Bowel Stimulators Market Outlook:

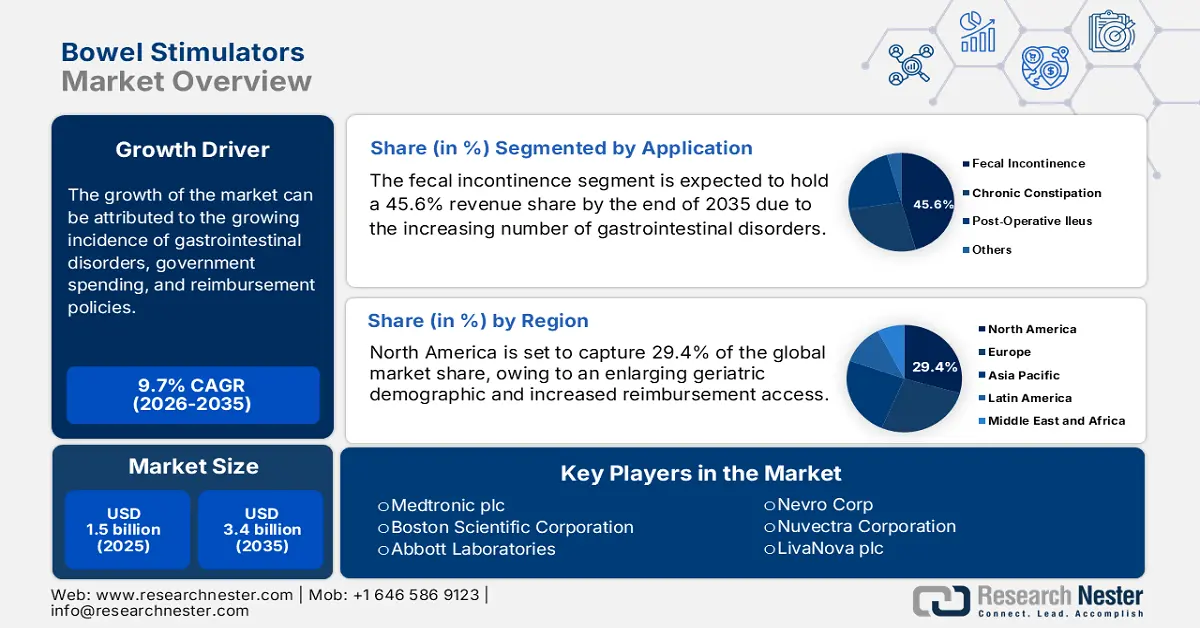

Bowel Stimulators Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 3.4 billion by the end of 2035, rising at a CAGR of 9.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bowel stimulators is estimated at USD 1.6 billion.

The bowel stimulators market is addressing a sizable population of people struggling with dysfunction in gastrointestinal movements. The demography consists of a wide range of disorders, including fecal incontinence, constipation, inflammatory bowel disease (IBD), and neurogenic bowel disorders, which is steadily rising with worldwide aging. Testifying to such a substantial epidemiology, a 2025 journal of Clinical Gastroenterology and Hepatology unveiled that more than 7.0 million people worldwide suffer from IBD, where its occurrence rate is steadily reaching 1% in certain industrialized regions, including Europe and North America. Besides, the increasing impact of chronic diseases, such as diabetes and spinal cord injuries, on the overall quality of life often results in bowel dysfunction.

Global trade dynamics in the bowel stimulators market are primarily controlled by imports and exports of raw materials and finished products. The inflationary cost of treating associated ailments also translates to a major hurdle in patient access. Evidencing the same, in a 2025 journal, the average direct health care expenses were calculated to be USD 9-12 thousand per person. On the other hand, the pricing landscape in this sector is increasingly influenced by policy changes in government insurance and private health plans. The competitive pricing pressures from emerging technologies and alternative therapies are further prompting manufacturers to adopt more flexible pricing strategies.

