Bio Plasticizers Market Outlook:

Bio Plasticizers Market size was valued at USD 3.5 billion in 2025 and is expected to reach USD 7.84 billion by 2035, registering around 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bio plasticizers is evaluated at USD 3.76 billion.

It is anticipated that using sustainable practices in the production of plastic will boost resource efficiency, and reduce waste and pollution. Moreover, it will result in opening up new avenues for innovation, boosting the economy thus, exponentially fueling the demand for bioplasticizerss.

Bio plasticizerss are environmentally sustainable and highly compatible with a wide spectrum of biopolymer matrices, making them the preferred choice for products such as bio-based polyvinyl chloride (PVC) and polylactic acid (PLA) films. For instance, in January 2024, specialty chemicals innovator Perstorp introduced PevalenTM Pro 100, which ushers in a new era in PVC plasticizing technology. Pevalen Pro 100 provides an approximate 80% reduction in carbon. Furthermore, taking into account, the biogenic CO2 uptake from its renewable raw materials.

Key Bio Plasticizers Market Insights Summary:

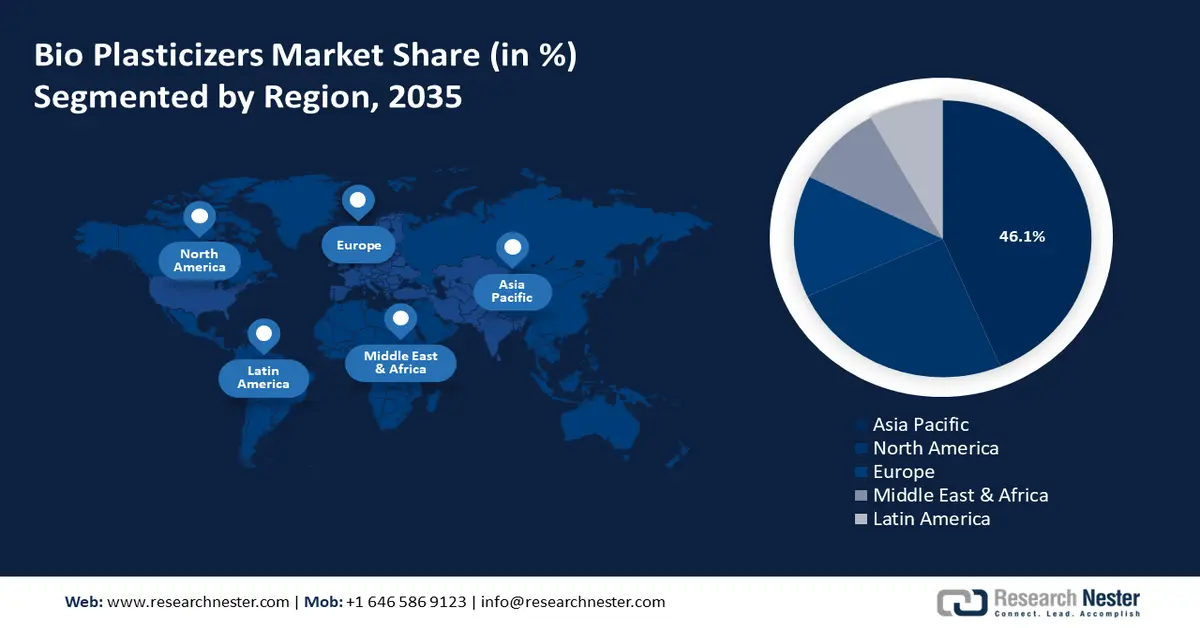

Regional Highlights:

- Asia Pacific leads the Bio Plasticizers market with a 46.1% share, driven by increasing demand for flexible PVC and packaging materials, supporting sustainable growth through 2026–2035.

- North America's bio plasticizers market is set for growth through 2026–2035, attributed to the growing automotive and construction sectors and consumer interest in biodegradable products.

Segment Insights:

- The Plant-based Sources segment is expected to experience significant growth from 2026 to 2035, fueled by biodegradability, re-manufacturability, and reduced reliance on fossil fuels, holding an 89.70% market share.

