Automated Whole-Breast Ultrasound Market Outlook:

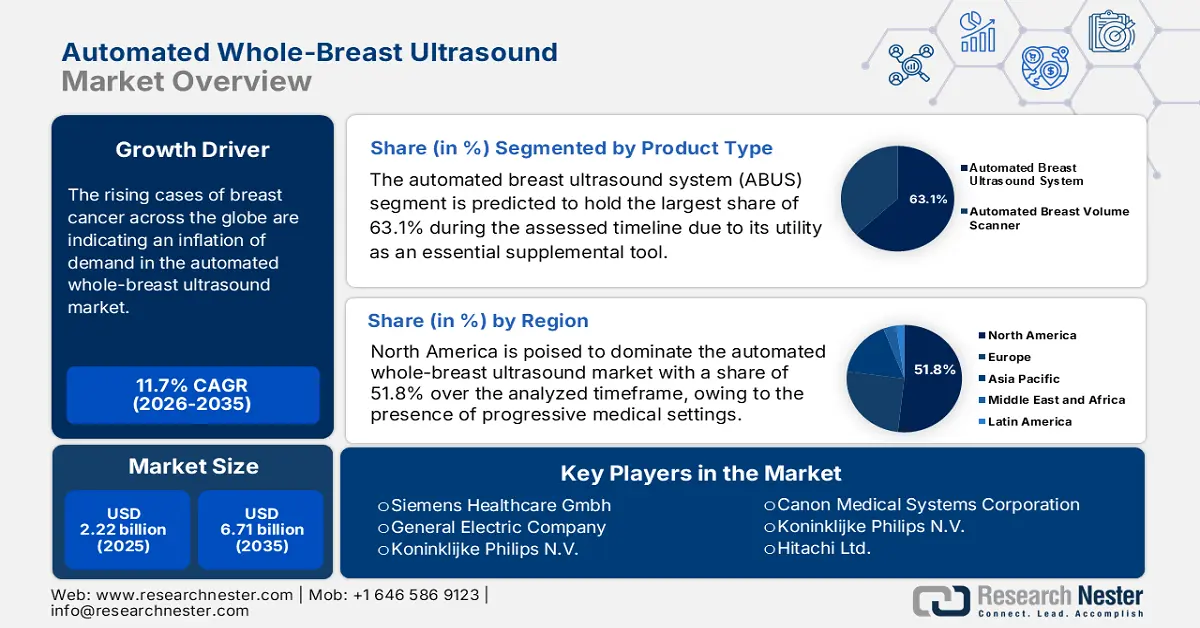

Automated Whole-Breast Ultrasound Market size was valued at USD 2.22 billion in 2025 and is likely to cross USD 6.71 billion by 2035, expanding at more than 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated whole-breast ultrasound is assessed at USD 2.45 billion.

Breast cancer (BC) is one of the most common and chronic gynecological malignancies in the world. In 2021, BC became the top most frequently diagnosed and 5th deadliest cancer globally, where around 2.3 million new cases registered in 2020, as per the GLOBOCON database. Further, in 2022, the same global statistics showcased a projection of 239.5 per 100,000 disability-adjusted life years (DALYs) by 2050, with a 54.7% increase in new incidences (3.5 million). To combat this widespread issue, many health organizations are now focusing on the development and implementation of advanced diagnostic measures. Thus, the rising cases are indicating an inflation of demand in the automated whole-breast ultrasound market.

The payers’ pricing for breast screening may vary according to individual guidelines, national policies, and the type of device used. On this note, in February 2025, NLM released a study on the variability of associated costs in America. It concluded the range of annual BC screening expenditure in the U.S. to be USD 8.0 billion-USD 30.0 billion. However, the average lifetime cost of diagnosis per patient for American College of Radiology (ACR), American Cancer Society (ACS), and U.S. Preventative Services Task Force (USPSTF) was USD 13,416.0, USD 7946.0, and USD 6931.0, respectively. These pricing signifies the spending on digital mammograms (2D), digital breast tomosynthesis (3D), and MRI.

