Global Automotive Aftermarket Fuel Additives Market Trends, Forecast Report 2025-2037

Automotive Aftermarket Fuel Additives Market size is projected to increase from USD 1.13 billion to USD 2.47 billion, reflecting a CAGR of over 6.3% during the forecast period, from 2025 to 2037. In the year 2025, the industry size of automotive aftermarket fuel additives is estimated at USD 1.19 billion.

The growth of the market can be attributed primarily to the rapidly expanding automotive industry. For instance, the Indian automotive industry is expected to generate 200 billion dollars by 2031, making it the world's third largest industry.

Automotive fuel additives are adopted to improve diesel fuel and gasoline performance. It helps to reduce maintenance charges, improves engine performance and others. Automotive fuel additives comprises of numerous lubricants such as gear oil, transmission fluid, power steering oil and others. Moreover, rising demand for fuel additives to improve fuel efficiency and increase engine performance, increasing purchasing power coupled with increase in personal disposable income is anticipated to drive global automotive aftermarket fuel additives market growth over the forecast period. According to the Bureau of Economic Analysis, personal income grew by USD 47.0 billion (0.2%) in July 2022, and disposable personal income (DPI) rose by USD 37.6 billion (0.2%).

Automotive Aftermarket Fuel Additives Sector: Growth Drivers and Challenges

Growth Drivers

- Growing Concern Over Carbon Dioxide Emissions – The United States Environmental Protection Agency (EPA) estimates that the average passenger vehicle emits approximately 4.6 tons of carbon dioxide per year. Globally, road transport contributes 16% of man-made carbon dioxide emissions, as per the International Organization of Motor Vehicle Manufacturers.

- The rapid growth of the automotive aftermarket fuel additives market across the globe is predicted to be driven by factors such as increasing government regulations regarding vehicle emissions, including environmental protection agency (EPA) regulations, and increased adoption of automotive fuel additives to enhance the power and fuel economy of automobiles.

- Increasing Production Of Motor Vehicles - Globally, motor vehicle production increased from 583,74,162 units in 2000 to 917,86,861 vehicles in 2019, according to the International Organization of Motor Vehicle Manufacturers (OICA).

- Surge in Sales of Passenger Cars Worldwide- It was observed that over the past year, global passenger car sales increased from 52 million units in 2020 to 55 million units in 2021, representing a significant increase.

- Rise in Air Pollution Across the Globe- It is estimated that approximately 67 million tons of pollution were released into the atmosphere in the United States in 2021, according to the United States Environmental Protection Agency.

- Increasing Ownership Of Cars- For instance, China's car ownership has increased by more than 180% over the past decade from 103 million cars in 2011 to 300 million in 2021.

Challenges

- Introduction Of Alternative Fuel Vehicles Such As Electric Cars

- High Research And Development Cost

- Increasing Price Of Raw Materials

Automotive Aftermarket Fuel Additives Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.3% |

|

Base Year Market Size (2024) |

USD 1.13 billion |

|

Forecast Year Market Size (2037) |

USD 2.47 billion |

|

Regional Scope |

|

Automotive Aftermarket Fuel Additives Segmentation

Distribution Channel (E-Commerce, Big Stores, 4S Stores, Unauthorized Spare Parts, Service Centers, Gas Stations)

The e-commerce segment is anticipated to capture the largest share in the automotive aftermarket fuel additives market by 2037. As a result of the availability and accessibility to a wide range of products at competitive prices, e-commerce has a significant dominance over the market. Online platforms are appealing to both individual buyers and businesses owing to convenience, doorstep delivery, and product comparisons. This trend is reshaping the traditional supply chains by letting manufacturers reach a broader audience.

Application (Gasoline, Diesel)

Based on application, diesel holds a considerable share in the market due to its widespread use in commercial vehicles, heavy-duty trucks, and industrial machinery. Diesel engines often require fuel additives to improve combustion efficiency and prevent engine deposits, ensuring optimal performance. The durability and fuel economy associated with diesel vehicles will further drive the demand for these automotive aftermarket fuel additives.

