Automotive Wrap Films Market Outlook:

Automotive Wrap Films Market size was valued at USD 12.59 billion in 2025 and is set to exceed USD 103.92 billion by 2035, expanding at over 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive wrap films is estimated at USD 15.25 billion.

The growing global population, increasing urbanization, and rising personal income levels are all contributing factors to the rise in luxury car sales. This is one of the main reasons behind the global need for car wrap films, along with significant advancements in the automotive infrastructure. Furthermore, the market is expanding because more people are becoming aware of the advantages of utilizing automotive wrap films in cars, including their affordability, ease of removal, durability, and resistance to weather, UV rays, and other environmental conditions.

Key Automotive Wrap Films Market Insights Summary:

Regional Highlights:

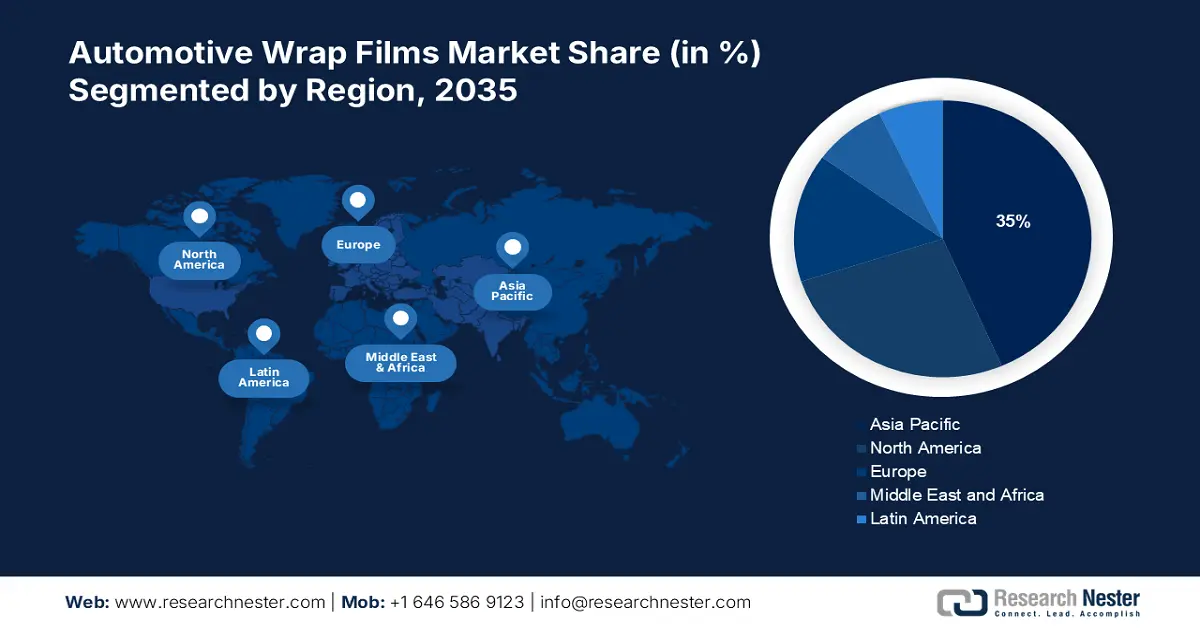

- Asia Pacific automotive wrap films market achieves a 35% share by 2035, driven by rising automobile production, growing disposable incomes, and consumer interest in vehicle customization.

Segment Insights:

- The cast film segment in the automotive wrap films market is expected to achieve a 56% share by 2035, driven by outstanding conformability, durability, and UV stability of cast films.

- The passenger cars segment in the automotive wrap films market is forecasted to witness significant growth till 2035, driven by high vehicle production and widespread use of wrap films in passenger cars.