On the other hand, the diagnostic procedures from the automated whole-breast ultrasound market are dedicated to offering lower payers’ pricing. This is testified by the standard cost per patient (having mammographically dense breasts) of USD 550.0, determined by the 2023 Stanford Health Care radiology guidelines. Another NLM cost-effectiveness review from July 2021 revealed that the compatibility of automated breast ultrasound (ABUS) with mammography has the potential to save up to USD 58.4 million for the Italian National Healthcare Service. This signifies the accessibility and increasing worldwide adoption in this sector.

Key Automated Whole-Breast Ultrasound Market Insights Summary:

Regional Highlights:

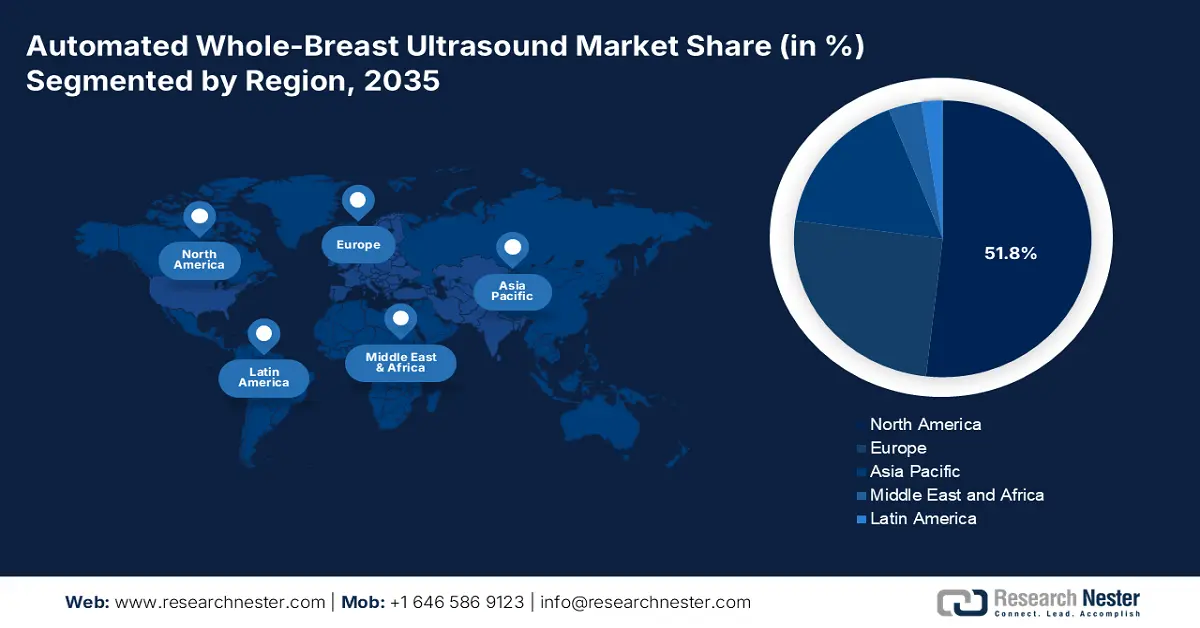

- North America automated whole-breast ultrasound market will account for 51.80% share by 2035, attributed to advanced medical organizations, availability of cutting-edge diagnostic tools, and a growing patient pool.

- Asia Pacific market will register notable growth during the forecast period 2026-2035, fueled by growing patient population, technological advances, AI integration in healthcare, and increased medical device production.

Segment Insights:

- The hospitals segment in the automated whole-breast ultrasound market is expected to capture an 80% share by 2035, fueled by rising hospital infrastructure expenditure and wide equipment adoption.

- The automated breast ultrasound system (abus) segment in the automated whole-breast ultrasound market is expected to hold a 63.10% share by 2035, driven by superior lesion detection and effectiveness for dense breasts and early diagnosis.

Key Growth Trends:

- Increased use of AI in healthcare developments

- Growing awareness about early detection

Major Challenges:

- Limitations in equipment purchase and handling

- Presence of incompetent legacy medical settings

Key Players: Siemens Healthcare Gmbh, General Electric Company, Koninklijke Philips N.V., Hologic Inc., Volpara Health Technologies.

