Blood Collection Market Outlook:

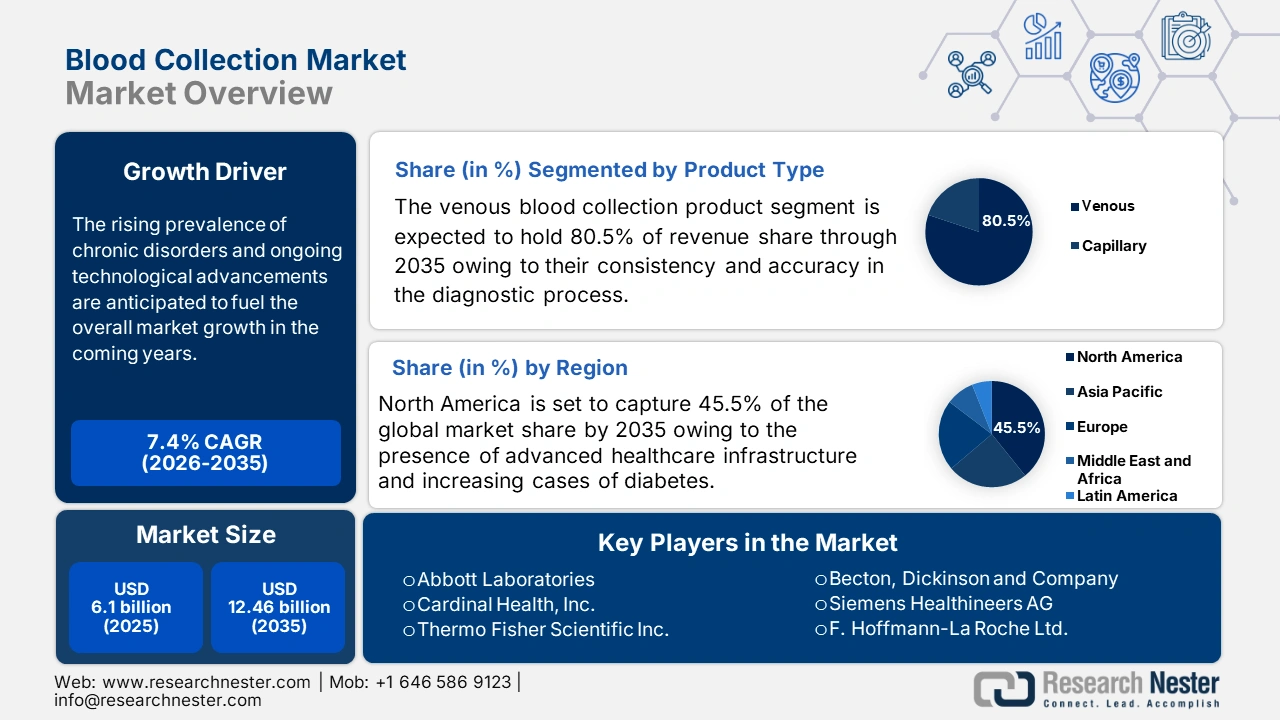

Blood Collection Market size was over USD 6.1 billion in 2025 and is anticipated to cross USD 12.46 billion by 2035, witnessing more than 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood collection is assessed at USD 6.51 billion.

The primary growth driver of the blood collection market is the increasing demand for blood and related products including cryoprecipitated AHF (cryo), red cells, platelets, plasma, and granulocytes to cater to diagnostics, surgical procedures, treatment of chronic diseases, and other healthcare needs. For instance, according to the American Hospital Association, by 2030, around 170 million people in the U.S. are predicted to have at least one chronic ailment, including hypertension, diabetes, heart disease, and arthritis.

The COVID-19 pandemic significantly influenced the blood collection market by highlighting the critical need for blood and plasma for treatment and research. Furthermore, the rise in cancer cases worldwide is driving the need for advanced blood collection products. For instance, the World Health Organization (WHO) estimates that more than 35 million new cancer cases are expected to be detected by 2050; this hike is pushing the need for advanced services including diagnostics.

Key Blood Collection Market Insights Summary:

Regional Highlights:

