Biologics CDMO Market Outlook:

Biologics CDMO Market size was valued at USD 21.02 billion in 2025 and is likely to cross USD 73.27 billion by 2035, registering more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biologics CDMO is assessed at USD 23.54 billion.

The biopharmaceutical industry experienced rapid expansion, particularly in emerging markets, and is significantly prospecting the pharma sector. For instance, the biopharma sector in India held a 49.0% stake in the bioeconomy in 2022, according to the Biotechnology Industry Research Assistance Council. An estimated USD 39.4 billion was the segments total economic contribution. Further, rising healthcare needs and biotech advancements drive demand for recombinant therapies, contributing to contract processing growth globally and increasing the capacity to manufacture monoclonal antibodies and gene therapies at an industrial scale. This expansion allows contract biomanufacturing to meet regional and global needs, driving continued escalation in the biologics CDMO market.

Additionally, the growing trend towards personalized medicine, driven by advancements in gene-based treatments and targeted interventions, is creating a need for more customized and smaller batches of biologicals. These remedies require highly customized processes to ensure precision and efficacy. CDOs have the expertise and facilities to produce these smaller, proficient batches, making them the perfect choice for pharma companies. As more biopharmaceutical companies turn to contract manufacturers for this specialized development, the demand for these services continues to rise, contributing to the surge of the market.

Key Biologics CDMO Market Insights Summary:

Regional Highlights:

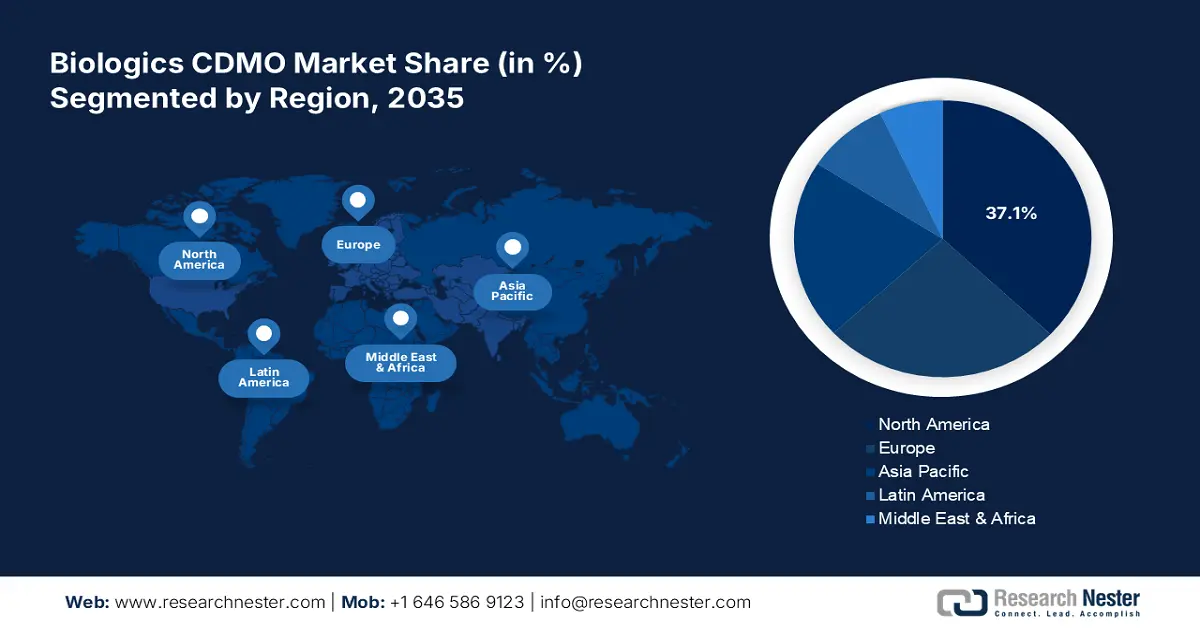

- The North America biologics cdmo market will dominate more than 37.10% share by 2035, driven by the development of cutting-edge therapies like gene editing and cell therapies, alongside increasing prevalence of chronic diseases, cancer, and autoimmune disorders.

- The Asia Pacific market will achieve the fastest growth during the forecast timeline, fueled by rapid expansion of the biopharmaceutical industry, increasing healthcare needs, advancements in biotechnology, and rising demand for biosimilars.

Segment Insights:

- The biologics segment in the biologics cdmo market is expected to hold a 73.4% share by 2035, driven by increasing demand for advanced therapies such as monoclonal antibodies and vaccines.

