Anesthesia Machines Market Outlook:

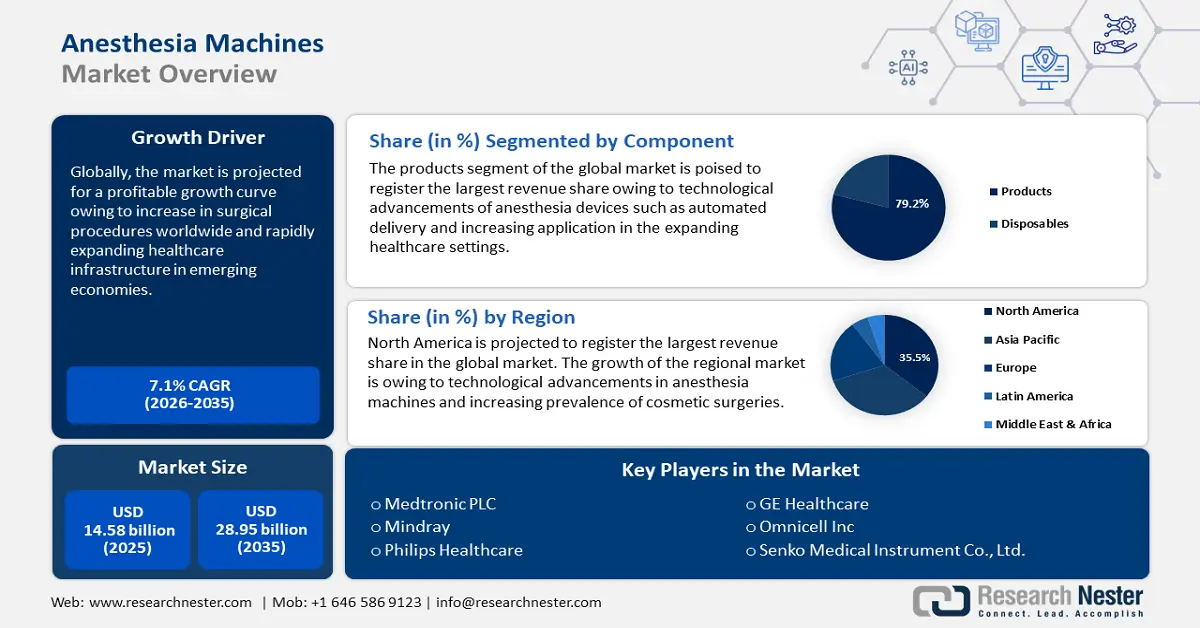

Anesthesia Machines Market size was over USD 14.58 billion in 2025 and is projected to reach USD 28.95 billion by 2035, witnessing around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anesthesia machines is assessed at USD 15.51 billion.

The market’s growth is attributed to the rising prevalence of surgeries, including cosmetic procedures, and the consecutive demand for anesthesia administration. For instance, in June 2024, the International Society of Aesthetic Plastic Surgery (ISAPS) estimated a 40% increase in aesthetic surgical procedures in the past 4 years, with more than 15.8 million procedures performed by plastic surgeons.

Key players in the anesthesia machines market are investing in the innovation of automated anesthesia systems to improve patient safety. For instance, in April 2022, GE Healthcare announced approval by the Food & Drug Administration (FDA) of software automating anesthesia delivery with the ability to reduce greenhouse gas (GHG) emissions during surgeries. Innovations as such are poised to expand themarket creating increasing revenue opportunities. Additionally, the integration of artificial intelligence (AI) in healthcare is poised to benefit the sector’s growth with AI-equipped anesthesia workstations able to predict patient responses, leading to better outcomes.

The anesthesia machines market is poised to offer profitable opportunities owing to the integration of anesthesia machines with electronic medical record (EMR) systems boosting seamless data transfers. Surgical centers with high-volume patient footfall require workflow efficiency and accurate data tracking, driving opportunities in the sector for the integration of anesthesia machines with EMR systems.

Additionally, opportunities arise in anesthesia machine advancements that can support remote monitoring, driving adoptions in under-resourced healthcare facilities. The global market is positioned to find profitable opportunities in military healthcare by providing portable anesthesia machines to cater to mobility solutions. The trends highlight the profitable scope of the anesthesia machines market beyond traditional surgical applications and the global sector is poised to leverage the favorable trends to continue its rapid growth surge by the end of the forecast period.

