Lubricants Market Outlook:

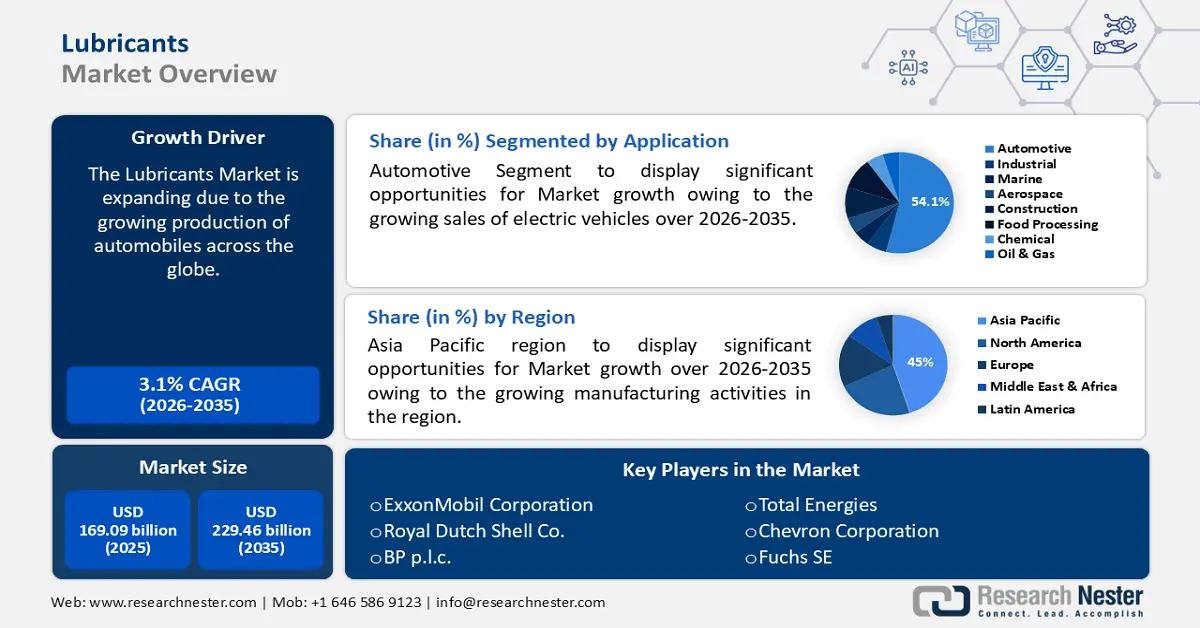

Lubricants Market size was over USD 169.09 billion in 2025 and is anticipated to cross USD 229.46 billion by 2035, growing at more than 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lubricants is assessed at USD 173.81 billion.

The growing production of automobiles acts as a primary growth driver for the lubricants market by directly influencing the need for high-performance lubricants across various segments of the automobile industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), the estimated world vehicle motor production in 2023 was approximately 93 million units. Modern vehicles are designed with higher performance standards, which necessitate advanced lubricants to meet these requirements. This includes lubricants that can withstand higher temperatures, reduce friction, and improve fuel efficiency. Moreover, global expansion of vehicle fleets drives demand for lubricants for maintenance and performance optimization.

Key Lubricants Market Insights Summary:

Regional Highlights:

