Biodegradable Polymers Market Outlook:

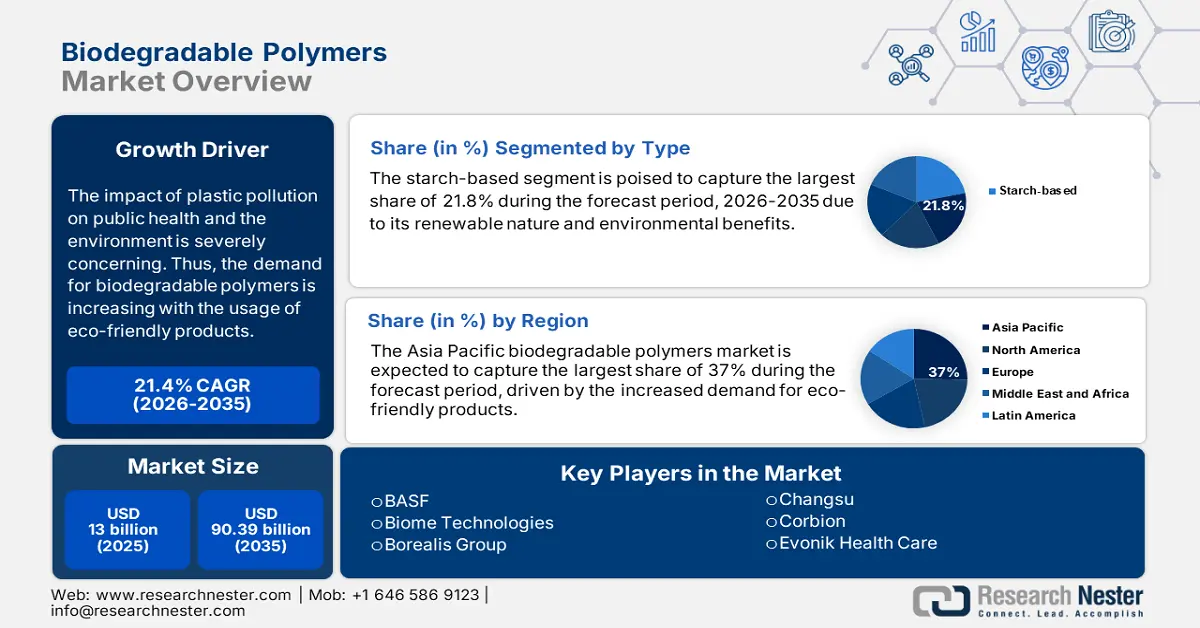

Biodegradable Polymers Market size was over USD 13 billion in 2025 and is anticipated to cross USD 90.39 billion by 2035, witnessing more than 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biodegradable polymers is estimated at USD 15.5 billion.

The changing consumer preferences towards the usage of eco-friendly products drive significant growth. The impact of plastic pollution on public health and the environment is severely concerning. Non-biodegradable components take a long time to be demolished, increasing the amount of waste in society. According to a UN report published in May 2023, plastics take 1000 years to be broken naturally. Thus, the discarded waste affects marine wildlife, soil, and water, causing serious health issues in the future.

Plastic polymers have become a part of daily human lives through their diverse usage in various sectors. This inspires the biodegradable polymers market to produce more effective alternatives. The massive acceptance from consumers has increased the production of bio-based components to be used as a replacement for conventional ones. Discoveries in this industry are inspiring chemical market leaders to invest in more innovative products. The rise of bioplastics is gaining traction in various applications such as consumer goods and agricultural films. According to an NLM article published in February 2023, global bioplastic production is expected to account for 7.5 million tons by 2026. The article further states that the production of biodegradable plastics in 2021 captured 64% of the total bioplastic capacity.

Key Biodegradable Polymers Market Insights Summary:

Regional Highlights:

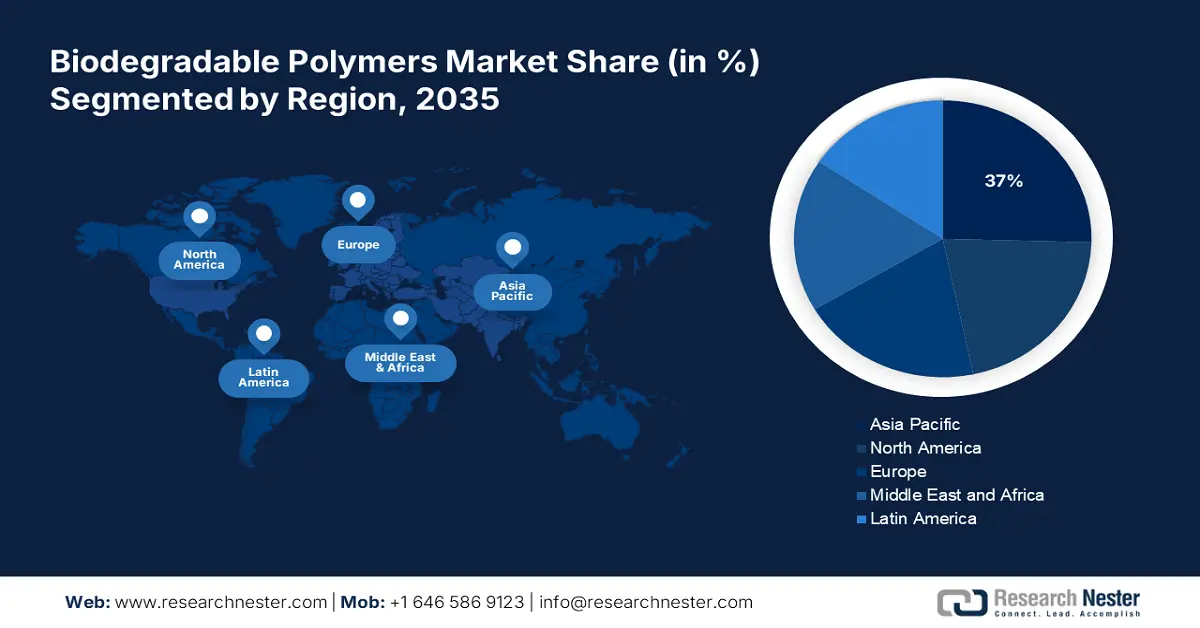

- Asia Pacific dominates the biodegradable polymers market with a 37% share, propelled by increased demand for eco-friendly products due to a focus on reducing plastic pollution, ensuring growth through 2026–2035.

- North America’s biodegradable polymers market is set for notable growth from 2026–2035, driven by increasing consumer awareness and regulatory promotion of renewable alternatives.

Segment Insights:

- The starch-based segment is forecasted to hold a 21.8% share by 2035, driven by its renewable, eco-friendly nature and enhanced blend capabilities.

Key Growth Trends:

- Application in the packaging industry

- Government initiatives to promote adoption

Major Challenges:

- Expensive market price

- Conditional degradation

- Key Players: BASF, Biome Technologies, Borealis Group, Changsu, Corbion, Evonik Health Care, FKuR, Jiangmen Xinshuo New Materials Co., Ltd, NaturTec, Novamont, Polysciences, Kaneka.

Global Biodegradable Polymers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13 billion

- 2026 Market Size: USD 15.5 billion

- Projected Market Size: USD 90.39 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Biodegradable Polymers Market Growth Drivers and Challenges:

Growth Drivers

- Application in the packaging industry: The shift towards sustainable options for packaging has enlarged the biodegradable polymers market. Driven by consumer demand, packaging for consumer goods, particularly food, is switching to eco-friendly options. Companies are prioritizing the usage of biodegradable packaging to obtain sustainability. Many utilize this alternative to distinguish their branding by portraying themselves as environmentally responsible brands. This further encourages other competitors to invest in these biodegradable solutions. For instance, in September 2022, Amcor invested USD 0.25 million in Bloom and Nfinite to utilize their recyclable and biodegradable polymers.

- Government initiatives to promote adoption: Strict regulatory policies on banning plastic usage in every sector have forced consumers to switch to alternatives. This further derives greater acceptance and demand in the biodegradable polymers market. Worldwide governing authorities are implementing regulations to promote the usage of these non-conventional polymers through incentives and mandates. Governments are also setting standards to maintain the quality of polymers, building consumer trust. For instance, the Plastic Waste Management Rules mandate certification of all biodegradable plastics. Under this act, the products shall comply with Indian Standard IS: 17088 before supplying, according to the PIB Delhi article, March 2023.

Challenges

- Expensive market price: The high cost of products may become a hurdle for the biodegradable polymers market. These often rely on renewable sources such as starch, PLA, and PHA, which can be more expensive than fuel-based feedstocks. On the other hand, the complexity of the manufacturing process requires extensive equipment, resulting in additional expenses. As the industry is still developing, there are limitations in sufficient investments for research and development.

- Conditional degradation: Many biodegradable polymers require specific disposal conditions, such as moisture, temperature, and microbial activity. Lack of composting facilities may hinder the process of effective degradation. Thus, polymers can fail to serve their purpose of a shorter presence in the environment. This further violates the regulatory framework and affects consumer trust. The inconsistent degradation rates can also limit the product’s end-of-life options. This may lead to less biodegradable polymers market acceptance, pushing consumers to switch to alternatives.

Biodegradable Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 13 billion |

|

Forecast Year Market Size (2035) |

USD 90.39 billion |

|

Regional Scope |

|

Biodegradable Polymers Market Segmentation:

Type (Starch-based, Polylactic Acid, Polyhydroxy Alkanoates, Polyesters, Cellulose Derivatives)

Based on type, starch-based segment is anticipated to dominate around 21.8% biodegradable polymers market share by the end of 2035. The growth is driven by its renewable nature and environmental benefits. The polymer is formulated by processed starch, extracted from bio-sources such as corn, potato, and tapioca. Companies are now blending starch-based polymers including TPS with other bioplastic materials such as PLA to enhance their properties. Private-public collaboration is putting efforts into discovering more reliable starch sources. For instance, in July 2024, Ecostarch inaugurated a bioplastic bag manufacturing plant with the support of NECTAR. The facility will utilize biodegradable polymers made from Cassava starch through its plantation in Nagaland.

Application (Agriculture, Textile, Consumer Goods, Packaging, Healthcare)

In terms of application, the agriculture segment is projected to create one of the largest consumer bases for the biodegradable polymers market. The growing popularity of sustainable and eco-friendly farming practices is driving rapid growth in this segment. Increasing demand for organic farming goods is pushing this sector to adopt bio-based products. Biodegradable polymers are now being used to produce various farming essentials such as fertilizers, pesticides, seed coatings, mulch films, and others. For instance, in November 2023, Sulzer launched its licensed PCL manufacturing technology CAPSUL. This solution can accelerate PCL production for industries including agriculture. These innovations are propelling the process of development to serve large-scale farming.

Our in-depth analysis of the global biodegradable polymers market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biodegradable Polymers Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is set to account for largest revenue share of 37% by 2035. The region is focused on reducing plastic pollution, leading to increased demand for eco-friendly products. This further encourages the extensive adoption of bio-based polymers to align with strict regional environmental regulations. The enlarging surge for organic consumer goods is also influencing companies to accelerate renewable polymer production. Global leaders are now expanding their production capacity of renewable polymers to capture such a large market space. For instance, in April 2023, BASF established compounding capacities in China to make Ecovio accessible to customers in Asia Pacific. Qualifying trials aim to extend the company portfolio by introducing innovative biopolymers and services.

India is embarking on significant growth in the biodegradable polymers market due to increased plastic pollution across the country. Government and public health authorities are proactively taking action to help promote compostable products. Thus, it increases the demand for biodegradable polymers to produce organic products. Both domestic and international companies are contributing to offering regulatory-compliant materials. Research and development are also being encouraged to introduce more efficient solutions. For instance, in September 2023, researchers from IASST, Guwahati discovered a flexible biodegradable nanocomposite film PVA-CuO. The optically active polymer performs excellently for stretchable optical devices such as flexible displays, flexible organic LED, and others.

Holding one of the biggest populations in the world, China has been reported to encounter massive plastic pollution. According to a report published by the Asian Development Bank, in June 2023, the PRC generated 590.4 million tons of plastic waste by 2019. This has paved the focus of both national and international environmental organizations. Besides recycling, they are considering the implementation of bioplastics in every sector as an effective solution. The government of China is also contributing to this growth by issuing subsidiary projects. Thus, it further fosters great investment opportunities for the market.

North America Market Analysis

North America is predicted to generate notable revenue from the biodegradable polymers market by the end of 2035. Increasing consumer awareness is influencing industries to restrict the usage of single-use plastics. The regulatory framework also promotes the adoption of renewable alternatives for packaging and other industries. The diverse applications and public-private collaboration are helping to commercialize bioplastics. The market expansion is also propelled by increased research and development in this sector.

The U.S. is projected to register a remarkable adoption rate in the biodegradable polymers market. As obtaining sustainability becomes a priority for industries, the country is predominantly acquiring a larger consumer base for continued growth. Advancements in polymers such as PLA and PHA are inspiring companies to introduce more innovation in this sector. Global leaders are investing to expand their product portfolio to offer affordable materials. For instance, in August 2021, Danimer Scientific acquired Novomer, a biodegradable polymer production house. The strategic move was made to access Novomer’s conversion technology and quality materials to reduce its production cost.

Canada is garnering a lucrative scope of development in the biodegradable polymers market by investing in replacing plastic usage with alternative renewables. Growing demand for sustainable packaging and consumer goods penetrating innovations. The country is positioning itself as a big market participant by fostering collaboration among businesses. Industries are adopting bio-based solutions to meet their sustainability goals and consumer expectations. Moreover, the partnered effort from government and private individuals is presenting a favorable opportunity for global leaders.

Key Biodegradable Polymers Market Players:

- BASF

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biome Technologies

- Borealis Group

- Changsu

- Corbion

- Evonik Health Care

- FKuR

- Jiangmen Xinshuo New Materials Co., Ltd

- Mitsubishi Chemical Group

- NaturTec

- Novamont

- Polysciences

The biodegradable polymers market players are introducing innovative solutions to stand out in global competition. New production technology and biobased raw materials are in prime focus to collect great success in lowering plastic waste. They are also utilizing recycled materials to produce high-quality and eco-friendly outputs. For instance, in May 2023, TotalEnergies Corbion and Coexpan collaboratively launched biobased cups using recycled PLA. The production of this product utilizes FFS technology to accelerate output compared to the other plastic materials. Such collaboration inspires other market leaders to participate in introducing more developments in this sector. These key players include:

Recent Developments

- In May 2024, SKC started constructing the world’s biggest PBAT production plant in Vietnam. The manufacturing unit aims for an annual output of 70,000 tons of biodegradable material. The production plant will be able to operate efficiently for raw material mixing and ester polymerization to produce PBAT.

- In April 2024, Lygos launched a high-performing biodegradable polymer, Soltellus. This line of eco-friendly substances can enhance sustainability for the skin and hair care industry. The polymer is multi-functional and serves with cost-effective benefits.

- Report ID: 6647

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biodegradable Polymers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.