Anti-HA Antibody Market Outlook:

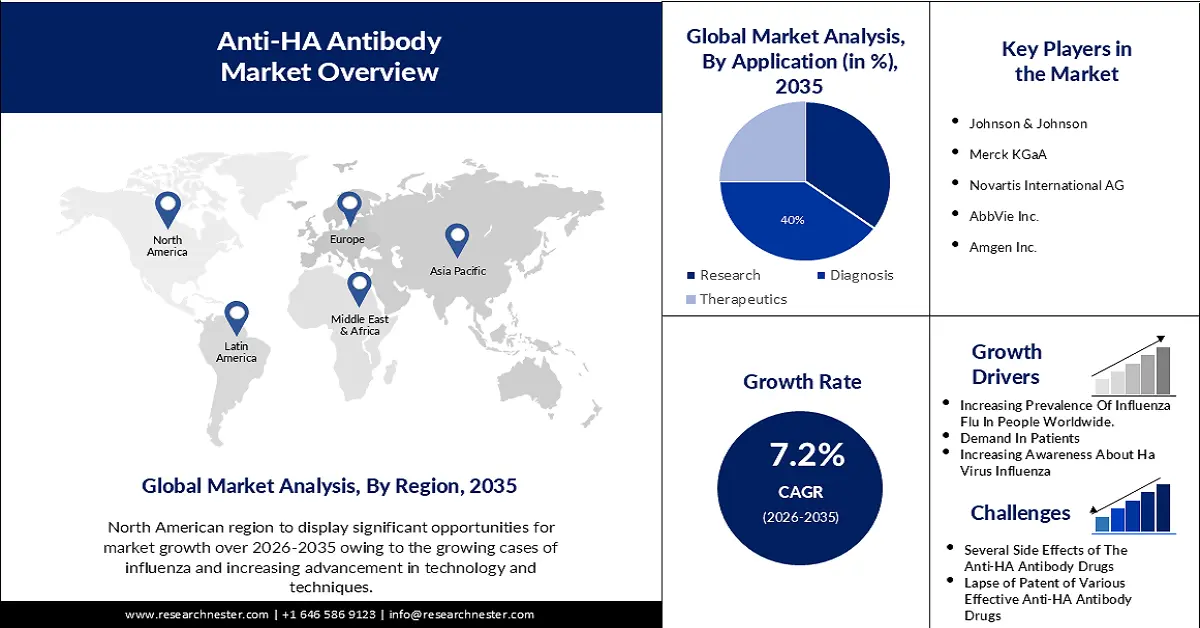

Anti-HA Antibody Market size was over USD 1.14 billion in 2025 and is anticipated to cross USD 2.28 billion by 2035, growing at more than 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-HA antibody is assessed at USD 1.21 billion.

The prevalence of influenza infection across the world is anticipated to primarily wheel the market to grow. A calculated 1 billion people internationally are infected by seasonal influenza yearly. Out of those 1 billion, about 3-5 million people have a massive case of flu each year. Across the globe, a calculated 290,000 – 650,000 deaths appear because of flu each year. The World Health Organization has international programs that supervise influenza activity around member countries and follow international trends, spread, intensity, and influence of influenza.

Another factor that is estimated to highly contribute to the rapid growth of the anti-HA antibody market during the forecast period is its demand to cure influenza-infected patients worldwide. Oseltamivir can limit the average duration of influenza disorder by 1.3 days and considerably limits indications compared to placebo if provided within 48 hr of indication onset. In a prophylactic study, oseltamivir dropped rates of influenza infection 5-fold from 5% (25/519) for the placebo (an anti-HA antibody drug) group to 1% (6/520) for the oseltamivir-dealt group. Seasonal influenza vaccines have focused on producing nullifying anti-HA antibodies for security since licensure. In recent years, anti-NA antibodies have been accepted as an additional correlate of protection. While HA and NA antigenic transformations appeared inharmoniously, the anti-HA and anti-NA antibody profiles have seldom been assessed in parallel at the singular level, because of the restricted wisdom of NA antigenic transformations.