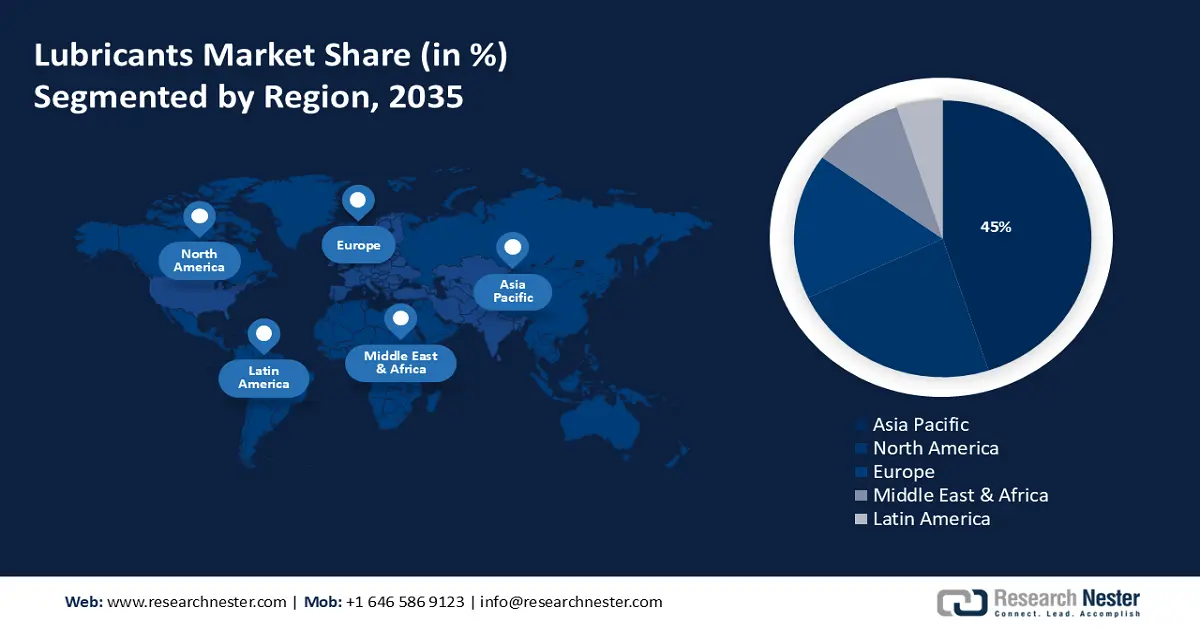

- The Asia Pacific lubricants market will secure over 45% share by 2035, driven by increasing manufacturing activities and demand for innovative lubricant products.

- The North America market will exhibit tremendous growth with a strong share by 2035, driven by the rising demand for oil and gas lubricants fueled by shale production and energy infrastructure investments.

Segment Insights:

- The automotive segment in the lubricants market is expected to experience robust growth till 2035, driven by the growing sales of electric vehicles.

- The hydraulic fluid segment in the lubricants market is projected to secure a significant share by 2035, driven by its widespread applications across various sectors.

Key Growth Trends:

- Expanding food & beverage industry

- Increasing spending in construction

Major Challenges:

- Stringent environmental regulations

- Volatility in the prices of base oils

Key Players: ExxonMobil Corporation, Royal Dutch Shell Co., BP p.l.c., Total Energies, Chevron Corporation, Fuchs SE, Castrol India Ltd., Amsoil Inc.

Global Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 169.09 billion

- 2026 Market Size: USD 173.81 billion

- Projected Market Size: USD 229.46 billion by 2035

- Growth Forecasts: 3.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, Indonesia, Thailand

Last updated on : 17 September, 2025

Lubricants Market Growth Drivers and Challenges:

Growth Drivers

- Expanding food & beverage industry - As the food & beverage industry expands, there is a greater demand for machinery such as conveyor belts, mixers, packaging equipment, and processing machines. These require lubrication to operate efficiently and maintain uninterrupted production. It is anticipated that the global food & beverage industry will expand by around 12% by 2027. Additionally, there is a high need for food-grade lubricants to ensure compliance with stringent safety and regulatory requirements set by food and safety organizations, prevent contamination, and maintain product quality.

- Increasing spending in construction - Construction activities such as building infrastructure, residential complexes, and commercial spaces involve heavy machinery and equipment that depends on lubricants for smooth operation and maintenance. Therefore, as construction expenditure rises, there is a corresponding surge in the demand for lubricants to maintain the optimal efficiency and longevity of the machinery. In 2023, the US construction sector was valued at about USD 2 trillion. By 2027, the total value of construction projects in the United States, including residential, non-residential, and non-building categories, is expected to exceed USD 2.2 trillion.

- Flourishing marine sector - The rise in global marine trade increases maritime transportation, leading to an increased market demand in marine. Ships and vessels in the marine industry depend on lubricants to maintain the efficiency and longevity of their engines and other machinery. The need for high-performance lubricants is further fueled by stringent environmental regulations. Additionally, leading marine companies are collaborating to set strategies into place that will reduce shipping emissions. For instance, in 2023, Mitsui O.S.K. Lines, Ltd. and Shell Marine Products Singapore, a business division of Shell Eastern Trading Pte. Ltd. (Shell), signed a Memorandum of Understanding (MoU), pledging to work together towards the advancement of alternative maritime solutions and the holistic management of carbon emissions liabilities.

Challenges

- Stringent environmental regulations - Increasingly stringent regulations regarding emissions and environmental impact are pushing lubricant manufacturers to develop more eco-friendly products. This can increase costs, restraining market growth.

- Volatility in the prices of base oils - The lubricants market is restrained by the volatile price of the raw materials required to manufacture industrial lubricants. Mineral and synthetic-based base oils are predominantly derived from crude oil and the constant fluctuation in crude oil prices acts as a barrier to market expansion.

Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 169.09 billion |

|

Forecast Year Market Size (2035) |

USD 229.46 billion |

|

Regional Scope |

|

Lubricants Market Segmentation:

Application Segment Analysis

Automotive segment is projected to account for around 54.1% lubricants market share by 2035. The segment growth can be attributed to the growing sales of electric vehicles. As per the International Energy Agency (IEA), sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, a 35% annual rise.