Key Growth Trends:

- Rise of the international sign and graphics sector

- Emergence of automotive wrap film customization choices

Major Challenges:

- Technological Issues

- Complexity in installation

Key Players: 3M, KPMF, Arlon Graphics LLC, Fedrigoni S.p.A., Vvivid Vinyl, ORAFOL Europe GmbH, HEXIS S.A.S., Guangzhou Carbins Film Co., Ltd., JMR Graphics, Nitto Denko Corporation.

Global Automotive Wrap Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.59 billion

- 2026 Market Size: USD 15.25 billion

- Projected Market Size: USD 103.92 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Automotive Wrap Films Market Growth Drivers and Challenges:

Growth Drivers

- Rise of the international sign and graphics sector - The need for graphics in a wider range of applications and advancements in printing technology & functional printing have led to a recent surge in the global sign and graphics business. As per the Advertising Association of America, the global industry for outdoor advertising is growing at a substantially quicker pace than that of indoor advertising.

Over the past few years, advances in inkjet printer technology have led to higher productivity, longer lifespans, and lower sales of printers. It is anticipated that emerging technologies will sustain the vibrancy of the printer industry and propel digital printing's growth in a variety of sectors, including automotive wrap films market. As observed, in 2024, the digital printing industry is expected to be worth USD 33.43 billion and by 2029 it will have reached $45.93 billion.

- Emergence of automotive wrap film customization choices - automotive wrap films may provide automobiles with more vibrant colors and unique textures, as opposed to what paints can achieve. Since paints are sprayed directly to vehicle bodies in several layers over several days, the painted colors cannot be as vibrant and varied as vehicle wrap films. Before being shown on automobiles, these movies were created on computers. This makes it possible for expensive printers and complex software to adorn automotive wrap films with elaborate colors and patterns.

- Technological advancements - Technological developments in automotive wrap films, like the creation of nano-ceramic films, self-healing coatings, and smart films, have changed opacity and expanded the automotive wrap films market by providing better performance and durability. The US sector for Nano Ceramic Tint Films is estimated to grow from USD 1 million in 2024 to USD 2 million by 2031

Innovative film technology is developed by automakers to assist conceal radar sensors under ornamental metallic components. The demand for automotive films that give car occupants more privacy and protection is growing as vehicles become more autonomous.

Challenges

- Technological Issues - To wrap a car, the proper ambient conditions and high levels of efficiency are required. In order to achieve brilliant color and style on the wrap, proper printer code must be used. If there is a code mistake, the design is ugly and inappropriate for wrapping a car.

The longest and most labor-intensive portion of the process is looking for fenders, weather trimmings, and cracks on the car's surface. It is crucial to make sure that these fissures are clear and free of wax for an impeccable wrap finish. To wrap the automobile the day before washing, it needs to be totally dry.

- Complexity in installation - Installing car films requires precision to avoid mistakes that can impact performance and appearance. Skilled labor with training and experience is essential. Finding, training, and retaining experienced installers can be challenging and requires significant investment.

Automotive Wrap Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 12.59 billion |

|

Forecast Year Market Size (2035) |

USD 103.92 billion |

|

Regional Scope |

|

Automotive Wrap Films Market Segmentation:

Product Type Segment Analysis

Cast film segment is set to dominate around 56% automotive wrap films market share by the end of 2035. Cast film is a premium, pliable, thin film that is commonly used to wrap intricate curves and objects, like automobiles. Cast films are a great option for long-term outdoor applications because of their outstanding conformability, durability, and UV stability.

Cast films cost more than calendered films because of their high-performance features. Contrarily, calendered films are less costly and thicker than cast films. Usually, they are employed for transient purposes like momentary ads and event advertising. Calendered films are not as good at conforming to complex shapes as cast films because they are more inflexible. According to Car Wrap Montreal, the American Trucking Association (ATA) discovered that 91% of surveyed individuals notice vehicle graphics.

Distribution Channel Segment Analysis

The offline segment is estimated to garner significant automotive wrap films market share. Distributors, specialized shops, and physical storefronts are examples of offline distribution channels. For clients who are unfamiliar with automotive wrap films, these channels provide an opportunity to touch and feel the product before making a purchase. a predilection for in-person interactions with the merchandise in addition to a greater quantity of physical stores and specialty businesses.