Key Bowel Stimulators Market Insights Summary:

Regional Insights:

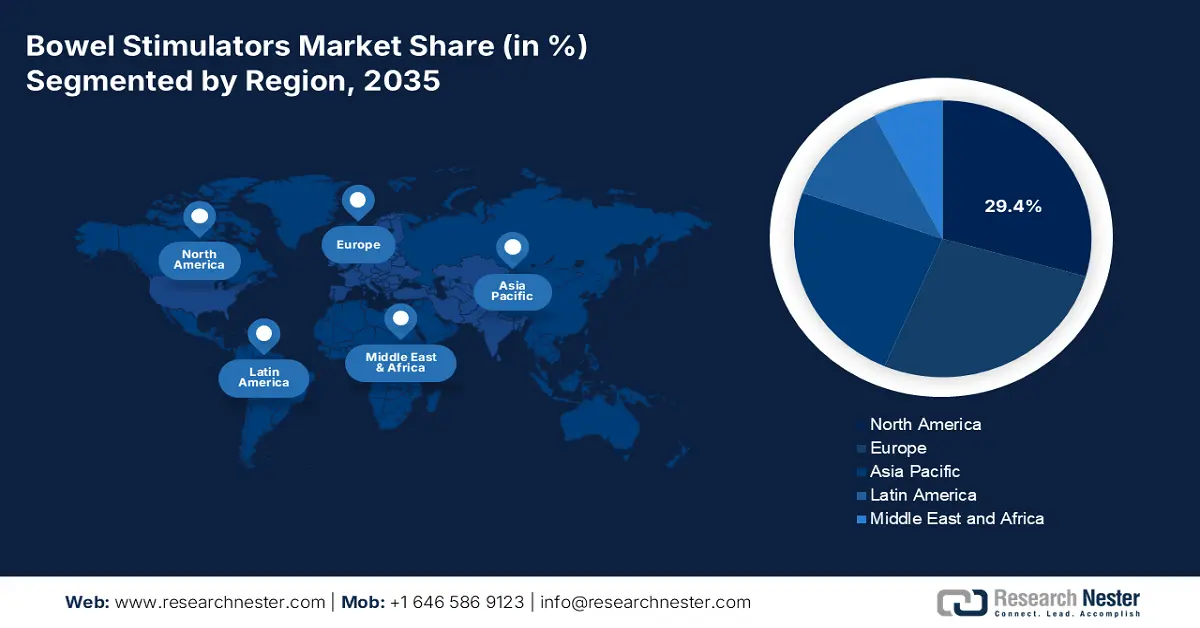

- North America is projected to capture a 29.4% share of the Bowel Stimulators Market by 2035, owing to the expanding elderly population, rising chronic GI disorders, and supportive reimbursement frameworks.

- Asia Pacific is estimated to witness the fastest growth by 2035, attributed to increasing incidences of constipation and IBD alongside improved reimbursement access in emerging economies.

Segment Insights:

- Fecal Incontinence (FI) is projected to hold a 45.6% share of the Bowel Stimulators Market by 2035, propelled by the rising prevalence of this condition among adults and elderly populations.

- Implantable SNS Devices are anticipated to command a 68.4% share by 2035, driven by their strong clinical efficacy and advancements in compact design and battery longevity.

Key Growth Trends:

- Growing incidence of spinal cord injury (SCI)

- Awareness increase and diagnostic advances

Major Challenges:

- Pricing and budget constraints in underserved regions

Key Players: Medtronic plc,Axonics, Inc.,Laborie Medical Technologies,B. Braun SE,SRS Medical Systems, Inc.,Nevro Corp.,Boston Scientific Corporation,Abbott Laboratories,LivaNova PLC,NeurAxis, Inc.

Global Bowel Stimulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 29 September, 2025

Bowel Stimulators Market - Growth Drivers and Challenges

Growth Drivers

- Growing incidence of spinal cord injury (SCI): According to a study from a team of researchers at the Zunyi Medical University, published in February 2025, the occurrence rate of neurogenic bowel dysfunction (NBD) among NCI patients is as high as 54%. It also underscored that 80%, 43%, 38%, and 5% among this proportion experience constipation, abdominal distension, abdominal pain, and fecal incontinence, respectively. This justifies the demographic expansion of the bowel stimulators market with the increase in the cases of SCI. In this regard, the WHO found out that more than 15 million individuals in the world were living with SCI in 2024 alone.

- Awareness increase and diagnostic advances: As more healthcare providers and patients become aware of early detection and treatment, the adoption rates of preventive and disease management solutions available in the bowel stimulators market amplifies. Particularly, educational campaigns, advocacy organizations, and media coverage boosts the uptake volume in this sector by encouraging a wide range of patient population. Besides, the impressive growth and advances in diagnostic technologies are also fueling the merchandise, which can be exemplified by the explosive augmentation of the fecal calprotectin testing industry.

