Automotive Textiles Market Outlook:

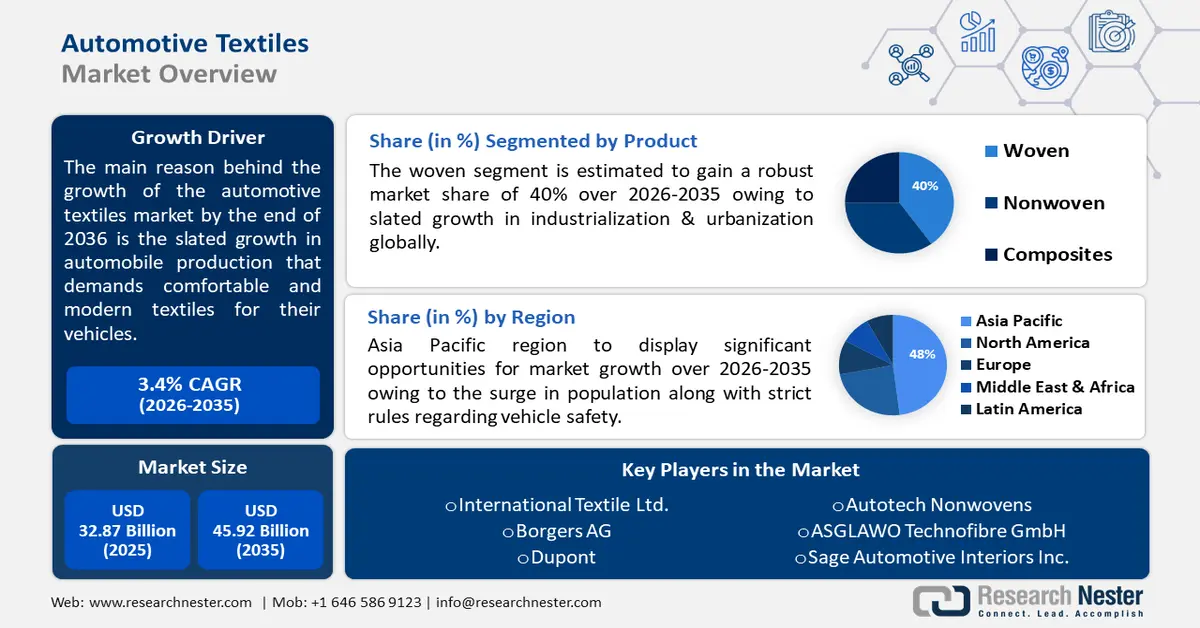

Automotive Textiles Market size was over USD 32.87 billion in 2025 and is poised to exceed USD 45.92 billion by 2035, growing at over 3.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive textiles is estimated at USD 33.88 billion.

The market expansion is primarily attributed to the increasing automobile production, which demands comfortable and modern vehicle textiles. The automotive industry is continuously growing credited to various factors such as urbanization, population growth, and rising disposable income. According to a report by the European Automobile Manufacturers’ Association in 2023, more than 85.0 million vehicles were produced globally, witnessing an increase of about 5.7% in 2021. This includes electric vehicles, heavy vehicles, passenger vehicles, buses, and light commercial vehicles. Furthermore, these vehicles require a diversified range of automotive textiles for several purposes such as components, carpeting, upholstery, headliners, and seating.

Key Automotive Textiles Market Insights Summary:

Regional Highlights:

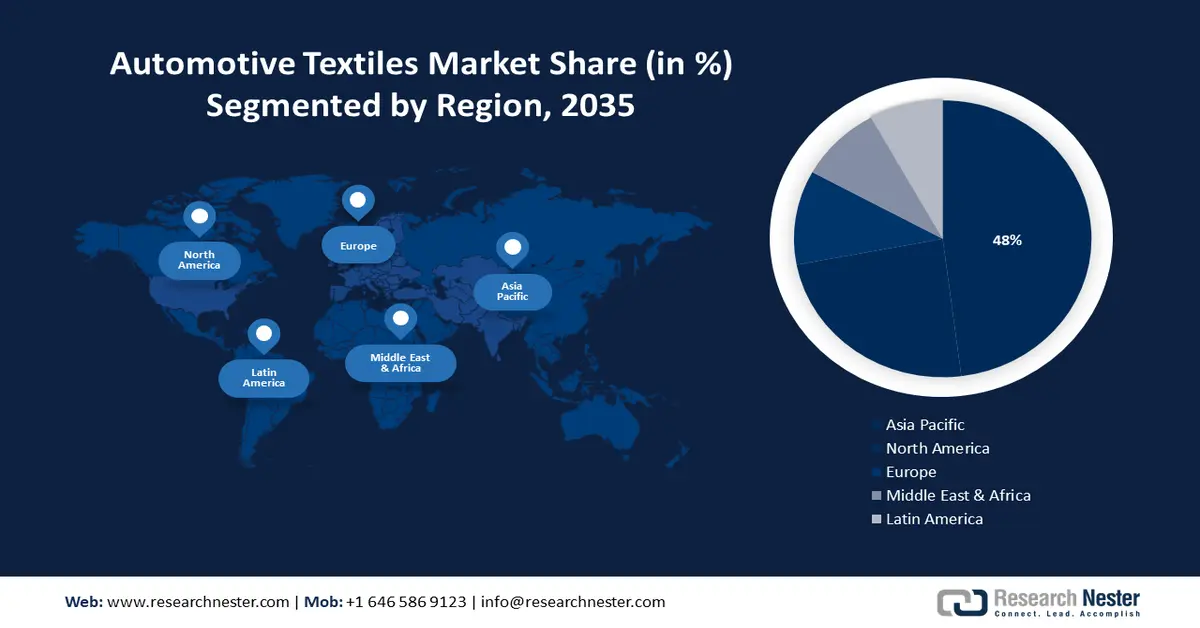

- Asia Pacific automotive textiles market will dominate around 48% share by 2035, driven by demographic dividends and fast economic growth boosting auto sales.

- North America market will secure the second largest share by 2035, driven by increase in vehicle production and sales, alongside urbanization.

Segment Insights:

- The woven segment in the automotive textiles market is expected to show robust growth till 2035, driven by the performance and properties of plain woven fabrics in automotive use.

Key Growth Trends:

- Rising road safety

- Expanding global population

Major Challenges:

- Inability to absorb moisture

- Presence of substitute

Key Players: Supima, Acme Mills, Aunde SA, International Textile Ltd., Borgers AG, Dupont, Autotech Nonwovens, ASGLAWO Technofibre GmbH, Sage Automotive Interiors Inc.

Global Automotive Textiles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.87 billion

- 2026 Market Size: USD 33.88 billion

- Projected Market Size: USD 45.92 billion by 2035

- Growth Forecasts: 3.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Automotive Textiles Market Growth Drivers and Challenges:

Growth Drivers

-

Rising road safety: The innovations in the automotive & transportation sectors are at a surge, owing to the fueled consumer demand. There is an increasing importance given to safety devices, as safety regulations are consumers' priority which demand products such as headrests, seat belts, and airbags. According to a report by the World Health Organization in 2023, about 1.19 million individuals succumb to road traffic crashes.

Additionally, 20-50 million people suffer from disabilities and non-fatal injuries from vehicle accidents. Credited to this, consumers now seek sustainability, and comfort in their vehicle choices which has also fueled the demand for automotive textiles. There is a surge in functional textiles, organic materials, and eco-friendly fabrics. According to a report by IFOAM in 2024, the global area for organic farming surpassed 96 million hectares in 2022. Additionally, the automotive safety system revenue has increased due to the increasing vehicle safety concerns. -

Expanding global population: As the population is constantly increasing, there is a high demand for textiles and clothing in automotive such as seat covers, and roof layers, due to which purchasing of these products has also increased. According to a report by the UN Trade & Development in 2022, the global population in developing countries increased to 83% in 2022 from 66% in 1950 and is expected to witness an 86% gain by 2050.

Moreover, there has been a growth in disposable income which is attributed to the growing need for comfort in automobiles, airbags, and seat belts. According to a report, by the Office for National Statistics in 2023, when compared to the gross disposable household income (GDHI) of 2020, it increased by 3.6% in 2021 in the UK. Moreover, there has been growth in residential housing which fuels the demand for this sector.

Challenges

-

Inability to absorb moisture: Carpets, seats, and insulation all use textiles, making them prone to holding moisture over time. Several materials, such as leather, polymers, and synthetic fibers, are hydrophobic, they don't absorb and repel moisture. This can result in the growth of mold and mildew, unpleasant smells, and even health problems. Credited to which moisture can also build up in places like the carpet padding, causing the growth of mold, and limiting the market growth.

-

Presence of substitute: With a large number of suppliers and manufacturers across the globe, the textile industry is competitive. Cost pressure and reduced profit margins can result from intense competition, particularly for commoditized textile items. This hinders the market expansion.