- The monoclonal antibodies segment in the biologics cdmo market is expected to capture a majority share by 2035, driven by increasing requisition for targeted therapies in cancer and autoimmune diseases.

Key Growth Trends:

- Rising demand for biologic drugs

- Outsourcing trends in the pharmaceutical sector

Major Challenges:

- Intellectual property risks

- Cost control

Key Players: Lonza Group AG, Catalent, Inc., Samsung Biologics Co., Ltd., WuXi Biologics (Cayman) Inc., Boehringer Ingelheim International GmbH, Fujifilm Diosynth Biotechnologies, Patheon (Thermo Fisher Scientific), AGC Biologics, Cytiva (Danaher Corporation), Rentschler Biopharma SE.

Global Biologics CDMO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.02 billion

- 2026 Market Size: USD 23.54 billion

- Projected Market Size: USD 73.27 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Biologics CDMO Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for biologic drugs: The rising prevalence of chronic diseases, cancer, and autoimmune disorders is significantly increasing the demand for bioengineered therapeutics. In March 2022, NLM predicted that by 2026, biologics accounted for 55% of the top 100 pharmaceuticals' total sales. These interventions, due to their complex nature, require highly focused engineering processes to ensure their safety and efficacy. Contract manufacturing is essential in fulfilling this need by providing the necessary expertise, infrastructure, and scalability to support the creation of these biological interventions. This demand for advanced processing capabilities is driving the surge of the biologics CDMO market.

- Outsourcing trends in the pharmaceutical sector: Pharmaceutical companies are increasingly outsourcing bioengineered fabrication to Contract Development and Manufacturing Organizations as a strategic move to reduce operational costs and streamline resources. By outsourcing, these companies can focus on their core competencies, particularly research and development, while benefiting from the expertise and scalability that they provide. This trend towards outsourcing is driving the demand for customized services in bio fabrication, leading to growth in the market.

Challenges

-

Intellectual property risks: Contract manufacturing must carefully navigate intellectual property (IP) concerns, particularly when working with innovative bioengineered therapies. As these remedies often involve novel formulations, technologies, or delivery methods, protecting propriety knowledge becomes critical. Ensuring that there are no infringements on existing patents or IP rights is especially challenging given the rapid pace of innovation in the biological space. Any failure to safeguard IP can lead to costly legal battles, loss of competitive advantage, or delayed product launches, significantly impacting biologics CDMO market success.

- Cost control: Bioengineering involves complex and resource-intensive processes, such as cell line development, fermentation, purification, and formulation, which contribute to high creation costs. For contract manufacturing, balancing these significant costs with competitive pricing can be challenging, particularly when working with smaller pharmaceutical companies that may have limited budgets. These smaller companies often struggle to afford the high upfront costs of biotech drug fabrication, making it difficult for CDOs to maintain profitability while offering cost-effective solutions to their clients.

Biologics CDMO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 21.02 billion |

|

Forecast Year Market Size (2035) |

USD 73.27 billion |

|

Regional Scope |

|

Biologics CDMO Market Segmentation:

Product Type Segment Analysis

The biologics segment is likely to capture biologics CDMO market share of around 73.4% by the end of 2035. The segment is growing due to increasing demand for advanced therapies such as monoclonal antibodies, vaccines, and gene therapies. As diseases such as cancer, autoimmune disorders, and chronic conditions rise, the need for recombinant products intensifies. CROs are crucial in providing exclusive processing services for these complex drugs, ensuring efficient formulation and compliance with regulatory standards. Additionally, the shift toward personalized medicine and biosimilars further drives growth, boosting the need for contract manufacturing capabilities in bio-med formulation.

Molecule Type Segment Analysis

By molecule type, the monoclonal antibodies segment is estimated to garner the majority biologics CDMO market share, over the forecast period. The segment’s growth is attributed to the increasing requisition for targeted therapies in treating cancer, autoimmune diseases, and other chronic conditions. According to NLM in June 2024, 56 anticancer monoclonal antibody-based treatments received approval from the Food and Drug Administration (FDA) and 48 from the European Medicines Agency (EMA). mAbs offer high specificity and efficacy, making them a preferred choice in modern medicine. They provide expertise, infrastructure, and compliance for large-scale mAb formation, driven by biotech advancements and growing global healthcare needs.

Our in-depth analysis of the global biologics CDMO market includes the following segments:

|

Product Type |

|

|

Molecule Type |

|

|

Type |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biologics CDMO Market Regional Analysis:

North America Market Insights

North America in biologics CDMO market is set to capture over 37.1% revenue share by 2035. North America is at the forefront of developing cutting-edge therapies, including gene editing and cell therapies, which drives the demand for customized information capabilities. As these therapies continue to grow, pharmaceutical companies increasingly outsource processing by fostering strategic partnerships. These collaborations enhance efficiency, streamline engineering processes, and reduce costs, contributing significantly to the expansion of the biological creation sector. The combination of innovation and outsourcing creates a dynamic growth environment for biological fabrication in North America.

