Antihemophilic Factor Market Outlook:

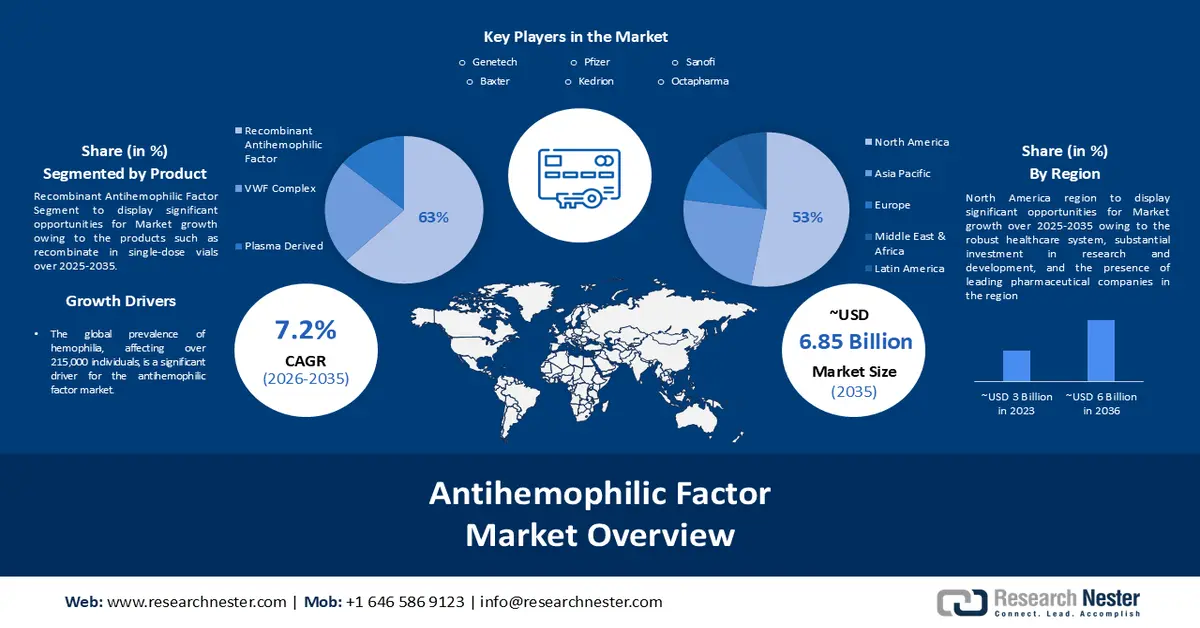

Antihemophilic Factor Market size was valued at USD 3.42 billion in 2025 and is expected to reach USD 6.85 billion by 2035, registering around 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antihemophilic factor is evaluated at USD 3.64 billion.

The market is experiencing exponential growth due to the need for effective hemophilia treatments amidst high treatment costs. A 2021, study highlights that lifetime treatment costs for severe hemophilia B can reach up to USD 21 million for on-demand fix treatment and USD 23 million for preventive treatment. Research from 2022 further revealed that annual treatment costs between USD 150,000 and USD 300,000, excluding indirect costs like lost productivity. These staggering expenses underscore the demand for more efficient, cost-effective antihemophilic factors.

Factors believed to propel antihemophilic factor market growth include market evolution – trend adaptation, highlighting the importance of quickly adapting to market trends and consumer demands. Moreover, the value chain optimization and pricing strategy plays a crucial role as it enhance productivity and competitiveness & expansion respectively. Together, these elements set the stage for the market's sustained growth and leadership.

Key Antihemophilic Factor Market Insights Summary:

Regional Insights:

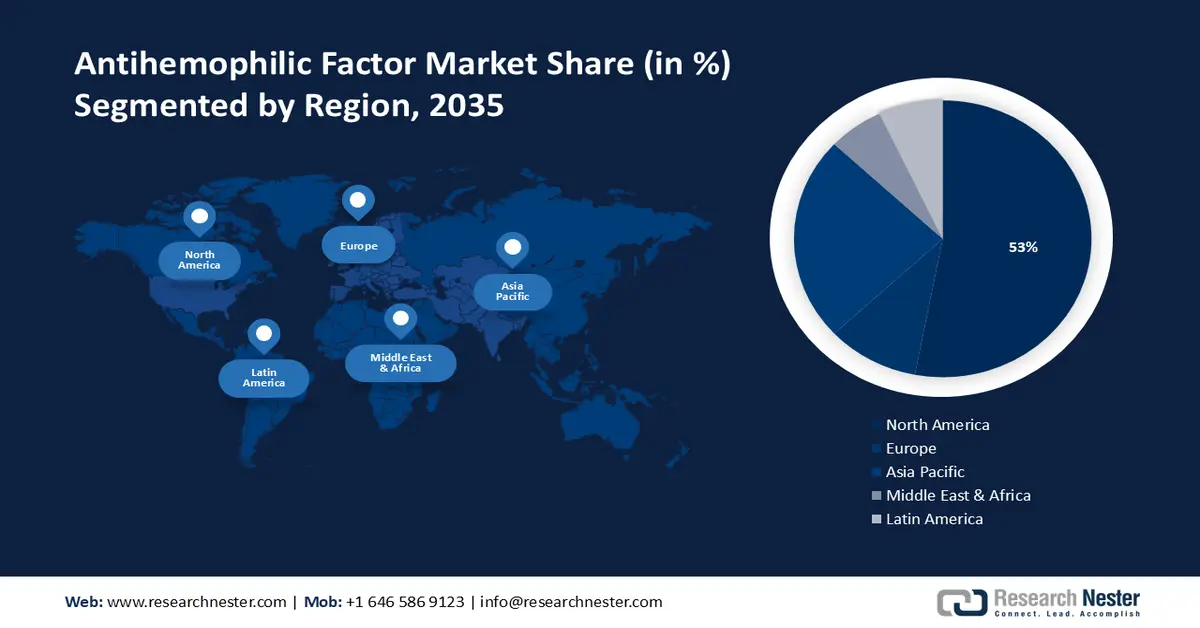

- North America is projected to command a 53% share of the antihemophilic factor market by 2035, supported by an advanced healthcare ecosystem, high R&D spending, and strong biologics policies owing to the expanding elderly population and rising Medicare Advantage penetration.

- Europe is anticipated to secure a 24% share by 2035, underpinned by elevated treatment-seeking behavior, established hemophilia care pathways, and strong biotech capabilities because of substantial per-patient hemophilia expenditure across major economies.

Segment Insights:

- The recombinant antihemophilic factor segment is expected to achieve a 63% share by 2035 in the global antihemophilic factor market propelled by advancements in rFVIII–rVWF co-expression technologies and improved patient-centric formulations.

- The retail pharmacies segment is set to capture a 57% share by 2035 supported by strong patient engagement and continued investment in targeted genetic mutation therapies.

Key Growth Trends:

- Increasing Prevalence and Underdiagnosis of Hemophilia

- Advancements in Gene Therapy for Hemophilia B

Major Challenges:

- High Cost and Accessibility

Key Players: Genetech, Biogen Idec, Bayer AG, Octapharma, Novo Nordisk, Baxter, Kedrion, Pfizer Inc., Sanofi SA, CSL Behring.

Global Antihemophilic Factor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.42 billion

- 2026 Market Size: USD 3.64 billion

- Projected Market Size: USD 6.85 billion by 2035

- Growth Forecasts: 7.2%

Key Regional Dynamics:

- Largest Region: North America (53% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 28 November, 2025

Antihemophilic Factor Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Prevalence and Underdiagnosis of Hemophilia: The global prevalence of hemophilia, affecting over 215,000 individuals, is a significant driver for the antihemophilic factor market. Emerging data suggest that the actual number could exceed 2 million due to underdiagnosis, highlighting a vast unmet need for effective treatments. Hemophilia predominantly affects those assigned males at birth, with those assigned females representing a smaller percentage of 18% of mild cases. This discrepancy underscores the conditions' complex diagnosis landscape, pushing for enhanced awareness and diagnostic capabilities, thereby driving demand for antihemophilic factors

- Advancements in Gene Therapy for Hemophilia B: The antihemophilic factor market is witnessing a transformative shift with the advent of gene therapy for hemophilia B. Clinical trials have shown promising results, with a dose-dependent expression of the factor IX (FIX) transgene yielding FIX activity levels of 2-11 IU/dL in participants. Remarkably, these therapeutic effects have demonstrated sustainability, with increased FIX activity in the range of 2-5% persisting for up to 8 years across various dose cohorts. This breakthrough underscores a potential paradigm shift in treatment methodologies, offering long-term benefits and reducing the dependency on traditional factor replacement therapies.