Global Automated Whole-Breast Ultrasound Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.22 billion

- 2026 Market Size: USD 2.45 billion

- Projected Market Size: USD 6.71 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Automated Whole-Breast Ultrasound Market Growth Drivers and Challenges:

Growth Drivers

- Increased use of AI in healthcare developments: The positive impact of AI in the medical system has followed deep penetration into all aspects, including diagnosis. Its contribution in bringing automation in operations is making the required detection procedures faster and more affordable, promoting greater investments in the automated whole-breast ultrasound market.

- Growing awareness about early detection: Considering the severity of breast cancer widespread around the globe, many public and private organizations are proactively engaged in educating people about the benefits of preventive approaches. These campaigns incorporate and promote advanced tools from the automated whole-breast ultrasound market to get a precise overview of disease progression. For instance, in January 2023, the team of Abdul Latif Jameel Health and iSono Health started the distribution of ATUSA systems in 31 globally underserved nations. This communal initiative availed AI-driven portable 3D breast ultrasound across the Middle East and North Africa, Africa, South Asia, and Southeast Asia.

Challenges

- Limitations in equipment purchase and handling: Despite offering affordable screening services for patients, the initial investment for installing such equipment is still high for many institutions. Additionally, the extensive expenses on maintenance and skilled operational teams may create an economic barrier for the global expansion of the automated whole-breast ultrasound market. Service providers also face disparities in sufficient funds and professional hiring, which may discourage them from adopting such expensive and complex devices.

- Presence of incompetent legacy medical settings: Besides reimbursement issues, low- and middle-income countries witness difficulty in complete penetration due to inadequate infrastructure. The optimum effectiveness and affordability of services from the automated whole-breast ultrasound market highly depend on digital data and mammography. Thus, the absence of electronic health records (EHRs) and other compatible systems in these resource-constrained premises makes it challenging for such advanced tools to operate.

Automated Whole-Breast Ultrasound Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 2.22 billion |

|

Forecast Year Market Size (2035) |

USD 6.71 billion |

|

Regional Scope |

|

Automated Whole-Breast Ultrasound Market Segmentation:

Product Type Segment Analysis

Automated breast ultrasound system (ABUS) segment is anticipated to hold automated whole-breast ultrasound market share of more than 63.1% by 2035. The tool is becoming an essential supplemental tool, efficient for both diagnosis and screening of BC. An article from the 2024 Clinical Radiology Journal revealed that the use of ABUS increased the lesion detection rate from 1.9 to 7.7 cases per 1,000 candidates. It outperformed the effectiveness of mammography and handheld ultrasound (HHUS). Where, mammography’s sensitivity drops by 25.0% in case of fatty breasts: 2022 NLM study. Thus, its ability to assist caregivers in detecting malignancies at an early stage and for dense breasts is consolidating this device’s dominance over the market.

End use Segment Analysis

In terms of end use, the hospitals segment is expected to hold the largest share in the automated whole-breast ultrasound market by the end of 2035. These tools are widely used and desired by such primary healthcare settings due to their reliability and user convenience. As the expenditure on hospital infrastructure increases, the capital influx in this segment grows. This attracts more dedicated equipment suppliers to prioritize this wide network of distribution channels, which can be testified by the continuous expansion of the hospital industry in emerging regions, such as India.

Our in-depth analysis of the global automated whole-breast ultrasound market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Whole-Breast Ultrasound Market Regional Analysis:

North America Market Insights

North America in automated whole-breast ultrasound market is set to capture around 51.8% revenue share by the end of 2035. This region's proprietorship is pledged to the presence of progressive medical organizations and settings, availing advanced diagnosis for individuals. The enlarging patient pool across North America is serving global pioneers with a wider scope of applications. For instance, in November 2023, the U.S. subsidiary of Siemens Healthineers launched a powerful, versatile, and affordable ultrasound system, ACUSON Maple. The portable AI-powered system serves a wide spectrum of customers, such as small hospitals, outpatient centers, private practices, and urgent care centers. Such innovations are inspiring others to participate in this marketplace.