The increasing prevalence of chronic diseases, cancer, and autoimmune disorders in the U.S. is driving the demand for recombinant products, which necessitates efficient fabrication solutions provided by CDOs. To meet this growing demand, U.S. companies are investing heavily in fabrication infrastructure to extend their formation capacity. The President's pledge to expand the bioeconomy prompted USD 46.0 billion in investments in bioprocessing projects in the public and commercial sectors, according to a White House report released in November 2024. These investments enable them to scale production, improving efficiency and supporting large-scale processing. Such growing investments drive U.S. biologics CDMO market expansion.

The shift toward personalized medicine in Canada, including targeted therapies and gene-based treatments, is driving the demand for genetically altered products, which requires specialized creation handled by CROs. To meet this growing demand, Canada is heavily investing in expanding its bio formulation infrastructure, including new facilities and the expansion of existing ones. In July 2021, the government of Canada stated that it spent more than USD 1.2 billion to rebuild the country's capacity for vaccines, medicines, and biomanufacturing. This investment enabled CDOs to scale up processing, offer comprehensive services, and meet global demand, significantly contributing to the growth of the biologics CDMO market in Canada.

APAC Market Insights

In APAC, the biologics CDMO market is set to garner the fastest CAGR over the forecast period. The rapid expansion of the biopharmaceutical industry in this region, driven by increasing healthcare needs and advancements in biotechnology, is boosting the demand for genetically modified products. With patent expirations for blockbuster biologics, the demand for biosimilars has surged. CROs play a crucial role in supporting the formulation of both biologics and biosimilars, driving market growth by providing specialized formation capabilities. Their involvement in the development and formation of these therapies contributes significantly to the expansion of the biologics CDMO market in the region.

China is becoming a global hub for R&D, with numerous pharmaceutical and biotech companies focusing on biologic drug development. This growing number of biological candidates drives demand for specialized creation services. Additionally, the expanding economy and improving healthcare infrastructure in China coupled with increasing disposable income and better healthcare access, contribute to the rising demand for advanced biologic therapies. These factors collectively fuel the growth of the biologics CDMO market, positioning China as a key player.

The growing biotechnology sector in India is fueled by both public and private investments, driving demand for drug development, including vaccines, monoclonal antibodies, and biosimilars. This demand boosts the need for specialized outsourced services. Additionally, the government of India, favorable policies, such as the National Biopharma Mission, support the pharmaceutical and biotechnology industries, creating a favorable environment for bio-synthetic production. For instance, in IBEF November 2024, India's biotechnology sector doubled to 70.2 billion in 2020 and is expected to reach USD 150 billion in 2025. These factors collectively contribute to the acceleration of the biologics CDMO market in India.

Biologics CDMO Market Players:

- 3P Biopharmaceuticals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie Inc.

- AGC Biologics

- Binex Co. Ltd.

- Boehringer Ingelheim International GmbH

- Bora Pharmaceuticals

- Kemwell Biopharma Pvt. Ltd.

- Lonza Group Ltd.

- Novartis AG

- Eurofins Scientific

- Rentschler Biopharma SE

Key companies in the biologics CDMO market are innovating by investing in advanced technologies such as cell and gene therapies, AI-driven process optimization, and state-of-the-art processing capabilities. They focus on enhancing bio-engineered assembly through scalable, efficient, and cost-effective solutions. Additionally, they are forming strategic partnerships to strengthen their service offerings and expand their geographic presence. For instance, in February 2024, Eurofins CDMO Alphora Inc. empowered its market grip by combining expertise in API/HPAPI with advanced biologics capacity and enhancing development capabilities through its new pilot-scale facility. Such innovations accelerate drug development and increase capacity. Some of these key companies are:

Recent Developments

- In September 2024, Eurofins Scientific expanded its bBiologics CDMO capabilities by acquiring Infinity Laboratories. The acquisition, enhanced the company’sing microbiology, chemistry, sterilization, and package testing services, strengthening its global biopharma product testing network.

- In June 2024, Asahi Kasei Medical solidifiedexpands its bBiologics CDMO presence through Bionova Scientific by, launchinged plasmid DNA services and a Texas facility, leveraging its bioprocess expertise and CRO/CDMO integration for growth.

- Report ID: 5516

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biologics CDMO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.