Antidiabetics Market Outlook:

Antidiabetics Market size was valued at USD 94.9 billion in 2025 and is expected to reach USD 241.71 billion by 2035, expanding at around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antidiabetics is evaluated at USD 103.27 billion.

The increasing cases of diabetes, the rising geriatric population, and ongoing advancements in anti-diabetic drugs are positively influencing the overall antidiabetics market growth. According to the World Health Organization (WHO), diabetes is a chronic metabolic disease that affects the eyes, heart, kidneys, and nerves over time. Type 2 diabetes is most common across the world and particularly affects adults. Type 1 diabetes also known as juvenile diabetes or insulin-dependent diabetes is chronic in nature and can be treated through insulin intakes. As per WHO estimations around 422 million people are living with diabetes globally, and about 1.5 million deaths occur yearly due to diabetes.

The rising adoption of a sedentary lifestyle, hike in obesity cases, and poor eating habits are driving the prevalence of diabetes, ultimately augmenting the sales of antidiabetic drugs. According to World Obesity Atlas 2023, more than half of the global population is likely to become obese in the next 12 years if proper treatment and support are not provided. According to the National Center for Biotechnology Information (NCBI), excess amount of body fat is one of the causes of type 2 diabetes.

Key Antidiabetics Market Insights Summary:

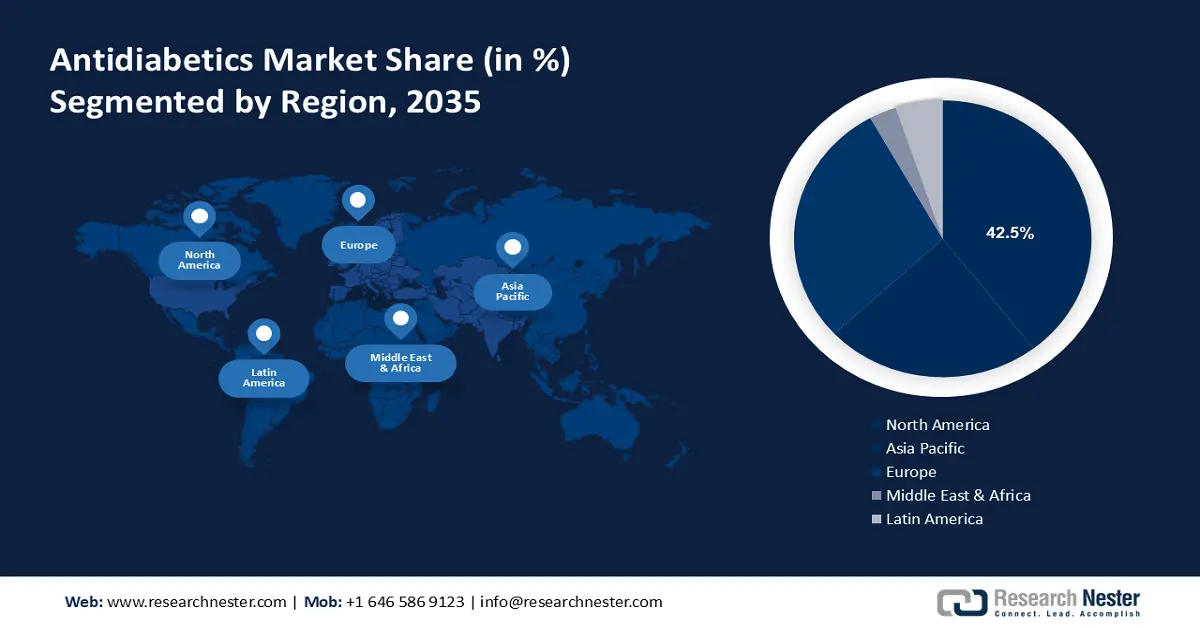

Regional Highlights:

- North America’s antidiabetics market is anticipated to capture 42.5% share by 2035, driven by the presence of cutting-edge diabetic research and treatment organizations, favorable reimbursement policies, and production of novel antidiabetic drugs by key market players.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by the dramatically increasing cases of diabetes in India, China, and Japan.