- Emergence of neuromodulation technologies: Innovations in sacral nerve stimulation and other neuromodulation techniques have improved the safety, efficacy, and comfort of products available in the bowel stimulators market. Specifically, the minimally invasive nature, better battery life, and customizable parameters offered by these advanced pipelines deliver greater compliance and patient adherence, while inspiring more companies to invest in R&D. Following the same pathway, in February 2022, Medtronic earned FDA clearance for its next generation recharge-free stimulator device, InterStim X, offering personalized options for sacral neuromodulation (SNM) therapy.

Historical Trends in Potential Demographics of the Bowel Stimulators Market

Trends in Global Prevalence of IBD

|

Timeline |

Overall IBD Prevalence (per 100,000) |

Crohn's Disease Prevalence (per 100,000) |

Ulcerative Colitis Prevalence (per 100,000) |

|

2002 |

161.3 |

69.9 |

78.6 |

|

2002-2007 |

71.4 |

23.4 |

35.2 |

|

2007-2012 |

321.0 |

119.8 |

167.6 |

|

2012-2017 |

290.5 |

97.3 |

168.8 |

|

2017-2022 |

305.1 |

124.0 |

168.5 |

Source: NLM

Challenges

- Pricing and budget constraints in underserved regions: With government procurement, high-cost devices are strictly capped. WHO reports indicate that both innovative and generic medicines are priced unreasonably high and differ more in each country's tier. Reimbursement links to pricing models for new neurostimulation applications, such as bowel stimulators, and uncapped payors. Using the limited reimbursement mark set by government health systems as a guide, manufacturers were forced to seek cost-sharing agreements or price-matching agreements with local hospitals to maintain an established market presence.

Bowel Stimulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

Bowel Stimulators Market Segmentation:

Application Segment Analysis

Fecal incontinence (FI) is expected to dominate the field of application in the bowel stimulators market with a share of 45.6% by the end of 2035. The segment’s leadership in this sector is largely fueled by the predominant proportion of this ailment in the overall demography. This can be evidenced by the occurrence of FI among every 1 in 12 adults around the world, as published by the 2024 Journal of Clinical Gastroenterology and Hepatology. Additionally, the FI incidence is evidently higher in older individuals, particularly those over the age of 65, resulting from weakened pelvic floor muscular function and more chronic conditions.

Product Type Segment Analysis

Implantable SNS devices are predicted to lead the bowel stimulators market by capturing the highest share of 68.4% over the discussed period. Through being widely used for high clinical efficacy and ability to provide sustained symptom control, this subtype is consolidating its forefront position in this sector for the upcoming years. They are also globally recognized as a second-line therapeutic option with clinically proven success rates, influencing a greater proportion of the consumer base to opt for this tool. Currently, the introduction of more compact designs with longer battery life and improved programming capabilities is gaining momentum by enhancing patient comfort and adoption.

End user Segment Analysis

Hospitals are estimated to account for 55.3% revenue share in the bowel stimulators market throughout the assessed timeline. The sole proprietorship is led by their ability to enable wider patient access to specialized gastroenterologists and efficient management of complex cases. The supportive jurisdictions suggesting therapy initiation and conduction for chronic GI conditions in hospitals further create opportunities for this segment. Furthermore, the presence of an adequate infrastructure that offers the flexibility to customize settings when it comes to the individual patient makes it the most preferred choice for a majority of afflicted individuals.

Our in-depth analysis of the global bowel stimulators market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Patient Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bowel Stimulators Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest share of 29.4% in the bowel stimulators market during the analyzed timeframe. The region’s proprietorship in this sector is primarily empowered by the amplifying geriatric demography, high incidence of chronic GI illnesses, and ongoing expansion in reimbursement coverage. The epidemiological growth factor can be testified by the 2022 NLM findings, concluding the overall IBD prevalence in North America to be 252.3 per 100,000 people. Furthermore, favorable regulatory pathways toward technological innovations inspire more MedTech pioneers to participate in this landscape.

The U.S. is augmenting a strong uptake in the bowel stimulators market on account of its technologically advanced healthcare system and MedTech industry. On the other hand, the rising incidence of opioid-induced constipation (OIC) and SCI is expanding the demography in this field. In this regard, a 2024 study from the Journal of Neurogastroenterology and Motility unveiled that the occurrence rate of OIC among Americans totaled 6.0%, affecting more than 80 thousand people across the country. Besides, another 2022 report from the U.S. Department of Health and Human Services highlighted that over 12 thousand new SCI cases were being registered every year in the country.