Key Anti-HA Antibody Market Insights Summary:

Regional Highlights:

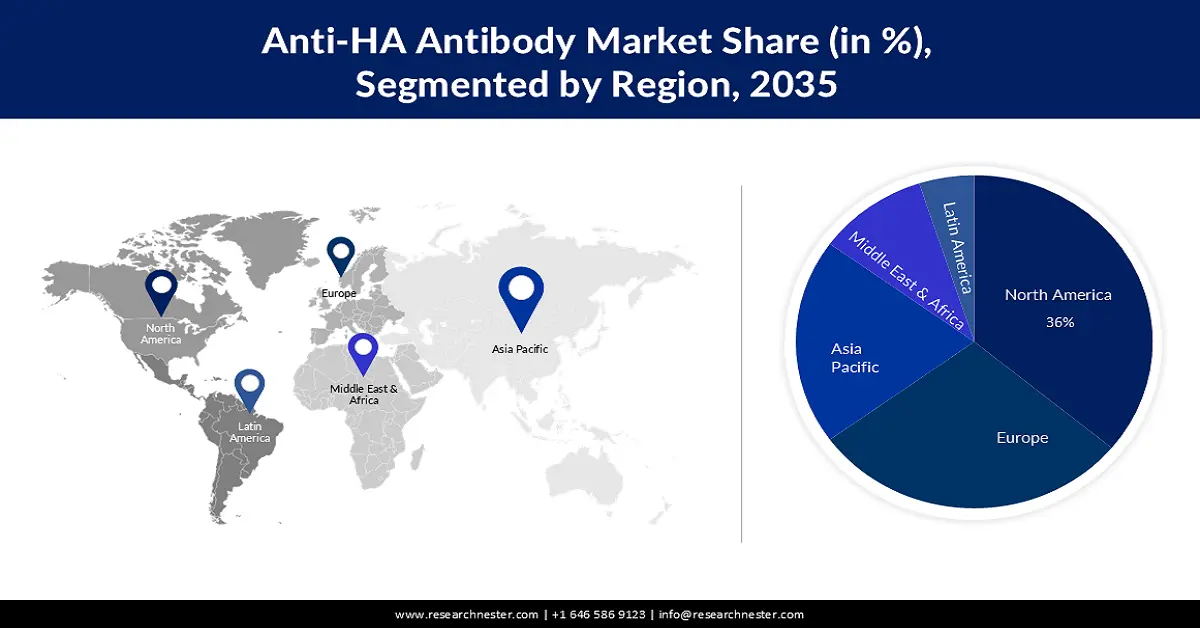

- North America in the anti-HA antibody market is anticipated to capture the largest revenue share of 36% by 2035, owing to advancements in technology such as genetic engineering and monoclonal antibody production.

- Europe is predicted to witness remarkable growth in the market by 2035, driven by the increasing prevalence of respiratory diseases.

Segment Insights:

- The IgM segment in the anti-HA antibody market is projected to hold 47% of the revenue share by 2035, impelled by the implementation of this type of anti-HA antibody in different medications.

- The diagnostic segment is estimated to account for 40% of the global market share by 2035, fueled by the wide utilization of blood tests for diagnostic purposes.

Key Growth Trends:

- Extensive Use as A General Antibody Epitope Tag

- Excessive Demand for Therapeutic Antibodies

Major Challenges:

- Delay in Approval of the Anti HA Antibody Drugs

- Several Side Effects of the Anti HA Antibody Drugs

Key Players: F. Hoffmann-La Roche Ltd., Johnson & Johnson, Merck KGaA, Novartis International AG, AbbVie Inc., Amgen Inc., Pfizer Inc., Bayer AG, Eli Lilly and Company, Bristol-Myers Squibb Company, Daiichi Sankyo Co Ltd, Takeda Pharmaceutical Co Ltd., Chugai Pharmaceutical Co Ltd, Sanofi KK.