The market is anticipated to be driven by the adoption of EVs, which need lubricants in critical electrical components such as braking fluids, grease, gear oils for differentials, wheels, chassis, and gear reducers, and coolants for car batteries to improve efficiency, extend the life of the vehicle, and lessen friction and wear on its moving parts.

Base Oil Segment Analysis

The synthetic segment in lubricants market is estimated to gather the highest CAGR during the forecast timeframe. The major factor in the expansion of the segment is the rising focus on sustainability. In 2023, more than 55% of businesses globally began utilizing more environmentally friendly resources, such as recycled materials and goods with reduced emissions.

Synthetic lubricants ensure sustainable performance as they improve fuel efficiency, have low maintenance costs, and help to adopt a more environmentally friendly and sustainable strategy by lowering the need for packaging materials. Synthetic lubricants are made from sophisticated synthetic base stocks; therefore, there is less need for large-scale crude oil extraction, which also lowers the carbon emissions brought on by lubricant distribution, logistics, and transportation.

Product Type Segment Analysis

The hydraulic fluid segment is assessed to generate a significant lubricants market share by the end of 2035 due to its widespread applications across different sectors. For instance, hydraulic fluids are widely used in forklift trucks, log splitters, car lifts, snow plows, skid steerers, aircraft, air tools, tractors, cruise ships, and the marine industry. Hydraulic oil keeps moving parts lubricated, promotes effective power transmission, and ensures smooth operation of hydraulic equipment. The demand for hydraulic oil is mostly driven by the growing use of hydraulic equipment in heavy machinery and automobiles.

Our in-depth analysis of the global lubricants market includes the following segments:

|

Base Oil |

|

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lubricants Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 45% by 2035. The market growth in the region is expected on account of the increasing manufacturing activities. Presence of many key players like Shell, ExxonMobil, and Total Energies dominate the regional market, focusing more on innovation and sustainability in lubricant products to meet diverse industry needs.

Japan's aerospace sector is now a thriving industry, which may lead to higher demand for lubricants that are used in the production, maintenance, and repair of aircraft, spacecraft, and defense systems and technologies. The aircraft manufacturing business produced over USD 10 billion in fiscal year 2022, up from around USD 7 billion in the previous fiscal year.

In the upcoming years, there is anticipated growth in the lubricants market in China as the country aims to lead the world in smart manufacturing. Moreover, China’s automotive lubricants market is expected to grow at a significant growth rate. For instance, according to the China Association of Automobile Manufacturers, total vehicle sales of both passenger and commercial vehicles increased from 27 million in 2021 to 27.7 million in 2022.

South Korea's robust automobile manufacturing sector is one of the primary growth drivers leading to market expansion. Key players such as Hyundai and Kia are experiencing a constant increase in demand for premium lubricants. Furthermore, the strong industrial sector in South Korea has boosted market growth. This includes the shipbuilding, steel, and electronics sectors, all of which depend on different kinds of lubricants to ensure the reliable and efficient operation of machinery.

North American Market Insights

The North America region will also register tremendous lubricants market revenue during the forecast period. The market expansion is attributed to the rising demand for oil and gas lubricants in the region. This rise has been fueled by factors such as shale production and energy infrastructure investments, in addition to good economic conditions and continuous regional industrial advancements.

The lubricants market in the United States is one of the world's largest, owing to the presence of diverse industrial sectors, wide transportation networks, and robust automobile industry. According to the International Trade Administration in 2020, U.S. light vehicle sales were 14.4 million units.

In Canada the construction sector’s growth and infrastructure development projects create a demand for lubricants for construction equipment and machinery. The Canada construction landscape reached USD 350.1 billion in 2023.

Lubricants Market Players:

- Philips 66 Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil Corporation

- Royal Dutch Shell Co.

- BP p.l.c.

- Total Energies

- Chevron Corporation

- Fuchs SE

- Castrol India Ltd.

- Amsoil Inc.

The lubricants market consists of many key players who are thought to be the main participants in this market as they are always working together, growing, signing deals, and participating in joint ventures to support the development of this industry.

Recent Developments

- In October 2023, Exxon Mobil Corporation and Pioneer Natural Resources have announced a formal agreement for ExxonMobil to acquire Pioneer. Under the terms of the agreement, Pioneer shareholders received 2.3234 shares of ExxonMobil for each Pioneer share at closing.

- In May 2024, TotalEnergies announced the creation of the first standardized specifications for Electric Drive System (EDS) fluids to satisfy strict requirements like viscosity, oxidation, corrosion, durability, and material compatibility while maximizing the performance and energy efficiency of electric transmissions and motors.

- Report ID: 6275

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.