Segment Insights:

- The insulin segment in the antidiabetics market is projected to hold a significant share by 2035, influenced by insulin’s effectiveness in diabetic care, particularly for type 1 patients.

- The geriatric segment in the antidiabetics market is expected to secure a dominant share by 2035, driven by the high prevalence of diabetes among the elderly population.

Key Growth Trends:

- Rising diabetes awareness programs

- Generic antidiabetics gaining traction

Major Challenges:

- High treatment cost

- Side effects associated with consumption of diabetic drugs

Key Players: Eli Lilly and Company, Pfizer, Inc., Johnson & Johnson Services Inc., Merck & Co. Inc., and Novartis AG.

Global Antidiabetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.9 billion

- 2026 Market Size: USD 103.27 billion

- Projected Market Size: USD 241.71 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

Antidiabetics Market Growth Drivers and Challenges:

Growth Drivers:

- Rising diabetes awareness programs: The rising cases of diabetes and increasing awareness programs carried out by respective government organizations and antidiabetics market players are pushing the sales of antidiabetics. For instance, the National Diabetes Prevention Program or National DPP is an initiative by the Center for Disease Control and Prevention (CDC) to address the rising diabetes burden and spread awareness among the U.S. population. Apart from this, many governments across the world are offering supportive reimbursement policies for the treatment of chronic medical conditions including diabetes, which again is acting as a growth factor for the sales of antidiabetic drugs.

- Generic antidiabetics gaining traction: Ongoing advancements are offering patient-centric care for diabetes patients while on the other hand, continuous innovations are surging the price of antidiabetic solutions. Patients with low earning power can't afford such advanced treatment options, considering this aspect several antidiabetics market players are focusing on developing generic versions of premium diabetic drugs. This move is anticipated to offer novel and cost-effective medications for diabetes patients and boost the profits of producers.

For instance, in January 2024, Lupin Limited a leading producer of pharmaceuticals obtained a tentative U.S. FDA approval for the use of Dapagliflozin and Saxagliptin tablets. Dapagliflozin and Saxagliptin tablets are generic Qtern tablets manufactured by AstraZeneca AB, effective in controlling type 2 diabetes.

Challenges:

-

High treatment cost: Diabetes is a chronic disorder and requires multiple visits to a doctor and medication courses to control the disease. The high treatment cost hinders antidiabetics market adoption in low-income groups. As a result, the majority of patients are deterred from getting proper treatment, hampering sales of antidiabetics to some extent. For instance, as per the analysis by the American Diabetes Association on the economic costs of diabetes in the U.S. was USD 412.9 billion in 2022, out of which USD 306.6 billion were associated with direct medical costs and USD 106.3 billion to indirect costs.

- Side effects associated with consumption of diabetic drugs: Antidiabetic biguanides such as metformin are widely used to control diabetes in the majority of countries. According to the Science Direct report, some of the side effects associated with antidiabetic biguanides are headaches, vomiting, rash, indigestion, nausea, diarrhea, and body pain. Such aspects are expected to hinder the sales of diabetic drugs to some extent in the coming years.

Antidiabetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 94.9 billion |

|

Forecast Year Market Size (2035) |

USD 241.71 billion |

|

Regional Scope |

|

Antidiabetics Market Segmentation:

Product Segment Analysis

Insulin segment is predicted to capture antidiabetics market share of over 53.5% by 2035, owing to its effective results in diabetic care. Insulin is one of the most preferred therapies for diabetes control and offers effective results in type 1 patients. According to the National Institute of Diabetes and Digestive and Kidney Diseases, type 1 diabetic patients are suggested to take insulin as their bodies do not make it. The ways to take insulin are through insulin pens, insulin pumps, and syringes, automated insulin delivery system or artificial pancreas is also an option to take insulin for some patients.