The U.S. presents an emerging and demanding consumer base for the automated whole-breast ultrasound market. Ductal cell carcinoma (IDC), the advanced form of ductal carcinoma in-situ (DCIS), is one of the most prevalent BCs among the country's citizens, counting for 287,850 new female cases in 2022. The total number of BC residents in the U.S. is predicted to become 364,000 by 2040: NLM. This shows two major growth factors of this sector: a surge for early diagnosis and efficient screening systems. Furthermore, the country is proactively investing in upgrading medical infrastructure and facilities, fueling a good flow of business in this category.

Canada is focusing on extensive R&D in screening methods and accommodations, bringing innovations to the automated whole-breast ultrasound market. The collaborative efforts from both the federal government and research institutions are propelling the pace of domestic development and accessibility. For instance, in November 2024, the Ministry of Health in Canada announced the allocation of USD 545,000.0 for two local organizations dedicated to the advancement and promotion of BC screening. The cash distribution was designated as USD 295,000.0 for the Canadian Partnership for Tomorrow's Health and USD 250,000.0 for the Canadian Cancer Society.

APAC Market Insights

Asia Pacific is poised to register a notable growth in the automated whole-breast ultrasound market by the end of 2035. There are several factors, such as growing patient population, technological advances, and a strong emphasis on medical device production, driving its progression. Among these, the integration of AI in the healthcare industry is one of the top contributors to this sector’s expansion, where APAC is predicted to account for 39.0% of the global revenue from this merchandise. Another NLM observation forecasted the increment in age-standardized mortality rate (ASMR) to be 7.0% in East Asia and 35.0% in South Asia among 50-to 80-year-old female citizens by 2030. This signifies the heightening risk of BC-related death in the rapidly aging habitats and the inflating demand for early detection.

India is augmenting the automated whole-breast ultrasound market with its emphasizing economy and increasing government expenditure on healthcare. After the pandemic strike, the governing bodies of this country have realized the importance of access to complete medical care in underserved areas, which ultimately pushed them to uplift associated public spending by 2.5% by 2025. With a 7.0% year-on-year GDP growth, India is now proceeding to generate a value of USD 612.0 billion from the healthcare industry: International Trade Administration. Furthermore, the penetration of digital tools in this field is propelling advancements.

According to the 2022 GLOBOCON report, the count of new BC incidences in China was 357200, consisting of the largest portion of 36.3% of the total new cases in Asia. A similar lead was found to be followed by this country as per age classifications, accounting for a notable 42.7% of the 50-59 age group in this region. This reflects the upsurging demand for advanced and accessible diagnostic options, fostering a profitable business environment for the automated whole-breast ultrasound market. Moreover, the country also focuses on cultivating local supply channels of such equipment by utilizing its manufacturing capabilities.

Automated Whole-Breast Ultrasound Market Players:

- Siemens Healthcare Gmbh

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric Company

- Koninklijke Philips N.V.

- Hologic Inc.

- Volpara Health Technologies

- Mindray

The automated whole-breast ultrasound market is currently witnessing a trend of upscaling the efficiency of the existing pipeline. Key players in this industry are continuously evolving their products to captivate maximum customers. For instance, in December 2024, Siemens Healthineers enabled a major software and hardware update to its Acuson Sequoia ultrasound system, presenting Acuson Sequoia 3.5. The new version encompasses AI Abdomen with improved ergonomics and new solutions for better outcomes from breast and musculoskeletal imaging. Such competency among global developers is further inspiring other medical device leaders to engage their resources in this sector. This cohort of pioneers includes:

Recent Developments

- In March 2025, GE HealthCare announced the commercial launch of Invenia Automated Breast Ultrasound (ABUS) Premium. The 3D ultrasound system is backed by advanced artificial intelligence (AI) and innovative features offering reproducible supplemental screening and streamlining exam readings.

- In November 2024, Mindray introduced its latest premium ultrasound system, Resona A20, at EUROSON 2024. The new screening device is backed by acoustic intelligence technology (AIT) and a wide range of AI tools, including Smart Breast, to offer precise image quality.

- Report ID: 7474

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.