Key Growth Trends:

- Adoption of sustainable solutions

- Accelerating growth in renewable plastics

Major Challenges:

- Restricted performance

- Lack of standardization

- Key Players: Avient Corporation, BASF SE, Cargill, Incorporated, DIC Corporation, Dow, Inc., Emery Oleochemicals, Evonik Industries AG.

Global Bio Plasticizers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.76 billion

- Projected Market Size: USD 7.84 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, Germany, United States

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 14 August, 2025

Bio Plasticizers Market Growth Drivers and Challenges:

Growth Drivers

-

Adoption of sustainable solutions: Concerns over sustainability have stimulated the bio plasticizers market practices in a manner to reduce the impacts on the environment. Furthermore, a shift can be seen toward bio-based plasticizerss, thus driving innovations toward greener chemistry and resource efficiency. For instance, in April 2021, BASF introduced biomass-balanced (BMB) plasticizerss under the brand names Hexamoll, DINCH BMB, Palatinol, N BMB, Palatinol, 10-P BMB, and Plastomoll. Such plasticizerss are composed of organic waste such as biogas was used in place of fossil fuels, to reduce C02 emissions.

- Accelerating growth in renewable plastics: The bio plasticizers market has been growing at a steady pace over the past few years. For instance, in June 2023, the KLJ Group invested USD 145 million and inaugurated a production facility. This is a BIS-certified, Plasticizerss & Phthalic Anhydride facility opened to serve in Gujarat. The KLJ Group utilized between 70 and 75% of the phthalic anhydride produced for internal use. As the bioplastics industry grows, so do the requirements for high-performance, sustainable, and efficient plasticizerss will grow.

Challenges

-

Restricted performance: The bio plasticizers market faces challenges due to the complexities involved in designing through chemical modification techniques. It possesses inadequate thermal stability and mechanical strength which reduces the lifespan of the product. Moreover, it has confined compatibility with other polymers in contrast to traditional phthalates and thus restricts their use in high-performance applications. In addition, higher production costs lead to restricted research and developmental activities in this field.

- Lack of standardization: Concerns about performance, quality, and environmental impact are frequently raised when standardized testing procedures are not met. This challenge poses a difficulty for the players to adopt bio plasticizerss solutions. The industries also hesitate about moving to bio-plasticizerss, while lacking relevant data regarding long-term performance and sustainability benefits. Furthermore, ambiguity in regulatory compliance across different geographies causes disparities and thus obstructs consumers from having an apt comparison.

Bio Plasticizers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 7.84 billion |

|

Regional Scope |

|

Bio Plasticizers Market Segmentation:

Raw Material Sources (Plant-based Sources, Bio-waste derived materials, Others)

Plant-based sources dominate the bio plasticizers market with a notable share of 89.7%, due to their availability, re-manufacturability, and biodegradability. In addition, bio-based plasticizerss are derived from extracts of oil such as soybean, castor oil, and palm oil. This reduces dependence on fossil fuel reserves and helps lower greenhouse gas emissions. For instance, in October 2021, with the introduction of Bioveroa bio-based plasticizers, Cargill expanded its portfolio of bioindustrial solutions. Production of Biovero plasticizerss was an effort toward a more sustainable supply chain in commercial manufacturing. This leverages new uses for renewable feedstocks and brings more ecologically friendly products to the bio plasticizers market.

Product (Epoxidized Soybean Oil (ESBO), Citrates, Castor Oil-based plasticizerss, Succinic Acid, Glycol Esters, Others)

The epoxidized soybean oil (ESBO), is accounted to dominate the market owing to its high plasticizing efficiency, good thermal stability, and low tendency to migrate. For instance, in September 2021, CHS increased the capacity of its soybean oil refining plant in Mankato with an estimated investment of USD 60 million. This opportunity helped in expanding market access and shifting market dynamics. At the Mankato facility, the yearly production of epoxidized soybean oil rose by more than 35% annually. Moreover, its dominance is evident in automotive applications as bioplastics are suitable for interior components and enhance performance.

Our in-depth analysis of the bio plasticizers includes the following segments:

|

Product |

|

|

Raw Material Sources |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bio Plasticizers Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific industry is likely to dominate majority revenue share of 46.1% by 2035, and increasing demand for flexible PVC and packaging materials. Moreover, government policies and regulations, availability of feedstocks, relatively low manufacturing costs, and expansive automotive and construction industries further contribute to the growth. In this region, public and private entities facilitate and push innovations and development in the field through their investments.

China is evolving with stringent policies and regulatory frameworks in the bio plasticizers market. For instance, in April 2021, China released GB/T 39514-2020, a new national product standard that covered biobased material additives, biobased composites, and goods manufactured from a variety of biobased materials. According to this standard, clear and permanent marking techniques such as molding, printing, embossing, branding, and others can be used to identify a product.

In India, the focus of the bio plasticizers market players is on the expansion of infrastructure to facilitate the operations in the manufacturing of bio plasticizerss, For instance, in April 2024, Payal Plastichem Pvt. Ltd., part of Payal Group, initiated phase 1 for commercial operation of its plasticizers plant in Coimbatore. The plant's initial production capacity was estimated at around 30,000 MT/PA. Furthermore, it is also the first plasticizers plant in Southern India that aims to focus on phthalate-free & REACH-compliant products.

North America Market Analysis

North America will experience the fastest growth in the bio plasticizers market after Asia Pacific owing to the increasing automotive and construction sector, availability of bio-based feedstocks such as soybean oil or corn starch, phthalate-based plasticizers regulations, and increasing consumer interest in biodegradable products. Overall, North America possesses adequate well-established manufacturing infrastructure, research institutions, as well as industry collaborations that provide the foundation for the innovation and commercialization of bio-plasticizerss.

In the U.S. market players are substantially expanding their portfolios through strategic collaborations within the bio plasticizers market. For instance, in March 2024, a new partnership agreement was announced between Innoleics and Baerlocher USA. As per the agreement, Baerlocher USA became the U.S. distributor of Innoleics' entire range of bio-based plasticizerss for flexible polyvinyl chloride (PVC) applications, giving customers more access to these cutting-edge, eco-friendly materials. The company will also leverage to produce customizable bio plasticizerss.

In Canada, the local government initiatives aid in revolutionizing the shift towards a greener environment in the bio plasticizers market. For instance, in February 2024, the local government, via the Jobs and Growth Fund initiative, committed to grant USD 1 million in favor of BOSK Bioproducts. To create bioplastics, BOSK Bioproducts gathered industrial waste such as bio-sludge from the paper industry and converted it into alternatives that can be composted. The goal of this 100% compostable solution is to drastically cut down on environmental plastic waste.

Key Bio Plasticizers Market Players:

- DIC Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avient Corporation

- BASF SE

- Cargill, Incorporated

- Dow, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Goldstab Organics Pvt. Ltd.

- GRUPO PRINCZ IPASA

- JUNGBUNZLAUER SUISSE AG

The bio plasticizers market landscape is being shaped by global companies and emerging players placing their focus on sustainable materials. For example, In March 2023, OQ Chemicals marked a critical turning point in the development of sustainable chemicals. It introduced OxBalance Isononanoic Acid, composed of bio-based content (70%) and circular feedstocks. In addition, it had ISCC PLUS certification and was the first commercially available product in the world. Furthermore, the stringent environmental regulations are compelling market players to incline for renewable resources including biomass and vegetable oils. Furthermore, the advanced research and extensive distribution network assist in meeting the growing consumer needs and preferences.

Here is the list of some eminent players:

Recent Developments

- In January 2022, Evonik released cyclohexanoate, another cutting-edge plasticizers of the newest generation. The novel substance possesses highly desirable qualities that greatly enhance the product's ability to withstand weather and last longer.

- In October 2020, Emery Oleochemicals, offered the new EMEROX Ester Plasticizers product line. It possessed outstanding low-temperature performance, low water solubility, low viscosity, and high thermal stability.

- Report ID: 6574

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bio Plasticizers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.