Key Anesthesia Machines Market Insights Summary:

Regional Highlights:

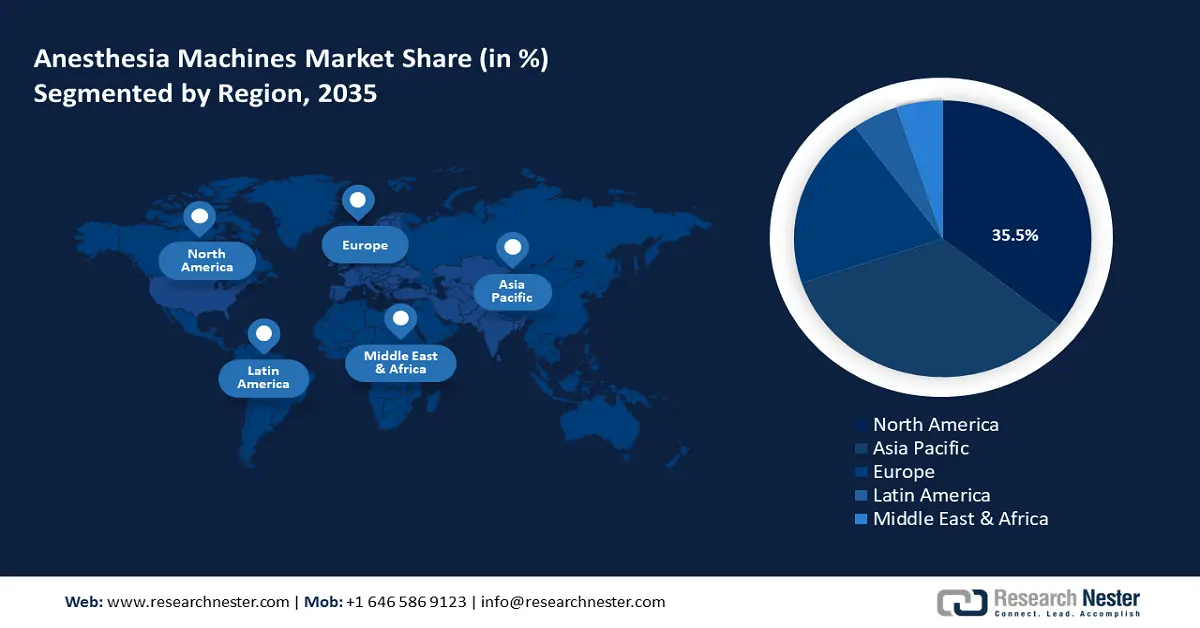

- North America commands the Anesthesia Machines Market with a 35.5% share, propelled by advanced healthcare infrastructure fueling a high volume of surgical procedures, ensuring robust growth through 2026–2035.

- The APAC Anesthesia Machines Market is experiencing rapid growth through 2035, fueled by the rise of medical tourism and increasing patient footfalls.

Segment Insights:

- The Products segment is set for significant growth from 2026-2035, propelled by technological advancements in anesthesia devices enhancing user experience and outcomes.

Key Growth Trends:

- Surge in surgical procedures worldwide

- Expansion of healthcare infrastructure in emerging economies

Major Challenges:

- Challenges in expanding to remote and under-resourced regions

- High costs of automated anesthesia machines

- Key Players: Philips Healthcare, Medtronic PLC, Cardinal Health Inc., Mindray, GE HealthCare, Omnicell Inc., Philips Healthcare, and Drägerwerk AG & Co. KGaA.

Global Anesthesia Machines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.58 billion

- 2026 Market Size: USD 15.51 billion

- Projected Market Size: USD 28.95 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Anesthesia Machines Market Growth Drivers and Challenges:

Growth Drivers

- Surge in surgical procedures worldwide: The rising number of surgical procedures worldwide is poised to boost the growth of the global anesthesia machines market. Cardiovascular, oncological, and orthopedic medical sectors are driving surgical interventions necessitating anesthesia machines. Increasing cases are prompting healthcare infrastructures such as hospitals and surgical centers to invest in anesthetic capabilities driving demands for machines.

Additionally, the surge in surgical aesthetic procedures is poised to drive the sector’s growth. For instance, in June 2024, the International Society of Aesthetic Plastic Surgery (ISAPS) highlighted liposuction as the most common surgical procedure in 2023, with more than 2.2 million surgeries followed by breast augmentation. For instance, in September 2023, the Colorado Plastic Surgery Center announced local anesthesia as an option for breast augmentation procedures. - Expansion of healthcare infrastructure in emerging economies: The global anesthesia machines market is poised to find profitable opportunities in the emerging markets of Asia Pacific (APAC), Africa, and Latin America. The significant investments to improve healthcare infrastructure in emerging economies are poised to drive demands for anesthesia machines.

