Automatic Pill Dispenser Market Outlook:

Automatic Pill Dispenser Market size was valued at USD 3.41 billion in 2025 and is likely to cross USD 7.5 billion by 2035, registering more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automatic pill dispenser is assessed at USD 3.66 billion.

It is evident that for doctors, nurses, pharmacists, patients, and caregivers automatic pill dispensers are commonly utilized in the management of medicines, counting of doses, and inventory purposes. According to the reports of the National Center for Biotechnology Information published in June 2020, 94% of the respondents found automatic pills dispenser use to be easy. Automatic pill dispenser is also used in medical care to assist patients in taking prescribed medications and daily supplements at fixed times.

Key Automatic Pill Dispenser Market Insights Summary:

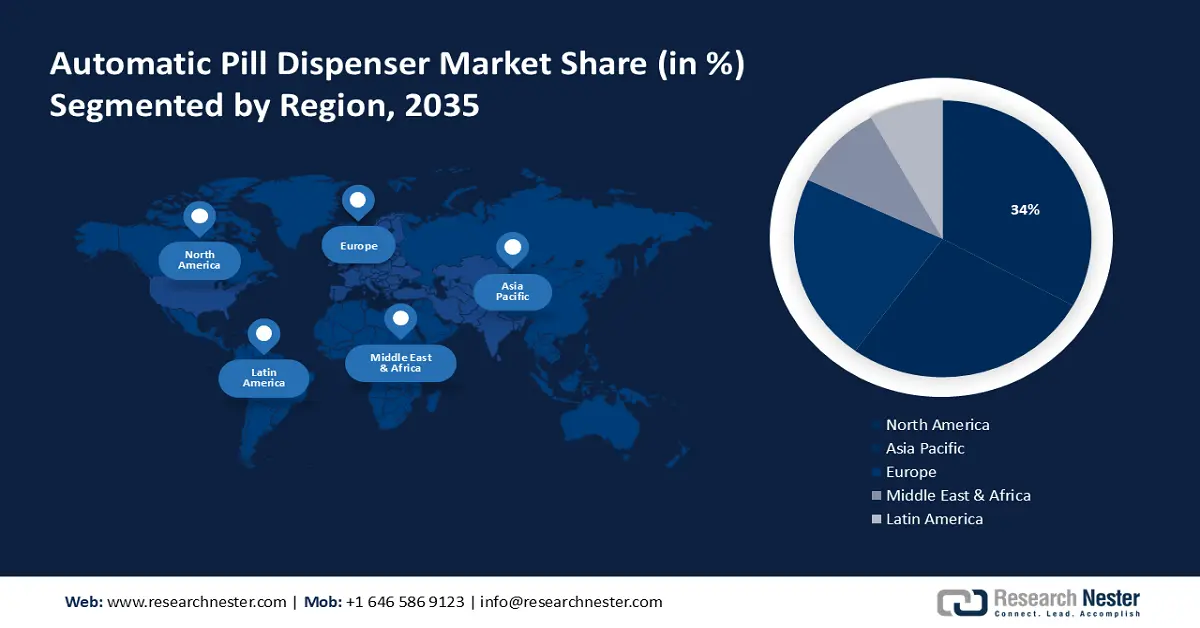

Regional Highlights:

- Asia Pacific automatic pill dispenser market is expected to capture 44% share by 2035, driven by a booming population, chronic disease prevalence, and supportive government initiatives in medication management.

Segment Insights:

- The centralized automated dispensing systems segment in the automatic pill dispenser market is projected to capture a 56% share by 2035, driven by increased productivity and decreased medication errors.

- The hospital pharmacy segment in the automatic pill dispenser market is projected to see significant growth till 2035, driven by rising medication management problems and enhanced medication safety.

Key Growth Trends:

- Surge in the prevention of chronic diseases

- Technological advancements

Major Challenges:

- Lack of awareness

Key Players: Philips Healthcare, Hero Health, Inc., MedMinder Systems, Inc., Capsa Healthcare, Omnicell, Inc., ARxIUM, Inc., Talyst, LLC (Swisslog Healthcare), ScriptPro LLC, Parata Systems, LLC, e-pill Medication Reminders.

Global Automatic Pill Dispenser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.41 billion

- 2026 Market Size: USD 3.66 billion

- Projected Market Size: USD 7.5 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Automatic Pill Dispenser Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the prevention of chronic diseases - Medications for chronic diseases like Alzheimer's and prolonged diseases like Diabetes, medications are expected to be taken in different doses and at different timing that usually confuses the patient with the intake. According to the reports of the National Institute of Health issued in 2022, around 24 million people are diagnosed with Alzheimer's globally, and diabetes is said to capture around 700 million people by 2030. Since a large number of people have various intake prescriptions, an automatic pill dispenser could be a convenient device.

- Upgrading drugs failure to comply - Lack of compliance due to casual forgetting of the dosages of the prescribed treatments is another factor that leads to sub-standard usage. A fully automatic dispensing system for medications is safer and assists in maintaining the dosage schedules for patients with physical disabilities, neurological disorders, or conditions such as dementia.