Global Anti-HA Antibody Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.14 billion

- 2026 Market Size: USD 1.21 billion

- Projected Market Size: USD 2.28 billion by 2035

- Growth Forecasts: 7.2%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 26 November, 2025

Anti-HA Antibody Market - Growth Drivers and Challenges

Growth Drivers

- Extensive Use as A General Antibody Epitope Tag- HA (hemagglutinin) tag is taken from the human influenza virus HA protein. It is well-attributed and is implemented widely as a general antibody epitope tag. The HA tag is taken from the HA molecule comparable to amino acids 98-106 and has been widely implemented as a general epitope tag in expression vectors. Many recombinant proteins have been planned to communicate to the HA tag, which does not interfere with the bioactivity or the allotment of the recombinant protein. This tag facilitates the detection, isolation, and purification of the proteins.

- Excessive Demand for Therapeutic Antibodies - Therapeutic antibodies have become the dominant class of new drugs advanced in current years. Over the past five years, antibodies have turned into the best-selling medications in the pharmaceutical market, and in 2023, eight of the top ten highly successful medications globally were biologics. Vital modifications in antibody engineering done over the past decade have increased the protection and effectiveness of therapeutic antibodies. These advancements, as well as a greater knowledge of the immunomodulatory properties of antibodies, have created the way for the next generation of new and modified antibody-dependent medications for the therapy of human diseases.

- Reliable Techniques of the Antibodies to Treat Influenza Viruses - HA tag antibodies give a reliable technique for the spotting and refinement of tagged aimed proteins without a protein-definite antibody or probe. Invitrogen HA tag antibodies faithfully spot recombinant HA-tagged proteins and every antibody is confirmed for implementation in multiple uses. Antibodies to HA can be implemented to study possible objectives for antiviral medications because of their main roles in the beginning stages of infection: receptor binding and the combination of virus and cell membranes. They are antigen-canceling molecules, generated by plasma B-cells in the body, that secure individuals by damaging pathogens and prohibiting their propagation. The primary functions executed by antibodies are neutralization, opsonization, stimulation of the supplement pathway, and antibody-dependent cell-referred cytotoxicity.

Challenges

- Delay in Approval of the Anti-HA Antibody Drugs - Drug lag, the procrastination between the first international regulatory approval and acceptance by the national health authorities in other countries, influences the availability of medications. For instance, let's talk about Canada’s drug approval technique, if delivered under the standard technique, Health Canada has an aim timeline of 300 days to answer to the healthcare and pharmaceutical agency. However, this aim is not always reached while in practice. Of all new medication submissions filed in recent years, only 33% got an answer within the target. In fact, 18% took more than a year to investigate, and approximately 5% took over two years. On the whole, the standard investigation techniques lasted 335 days. Researchers have decided just how many lives are lost when efficient experimental drugs are not licensed immediately. To redeem costs, a lot of governments currently delayed the acceptance of seven new medicines suggested by the Pharmaceutical Benefits Advisory Committee (PBAC) for up to seven months.

- Several Side Effects of the Anti-HA Antibody Drugs

- Lapse of Patent of Various Effective Anti-HA Antibody Drugs

Anti-HA Antibody Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 1.14 billion |

|

Forecast Year Market Size (2035) |

USD 2.28 billion |

|

Regional Scope |

|

Anti-HA Antibody Market Segmentation:

Type Segment Analysis

The IgM segment in the anti-HA antibody market is expected to hold 47% of the revenue share during the forecast period owing to the implementation of this type of anti-HA antibody in different medications. For instance, in mice, a singular intranasal dose of IgM-14 at 0.044 mg per kg body weight provides prophylactic efficiency and a single dose at 0.4 mg per kg provides therapeutic efficiency against SARS-CoV-2. IgM-14, but not IgG-14, also provides powerful therapeutic protection against the P.1 and B.1.351 variants. IgM anti-HA antibodies are mainly oriented against the HA molecule itself and can be spotted in the blood after detection of HA. These antibodies may help safeguard against disease by Haemophilus influenzae, a bacterium that can create respiratory infections.