The surge in awareness for quality healthcare along with the rise in disposable income to be spent on healthcare is poised to create a profitable ecosystem for the adoption of anesthesia machines. The healthcare sector trends are favorable for the growth of the anesthesia machines market. For instance, in September 2024, the World Federation of Societies of Anesthesiologists joined with partners to sign an action letter demanding the inclusion of capnography as essential monitoring equipment in general anesthesia guidelines. - Rise in minimally invasive procedures and expansion of anesthetic portfolios: The increasing prevalence of minimally invasive surgeries is poised to drive the revenue growth of the global anesthesia machines market. Minimally invasive surgeries are known for shorter recovery times and reduced patient traumas, driving the surging prevalence in the healthcare sector. Minimally invasive procedures require precise and safe anesthesia delivery, boosting demands for machines in healthcare setups that can perform effective delivery.

Additionally, companies expanding their portfolio of anesthetics are poised to benefit the growth of the global anesthesia machines market by driving demands for precision delivery anesthesia machines. For instance, in November 2023, Pacira announced the FDA approval of sNDA to expand the bupivacaine liposome injectable suspension label, EXPAREL. This has created an opportunity for the company to transition to non-opioid-based pain management in an ambulatory environment. The growth of local anesthesia drugs is poised to boost the demand for anesthesia machines in the future.

Challenges

- Challenges in expanding to remote and under-resourced regions: The global anesthesia machines market faces challenges in expanding to geographically remote regions. Emerging markets with unstable healthcare infrastructure are the roadblocks to the adoption of anesthesia machines. Additionally, fluctuating power or electricity in remote or underdeveloped regions can cause challenges in machine maintenance.

- High costs of automated anesthesia machines: The onset of automated, AI-integrated anesthesia machines is poised to drive adoption costs. The high costs can prove to be a deterrent for smaller healthcare facilities, causing hurdles in anesthesia machines market expansion. Additionally, maintenance and software updates of the machines can add to the cost further denting accessibility to healthcare facilities catering to various income-based demographics.

Anesthesia Machines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 14.58 billion |

|

Forecast Year Market Size (2035) |

USD 28.95 billion |

|

Regional Scope |

|

Anesthesia Machines Market Segmentation:

Component (Products, Disposables)

By component, the products segment is predicted to hold anesthesia machines market share of more than 79.2% by 2035. The growth of the segment is attributed to rising technological advancements in anesthesia devices boosting user experience and outcome. The wide range of products in the segment by type and modality increases the scope of revenue share. Additionally, integration of AI and automated delivery systems are sought after owing to their automated dosing features.

Anesthesia monitoring devices are experiencing surging demands owing to rising emphases on real-time patient monitoring for critical cases, benefitting the growth of the products segment. For instance, in March 2024, Medtronic PLC announced U.S. FDA clearance for the BIS Advance Monitor to help anesthesia providers personalize anesthesia dosing and improve outcomes.

The disposables segment of the global anesthesia machines market is poised to increase its revenue share by the end of the forecast period. The segment’s growth is owed to a heightened focus on patient safety and infection prevention. For instance, in November 2022, Anecare was awarded an agreement to provide ANEclear’s low-cost easy-to-use disposable technology to improve anesthesia recovery outcomes for senior patients at more than 4000 U.S. hospitals.

Owing to rising awareness of the prevention of cross-contamination in healthcare settings, disposable anesthesia products are experiencing a surge in demand. Additionally, the segment is poised to leverage the expansion of the healthcare sector globally with investments in establishing new clinics in remote or rural areas, that will drive demands for disposable anesthesia products.

End user (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers)

By end user, the hospital segment is poised to register a significant revenue share in the global anesthesia machines market. The segment’s profitable growth curve is attributed to a high volume of surgical procedures in hospitals positioning it as the largest end-user of anesthesia machines. Additionally, hospitals utilize various components of anesthesia machines providing the market ample scope for expansion. The ongoing modernization of hospital infrastructures globally to increase capacities and patient care is positioned to boost the further expansion of the segment as the largest end-user of anesthesia machines. For instance, in November 2024, Apollo Hospitals announced the decision to add 3512 beds and invest USD 722.8 million in the next 4 years.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anesthesia Machines Market Regional Analysis:

North America Market Forecast

North America industry is set to hold largest revenue share of 35.5% by 2035, owing to an advanced healthcare infrastructure fueling a high volume of surgical procedures. The rising number of surgical procedures contributes to the surging demand for anesthesia machines. The revenue share of the region is led by the U.S. and Canada. The demand for effective anesthesia machines in large hospital networks and outpatient surgical centers with high patient throughput requires reliable anesthesia solutions. Additionally, the region is set to benefit from a robust regulatory framework fueling advancements in anesthesia medicines. For instance, in November 2023, Science News published research on a new brain-monitoring device that can automate the supply of controlled anesthetic dosages by the Massachusetts General Hospital and Harvard Medical School.