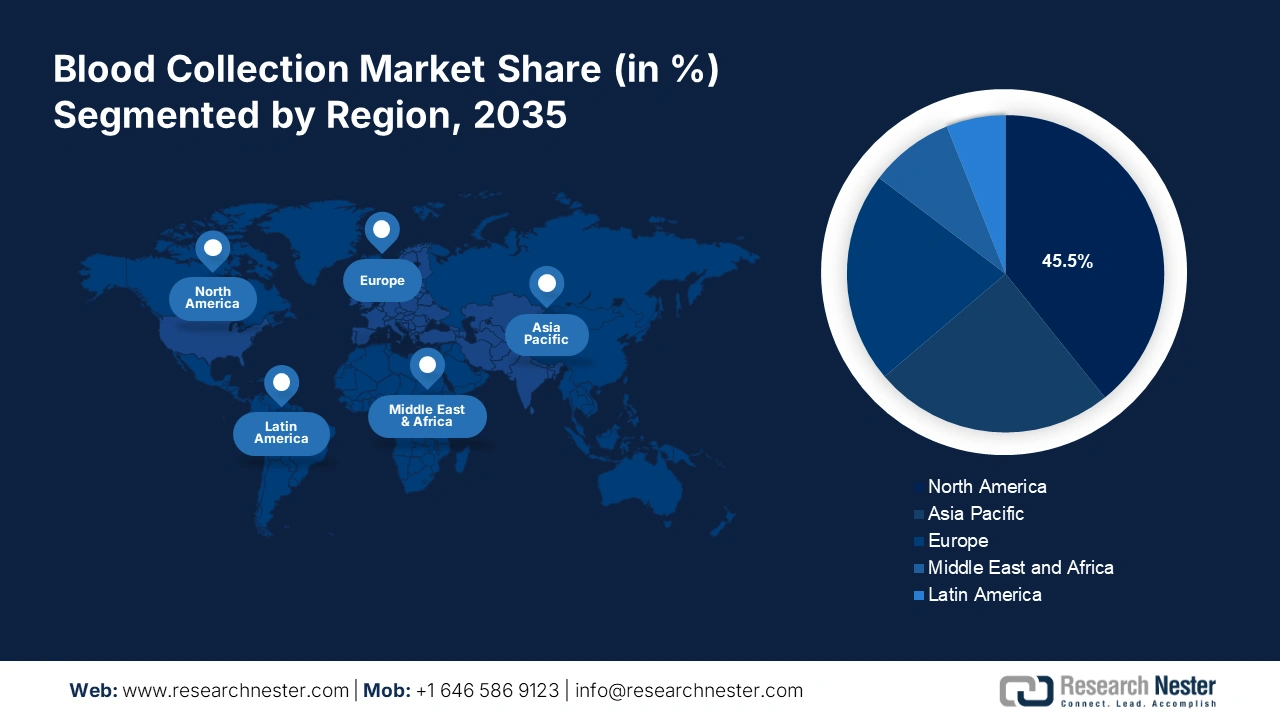

- North America blood collection market will account for 45.50% share by 2035, driven by advanced healthcare infrastructure and increasing prevalence of diabetes.

Segment Insights:

- The venous segment in the blood collection market is projected to maintain an 80.50% share by 2035, driven by rising surgical procedures and demand for reliable diagnostic blood samples.

- The manual blood collection segment in the blood collection market is anticipated to hold a 70.50% share by 2026-2035, driven by cost-effectiveness and extensive use in low-resource healthcare environments.

Key Growth Trends:

- Rising popularity of automated blood collection systems

- Growth in point-of-care (POC) testing

Major Challenges:

- Stringent product approval procedures

- Lack of standardization

Key Players: Abbott Laboratories, Becton, Dickinson and Company, Thermo Fisher Scientific Inc., and Cardinal Health, Inc.

Global Blood Collection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.1 billion

- 2026 Market Size: USD 6.51 billion

- Projected Market Size: USD 12.46 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Blood Collection Market Growth Drivers and Challenges:

Growth Drivers

- Rising popularity of automated blood collection systems: Automated systems streamline the blood collection process, allowing for faster sample collection and processing. This efficiency can lead to increased throughput in blood banks and hospitals. Automation in the blood bank offers numerous beneficial advantages, including increased quality, reduced wasted time, optimized blood product utilization, standardization, reduced manual errors, staff time savings, and more. For instance, the university hospital in Aalborg, Denmark uses KUKA lab robots and intelligent transport boxes to automatically monitor and sort blood samples. Pick-and-place machine applications like this reduce the workload for hospital personnel and give them time for more valuable tasks. KUKA lab robots sort up to 3,000 blood samples per day.

- Growth in point-of-care (POC) testing: POC testing allows for rapid diagnosis and immediate results, leading to a higher volume of blood collection for various tests, including glucose monitoring, infectious disease screening, and other diagnostics. Moreover, POC testing enables testing in diverse settings such as homes, clinics, and remote locations, making it easier for patients to access testing and increasing the frequency of blood collection.

- Moreover, the growth in point-of-care testing is anticipated to drive lucrative opportunities for portable blood collection device manufacturers. POC testing offers immediate results, leading to timely clinical decisions. The innovations in biosensors, microfluidics, and portable devices are making it easier to conduct complex tests at the point-of-care. The ongoing developments in POC testing are expected to minimize laboratory expenses and drive overall blood collection market growth in the coming years.

Challenges

- Stringent product approval procedures: Lengthy approval processes can delay the introduction of new blood collection technologies, slowing innovation and blood collection market responsiveness. Compliance with rigorous regulatory requirements can lead to higher development and operational costs for manufacturers, potentially limiting the entry of smaller companies.

- Lack of standardization: Blood needs to be stored at precise temperatures and conditions to maintain its viability and safety. The lack of standard collection, storage, and monitoring systems increases the risk of blood contamination and spoilage. Such factors lead to the recall of products, hampering the goodwill and profits of blood collection systems and device manufacturers.