Patient Population Segment Analysis

The geriatric segment in antidiabetics market is expected to hold a dominant revenue share through the forecasted period. Senior people are more prone to chronic disorders such as diabetes and often require antidiabetics such as insulin to control and maintain their glucose levels. Obesity, lack of proper diet, and a sedentary lifestyle are prevalent among the older population, which contributes to a high risk of diabetes leading to growing sales of antidiabetics. For instance, according to the Endocrine Society report, 33% of diabetic patients are aged 65 or older, and have a high risk of developing diabetes-related issues such as kidney failure, heart disorder, and hypoglycemia.

Our in-depth analysis of the antidiabetics market includes the following segments:

|

Product |

|

|

Patient Population |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antidiabetics Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 42.5% by 2035. The presence of cutting-edge diabetic research and treatment organizations such as the American Diabetes Association, the implementation of favorable reimbursement policies by respective governments, and the production of novel anti-diabetic drugs by key market players are some of the factors driving the market growth in North America.

The U.S. antidiabetics market is expected to expand at a lucrative CAGR till 2035. The increasing prevalence of diabetes and the strong presence of antidiabetic drug manufacturers are pushing the U.S. market growth. For instance, in January 2023, Eli Lilly and Company announced the expansion of their incretin products (that treat diabetes) manufacturing facility in North Carolina.

Canada is also an opportunistic antidiabetic market producer owing to the high demand for next-gen treatment options. According to Diabetes Canada, around 30% of the population in the country is living with diabetes. Swiftly increasing cases of diabetes and advancements in healthcare facilities are positively influencing the sales of diabetic drugs in the country.

APAC Market Insights

Asia Pacific is estimated to be a fast-growing antidiabetics market owing to the dramatically increasing cases of diabetics in India, China, and Japan. According to a report published by the Indian Council of Medical Research in 2023, around 100 million people in India are having diabetes.

India is experiencing a hike in diabetes cases and to overcome this issue government is conducting several awareness programs. Through a press release, in December 2022, the Department of Health & Family Welfare, Government of India announced that they are offering financial and technical support to diabetic patients through initiatives such as ‘Pradhan Mantri Bhartiya Janaushadhi Pariyojana’ (PMBJP) and Free Drugs Service Initiative of NHM. These schemes offer subsidized essential generic medicines for diabetes patients in India. antidiabetics market players in India are offering cost-effective and generic forms of diabetes medication, as the majority of families in the country belong to the middle-class population group. For instance, in January 2024, Lupin Limited announced the production of generic Dapagliflozin and Saxagliptin tablets for the treatment of type 2 diabetes in its Pithampur facility in India. Similarly, in August 2022, Cadila Pharmaceuticals announced the launch of generic versions of sitagliptin under the brand names Jankey & Sitenali in India to control type 2 diabetes.

Antidiabetics Market Players:

- Eli Lilly and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim

- Bristol-Myers Squibb Company

- Pfizer, Inc.

- Halozyme Therapeutics

- AstraZeneca Plc

- Bayer AG

- Johnson & Johnson Services Inc.

- Sanofi S.A.

- Oramed Pharmaceuticals

- Novo Nordisk

- Merck & Co. Inc

- Novartis AG

Key players in the antidiabetics market are employing several organic and inorganic strategies such as new product launches, collaborations, partnerships, mergers, and regional expansion to increase their market reach and profit shares. Industry giants are entering into partnership strategies with other players to boost technological innovations and develop advanced solutions.

Some of the key players include

Recent Developments

- In January 2024, Glenmark Pharmaceuticals Ltd. announced the launch of the antiâ€diabetic biosimilar Lirafit. Lirafit aids in controlling glycemic in adult patients with type 2 diabetes mellitus

- In October 2022, NuGen Medical Devices Inc. revealed the launch of its InsuJet device in Canada. InsuJet is a high-quality needle-free drug delivery device used by diabetic patients to take insulin.

- Report ID: 6405

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antidiabetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.