The U.S. is poised to lead the revenue share in the anesthesia machines market in North America. The market’s profitable surge in the country is attributed to the rising percentage of surgical procedures boosting demands for anesthesia machines. A major driver of the market in the U.S. is the increasing number of cosmetic surgeries owing to evolving beauty trends. The increasing surgical interventions for cosmetic procedures create a burgeoning end-user for anesthesia machines as they are adopted in hospitals as well as specialty plastic surgery clinics. For instance, the American Society of Plastic Surgeons released data for 2023 and estimated 347 thousand procedures performed indicating a 7% increase from 2022. Additionally, the society estimated a 6% increase in minimally invasive procedures from 2022. The favorable trends indicate a soaring market for anesthesia machines in the country.

Canada is poised to increase its revenue share in the North America anesthesia machines market. The growth in Canada is attributed to rising investments in the healthcare infrastructure and an increasing percentage of surgical procedures in the country. Additionally, demands to reduce the use of surgery anesthetics with a high carbon footprint in the country drive the need for advancements to lower GHG emissions. Businesses in the country can leverage burgeoning opportunities to provide effective anesthesia-delivering machines to various sectors. For instance, in February 2024, the U.S. Department of Defense awarded a USD 356 million contract to Thornhill Medical to provide innovative anesthesia and life-support equipment to the U.S. military.

APAC Market Analysis

APAC is poised to register the fastest revenue growth in the global anesthesia machines market. The market benefits from the rise of medical tourism due to comparatively lower healthcare costs in the regional countries, and boosting patient footfalls. Increasing patient footfalls and surgical procedures drive demands for anesthesia machines.

Emerging economies in APAC are significantly investing to improve their healthcare infrastructure. National programs investing in healthcare are poised to improve the adoption of anesthesia machines in remote and rural areas, increasing the revenue scope of the market. Additionally, APAC has a high-density population leading to a greater number of patients requiring surgical procedures. China, India, Japan, and South Korea lead the revenue share in APAC. According to export-trade data from Volza, China was the leading global exporter of anesthesia machines in 2023, accounting for approximately 11,195 export shipments—or around 45 % of the global export share.

China is projected to register the largest revenue share in the APAC anesthesia machines market. The growth of the market in China is attributed to healthcare advancements and a robust medical equipment manufacturing hub, positioning the country to be vital in the global anesthesia machine export supply chain. The market is poised for a robust growth curve owing to the presence of robust medical device manufacturing players in the country catering to surging demands for effective and advanced anesthesia machines in the healthcare sector. Companies can leverage the burgeoning demands to increase their revenue share. For instance, in August 2023, Mindray introduced upgrades to the A series anesthesia systems for improved patient safety and efficiency.

India is projected to increase its revenue share in the anesthesia machines sector of APAC. The growth of the anesthesia machines market in India is owing to the rising prevalence of medical tourism and increasing surgical procedures. Additionally, the cosmetic surgery products sector is growing in the country, driving demands for efficient anesthesia machines in various healthcare settings. Companies are investing in automated anesthesia delivery machines to leverage the market’s opportunities and increase their revenue share. For instance, in October 2024, Shree Krishna Hospital in Gujarat announced an AI-based target-controlled infusion (TCI) system in anesthesia practice and claimed that the technology would allow precise intravenous administration of anesthesia drugs.

Key Anesthesia Machines Market Players:

- Philips Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic PLC

- Cardinal Health Inc.

- Mindray

- GE HealthCare

- Omnicell Inc

- Philips Healthcare

- Drägerwerk AG & Co. KGaA

The global anesthesia machines market is poised for a profitable growth curve during the forecast period. Key players are investing in automated anesthesia machines and strengthening the manufacturing and supply chain to increase their revenue shares in the global and regional markets.

Here are some key players in the market:

Recent Developments

- In September 2024, Heron Therapeutics announced the FDA approval of ZYNRELEF (bupivacaine and meloxicam) extended-release solution VAN. The user-friendly " design of the VAN resembling a container is poised to enhance the safe use of ZYNRELEF, increase adoption, and improve the preparation process.

- In April 2024, Baxter International Inc., announced the launch of five injectable product launches in the U.S. with the continued expansion of its portfolio. Ropivacaine Hydrochloride Injection, USP in a ready-to-use, single-dose infusion bag is one among the five new launches by Baxter.

- Report ID: 6707

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anesthesia Machines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.