Vehicle Type Segment Analysis

By 2035, passenger cars segment is anticipated to account for around 42% automotive wrap films market share. Every year, some 70 million new cars are made, and almost all of them run on diesel or gasoline. Since passenger cars are the most prevalent kind of vehicles on the road, the market for automotive wrap films is dominated by them.

Car wrap films are used to alter a vehicle's look or preserve the original paint job, and passenger automobiles are regularly altered for business or personal use. The automotive wrap film market expansion is positively impacted by each of these variables.

Our in-depth analysis of the automotive wrap films market includes the following segments:

|

Product Type |

|

|

Distribution Channel |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Wrap Films Market Regional Analysis:

APAC Market Insights

Asia Pacific region in automotive wrap films market is expected to account for revenue share of more than 35% by the end of 2035. The automobile industry is rising quickly in the Asia Pacific area, which is also home to some of the world's fastest-growing economies, including China and India. The automotive wrap films market is being driven by the region's customers' increasing disposable income and growing interest in customizing their vehicles.

China is the world's biggest manufacturer and purchaser of automobiles, according to OICA. Roughly 216 thousand commercial vehicles and 965 thousand passenger cars were sold in China in April 2022.

India is anticipated to rank third globally in terms of volume sales of automobiles by 2026, which is encouraging for electric and commercial vehicles. The increase in average family income to become the youngest country by 2025, the rise in vehicle penetration, and the expansion of research and development hubs are all responsible for the surge in demand for passenger car accessories, in turn fueling the demand for automotive wrap films market.

Japan is the second-biggest automobile manufacturer in the Asia-Pacific area, according to OICA. With a declining growth rate of almost 3%, Japan manufactured 7.85 million automobiles in 2021 as opposed to 8.06 million vehicles in 2020.

North America Market Insights

The North American region will also encounter huge growth in the automotive wrap films market during the forecast period and will hold the second position owing to the increasing frequency of obesity in this region. North America is a big market for automobile customization and is home to a large number of automotive enthusiasts. The area is a desirable market for vehicle wrap films since it has a thriving automotive industry and a high volume of passenger automobiles on the road. Furthermore, the industry is expanding due to the region's increasing need for out-of-home advertising.

The automotive wrap films market in the United States is projected to record significant growth during the forecast period. Over the course of the forecast period, the demand for automotive wrap films in the nation is anticipated to be driven by the growing trend of consumer spending on automobile customization as well as the rising number of medium-duty vehicles employed as food trucks, transportation vehicles, and other applications. In December, the US retail sales of medium trucks increased 9.1% year over year, with some 8% more than in 2022 at the end of 2023.

Automotive Wrap Films Market Players:

- AVERY DENNISON CORPORATION

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- KPMF

- Arlon Graphics LLC

- Fedrigoni S.p.A.

- Vvivid Vinyl

- ORAFOL Europe GmbH

- HEXIS S.A.S.

- Guangzhou Carbins Film Co., Ltd.

The automotive wrap films market is dominated by market players who are gaining traction in the market by adopting several strategies including mergers and acquisitions.

Recent Developments

- 3M, the American multinational company, announced the release of 3M Ceramic Coating, a new long-lasting protective finish for plastic trim, metal, automobile glass, wheels, and paint. This newest durable product offers the benefits that clients anticipate and is made to help the shops get into the growing private auto market segment. This coating gives the surface an amazing sheen, makes it very slick, helps to swiftly shed water, and gets rid of light dust. According to the business, 3M Ceramic Coatings are also resistant to other pollutants, road salts, acid rain, and severe chemicals.

- AVERY DENNISON CORPORATION declared the opening of a new production plant in Noida, India, as part of its global expansion. This growth will assist the business in fortifying its worldwide standing in the Asian marketplaces.

- Report ID: 6148

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Wrap Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.