Atorvastatin API Market Outlook:

Atorvastatin API Market size was over USD 1.68 billion in 2025 and is projected to reach USD 3.07 billion by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atorvastatin API is evaluated at USD 1.77 billion.

The atorvastatin API market is witnessing robust growth attributable to the growing incidences of hypercholesterolemia. According to an NLM article, published in June 2022, the disability-adjusted life of years attributed to an increment of LDL-C cases, reaching 98.6 million in 2019. Thus, atorvastatin API helps prevent the disease which further propels the market. Furthermore, the demand for atorvastatin API is expected to rise with the prevalence of lifestyle disorders, including obesity and diabetes, which are the main risk factors for cardiovascular diseases. According to the Centers for Disease Control and Prevention report, released in October 2024, 702,880 individuals died from heart disease in 2022. That is equivalent to 1 of every 5 deaths.

In addition, the growing geriatric population is yet another factor that further raises the prevalence of chronic diseases and increases the demand for efficient lipid-lowering therapy. WHO data, published in a 2023 NLM article states, that the global prevalence of high cholesterol was 39% amongst which 37% consisted of males and 40% female. Growing awareness about preventive healthcare and the importance of healthy cholesterol levels also raises market growth because patients as well as health care professionals are more inclined towards taking preventive treatment approaches. In addition, innovations in drug delivery systems and combination therapies enhancing efficacy and patient compliance further contributed to the expansion of the atorvastatin API market.

Key Atorvastatin API Market Insights Summary:

Regional Highlights:

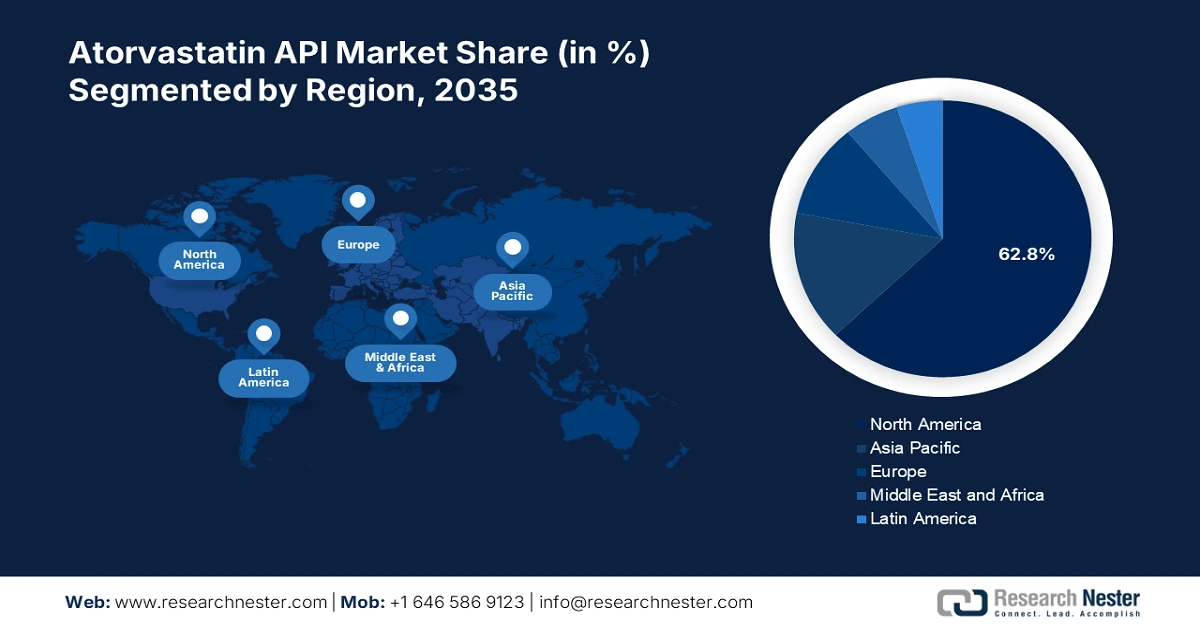

- North America's 62.8% share in the Atorvastatin API Market is driven by lifestyle-related illnesses like diabetes and obesity, cementing its dominance through rising pharmaceutical demand in 2026–2035.

- Europe’s atorvastatin API market is anticipated to experience lucrative growth by 2035, driven by synthesis innovations and continuous manufacturing.

Segment Insights:

- The Hypercholesterolemia segment is forecasted to achieve an 82.8% market share by 2035, driven by extensive clinical research proving atorvastatin's effectiveness in managing LDL cholesterol and cardiovascular risk.

Key Growth Trends:

- Government initiatives and health programs

- Research and development

Major Challenges:

- Supply chain disruptions

- Emergence of alternative therapies

- Key Players: Dr. Reddy’s Laboratories Ltd., Anuh Pharma Ltd., Jubilant Life Sciences Ltd., Ind-Swift Labs Ltd., Zhejiang Hisun Pharmaceutical Co Ltd., Cadila Pharmaceuticals, and more.

Global Atorvastatin API Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.77 billion

- Projected Market Size: USD 3.07 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (62.8% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Atorvastatin API Market Growth Drivers and Challenges:

Growth Drivers

- Government initiatives and health programs: The growth momentum of the atorvastatin API market is supported by increased access to vital medication through subsidized health programs and government initiatives. Through education in cholesterol management and financial incentives for statin therapies, such as atorvastatin, these prevention strategies can make proven treatment more accessible to broader cross-sections of patients. According to the PIB data, published in August 2021, to enhance the domestic production of APIs, the exports (3,90,476 million tons) exceeded the imports (3,24,331 million tons) in India. This promotes the demand for atorvastatin APIs as an essential element in the national health agendas.

- Research and development: An essential driving force in the atorvastatin API market, is thorough research & development where innovation can expand the therapeutic applications of the drug. Other advancements include formulation technologies, including novel drug delivery systems and combination therapies that can increase compliance and improve treatment outcomes among patients. In April 2024, Prauluent (Alirocumab) injections were approved by the FDA for use in pediatrics with high cholesterol. This allowed patients to lower and control LDL-C levels much earlier in life. This commitment to R&D will not only support new and improved formulations of atorvastatin but will also strengthen the position of manufacturers in a saturated market.

Challenges

-

Supply chain disruptions: The atorvastatin API market faced enormous challenges attributed to disruption in the supply chain arising majorly due to the COVID-19 pandemic and geopolitical tensions. It causes delays in raw material procurements, bottlenecks in manufacturing, and increased transportation costs, which ultimately impact the availability of atorvastatin. In addition, pharmaceutical companies are faced with challenges to maintain constant production, potentially leading to deficits in the market. This reliance on fewer numbers of suppliers for critical intermediates has increased vulnerability, and sourcing strategies need to be reevaluated to build resilience and have more stable supply chains in the future.

-

Emergence of alternative therapies: A major challenge for the atorvastatin API market is alternative therapies, since most alternative therapies are based on new mechanisms of action and offer better compliance to patients. With the rising preference for holistic and personalized medicine among consumers, newer options such as natural supplements, dietary interventions, and newer lipid-lowering agents are fast replacing it. This change will dislodge atorvastatin's market share and pressure pharmaceutical companies to innovate their products for better competitiveness. This growing attention to alternatives may ultimately eat away at the conventional leadership of atorvastatin and compel a reappraisal of marketing strategy and research investment in the statin.

Atorvastatin API Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.68 billion |

|

Forecast Year Market Size (2035) |

USD 3.07 billion |

|

Regional Scope |

|

Atorvastatin API Market Segmentation:

Application (Hypercholesterolemia, Hypertriglyceridemia, Dyslipidemia)

hypercholesterolemia segment is set to dominate atorvastatin API market share of around 82.8% by the end of 2035. The growth is driven by extensive clinical research data on atorvastatin which has been proven to be effective in the management of LDL cholesterol and associated cardiovascular risk. For instance, in May 2024, AstraZeneca and CSPC Pharmaceutical Group Ltd (CSPC) signed an exclusive license agreement. The company's cardiovascular portfolio is further strengthened by this partnership, which aids in addressing the main risk factors for chronic cardiovascular disease. The rapidly increasing attention of healthcare professionals toward cholesterol management as an essential part of preventive measures for cardiovascular diseases further fuels the growing demand for atorvastatin APIs.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atorvastatin API Market Regional Analysis:

North America Market Statistics

North America in atorvastatin API market is likely to hold over 62.8% revenue share by the end of 2035. The need for efficient cholesterol-lowering treatments has increased due to the rising prevalence of lifestyle-related illnesses such as diabetes and obesity. Pharmaceutical firms in the region have been enticed by this situation to invest in the creation and production of atorvastatin APIs, which has allowed them to diversify their product lines and improve patient access to necessary drugs.

Canada atorvastatin API market is anticipated to grow rapidly during the forecast period owing to the expanding infrastructure in research and development of API treatments. For instance, in July 2022, Piramal Pharma Limited's Pharma Solutions business inaugurated a new API plant. The facility is located within the business' headquarters in Aurora, Ontario. As one of the leading Contract Development and Manufacturing Organizations (CDMO), its objective is to have quality medications available in the market.

The U.S. atorvastatin API market is growing significantly attributable to the support of government agencies and organizations in the development and approvals of novel drugs. For instance, in August 2020, Biocon Biologics India Ltd. and Mylan N.V. announced the U.S. launch of Semglee in vial and pre-filled pen presentations. The U.S. Food and Drug Administration (FDA) has confirmed that Semglee is approved for the same indications as Sanofi's Lantus and shares the same amino acid sequence. Thus, this motive leads to preparing a conducive environment for treatments.

Asia Pacific Market Analysis

The atorvastatin API market in Europe is gaining traction and is expected to witness lucrative growth during the forecast timeline. Producers in the region are able to reduce production costs and guarantee consistent product quality owing to innovations such as continuous manufacturing and advancements in synthesis techniques. These technological developments are crucial for ensuring compliance with increasingly strict regulations while satisfying the rising demand for atorvastatin worldwide. This market shift is indicative of a larger movement in pharmaceutical manufacturing toward increased quality and efficiency.

China atorvastatin API market is experiencing significant growth owing to the rising number of people suffering from chronic diseases. According to IDF's 2022 statistics, 141 million people in China had diabetes in 2021. The high diabetic and obese population in the country has led to a stronger focus on developing advanced and safe API drugs. In addition, the WHO analysis states that the China government shifted its economy from centrally planned to market-based for the expansion and establishment of API manufacturing facilities in the country. For instance, in June 2022, WuXi STA opened a brand-new facility for a high-potency active pharmaceutical component at its location in Jiangsu. The firm expanded its Changzhou facility in response to increased demand for high-potency API process research and development services.

India is unfolding innumerable growth opportunities in the atorvastatin API market owing, the atorvastatin's patents have expired, and generic versions have proliferated, drastically reducing costs and expanding availability. Atorvastatin APIs' customer base is growing and competition is intensifying due to the generic market's expansion. Presence of leading producers of generic drugs worldwide, accounting for 20% of the world's generic medicine demand by volume. According to an Invest India Article, published in January 2023, the API industry of India held the 3rd leading position globally, with around 57% of WHO prequalified APIs.

Key Atorvastatin API Market Players:

- Centrient Pharmaceuticals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Morepen Laboratories Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Anuh Pharma Ltd.

- Jubilant Life Sciences Ltd.

- Ind-Swift Labs Ltd.

- Zhejiang Hisun Pharmaceutical Co Ltd.

- Cadila Pharmaceuticals

The need for niche competencies for manufacturing APIs has encouraged pharma companies to outsource production activities rather than manufacturing them in their own facilities. During the foreseeable years, this factor is expected to provide lucrative growth opportunities to key players in the atorvastatin API market. For instance, in August 2023, Merck & Co. established MK-0616 which is the oral PCSK9 inhibitor used in adults. It completed clinical trials in the year 2023 and was presented at scientific conferences including the 72nd Annual Session coupled with the World Congress of Cardiology at the American College of Cardiology. Here's the list of some key players:

Recent Developments

- In March 2024, Camber Pharmaceuticals announced the addition of atorvastatin calcium tablets, USP to its lineup. These tablets come in 90, 500, and 1000-count bottles containing 10 mg.

- In June 2023, CMP Pharma, Inc. declared that Atorvaliq (atorvastatin calcium) Oral Suspension, 20 mg/5 mL was the first and only FDA-approved oral liquid of atorvastatin. With this, high cholesterol and specific risk factors for heart disease or stroke can be treated.

- Report ID: 6919

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atorvastatin API Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.