Our in-depth analysis of the global automotive aftermarket fuel additives market includes the following segments:

|

By Application |

|

|

By Distribution Channel |

|

|

By Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

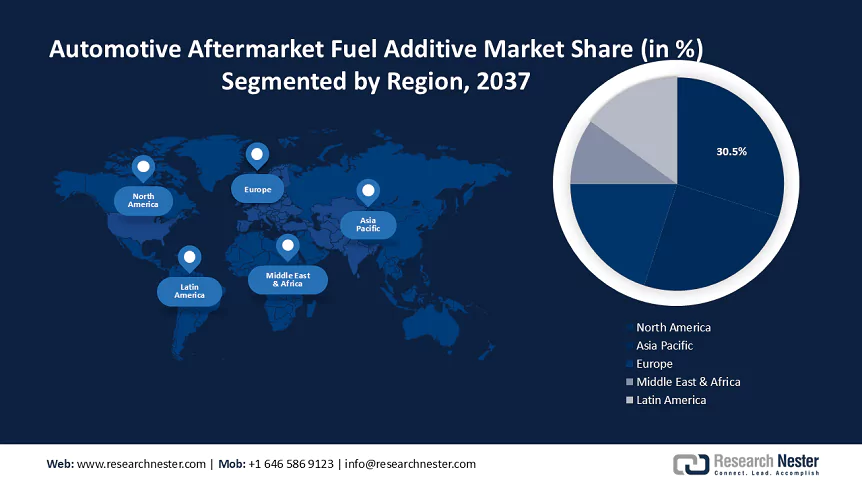

Automotive Aftermarket Fuel Additives Industry - Regional Synopsis

North America Market Statistics

North America is projected to hold largest market share by the end of 2037, backed by environmental regulations aimed at reducing greenhouse gas emissions and protecting the environment, increased automobile production, and the increase in per capita income. Additionally, the higher acceptance of additive rates and increasing production of biofuels are anticipated to drive the regional market. With a large number of aging vehicles, the demand for fuel additives continues to rise in the region.

The U.S. automotive aftermarket fuel additives market is driven by a rise in consumer awareness in terms of vehicle maintenance, growing concerns about fuel quality, and the adoption of biofuels. In June 2023, the EPA announced a final rule to establish biofuel volume requirements and associated percentage standards for cellulosic biofuel, biomass-based diesel (BBD), advanced biofuel, and total renewable fuel for 2023–2025. For instance, cellulosic biofuel requires 1.38 billion RINs as per volume targets, and biomass-based diesel requires 3.35 billion RINs. Stricter environmental regulations, supported by advancements in additive technologies are influencing the market growth further.

APAC Market Forecasts

Asia Pacific automotive aftermarket fuel additives market is projected to grow the fastest through 2037, owing to large and fast-growing population. Furthermore, factors such as rising disposable incomes, and urbanization are some of the most prominent driving factors in the region. The adoption of cleaner technologies is also boosting market expansion. For instance, in December 2021, Clean Edge Asia was launched to produce sustainable and secure energy markets. the total global increase in primary energy demand is projected to increase up to 60% by 2040, according to the International Energy Agency, requiring nearly USD 1 trillion in energy infrastructure investment annually for developing countries.

India automotive aftermarket fuel additives market is impelled by rising penetration of premium and high-performance vehicles, which require advanced fuel treatments for optimal performance. Leading companies are leveraging innovation to expand their product portfolios to meet the rising consumer demand in the country. Furthermore, focusing on optimizing fuel performance and reducing emissions are two of the most prominent trends witnessed in the country. Cummins Group in India showcased high-power, fuel-efficient technologies, the Legend L10 and M15, and its Hydrogen Internal Combustion Engine (H2ICE), at EXCON 2023, driving the demand for complementary fuel additives to maintain energy efficiency and compatibility with innovative systems.

Companies Dominating the Automotive Aftermarket Fuel Additives Landscape

- Ashland Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Afton Chemical Corporation

- BG Products Inc.

- Infineum International Ltd.

- Chevron Corporation

- Innospec Specialty Chemicals

- Lucas Oil Products Inc.

- TotalEnergies SE

- Lubrizol Corporation

Increasing production capacity is one of the major expansion strategies adopted by the companies in the automotive aftermarket fuel additives market. By doing this, businesses reduce lead times, optimize economies of scale, and cater to new markets. For instance, in August 2022, BASF inaugurated a new production plant for fuel performance additives in Shanghai, China, to address the growing demand for fuel performance additives in the region and bring better supply security and flexibility to customers in Asia.

Recent Developments

- In January 2024, BASF launched the next generation of its Keropur gasoline additive bottle in the Taiwan aftermarket. The product is designed to address the technical requirements of modern direct injection spark ignition (DISI) combustion engines.

- In May 2023, Cummins Inc. and Heliox signed an agreement to deliver both service and sale of EV chargers in North America. The contract was projected to bring both a mobile 50 kW DC charger, Mobile 50, and a stationary 180 kW DC charging system, Flex 180, to market.

- Report ID: 390

- Published Date: Jan 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Aftermarket Fuel Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert