Antimicrobial Nanocoatings Market Outlook:

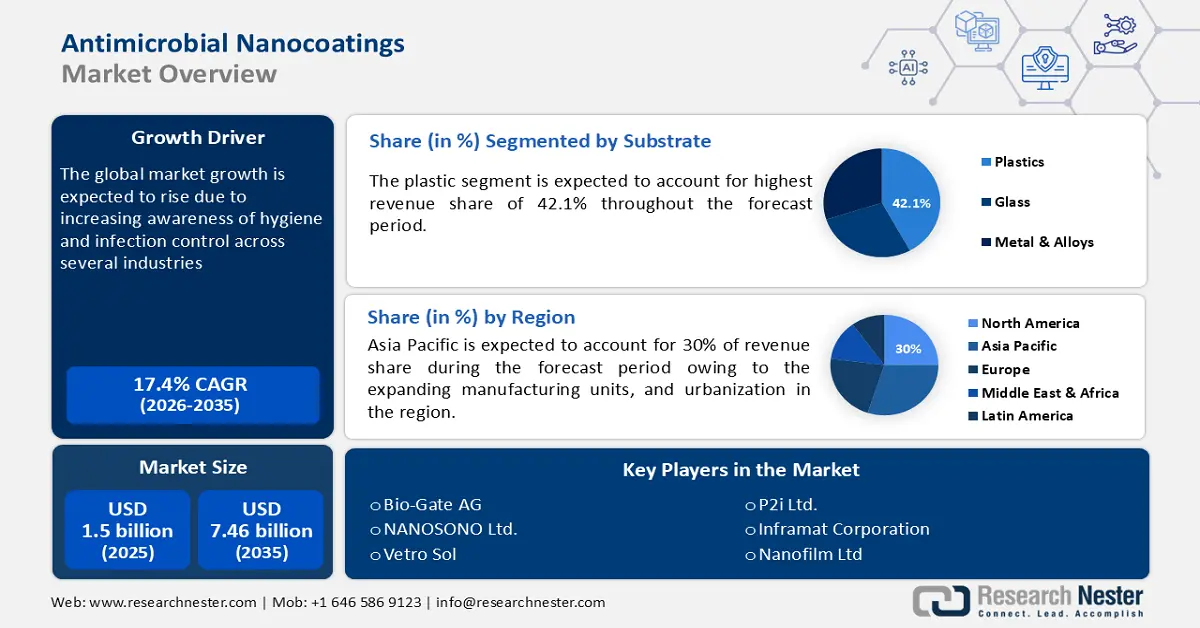

Antimicrobial Nanocoatings Market size was over USD 1.5 billion in 2025 and is projected to reach USD 7.46 billion by 2035, growing at around 17.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antimicrobial nanocoatings is evaluated at USD 1.73 billion.

Heightened focus on hygiene and infection control across healthcare, food processing, construction, and consumer goods, especially since the COVID-19 pandemic, has escalated the demand for antimicrobial solutions. Furthermore, technological advancements in nanotechnology have contributed to the development of more effective and durable antimicrobial coatings. Key antimicrobial nanocoatings market players are investing remarkably to fulfill the rising sanitation demands for medical facilities, public spaces, and household products, and launch products with long-term antimicrobial efficacy.

For instance, the Next Generation BiOactiVe NAnocoatings (NOVA) Project was launched in collaboration with 14 partners from 9 countries who are dedicated to developing a minimum of four novel antimicrobial coatings. These coatings are aimed at frequently touched surfaces in four specific application areas including public spaces, medical rooms, textiles, and touch screens. Furthermore, in July 2024, AkzoNobel announced a partnership with BioCote, aiming to expand Interpon brand and create Interpon AM, a range of antimicrobial powder coatings.

Key Antimicrobial Nanocoatings Market Insights Summary:

Regional Highlights:

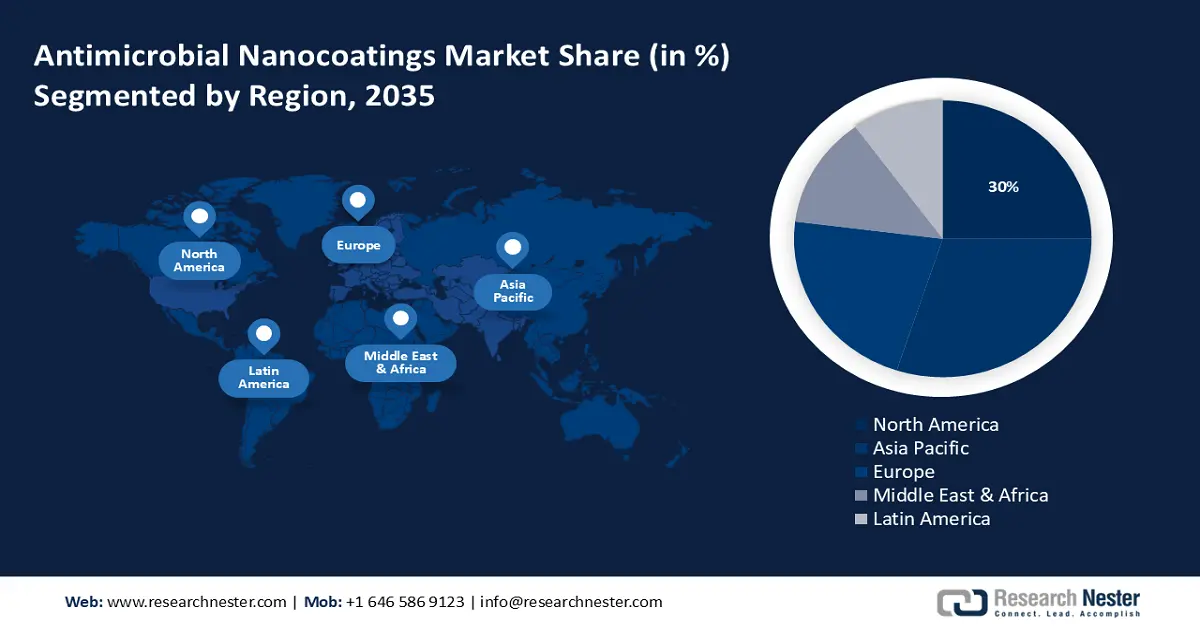

- Asia Pacific antimicrobial nanocoatings market will account for 30% share by 2035, driven by rapid growth in healthcare, food, and infrastructure sectors.

Segment Insights:

- The plastic substrates segment in the antimicrobial nanocoatings market is expected to achieve dominant growth till 2035, driven by the versatility, lightweight nature, and cost-effectiveness of plastics in various applications.

- The medical & healthcare industry segment in the antimicrobial nanocoatings market is expected to hold a dominant share by 2035, attributed to the critical need to prevent hospital-acquired infections and maintain sterile environments.

Key Growth Trends:

- Rising demand for antibacterial surfaces

- Advancements in nanomaterials

Major Challenges:

- High production costs

- Regulatory and environmental concerns

Key Players: Nanoveu Limited, Bio-Gate AG, Nano-Care Deutschland AG, P2i Ltd., Integricote, Inc., Nanosono Ltd., Nanophase Technologies Corporation, TSI Incorporated, Nanovere Technologies, LLC, Totem Technologies.

Global Antimicrobial Nanocoatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.73 billion

- Projected Market Size: USD 7.46 billion by 2035

- Growth Forecasts: 17.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Antimicrobial Nanocoatings Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for antibacterial surfaces: Sectors such as food processing and healthcare, in addition to public transportation are witnessing a growth in the demand for antibacterial surfaces. Owing to the dangers of diseases including HAIs and cross-contamination, there is a rising need for surfaces that can actively prevent the spread of harmful bacteria and viruses. These coatings, which offer continuous protection without needing constant cleaning or disinfecting, are becoming a preferred solution in high-traffic and sensitive areas.

Furthermore, airports and public transport systems worldwide have increasingly adopted antimicrobial nanocoatings to ensure cleaner, safer surfaces for passengers. For instance, in July 2020, Heathrow Airport applied an antimicrobial surface coating throughout high-traffic areas such as escalators, and check-in desks to minimize the risk of virus transmission, owing to the then ongoing COVID-19 pandemic. Such heightened demands reflect the urgent need for long-lasting antibacterial solutions across various sectors.

Advancements in nanomaterials: Innovations in materials including copper-based compounds, and silver nanoparticles, are improving the efficiency, and durability of these coatings. In December 2020, Corning Incorporated and Nippon Paint China announced the launch of Nippon Kid's Odour-Less All-In-One Interior Emulsion Paint-Anti Bacteria Plus. It is formulated for use in spaces where children spend the most time, and with Corning Guardiant which contains the most bioactive form of copper. Additionally, researchers are exploring biocompatible nanomaterials to meet the increasing regulatory and consumer demand for sustainable solutions.

Challenges

- High production costs: The complex manufacturing process, use of advanced raw materials, and need for specialized equipment drive up expenses, limiting the scalability and affordability of these products. Additionally, the stringent regulatory requirements for safety and efficacy further increase production expenses. As a result, high costs can restrict market adoption, mainly in price-sensitive industries, hindering overall antimicrobial nanocoatings market growth.

- Regulatory and environmental concerns: The use of nanoparticles can contain health risks and environmental impact which has led to strict regulations from the governing bodies. Manufacturers are required to comply with complex safety regulations to ensure nanomaterials used are non-toxic, biocompatible, and environmentally friendly. This often involves extensive testing and certification, which can slow down product development. These regulations can also delay antimicrobial nanocoatings market entry and limit the adoption of antimicrobial nanocoatings.

Antimicrobial Nanocoatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.4% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 7.46 billion |

|

Regional Scope |

|

Antimicrobial Nanocoatings Market Segmentation:

Substrate Segment Analysis

Plastic substrates dominate the antimicrobial nanocoatings market owing to their widespread use in various applications and industries. Plastics are inherently versatile, lightweight, and cost-effective, making them ideal for incorporating antimicrobial coatings to enhance their functionality. These coatings provide essential protection against microbial growth, which is crucial in high-touch areas and products, such as packaging materials, consumer goods, and medical devices.

Additionally, the adaptability of plastic substrates to different coating technologies and formulations allows for effective antimicrobial treatments across diverse applications. The ability to apply nanocoatings to plastics helps improve their durability and safety, addressing hygiene concerns and extending the lifespan of the products. This broad range of applications is driving the presence of plastic substrates in the market.

End use Segment Analysis

In terms of end use, the medical & healthcare industry dominated the antimicrobial nanocoatings market driven by the critical need to prevent hospital-acquired infections (HAIs) and maintain a sterile environment. These coatings are used widely on medical devices, surgical instruments, hospital surfaces, and protective gear to reduce harmful micro-organisms growth. Healthcare facilities have increasingly adopted antimicrobial nanocoatings, especially since the COVID-19 pandemic to ensure patient safety and hygiene standards, further boosting the segment’s dominance.

Moreover, antimicrobial nanocoatings are also useful for extending the lifespan of medical equipment and devices by protecting against microbial damage and degradation. Rising emphasis on patient safety is mainly driving the adoption of technologies that minimize infection risks in hospitals and clinics. In July 2023, Biocoat announced the acquisition of Chempilot, aiming to enhance the company’s R&D capabilities and production processes for coatings for medical and healthcare applications.

Our in-depth analysis of the antimicrobial nanocoatings market includes the following segments:

|

Substrate |

|

|

Material Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antimicrobial Nanocoatings Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 30% by 2035,APAC antimicrobial nanocoatings market is experiencing rapid growth driven by the growing demand across industries including healthcare, food packaging, and construction. Key market players such as Japan, China, and India are seeing significant investments in nanotechnology and innovations in antimicrobial solutions. The region’s expanding manufacturing base, urbanization, and emphasis on sustainability are further boosting the antimicrobial nanocoatings market’s growth. For instance, during the 15th Beijing International Automotive Exhibition, Nippon Paint China and KangDe Composites Co., Ltd. announced a partnership for the development of innovative coating technologies.

India is witnessing increasing demand for safe and high-performance materials in medical devices, especially due to the rising awareness of HAIs. Additionally, the expanding pharmaceutical and food processing industries, along with the country’s emphasis on improving sanitation and hygiene under campaigns such as Swachh Bharat, are key drivers. The government initiative to promote Make in India is also boosting local manufacturing in the country for antimicrobial surface coatings. The rise of smart cities and infrastructure development is additionally contributing to the increasing adoption of such coatings in the country.

China's large-scale infrastructure projects with a focus on innovation are significantly boosting antimicrobial nanocoatings market growth. Policies such as Healthy China 2030, emphasize improving public health and hygiene standards, fueling the demand for antimicrobial coatings in hospitals, public transport, and commercial spaces. The country’s dominant electronics manufacturing industry also supports the adoption of these coatings in consumer electronics. Moreover, the country’s focus on green building practices drives the market growth further to enhance durability and cleanliness.

North America Market Insights

The antimicrobial nanocoatings market in North America is driven by stringent health and safety regulations. Increasing R&D investments for nanotechnology-based solutions, supported by government grants and private sector innovation, further fuels the market growth. Rising demand for antimicrobial solutions, coupled with the growing demand for environment-friendly practices in schools, offices, and public spaces, is also propelling the adoption of nanocoatings across various industries.

Regulatory bodies like the FDA and EPA enforce strict safety regulations in the U.S. that boost the adoption of antimicrobial coatings in medical devices, surfaces, and high-traffic areas. Furthermore, strong R&D investments and government-funded initiatives supporting innovation in nanotechnology are making the U.S. lead in the North America antimicrobial nanocoatings market. The CDC has been actively promoting the use of antimicrobial solutions in healthcare to combat resistant pathogens, the expanding aerospace and defense sectors are also adopting these coatings for enhanced hygiene in aircraft interiors and military applications

The construction industry in Canada has particularly witnessed increased adoption of nanocoatings for residential and commercial buildings to improve hygiene and sustainability. However, Canada’s healthcare system is known for its high standards which is a key driver for the use of antimicrobial nanocoatings in hospitals and long-term care facilities. Rising attention to food safety is also encouraging the usage of these coatings in food processing and packaging, to prevent contamination, and extend shelf-life.

Antimicrobial Nanocoatings Market Players:

- Bio-Gate AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nilima Nanotechnologies

- Nano-Care Deutschland AG

- NANOSONO LTD

- GBneuhaus GmbH

- NANOPOOL GmbH

- NANO4LIFE EUROPE L.P

- Vetro Sol

- Inframat Corporation

- P2i Ltd

- Nanofilm Ltd

Companies with advanced expertise in nanotechnology and surface protection solutions drive the market. These market leaders are constantly innovating to meet the rising demand for coatings that prevent microbial growth, particularly in sectors including healthcare, and construction. Their products often incorporate titanium dioxide and copper which provide long-lasting antiviral protection. A majority of them are also focusing on sustainability, ensuring their coatings are safe for human health and the environment, while also adhering to regulatory standards. For instance, in December 2023, AkzoNobel Powder Coatings announced a partnership with coatingAI to assist customers in improving the application process and reducing their carbon footprint.

Recent Developments

- In October 2022, Microban International announced the launch of LapisShield, designed to integrate antimicrobial functionality into water-based coating formulation

- In October 2021, PPG received U.S. Environmental Protection Agency (EPA) registration for PPG COPPER ARMOR antimicrobial paint containing Corning Guardiant technology. The technology is proven to kill 99.9% of viruses and bacteria on the coated surface within two hours.

- In February 2021, Designsake Studio launched Matter, which is a new antimicrobial coating, developed to protect packages and handlers from bacteria and viruses.

- Report ID: 6462

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antimicrobial Nanocoatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.