- Rising Demand in Healthcare: The increasing demand for antihemophilic factors in hospitals and clinics worldwide is a significant boosting factor for the sector. This rise in demand is attributed to the crucial role these factors play in treating hemophilia, a genetic disorder that impairs the blood’s ability to clot. As awareness and diagnosis of hemophilia improve globally, the need for effective treatments, including antihemophilic factors, escalates, thus boosting sectoral growth. This trend highlights the importance of these treatments in healthcare settings and underscores their impact on sectoral expansion.

Challenges

-

High Cost and Accessibility: The production and distribution of antihemophilic factors involve significant costs, making treatments expensive and less accessible to patients in lower-income regions.

- Navigating through rigorous regulatory processes for approval can be time-consuming and challenging, affecting the timely availability of treatments.

- With advancements in gene therapy and alternative treatments, there’s pressure on traditional antihemophilic factors products to innovate and remain competitive in the antihemophilic factor market.

Antihemophilic Factor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 3.42 billion |

|

Forecast Year Market Size (2035) |

USD 6.85 billion |

|

Regional Scope |

|

Antihemophilic Factor Market Segmentation:

Product Segment Analysis

The recombinant antihemophilic factor offering products such as recombinant in single-dose vials with 250 to 2000 international units, is estimated to hold 63% share of the global antihemophilic factor market by 2035. The vials, when reconstituted, include stabilizers like human albumin, calcium, and polyethylene glycol, contributing to the segment’s growth. The co-expression of Recombinant von Willebrand factor (rVWF) with human recombinant FVIII (rFVIII) containing no more than 2ng rVWF, having no significant effect on von Willebrand disease, thereby ensuring efficacy and safety. This technological sophistication is expected to bolster market dominance, particularly in regions with growing healthcare infrastructure and patient awareness.

Distribution Segment Analysis

The retail pharmacies segment in the antihemophilic factor market is poised to secure the largest revenue share of 57% by 2035. This dominance is largely due to the substantial patient engagement these outlets experience, which is expected to drive sales of leading antihemophilic factors such as NovoSeven and FEIBA, which have historically reached USD 2 billion and USD 800 million in sales respectively. The ultimate investments by manufacturers in targeted genetic mutation therapies contribute to the growth, fostering a robust pipeline of innovative products that bolster the segment's expansion.

Our in-depth analysis of the global antihemophilic factor market includes the following segments:

|

Type |

|

|

Product |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antihemophilic Factor Market - Regional Analysis

North American Market Insights

North America industry is predicted to account for largest revenue share of 53% by 2035, on account of robust healthcare system, substantial investment in research and development, and the presence of leading pharmaceutical companies in the region.The market growth in the region is expected on account of a robust healthcare system, substantial investment in research and development, and the presence of leading pharmaceutical companies focused on innovative therapies for hemophilia. The region’s strong regulatory frameworks and supportive policies for biologics and advanced drug therapies are contributing factors to its dominant position. Furthermore, the rapid growth of the over 65% population in the United States, with its increased adoption of medicare advantage, could account for this change, projecting an increase from 44% in 2021 to about 54% penetration in the medicare population by 2030. Additionally, the improved profitability of managed Medicaid, due to more coordinated and integrated care, is likely to further enhance the market growth prospects.

European Market Insights

The Europe antihemophilic factor market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The market’s growth is bolstered by high treatment-seeking rates, boosted by heightened awareness of hemophilia, well-established treatment protocols, and active patient organizations. Additionally, the region benefits from a sophisticated biotechnology sector and strategic partnerships between domestic and global pharmaceutical firms. Economic considerations also play a pivotal role, with the cost of severe hemophilia in five European countries reaching 2 billion in 2014, translating to nearly USD 300,000 per patient annually. With Germany bearing the highest per-patient costs at USD 300,000 and the UK, at the lower end at USD 200,000, the financial implications are vast and influence drug development and healthcare policy decisions across Europe’s diverse regions.

Antihemophilic Factor Market Players:

- Genetech

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biogen Idec

- Bayer AG

- Octapharma

- Novo Nordisk

- Baxter

- Kedrion

- Pfizer Inc.

- Sanofi SA

- CSL Behring

Recent Developments

- Sanofi’s fitusiran, an innovative small interfering RNA (sIRNA) therapy, has successfully completed two phases 3 trials, demonstrating a significant decrease in annualized bleeding rates in hemophilia A or B patients, meeting its primary objective.

- Bayer AG has ceased the production of kogenate, a previously FDA-approved treatment for hemophilia A.

- Report ID: 5792

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antihemophilic Factor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.