Biofuels Market Outlook:

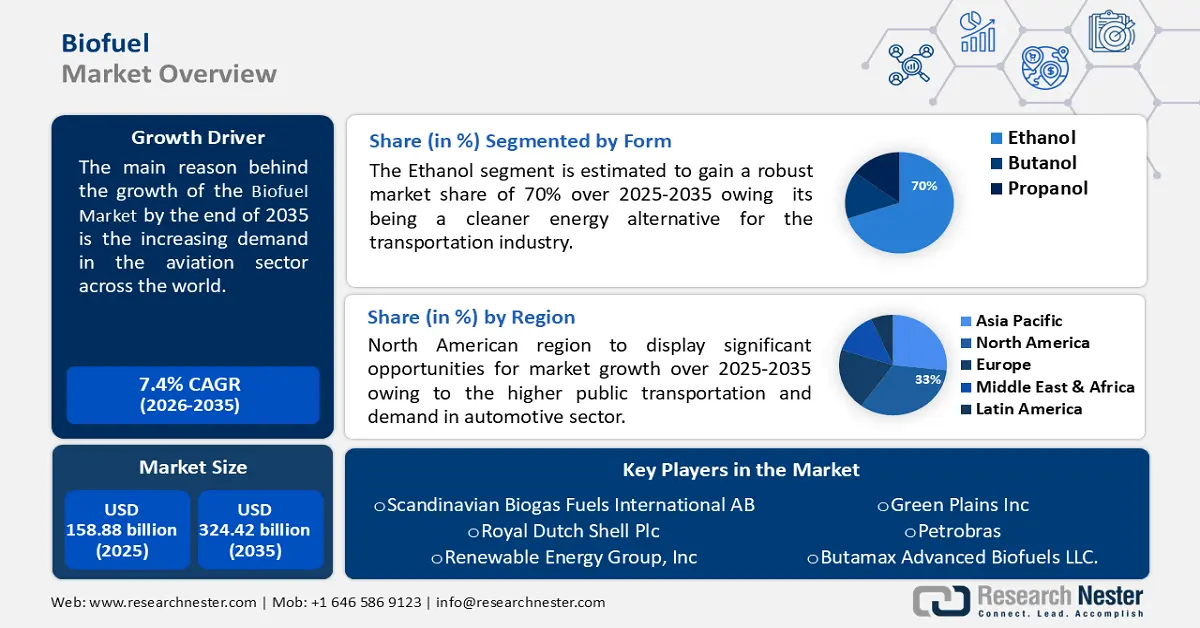

Biofuels Market size was over USD 158.88 billion in 2025 and is projected to reach USD 324.42 billion by 2035, witnessing around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biofuels is evaluated at USD 169.46 billion.

The primary growth factor boosting the expansion of the market is the high need for biofuels in the aviation sector. They are utilized as aviation fuels and also used with biomass waste, oil, and fat waste.

The aerospace sector is experiencing substantial growth due to the need for fuel-efficient and lightweight aircraft, increased air traffic, and higher income levels. Based on the International Air Transport Association (IATA) estimates, the revenue of commercial airlines in North America is projected to increase by 1.9% in 2022 compared to previous years.

Key Biofuels Market Insights Summary:

Regional Highlights:

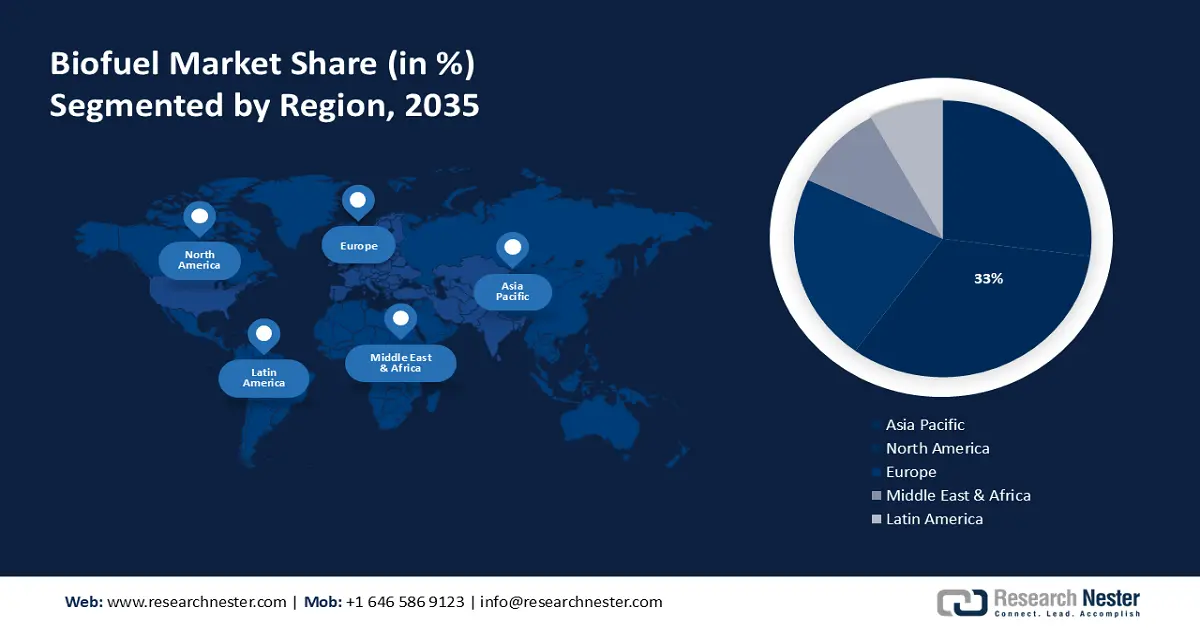

- North America biofuels market will hold more than 33% share by 2035, driven by abundant biofuel feedstock and strong government support for renewable energy.

- Asia Pacific market will achieve substantial CAGR during 2026-2035, driven by early-stage development supported by major investments and biofuel-friendly regulations.

Segment Insights:

- The ethanol segment in the biofuels market is expected to achieve a 70% share by 2035, driven by regulations encouraging renewable energy to reduce greenhouse gas emissions in transportation.

Key Growth Trends:

- Government regulatory standards to support the expansion of the market

- Urge to find suitable feedstock

Major Challenges:

- High production cost

- Industrial pollution associated with biofuels

Key Players: Butamax Advanced Biofuels LLC, Green Plains Inc., Petrobras, Renewable Energy Group, Inc., Royal Dutch Shell Plc, Scandinavian Biogas Fuels International AB.

Global Biofuels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 158.88 billion

- 2026 Market Size: USD 169.46 billion

- Projected Market Size: USD 324.42 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Brazil, Germany, China, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Biofuels Market Growth Drivers and Challenges:

Growth Drivers

- Government regulatory standards to support the expansion of the market - Government policies favoring the rapid use of biofuels are being driven by efforts to reduce carbon emissions and the decreasing availability of fossil fuels. To reach a minimum volume of 36.0 billion gallons of biofuels by 2022, the U.S. Energy Independence and Security Act of 2007 imposed standards to blend biofuels into transportation fuel.

- Urge to find suitable feedstock - The focus of biofuel advancements primarily revolves around discovering fresh sources of raw materials for producing fuels for transportation. Traditional sources like corn and sugarcane are widely utilized in biofuel manufacturing, but there is a noticeable lack of progress in converting agricultural waste, forestry leftovers, and municipal solid waste into liquid biofuels. Finding substitute raw materials is crucial to minimize the impact on land use and ensure food and feed security. Feedstock make up 3.8% of global bioethanol production in 2022 reported by IEA.

Challenges

- Industrial pollution associated with biofuels - The growth potential of biofuels is being hindered by industrial pollution caused by biofuel production and small-scale water pollution from biofuel manufacturing plants. Industrial pollution is also a result of high levels of nitrogen oxide being released into the atmosphere. As a result of these challenges, the biofuel market is expecting a decrease in growth.

- High production cost - The production costs of biofuel are quite high. Furthermore, there is a growing strain on agricultural feedstock for example, sugarcane, corn, cassava, and other biomass, which adds pressure to the market.

Biofuels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 158.88 billion |

|

Forecast Year Market Size (2035) |

USD 324.42 billion |

|

Regional Scope |

|

Biofuels Market Segmentation:

Fuel Type Segment Analysis

Ethanol segment is estimated to capture over 70% biofuels market share by 2035. The combustion of fossil fuels in internal combustion engines makes the transportation sector the largest contributor of greenhouse gas emissions on a global scale. To reduce these emissions, countries worldwide have implemented regulations to encourage the use of renewable energy sources.

