Auto-injectors Market Outlook:

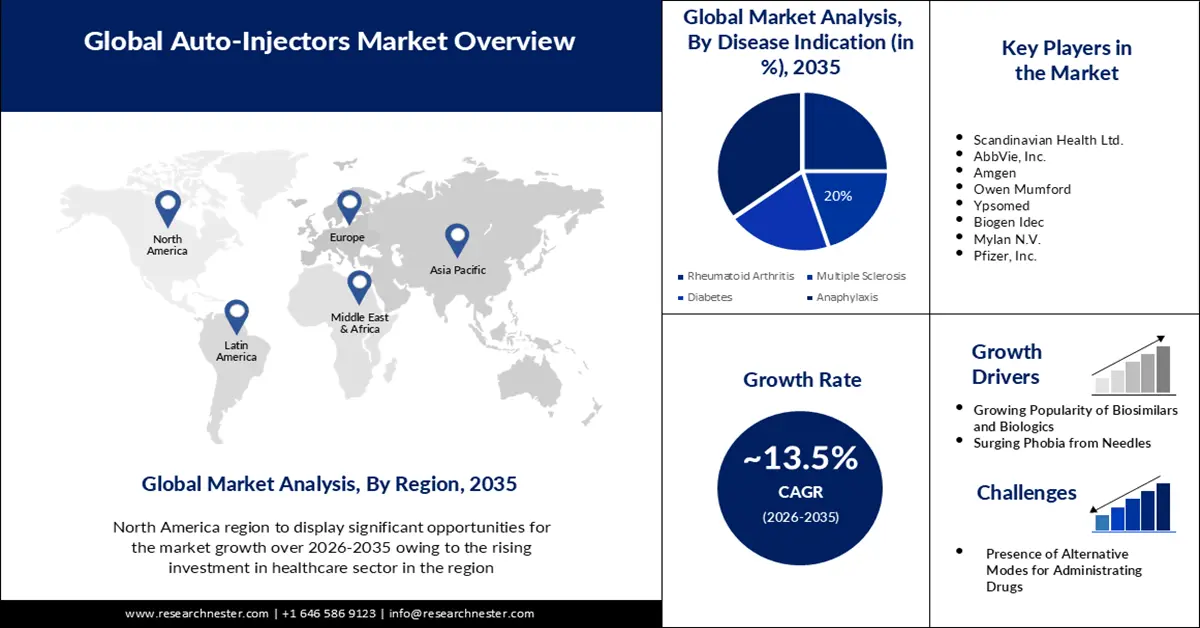

Auto-injectors Market size was over USD 10.53 billion in 2025 and is anticipated to cross USD 37.36 billion by 2035, witnessing more than 13.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of auto-injectors is assessed at USD 11.81 billion.

The growth in the market is impelled by the rising cases of rheumatoid arthritis (RA), multiple sclerosis (MS), and diabetes. In 2020, the number of people living with RA was 17.6 million, which is further expected to reach 31.7 million by 2050, as per NLM. Similarly, the count of MS was predicted at 2.8 million in 2020, as per the MS International Foundation. On the other hand, the International Diabetes Federation projected the volume of diabetes patients worldwide to surpass 853.0 million by 2050. Most of the treatment of these chronic conditions incorporate regular injections and self-administrations, where patient convenience and safety often get compromised due to accidental piercing or allergic reactions. This indicates an enlarging patient pool for this sector.

Advanced solutions available in the market are specifically engineered to make this process safer and comfortable while delivering the right amount of medication. Despite the higher payers’ pricing, this drug delivery approach becomes highly cost-effective for certain health conditions. For instance, in February 2020, an NLM study concluded that contextualized self-injectable epinephrine (SIE) for allergen immunotherapy (AIT) was found to be USD 3421.0 less expensive than the universal SIE prescriptions. It also mentioned that the universal SIE may also deliver value for money when the pricing per twinpack is USD 24.0, offering 1000x protection against fatality and the 2.7 per 10,000 AIT fatality rate. Moreover, advanced technologies such as 3D printing are proven to reduce the retail pricing of these products.

Key Auto-Injector Market Insights Summary:

Regional Highlights:

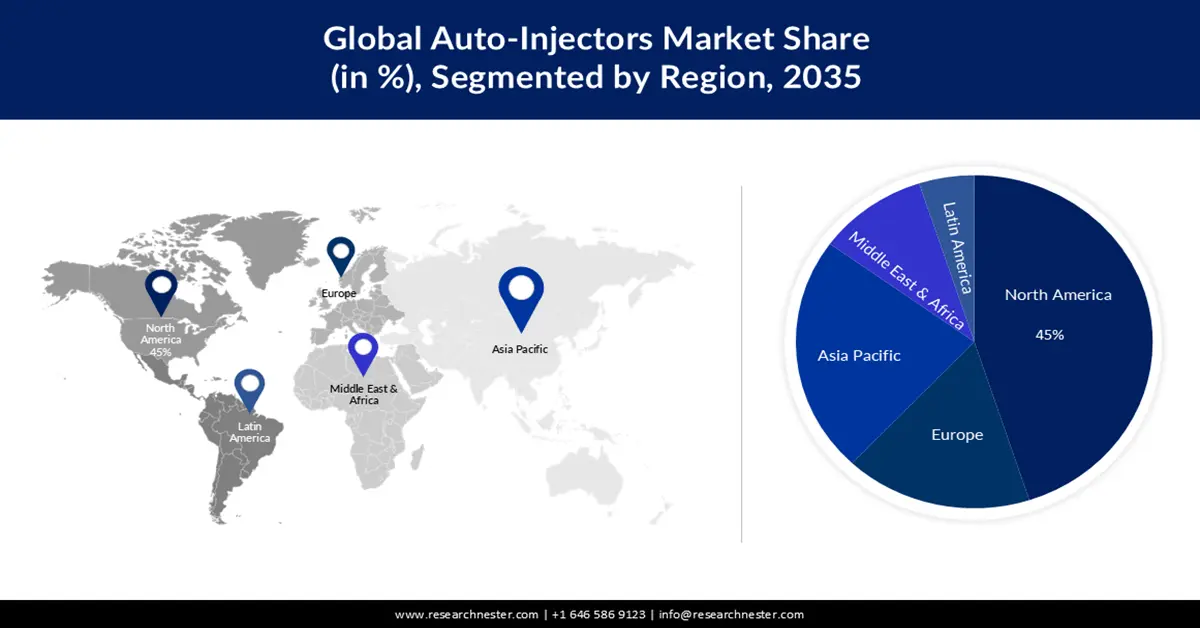

- North America auto-injectors market is poised to capture 45% share by 2035, fueled by rising healthcare investment and biosimilar product launches.

- Asia Pacific market will secure the second largest share by 2035, attributed to domestic production support and innovation in self-injectable medical tools.

Segment Insights:

- The anaphylaxis segment in the auto-injectors market is anticipated to achieve significant growth during 2026-2035, attributed to the increasing prevalence of food allergies and regulatory safety recommendations.

- The disposable auto-injectors segment in the auto-injectors market is forecasted to achieve a notable revenue share by 2035, driven by its ease of use and better compliance in fixed-dose subcutaneous delivery.

Key Growth Trends:

- Growing popularity of biosimilars and biologics

- Shifting preference toward remote healthcare

Major Challenges:

- Presence of alternative modes for administrating drugs

Key Players: Scandinavian Health Ltd., AbbVie, Inc., Amgen, Owen Mumford, Ypsomed, Biogen Idec, Mylan N.V., Pfizer, Inc., Sanofi, and Stevanato Group.

Global Auto-Injector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.53 billion

- 2026 Market Size: USD 11.81 billion

- Projected Market Size: USD 37.36 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Auto-injectors Market Growth Drivers and Challenges:

Growth Drivers

- Growing popularity of biosimilars and biologics: Biological pharmaceuticals and biosimilar medications are generally brittle proteins that require the use of self-injectables to raise the medication's therapeutic value. Thus, the increasing use of these therapies for treating autoimmune disorders and cancer is fueling demand in the auto-injectors market. According to a research article published by PLOS in July 2023, the market and manufacturing demand for these devices are anticipated to reach USD 37.5 billion by 2025. It further mentioned the use of newly introduced open-source hardware to mitigate the shortage of supply for these tools for insulin therapies. Such studies testify to the wide adoption in this sector as a result of the biologic drug surge.

- Shifting preference toward remote healthcare: After the pandemic struck, convenience, cost-reduction, and patient safety have magnified the importance of streamlining the home care approach. Particularly for older people, it has become necessary to avail required medical supplies for them at their doorstep, as they are mostly unable to visit the point-of-care premises. Many of them use solutions from the market for daily medications, signifying a growth opportunity in this sector.

Challenges

- Presence of alternative modes for administrating drugs: Medication administration techniques vary widely and are frequently categorized based on the site of administration, such as intravenous or oral, out of which oral administration is the recommended method for most prescribed medications. This, as a result, may limit the demand for intravenous or injectables, subsequently hindering business flow in the market. On the other hand, creating a single tool with varied injection rates and volumes while maintaining safety and accuracy is still a challenge, shrinking the scope of competency with alternatives.

Auto-injectors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 10.53 billion |

|

Forecast Year Market Size (2035) |

USD 37.36 billion |

|

Regional Scope |

|

Auto-injectors Market Segmentation:

Disease Indication Segment Analysis

The anaphylaxis segment in the auto-injectors market is estimated to gain a robust revenue share of 35% by the end of 2035. Globally, food allergies are becoming more common owing to various causes, including obesity, vitamin D deficiency, exposure to ambient chemicals, and others. This is pushing both public and private medical authorities to promote awareness about the available emergency relief options, including auto-injectors for these patients, creating a surge in this field. For instance, in June 2023, the Medicines and Healthcare Products Regulatory Agency (MHRA) released new guidelines suggesting carrying a minimum of two adrenaline auto-injectors as a part of the recent safety recommendations to combat the event of anaphylaxis, influencing more people to invest in this field.

Product Type Segment Analysis

Auto-injectors market from the disposable segment is set to garner a notable share. Disposable sub-types for prefilled syringes are simple to use and are meant for patients to administer fixed-dose injections subcutaneously. This essentiality solidifies this segment’s leadership over other types. As per an NLM article from September 2021, 62% of combination pharmaceutical products administrated through self-injectable devices were disposable. Furthermore, this segment is poised to grow with the increasing adoption of innovative technologies as they offer better patient compliance and adherence to antidotes, disease-modifying medicines, and monoclonal antibodies (2021 NLM article).

Our in-depth analysis of the global auto-injectors market includes the following segments:

|

Product Type |

|

|

Disease Indication |

|

|

End use |

|

|

Technology |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Auto-injectors Market Regional Analysis:

North American Market Insights

Auto-injectors market in North America is predicted to account for the largest share of 45% by 2035, impelled by the rising investment in the healthcare sector. The ongoing advancements and funding to improve public access to healthcare encourage more people with a variety of medical problems to adopt these personal care tools. In addition, recent developments and competitive strategies such as market expansion, mergers & acquisitions, and product launches have been considered to depict a competitive landscape in this region. For instance, in May 2023, Coherus BioSciences, a leading global biosimilar company, announced the commercial launch of UDENYCA, a single-dose prefilled auto-injector package, in the U.S. market. This pegfilgrastim biosimilar is given the day following chemotherapy to reduce the risk of infection.

The U.S. is augmenting the market with a promising growth trajectory, attributable to the favorable regulatory framework, increasing food poisoning cases, and the expanding biosimilar industry. This scenario is attracting global leaders to participate, escalating engagement in this sector. For instance, in July 2023, Boehringer Ingelheim commercially launched a new autoinjector option for its interchangeable biosimilar to Humira, Cyltezo Pen, in the U.S. marketplace. After gaining FDA approval in May, the company distributed the 40 mg/0.8 mL pre-filled adalimumab-adbm in two-, four-, and six-pack doses.

APAC Market Insights

The APAC auto-injectors market is estimated to be the second largest shareholder during the analyzed timeframe, led by rising advancement in medical technologies. Several government campaigns and initiatives from developing countries such as Japan, China, and India are promoting domestic production and the cultivation of innovative medical devices. On this note, in May 2024, Eisai and Nippon Medac collaboratively launched Metoject Subcutaneous Injection 7.5mg Pen 0.15mL, 10mg Pen 0.20mL, 12.5mg Pen 0.25mL, and 15mg Pen 0.30mL to treat rheumatoid arthritis patients in Japan. In addition, the rapidly aging population, with various chronic illnesses, in these nations are inflating the demand for sophisticated tools that are self-injectable and capable of delivering medications intramuscularly.

India is emerging as a great opportunity for profitable revenue generation for global leaders in the market. There are several factors contributing to the country’s successful propagation in this merchandise: the Make in India campaign, the growing diabetic patient pool, and the accelerating popularity of the remote care approach. In this regard, the Healthcare Federation of India predicted the country’s home healthcare industry to reach USD 19.9 billion by 2025 from USD 5.4 billion in 2022. Additionally, the diabetes population in India is expected to surpass 134.0 million by 2045, as per NLM.

Auto-injectors Market Players:

- Eli Lilly and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Scandinavian Health Ltd.

- AbbVie, Inc.

- Amgen

- Owen Mumford

- Ypsomed

- Biogen Idec

- Mylan N.V.

- Pfizer, Inc.

- Sanofi

- Stevanato Group

- Teva Pharmaceutical

- Taisho Pharmaceutical Co., Ltd.

Key players in the market are currently focusing on gaining an optimum safety profile for their pipelines for seamless globalization and large-scale production. In this regard, in June 2024, Instron introduced the next-generation Autoinjector Testing System to ensure the product’s compliance with performance requirements and ISO 11608 criteria. Simultaneously, many pharmaceutical giants are adopting this method of administration to make their medicines more accessible and easier to use for consumers. For instance, in February 2025, Eli Lilly and Company availed extended doses and savings options of Zepbound for self-pay patients, including 2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, and 15 mg per 0.5 mL single-dose pen. Such key players are:

Recent Developments

- In January 2024, Taisho Pharmaceutical announced the commercial launch of its Nanozora 30 mg Autoinjector for S.C. Injection for rheumatoid arthritis. This new form of TNFα inhibitor is designed while keeping user convenience on priority to prevent needle piercing accidents.

- In October 2024, Datwyler expanded its coated plungers pipeline, NeoFlex, by launching NeoFlex Prefilled Syringe 10ml and NeoFlex Cartridge Wearable 10ml plungers at CPHI Worldwide in Milan, Italy. This portfolio consists of new container sizes, delivering large volume injectables while maintaining the utmost quality and safety.

- Report ID: 3511

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Auto-Injector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.