Application Segment Analysis

The diagnostic segment is estimated to account for 40% of the global anti-HA antibody market share by 2035 and is anticipated to expand at the highest rate over the forecast timeline owing to the wide utilization of blood tests for diagnostic reasons like Food Allergy & intolerance testing and immunoprotein diagnostic testing among others. For instance, as of December 22, 2022, Austria had executed the most antibody tests per one million population among the countries most massively influenced by the pandemic. The U.S. has executed over 1.1 billion antibody tests in total. Countries across the globe made prevalent testing a key part of their strategies to exit lockdown. However, the international requirement for antibody test kits has been massive. The kits are implemented to recognize antibodies in a person’s blood pattern. The existence of antibodies signifies the person has been susceptible to the SARS-CoV-2 virus and created antibodies to help fight it.

Our In-Depth Analysis of the Global Market Includes the Following Segments:

|

Type |

|

|

Application |

|

|

End-Users |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-HA Antibody Market - Regional Analysis

North American Market Insights

The North America industry is expected to account for largest revenue share of 36% by 2035. Improvements in technology, like genetic engineering and monoclonal antibody production, have promoted the growth of more powerful and particular anti-HA antibodies which will further be the main reason for the anti-HA antibody market growth of this region. For instance, multiple dozen SARS-CoV-2-distinct mAbs, Tixagevimab + Cilgavimab, Sotrovimab, Regdanvimab, Casirivimab + Imdevimab (Ronapreve), and Bebtelovimab, among others and antiviral medications (Remdesivir, Molnupiravir, and Nirmatrelvir) have been licensed and are accessible in clinical practice in the USA.

European Market Insights

The Europe region is also predicted to notice an outstanding acceleration in the growth of the anti-HA antibody market in the predicted timeline and the increasing rate of Europeans encountering respiratory disease will wheel the growth of the market. Mortality from respiratory diseases is the third primary reason for death in EU countries, attributing to 8% of all deaths. More than 440,000 people died from respiratory diseases, a growth of 15% over the last year. Most of these fatalities (90%) were among people 65 and over than that years old. The primary reasons for death from respiratory diseases are chronic impeding pulmonary disease, pneumonia, asthma, and influenza.

Anti-HA Antibody Market Players:

- F. Hoffmann-La Roche Ltd.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- Merck KGaA

- Novartis International AG

- AbbVie Inc.

- Amgen Inc.

- Pfizer Inc.

- Bayer AG

- Eli Lilly and Company

- Bristol-Myers Squibb Company

Recent Developments

- Pfizer Inc. and BioNTech SE released positive topline outcomes from a Phase 1/2 study (NCT05596734) analyzing the protection, acceptability, and immunogenicity of mRNA-dependent mixture vaccine candidates for influenza and COVID-19 among healthy adults 18 to 64 years of age. The information from the investigation demonstrated that the organizations' lead preparation showed powerful immune replies to influenza A, influenza B, and SARS-CoV-2 strains.

- Pfizer Inc. presented information across its contagious disease portfolio at IDWeek 2023 occurred in Boston from October 11-15, 2023. Information from 45 abstracts shows the developments Pfizer is making in helping stop and cure specific contagious diseases, specifically respiratory illnesses. This comprised research highlighted in the IDWeek press program analyzing the possible public health influence of ABRYSVO™ (Respiratory Syncytial Virus Vaccine), the organization’s double respiratory syncytial virus prefusion F (RSVpreF) vaccine for motherly immunization to safeguard infants against RSV illness.

- Report ID: 5461

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-HA Antibody Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.