Ethanol and other biofuels are seen as cleaner energy alternatives for the transportation industry, potentially driving the growth of the biofuel market in the future. Renewable Fuels Association reports stated, that with the production of 15.4 billion gallons of fuel ethanol, the United States made its place as the top producer of biofuel globally in 2022.

Form Segment Analysis

Liquid segment in the biofuels market is likely to showcase lucrative growth rate till 2035. Liquid biofuel types are in high demand compared to solid and gaseous types because they are extensively used in flexible-fuel vehicles and there is a focus on energy security. These biofuels are derived from renewable sources, especially domestic and commercial waste, which reduces concerns about resource scarcity. Furthermore, the increasing use of liquid biofuels as a transportation fuel in the automotive transportation sector is driving the demand for biofuels.

Application Segment Analysis

In application segmentation, the automotive segment in the biofuels market is anticipated to dominate the revenue in the year 2035. Biofuels like ethanol, biodiesel, and other alternatives are being used more and more as a means of fuel for transportation in the automotive industry. The automotive sector has significant potential for growth due to factors for instance, the increasing need for fuel-efficient vehicles, the shift towards electric vehicles, and urbanization trends.

The number of newly registered vehicles in Australia saw a 1.2% increase, with 101,233 units in March 2022 compared to March 2021. As the automotive transportation sector experiences rapid growth and production trends, the demand for biofuels as transportation fuel or vehicle engine fuel is on the rise.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Fuel Type |

|

|

Feedstock |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biofuels Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 33% by 2035, influenced by rapid growth in the automotive industry in the region. The established base for biofuel utilization, abundant biofuel feedstock, and supportive government policies for renewable energy are influencing the promising growth potential of biofuel in this region. The growth of the automotive sector in North America is being driven by increasing public transportation, the demand for fuel-efficient vehicles, and stringent regulations for particulate emissions. In the United States automotive production grew by 10.8 million units in 2023, up from 10.47 million in 2022 found to data from the International Organization of Motor Vehicles Manufacturers.

The U.S. biotech sector is highly advanced internationally and can manufacture profitable biobased products. Due to multiple government initiatives aimed at supporting biofuels across different industries, Canada presents a promising potential for biofuel manufacturing.

APAC Market Insights

APAC biofuels market is estimated to grow substantially through 2035. In the Asia-Pacific region, the implementation and growing acceptance of biofuel-friendly laws and regulations are anticipated to boost the demand for biofuels, especially in the transportation industry. Despite biofuels being at an early stage in Asia Pacific, there is substantial room for expansion, exemplified by NESTE's investment of USD 1.4 billion in a biorefinery in Singapore in 2019.

Due to the increased awareness of reducing carbon emissions and improving the use of biofuels, India is making advancements.

The government in the region set a target to reduce greenhouse emissions to boost the market growth in Japan.

China is currently at the forefront in manufacturing, research, and innovation investments. One of the most crucial market factors is the need to reduce its dependence on oil and energy exports.

Biofuels Market Players:

- Wilmar International Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide S.A.

- Archer Daniels Midland Company

- Bunge North America, Inc.

- Butamax Advanced Biofuels LLC

- Green Plains Inc.

- Petrobras

- Renewable Energy Group, Inc.

- Royal Dutch Shell Plc

- Scandinavian Biogas Fuels International AB

The global industry faces intense competition, with major players actively engaging in research and development. The ongoing innovations by suppliers have emerged as a critical factor for companies to achieve success in the market. At present, there is a surge in investments, supported by favorable policies and economic backing from the governments of major economies.

Recent Developments

- Petrobras has announced the initiation of tests to assess the performance of a B24 bio bunker fuel blend, which will be utilized to power a vessel berthed at the Rio Grande (RS) Terminal. The ship, chartered by Transpetro, will be filled with 573,000 liters of this fuel blend.

- Zagros Petrochemical Company and Dalian Petrochemical Company of China have agreed to set up a plant in Iran for converting methanol to synthetic ethanol, marking the first ethanol plant in the country. The plant is anticipated to produce 300,000 tons and is scheduled to become operational within three years.

- Report ID: 6209

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biofuels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.