- Technological advancements- The technological enhancements have created the need to come up with better and improved gadgets that could help on dispensing for physically and visually impaired patients. This factor is majorly required to prevent medication errors, thus, these devices used to provide reminders of the time to take pills have grown popular. World Health Organization Analysis from a study conducted in 2023 showed that there is an estimate of 237 million medication errors in one country annually and 66 million of these are considered clinically significant. The annual costs of ADE to the government, which could have been prevented, is USD106.64 million.

Challenges

- High costing - The costs of these dispensers remain relatively high, which might pose challenges, in adoption especially among small users or low-income earners. This is because of inbuilt features including centralized tracking of inventory, remote monitoring, and integration of the devices with other healthcare systems that are likely to reduce the usability of these devices and their adoption.

- Lack of awareness - It is evident that the prevalence of automatic pill dispensers is still a novelty for many people, clients and caregivers, and medical personnel among others. The lack of awareness about what is available and who has the scarcity could potentially slow the market and limit the possibility of people having access to automatic pill dispensers.

Automatic Pill Dispenser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 3.41 billion |

|

Forecast Year Market Size (2035) |

USD 7.5 billion |

|

Regional Scope |

|

Automatic Pill Dispenser Market Segmentation:

Type Segment Analysis

Centralized automated dispensing systems segment is projected to hold more than 56% automatic pill dispenser market share by 2035. The segment growth can be attributed to several reasons like increased productivity of the personnel, and decreasing rate of medicated errors among others. On the nature and type of system, the dispensing method is directly controlled by the user in a centralized automatic system. Large numbers of drugs find an organized place in the robot COC without human intervention to enhance the operation of pharmaceuticals, ensuring security that decreases the chances of mistakes or medicine theft.

According to studies in 2022, Hyper Articles En Ligne reports that there is evidence of a reduction in the rate of dispensing errors ranging from 16% to 60% in various studies. This was confirmed in their study where the reduction of dispensing errors was to the tune of 41%. Therefore, the key features offered by the centralized automatic dispenser including continuous research, development, and innovativeness in this device are anticipated to boost the segment’s growth in the forecast period.

Application Segment Analysis

By 2035, hospital pharmacy segment is anticipated to dominate over 48% automatic pill dispenser market share. The segment growth can be attributed to the rising medication management problems, medication safety, accuracy, EHR incorporation, and central medication dispensing. In a recent study by the National Institute of Health, it was observed that after implementing the automatic dispenser cabinet (ADC) in the ICU, the prescription and dispensing errors decreased from 3.03 to 1.75 per 100000 prescriptions for drug orders and 3.87 to 0 per 100000 dispensations for drug administration. Hospitals are quickly adopting the use of automatic pill dispensers primarily to enhance medication delivery to enhance patient safety and productivity.

Our in-depth analysis of the automatic pill dispenser market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automatic Pill Dispenser Market Regional Analysis:

North American Market Insights

North America region in automatic pill dispenser market is expected to dominate revenue share of around 34% by the end of 2035. This region is anticipated to uphold its dominance in the market throughout the projected period because more and more practitioners in the healthcare industry are integrating advanced technology into the condition of patients to enhance comfort. There is also a mammoth customer base supported by the high growth of the geriatric population and chronic diseases contributing to the growth of this market in the region.

According to a report, the US reported 162 deaths per 100,000 citizens, majorly due to heart conditions. Hence, automatic pill dispensers help to improve patient safety, medication adherence, and workflow efficiency in healthcare settings-especially hospitals-dominating the US market. Another factor supporting market growth is the universal coverage provided by the US healthcare system and the promotion of access to medication management solutions.

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 44% by 2035. The booming population and increasing prevalence of chronic diseases like diabetes, hypertension, and neuromuscular disorders in countries like India and China are therefore leading to higher demands for advanced solutions in medication management. Growing awareness for automatic pill dispensers, good healthcare infrastructure, and favorable government initiatives are boosting the growth of the market in the Asia-Pacific region.

With a large population and demand for drug delivery devices and distribution, China holds the largest market share in the region. China is now covering around 90% of its citizens in its public healthcare system. Improving healthcare infrastructure in China, increasing awareness of automated pill dispensers and supportive government initiatives continue to boost this market.

South Korea has been making efforts towards technological innovations and upgrading of the infrastructure of health care. For instance, South Korean hospitals had 12.77 beds per 1,000 people as recorded in 2021, which was 2nd highest after Japanese hospitals. Increasing awareness among the population of South Korea and the focus on patient safety and care driving the integration of automatic pill dispensers into healthcare facilities fueling the growth of this market.

Automatic Pill Dispenser Market Players:

- ScriptPro

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter

- Becton, Dickinson and Company

- McKesson Company

- Capsa Healthcare

- Swisslog Holding AG

- Oracle Cerner

- Talyst Inc.

- Omnicell Inc.

- Medminer System Inc.

Here are the key players strolling in the automatic pill dispenser market:

Recent Developments

- Omnicell Inc. supported the Global charity Mercy Ships through the donation of solutions from the recently announced XT Amplify program.

- Baxter announced that the U.S. FDA has given approval for an expanded indication of Clinolipid for use in pediatric patients, including preterm and term neonates. Clinolipid in Baxter’s branded mixed oil lipid emulsion used to provide calories and essential fatty acids in parenteral nutrition when oral and enteral nutrition is not possible, sufficient, or contraindicated. Since 2019, Clinolipid has been available in the US for adults and is now available for all ages.

- Report ID: 6119

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automatic Pill Dispenser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.