Blood Coagulation Testing Market Outlook:

Blood Coagulation Testing Market size was valued at USD 4.73 billion in 2025 and is set to exceed USD 8.71 billion by 2035, expanding at over 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood coagulation testing is estimated at USD 5 billion.

The increasing prevalence of coagulation-related disorders such as hemophilia, thrombophilia, and vitamin K deficiency is significantly boosting the demand for reliable and efficient blood coagulation tests. According to a report by the CDC in May 2024, each year up to 900,000 people in the U.S. are affected by venous thromboembolism (VTE), which is a type of blood clot. These conditions require precise monitoring and early detection to prevent complications, driving the adoption of advanced diagnostic solutions. The growing awareness among patients and healthcare providers about the importance of accurate testing further supports market expansion, emphasizing the need for innovative technologies to enhance testing accuracy and efficiency.

Additionally, the global increase in the elderly population, who are more susceptible to coagulation-related disorders such as deep vein thrombosis and atrial fibrillation, is driving blood coagulation market growth. As per a study published in Springer Nature in July 2024, a study of 1,148 older patients in long-term care hospitals found a high lifetime prevalence (9.6%) and incidence of venous thromboembolism (2.82 per 100 person-years). Older adults often require frequent monitoring to manage these conditions effectively, leading to a higher demand for blood coagulation tests. This trend is further supported by the rising focus on preventive healthcare and advancements in diagnostic technologies, ensuring better detection and management of coagulation disorders in aging populations.

Key Blood Coagulation Testing Market Insights Summary:

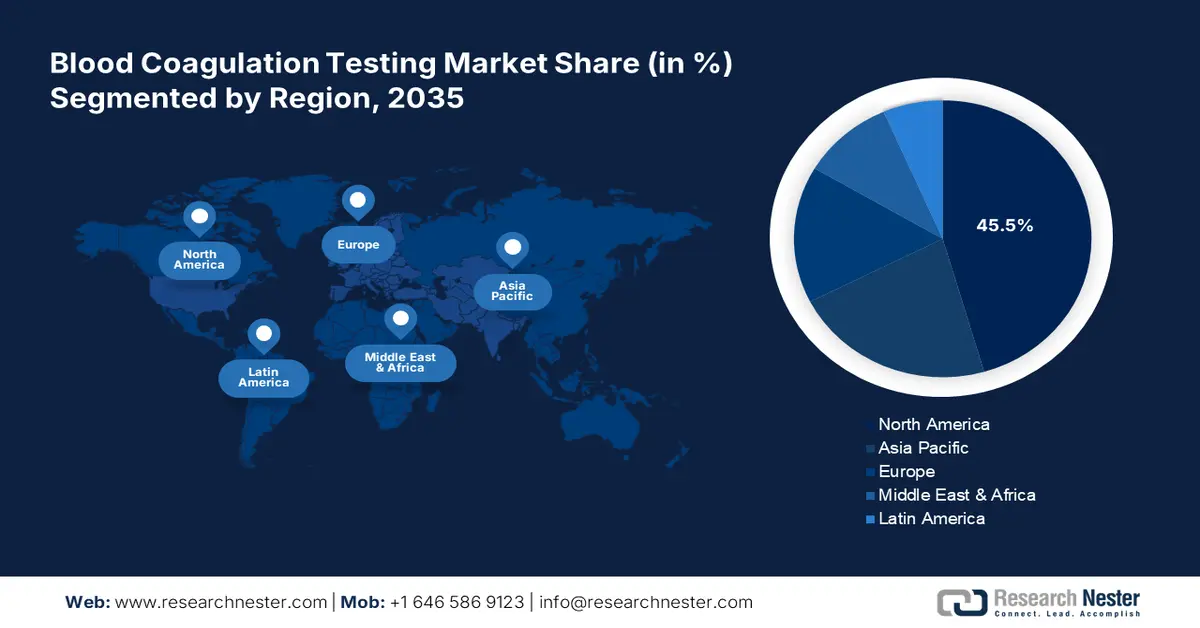

Regional Highlights:

- North America commands the Blood Coagulation Testing Market with a 45.5% share, fueled by the rising prevalence of coagulation disorders and advancements in testing technologies, driving growth through 2026–2035.

- Asia Pacific’s blood coagulation testing market is projected to grow significantly by 2035, driven by heavy investments in healthcare infrastructure and adoption of advanced diagnostic tools.

Segment Insights:

- The Hospitals segment is anticipated to generate the majority of market revenue from 2026 to 2035, driven by the increasing prevalence of coagulation disorders and advanced diagnostic capabilities.

- The consumables segment of the Blood Coagulation Testing Market is projected to hold more than 63.2% share by 2035, driven by the rising frequency of diagnostic procedures for hemophilia and thrombosis.

Key Growth Trends:

- Advancing diagnostics and awareness

- Government health initiatives

Major Challenges:

- High cost of advanced testing

- Regulatory and reimbursement challenges

- Key Players: Abbott, Siemens Healthcare, Thermo Fisher Scientific Inc., Werfen.

Global Blood Coagulation Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.73 billion

- 2026 Market Size: USD 5 billion

- Projected Market Size: USD 8.71 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Blood Coagulation Testing Market Growth Drivers and Challenges:

Growth Drivers

- Advancing diagnostics and awareness: Innovations such as automated analyzers, molecular diagnostics, and point-of-care devices have significantly improved the accuracy, efficiency, and accessibility of coagulation testing, driving global adoption. Additionally, increased government funding for healthcare infrastructure and diagnostics research is expanding access to advanced testing technologies. Public health initiatives emphasizing early diagnosis and treatment of blood disorders further boost the blood coagulation testing market growth by raising awareness and ensuring timely interventions, making coagulation testing more reliable and widely available across diverse healthcare settings.

- Government health initiatives: Governments worldwide are increasing funding and supporting healthcare infrastructure and diagnostic research, significantly expanding access to advanced blood coagulation testing. These investments in Advanced diagnostic technologies are set to improve healthcare accuracy and efficiency. A January 2024 OECD report indicates that health spending is rising due to demographics, income growth, and technology advancements, potentially reaching 11.8% of GDP by 2040 in OECD countries. Public health programs boost awareness and testing for blood disorders, enhancing the blood coagulation testing market growth and accessibility.

Challenges

- High cost of advanced testing: Advanced diagnostic tools, such as automated analyzers and molecular diagnostics, come with high costs, making them less accessible, particularly in low-income and developing regions. The price of these technologies limits their adoption in healthcare facilities, especially those in rural or underdeveloped areas, where financial constraints prevent investment in cutting-edge equipment. This creates significant barriers for healthcare providers and patients, ultimately restraining the growth of the blood coagulation testing market by limiting the availability of efficient diagnostic solutions.

- Regulatory and reimbursement challenges: Complex regulatory approval processes for new testing devices, combined with inconsistent reimbursement policies, can significantly delay the introduction and widespread adoption of innovative technologies in the blood coagulation testing market. These regulatory hurdles often create financial and operational challenges for manufacturers, as they must navigate lengthy approval timelines and uncertainty in reimbursement. Healthcare providers also face difficulties in adopting new technologies without clear reimbursement pathways, which slows market growth and limits access to advanced coagulation testing solutions.

Blood Coagulation Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 4.73 billion |

|

Forecast Year Market Size (2035) |

USD 8.71 billion |

|

Regional Scope |

|

Blood Coagulation Testing Market Segmentation:

Product (Analyzer, Consumables)

The consumables segment is likely to hold blood coagulation testing market share of more than 63.2% by 2035. The segment’s growth is attributed to the rising frequency of diagnostic procedures for conditions such as hemophilia and thrombosis. Consumables such as reagents, test strips, and controls are essential for daily testing, ensuring consistent demand. Additionally, the increasing adoption of point-of-care testing and automated systems has boosted the need for consumables compatible with these technologies. For instance, in June 2023, Sysmex launched an antimicrobial susceptibility testing system that improved diagnostic efficiency, highlighting advancements that also benefit the blood coagulation testing market.

End use (Hospitals, Research Institutes, Diagnostic Centers)

By end use, the hospital segment is estimated to garner the majority of market revenue over the forecast period. The segment is growing due to the increasing prevalence of coagulation disorders such as hemophilia, thrombosis, and stroke. Hospitals are the primary centers for diagnosis and treatment, equipped with advanced diagnostic tools and skilled professionals for comprehensive testing. The rising number of inpatient admissions requiring coagulation monitoring and the availability of specialized care in hospitals further boost demand. Additionally, growing healthcare infrastructure investments enhance hospitals' testing capabilities, driving segment growth.

Our in-depth analysis of the global blood coagulation testing market includes the following segments:

|

Product |

|

|

End use |

|

|

Test |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Coagulation Testing Market Regional Analysis:

North America Market Statistics

North America in blood coagulation testing market is poised to capture over 45.5% revenue share by 2035. The rising prevalence of coagulation disorders, such as hemophilia, thrombophilia, and vitamin K deficiency, is driving the demand for accurate and efficient blood coagulation tests. Additionally, the introduction of innovative technologies, including automated analyzers and molecular diagnostics, has significantly improved testing efficiency and accuracy. These advancements enable faster, more precise diagnosis and are fueling the blood coagulation testing market growth by meeting the increasing demand for effective coagulation disorder management and enhancing patient outcomes.

The growing aging population in the U.S. is leading to a higher incidence of coagulation-related disorders such as stroke and thrombosis, increasing the demand for blood coagulation tests. Older adults require consistent monitoring for blood clotting issues, further driving the blood coagulation testing market growth. Additionally, increased government funding for healthcare infrastructure and research is facilitating advancements in coagulation testing technologies. According to the American Medical Association, health spending in the U.S. rose by 4.1% in 2022, reaching USD 4.5 trillion, or USD 13,493 per person. Investments enhance innovative technologies, improving healthcare availability and outcomes.

The government of Canada increased healthcare investments have enhanced access to advanced diagnostic tools, improving the availability and accuracy of blood coagulation tests. According to a July 2024 Government of Canada report, the government spent about USD 200 billion over ten years to enhance healthcare services. Alongside this, the development and adoption of innovative testing technologies, such as automated analyzers and molecular diagnostics, have further boosted test efficiency and precision. These combined factors are driving the blood coagulation testing market growth by making coagulation tests more accessible, efficient, and accurate, ensuring better management of coagulation-related disorders in Canada.

Asia Pacific Market Analysis

In APAC the blood coagulation testing market is poised to garner a lucrative market share over the forecast period. Countries such as China and India are investing heavily in healthcare infrastructure, adopting advanced diagnostic tools that enhance access to blood coagulation testing services. This expansion, supported by government funding for healthcare development across Asia Pacific, is driving the blood coagulation testing market growth. The promotion of diagnostic tools and treatments of blood disorders ensures improved accessibility and affordability of tests, which in turn fuels the demand for accurate and efficient blood coagulation testing, contributing to market expansion in the region.

The aging population in China is leading to a rise in coagulation-related health issues such as stroke and thrombosis, driving demand for blood coagulation testing. According to an NLM report of January 2024, between 2011 and 2019, THA cases in China increased from 168,040 to 577,153. Additionally, increasing awareness about coagulation disorders, along with improved healthcare access in both urban and rural areas, is further fueling the need for coagulation testing services. These factors are collectively contributing to the growth of the blood coagulation testing market in China, expanding both the demand and availability of diagnostic services.

The adoption of automated analyzers and molecular diagnostic technologies in India is enhancing the accuracy and efficiency of blood coagulation testing, contributing to market growth. Additionally, the government of India invests in healthcare infrastructure and public health programs improving access to advanced diagnostic tools, further boosting the availability of blood coagulation testing services. In March 2023, the Journal of Medical Sciences mentioned that the country's hospital sector, which makes up 80% of the healthcare system overall was estimated to value USD 132 billion in 2023. These combined efforts are driving the overall market expansion of the blood coagulation testing in India.

Key Blood Coagulation Testing Market Players:

- Hoffmann-La Roche Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Siemens Healthcare

- Thermo Fisher Scientific Inc.

- Werfen

- HemoSonics, LLC

- Micropoint Biotechnologies Co., Ltd.

- Helena Laboratories

- Meril Life Sciences Pvt. Ltd.

Key companies are innovating the blood coagulation testing market by developing advanced technologies such as automated blood coagulation analyzers, chemiluminescence enzyme immunoassay (CLEIA), and molecular marker-based testing. These innovations improve diagnostic accuracy, efficiency, and speed, allowing for faster detection of coagulation abnormalities. For instance, in May 2022, HORIBA Medical showcased its latest Yumizen G hemostasis analyzers and reagents at ISTH 2022, enhancing laboratory productivity and efficiency. Additionally, integrating these technologies into single devices enables comprehensive testing, driving market growth by enhancing the capabilities of healthcare providers to manage and treat coagulation disorders more effectively. Some of these players are:

Recent Developments

- In April 2024, Siemens Healthineers and Sysmex offer integrated hemostasis testing solutions, enhancing lab workflows, standardizing results, and accelerating diagnostics, driving advancements in blood coagulation testing globally.

- In February 2024, Roche launched CE-marked coagulation tests for Factor Xa inhibitors, improving clinical decisions for stroke, embolism, and VTE, boosting blood coagulation testing advancements.

- Report ID: 7011

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Coagulation Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.