FDA approved Neurosteer’s brain monitoring system while in March 2022, approval was granted to SedLine’s brain function monitoring electroencephalogram (EEG) sensor system. Due to the increased focus on advanced neurological care and continuous technological innovations, the regulatory hurdles have lessened. An increasing rate of regulatory approvals in the market boosts its growth as more products can be introduced to help the end user.

- Technological innovations and increasing clinical studies: A key growth factor boosting brain monitoring market growth has been the increasing number of clinical studies conducted on brain monitoring wearable devices. As per a study conducted by the American Stroke Association in February 2020, wearable non-invasive brain stimulation devices can improve motor functions in patients suffering from stroke. In March 2021, a clinical trial was conducted by Brain Scientific Inc. to improve its Cognilum brain monitoring device.

Another study on brain implants by Neuralink Corp is currently underway, and expected to be completed by 2026. This implant may give paralyzed patients the ability to operate digital devices by their thoughts. The innovation-oriented approach lays the groundwork for the continuous growth of the market.

Challenges

- High cost of treatments: The cost of neurological treatments is high and can be unaffordable for patients in developing nations. Since the application of the devices are intricate, they also incur high costs in application which can deter a lot of end users. The lack of investments in the healthcare sector in certain emerging economies can prove to be a restraint for the growth of the market. Another roadblock to the growth is the safety concerns associated with the devices.

- High rate of complexity of the devices: The brain monitoring can be complex to put into application and require trained healthcare professionals to implement. A lot of emerging economies struggle to fill the gap in the lack of trained workforce in the healthcare sector which hampers the brain monitoring market growth. The reimbursement policies in emerging economies can often be unfavorable which adds to the indirect expenses in the maintenance of these devices. Market growth can be affected due to the lack of cost-effectiveness in the application of these devices.

Brain Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 5.06 billion |

|

Forecast Year Market Size (2035) |

USD 9.68 billion |

|

Regional Scope |

|

Brain Monitoring Market Segmentation:

Product Segment Analysis

Among the product types, the transcranial doppler devices (TCD) segment in the brain monitoring market is poised to have the highest growth during the forecast period. The device is used for ultrasound and uses sound waves to monitor the blood flow in the brain. In October 2022, WHO published a report highlighting a 50% increase in stroke cases globally over the last 27 years, and that 1 in 4 people is estimated to suffer from a stroke in their lifetime. The increasing number of cases of stroke is the primary driver in the growth of the TCD segment. In 2022, Viasonix reported that there was a 75% increase in the sales of their TCD devices.

The electroencephalography (EEG) devices segment is expected to register rapid revenue growth by 2035 owing to rising demand for non-invasive diagnostic process, increasing neurological disorders, and rising availability of technological advancements in EEG products.

End use Segment Analysis

The hospitals segment holds a significant brain monitoring market share and is expected to continue to grow steadily during the forecast period. The growth of the hospital segment coincides with increased spending on neurological care. Countries such as the U.S, Switzerland, and Germany, spend a considerable amount on healthcare, allowing hospitals to have the necessary funds to set up quality infrastructure.

In 2023, WHO released the Intersectoral Global Action Plan (IGAP) on neurological disorders, poised to lead to greater investments in neurological care. Hospitals see the highest footfall of patients for various neurological conditions such as multiple sclerosis, epilepsy, mental illnesses, Alzheimer's, brain tumors, and traumatic brain injuries due to which the use of brain monitoring in hospitals is higher compared to other segments.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Procedure |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brain Monitoring Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 40% by 2035. The U.S. is the primary contributor to the North America market since it invests the highest amount of money in healthcare globally. In 2022, the U.S. government spent around USD 1.5 trillion on healthcare. The increase in the geriatric population in the U.S and high prevalence of neurological diseases are key factors boosting market growth in the country. A Population Reference Bureau (PRB) report from January 2024 highlighted that there will be a 47% increase in the geriatric population in the U.S. between 2022 to 2050. Due to the rise in neurological disorders and the need for advanced care for an increasingly ageing population, the demand for brain monitoring is expected to witness a boost.

Canada is another major contributor to the North America market. Canada spends around 12.5% of its GDP on healthcare making the healthcare infrastructure conducive for market growth. The cases of neurological disorders such as strokes and brain tumors are increasing by 1% annually which points to the growing demand for brain monitoring. The growth has also been boosted by technological breakthroughs such as in September 2022, portable brain scanner technology NeuroCatch received approval by Health Canada.

Asia Pacific Market Insights

Asia Pacific brain monitoring market is poised to be the fastest-growing region during the forecast period owing to factors such as the aging population, improving health infrastructure, increasing income levels, and rising awareness for advanced neurological care. In addition, the rising number of hospital and diagnostics centers in countries such as Japan, India, China, and South Korea and increasing patient footfall with neurological conditions have led to growth in the market.

In India, the sales of brain monitoring are expected to drastically increase during the forecast period owing to rising cases of neurological disorders in the country. As per an NLM report, around 30 million people are diagnosed with neurological disorders in India with the most common being stroke, Parkinson’s disease, dementia, epilepsy, and migraine. Another key market growth driver is the introduction of welfare programs such as Ayushmann Bharat that cover neurological disorders.

China is a major player in the brain monitoring market. The government has been investing more in the development and production of brain monitoring with several domestic players. The health infrastructure in the country has developed rapidly to cater to the huge population, leading to market growth. As per an NLM report, stroke cases in the country had increased by around 3 million in 2019, leading to rising sales of brain monitoring.

Japan is poised to be a significantly large market for brain monitoring during the forecast period as it has the highest percentage of aging population. The country sees increased spending on healthcare by the government due to the ageing population and a rise in Alzheimer's cases. The technologically driven landscape in the country and growing demands for brain monitoring is expected to be significant drivers in the continued brain monitoring market growth.

Brain Monitoring Market Players:

- Natus Medical Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Neurosoft

- Rimed Inc.

- Medtronic PLC

- Advanced Brain Monitoring Inc.

- Elektra AB

- B. Braun Medical

- Masimo Corporation

- Neuphony

- Integra Lifesciences

The market is highly competitive with several global and regional players seeking to launch new products and meet the needs of healthcare providers and consumers. The rise of neurological disorders globally and the increased rate of product approvals in this field have boosted the market growth. The key players in the market are striving to expand, improve production, and invest in R&D to enhance the quality of product and increase market presence. They are implementing various strategies such as partnerships with local and global retailers, hospitals, clinics, and specialty centers. Here are some key players dominating the global brain monitoring market:

Recent Developments

- In April 2024, NeuroVigil launched iBrain, a portable non-invasive device that can record the electrical activity in the brain. This device is widely used by patients at home and while sleeping, allowing user-friendly and efficient EEG data collection.

- In January 2024, the FDA approved Medtronic’s Percept RC Deep Brain Stimulation (DBS) system. The sensing-enabled system allows the healthcare professional to personalize the treatment of patients suffering from disorders such as Parkinson’s disease, dystonia, and epilepsy.

- In June 2021, Neuphony released the EEG Flex Cap that is ideal for sleep monitoring and brain health. The product is the first of its kind launch in India.

- Report ID: 6376

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Brain Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.