Automotive Textiles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.4% |

|

Base Year Market Size (2025) |

USD 32.87 billion |

|

Forecast Year Market Size (2035) |

USD 45.92 billion |

|

Regional Scope |

|

Automotive Textiles Market Segmentation:

Product Segment Analysis

Woven segment is poised to account for more than 40% automotive textiles market share by the end of 2035. Plain woven fabrics are made from air-jet textured and spun polyester yarns, impacting the automotive textiles landscape. Moreover, non-woven is also witnessing a boost as this product is easily moldable, abrasion resistant, readily sewn, seamed, flame resistant, coated, thermal protection, superior strength, and weight, easily shape retention, acoustic insulation, dyed and laminated, fireproof insulation, and air filtration. Growth in this sector will fuel the high performance insulation material value in the near future.

Application Segment Analysis

In automotive textiles market, upholstery segment is estimated to register lucrative growth through 2035. Ongoing development of upholstery polyester and the entrance of emerging players are aiding segment proliferation. In 2022, the Swedish School of Textiles knitting lab and advanced EV manufacturer Polestar collaborated to launch upholstery textiles for the Polestar 4 electric SUV coupe. Automobile manufacturing companies are fostering sustainability and reduction in carbon footprint. For instance, in June 2023, Toyota the C-HR as a part of Europe's C-segment SUVs. Compared to its predecessor, the Toyota C-HR new car uses recycled plastics in more than 100 different components. The materials include an innovative seat upholstery fabric made from recycled PET bottles.

Our in-depth analysis of the global automotive textiles market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Textiles Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 48% by 2035. Asia Pacific has benefited from demographic dividends and fast economic growth in the past two decades, with robust growth in auto sales in China. In 2023, the World Economic Forum confirmed that China was the world’s biggest auto exporter and BYD, a domestic manufacturer became the biggest single electric car maker by the end of 2022. The company’s overseas sales rose by 334% in 2023. The booming automobile manufacturing sector in the region is set to proliferate the overall market growth.

Attributed to Japan’s fourth position in the automotive & transportation market value, and the presence of several globally leading automobile manufacturers such as Suzuki, Mazda, and many more in this region. According to a report by the International Trade Administration in 2024, the automobile industry in Japan constitutes about 2.9% of its GDP while more than 13.9% of manufacturing GDP.

There is an increasing population in China that demands automobiles and technical textiles. The market is driven by the presence of a large number of local players comprising Changshu Automotive trim, China Shenma Industry, China New trend Group, Huamao Group, Jiangsu Hengli Group, Hebei Berger Phoenix tape Weaving, Jiangsu Yueda textile Group, Junma tyre Cord, Kuangda Group, and Hebei Berger Phoenix tape Weaving, among several others.

North America Market Insights

The automotive textiles market in North America will also encounter huge growth during the forecast period, accounting for the second-largest revenue share. This growth is led by the increase in vehicle production and sales. A recent report by Research Nester in 2024 estimated that more than 7 million automobiles were sold in the first 6 months of 2024. This registered a gain of 2.3% as compared to the previous year. Moreover, urbanization is also predicted to act as a growing factor for the market in this region. According to the UN-Habitat, it is predicted that in 2018, about 82% of the North American population lived in urban areas.

The growing sales of cars in the U.S. are expected to grow the automotive textiles market in this country. According to a report in 2024, auto sales in the U.S. are projected to grow 5% with sales of about 6 million in 2024 which is an increase of about 3.5% from 2023.

In Canada, there is a high demand for various vehicles such as electric and passenger vehicles which acts as a demand for the market in this country. A recent report in 2024, sales of light vehicles in Canada are expected to gain a growth rate of about 9.6% with more than 1.9 million unit sales.

Automotive Textiles Market Players:

- Mercedes-Benz

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Supima

- Acme Mills

- Aunde SA

- International Textile Ltd.

- Borgers AG

- Dupont

- Autotech Nonwovens

- ASGLAWO Technofibre GmbH

- Sage Automotive Interiors Inc.

The automotive textiles market expansion is predicted to grow impelled by these companies occupying a lucrative size. Most of these companies are continuously collaborating, making agreements, expanding, and joining ventures for the growth of this industry. With the increasing demand for vehicles and their textiles, various companies are adapting to the latest trends and are set to be the major key players in this sector.

Some of the key players include:

Recent Developments

- In September 2023, Mercedes-Benz launched its Mercedes-EQ model. The SUV features metal and wood accents, along with dual-tone leather upholstery and a multipurpose steering wheel. The company’s focus on textile innovation has set a benchmark for competitors and has facilitated focus on R&D.

- In June 2022, Supima along with TextileGenesis collaborated to establish a new industry traceability benchmark. Supima, the brand for Pima cotton farmed in the U.S., established a strategic alliance with TextileGenesisTM to create the next standard platform for cotton authentication in the industry.

- Report ID: 6224

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Textiles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.