Blood Collection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 6.1 billion |

|

Forecast Year Market Size (2035) |

USD 12.46 billion |

|

Regional Scope |

|

Blood Collection Market Segmentation:

Product Type Segment Analysis

In blood collection market, venous segment is predicted to dominate revenue share of over 80.5% by 2035. The rising number of surgical procedures and the growing need for medical equipment for diagnosis and detection is fuelling the growth of the segment. Venous blood samples are the gold standard for a wide range of diagnostic tests, leading to sustained demand. Moreover, manufacturers are investing heavily in the development of devices with enhanced safety such as safety needles and blood collection sets to mitigate contamination risks. Venous blood collection products are more reliable and consistent, which is driving their demand for accurate diagnostic results and long-term studies.

Method Segment Analysis

By 2035, manual blood collection segment is projected to account for blood collection market share of around 70.5%, owing to its cost-effectiveness and extensive use by hospitals, individual clinical laboratories, and pathology laboratories. Manual blood collection systems are less expensive compared to automated ones, which makes them accessible to a wide range of healthcare facilities.

Additionally, manual methods can be used in low-resource environments. For instance, according to the WHO, in 2021, 4.5 billion people worldwide lacked complete access to basic healthcare services, highlighting the need for simpler blood collection methods.

Application Segment Analysis

Diagnostics segment is anticipated to capture blood collection market share of over 68.5% by 2035. The rising importance of preventive healthcare on regular blood testing for early detection of diseases is augmenting the demand for diagnostic blood collection products. This trend is expected to maintain its dominance as the healthcare sector expands, driving the reliance on blood-based diagnostics.

Moreover, companies specializing in diagnostic technologies often partner with hospitals and research institutions to develop and validate innovative tests for early cancer detection. These collaborations facilitate access to clinical data and patient samples, significantly boosting the demand for diagnostic testing. For instance, in 2023, Providence, a non-profit health system serving the Western U.S., and GRAIL, LLC, a healthcare company, announced the expansion of their partnership to include multi-cancer early detection screening as part of clinical care for eligible individuals across Providence health system. Through the collaboration, eligible patients at Providence's 52 hospitals and 900 clinics in seven states will have access to GRAIL's Galleri multi-cancer early detection (MCED) test as part of a broad range of health services.

Our in-depth analysis of the blood collection market includes the following segments:

|

Product Type

|

|

|

Method |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Collection Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 45.5% by 2035. The presence of advanced healthcare infrastructure, the existence of key market players, and the increasing prevalence of diabetes are some of the factors boosting the blood collection market. Several blood donation initiatives by public and private organizations are also contributing to the blood collection system sales growth.

The U.S. is advancing in the field of healthcare with ongoing R&D activities leading to the development of next-gen medical devices including blood collection products. The rising prevalence of chronic disorders such as cancer and diabetes is also contributing to the blood collection market growth. For instance, according to the Centers for Disease Control and Prevention (CDC), around 136 million adults in the U.S. are living with diabetes.

In Canada, the importance of blood, plasma, tissues, and organs is high, and several awareness programs conducted by public and private organizations such as Canadian Blood Services are increasing the sales of modern blood collection products in the country.

APAC Market Insights

Asia Pacific blood collection market is expected to expand at a fast pace during the forecasted period owing to increasing healthcare expenditure. Governments in the region are investing heavily in advancing their healthcare infrastructure. Such aspects are generating high-earning opportunities for medical surgical and diagnostic solution producers in Asia Pacific particularly India, China, Japan, and South Korea.

India is witnessing a high growth in the healthcare sector, and the demand for medical professionals is expected to double by 2030. Also, the Government of India is promoting voluntary blood donation campaigns and establishing blood banks, which enhance the overall blood collection infrastructure. According to the Ministry of Health and Family Welfare, Government of India, there are 4153 licensed blood banks in the country as of 2023.

Blood Collection Market Players:

-

Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Cardinal Health, Inc.

- F. Hoffmann-La Roche Ltd.

- FL MEDICAL s.r.l.

- Fresenius SE & Co. KGaA

- Medtronic Plc

- Vitestro B.V.

- QIAGEN N.V.

- Haemonetics Corporation

- Greiner AG

Key players in the blood collection market are adopting various organic and inorganic strategies to boost their profit shares. They are investing heavily in R&D to introduce advanced blood collection products and attract a wider consumer base. Industry giants are also partnering with other players and collaborating with research organizations to enhance their distribution networks and product visibility. Leading companies are also focusing on regional expansion strategies to tap into new revenue streams.

Some of the key players include in blood collection market:

Recent Developments

- In April 2024, Becton, Dickinson and Company launched a new blood collection device UltraTouch in India. This blood collection device is estimated to reduce patient pain and discomfort, and needle injury by 88%.

- In May 2022, Vitestro B.V. introduced an advanced autonomous blood-drawing device using artificial intelligence technology. The company launched this product at the annual meeting of the Netherlands Society for Clinical Chemistry and Laboratory Medicine (NVKC) in Rotterdam.

- Report ID: 6474

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Collection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.