As Health Canada and the Canadian Institute for Health Information (CIHI) increase their focus on GI device reimbursement, the cash inflow in the bowel stimulators market stabilizes. This is further fostering a lucrative environment for the merchandise. Provincial health authorities, such as Ontario and Alberta, are also expanding direct funding for these tools, prompting rapid development and wide adoption in this sector. Particularly, the nationwide acceptance of home-based therapy is benefiting from such government-backed R&D cohorts.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the market by the end of 2035. The landscape is led by China and is largely backed by a higher incidence of chronic constipation and IBD. Testifying to the same, an NLM study recorded a moderate prevalence of IBD in Asia, accounting for 51.0 per 100,000 people in 2022. Besides, improved reimbursement programs across emerging economies, including China and India, are fueling adoption in this field.

China stands as one of the largest consumer bases in the Asia Pacific bowel stimulators market, fueled by its large patient population of GI-related disorders. According to a 2025 study, the country is the origin of approximately 50% of new SCI cases worldwide, totaling an annual 23o thousand. It further claimed that more than 30% of the total SCI readmissions in hospitals within one year of discharge are caused by bowel dysfunction. This strongly indicates the urgent need for maximum stimulator deployment in nationwide medical settings to cater to such an enlarging epidemiology.

India is notably contributing to the accelerated pace of progress in the regional bowel stimulator market. Increasing government healthcare spending and patient expenditures are collectively enabling a continuous flow of capital in this sector. Overall, the ageing population, the emergence of digital therapeutics, and government-backed awareness campaigns continue to propel the country’s progression in this field onward as a lucrative business opportunity for both domestic and foreign MedTech leaders. Inspired by the same, in November 2024, Medtronic launched its SNM system, Interstim X, in India to capitalize on the unmet needs related to bowel control.

Europe Market Insights

Europe is predicted to hold a prominent share in the market over the timeline between 2026 and 2035. Heightening burden of GI-related health issues and proactive government initiatives to combat the epidemiology are cumulatively fostering a favorable environment for the merchandise in this region. Evidencing the same, in 2022, the IBD prevalence in Europe stood at the world’s highest rate of 348.4 per 100,000 people, according to an NLM finding. Furthermore, the well-established medical infrastructure and a growing geriatric demography are increasing demand in this sector.

The UK represents a key landscape within the Europe bowel stimulators market, which is empowered by the increasing cases of chronic constipation and related GI disorders. Further, strong financial backing from the National Health Service (NHS), growing patient awareness programs, and improved access to advanced medical technologies contribute to steady market growth. As evidence, in July 2023, the NHS launched a constipation campaign to support people with a learning disability after identifying it as a life-threatening condition among this demographic.

Germany is established as both a large consumer base and a hub of MedTech pioneers in the bowel stimulators market. It is primarily fueled by a robust healthcare system and a high occurrence rate of GI disorders among older residents. On the other hand, the globally leading position of Germany in advancing medical device technologies further broadens patient access and continuous innovation in this category. Moreover, the continuously shifting consumer preference towards minimally invasive treatment options boosts the nation’s significance in this sector.

Key Bowel Stimulators Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Axonics, Inc.

- Laborie Medical Technologies

- B. Braun SE

- SRS Medical Systems, Inc.

- Nevro Corp.

- Boston Scientific Corporation

- Abbott Laboratories

- LivaNova PLC

- NeurAxis, Inc.

The global bowel stimulators marketplace is highly consolidated, with Medtronic, Abbott, and Axonics dominating the space through patented technologies and global distribution strategies. Innovation, particularly in the use of emergent technologies, is currently dominated by the U.S., Germany, and Japan, augmenting the bowel market with eminently qualified engineering, research, development, and support. Examples of strategic moves include mergers and acquisitions, miniaturization of products for home use, and large-scale disruption.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In November 2024, NeurAxis attained a new 510(k) clearance for its IB-Stim Nonimplanted Nerve Stimulator for functional abdominal pain relief from the FDA. The new indication expanded IB-Stim’s addressable market and overall accessibility of devices for every patient.

- In January 2024, Boston Scientific completed the acquisition of Axonics in transaction of an equity and enterprise value of approximately USD 3.7 billion and USD 3.4 billion. This strengthened the company’s portfolio of differentiated devices to treat urinary and bowel dysfunction.

- Report ID: 3967

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bowel Stimulators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.