Alcohol Ethoxylates Market Outlook:

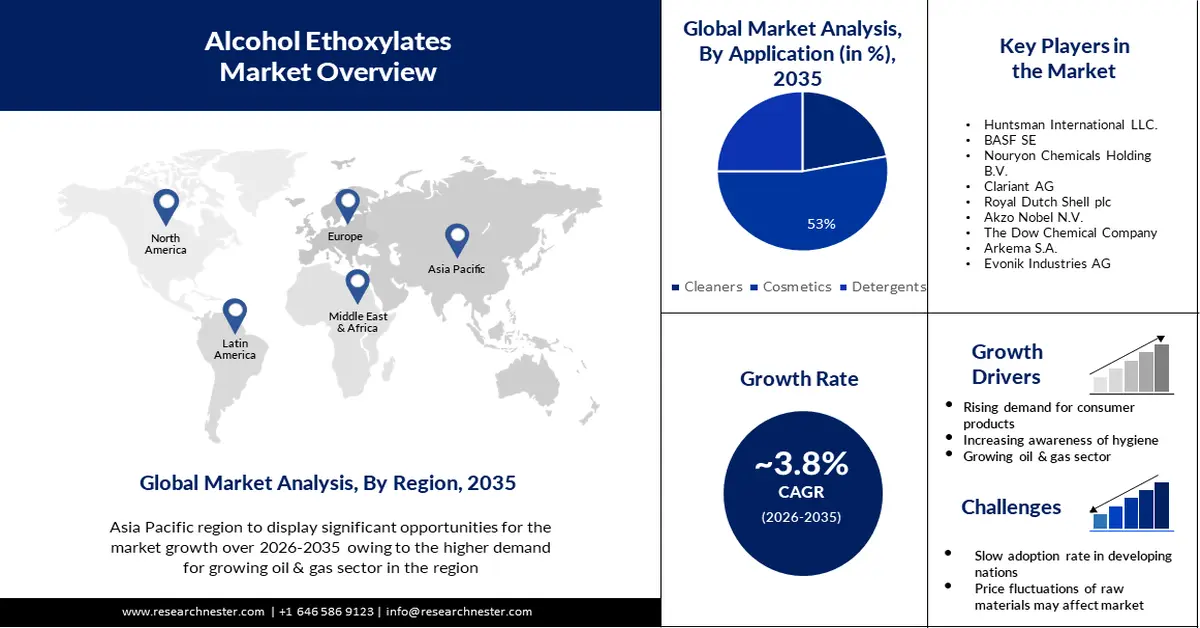

Alcohol Ethoxylates Market size was valued at USD 7.21 billion in 2025 and is expected to reach USD 10.47 billion by 2035, expanding at around 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alcohol ethoxylates is evaluated at USD 7.46 billion.

The expanding construction sector could also be associated with the expansion of the market. In the building industry, alcohol ethoxylates are used in many different applications and their use can be varied. In particular, given the ability to act as wet substances, emulsifiers, or dispersants, they have been particularly useful in concrete production, adhesives and paints. Overall, there were 1,337,800 housing units at the end of 2021 across the United States, which is an increase of 4% from last year.

Moreover, an increased demand in the pharmaceutical industry is expected to be one of the factors contributing to market growth for alcohol ethoxylates. Alcohol ethoxylate has been used in the pharmaceutical industry to manufacture novel products and acts as an emulsifier. R&D spending by the pharmaceutical industry is approximately USD 100 billion a year.

Key Alcohol Ethoxylates Market Insights Summary:

Regional Highlights:

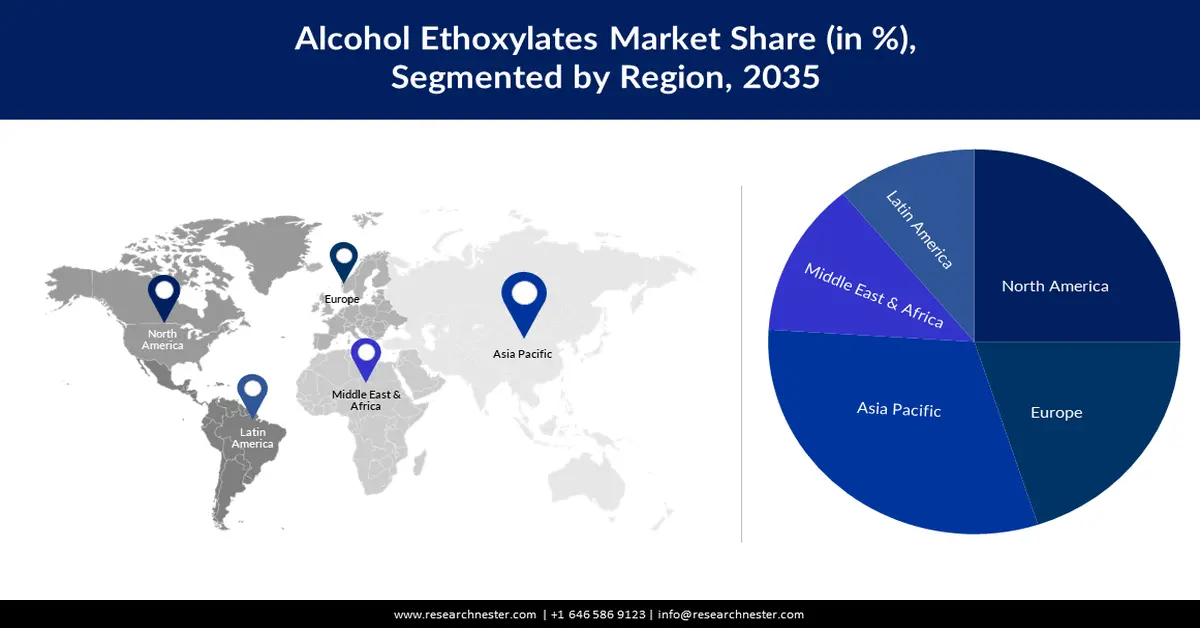

- Asia Pacific alcohol ethoxylates market will secure around 31% share by 2035, driven by expansion of the personal care industry and increased household spending.

- North America market will achieve a 25% share by 2035, driven by increased use of industrial cleaners across multiple industries.

Segment Insights:

- The cosmetics segment in the alcohol ethoxylates market is forecasted to attain a 53% share by 2035, fueled by growing demand for sustainable, biodegradable surfactants in cosmetics.

- The metal working segment in the alcohol ethoxylates market is anticipated to hold a 28% share by 2035, influenced by widespread usage of ethoxylates in oil-based metal working fluids.

Key Growth Trends:

- Growing Oil & Gas Sector

- Rising Demand for Consumer Products

Major Challenges:

- Slow Adoption Rate in Developing Nations

- Too many restrictions imposed by the government could prevent the market from growing

Key Players: Huntsman International LLC., BASF SE, Nouryon Chemicals Holding B.V., Clariant AG, Royal Dutch Shell plc, Akzo Nobel N.V., The Dow Chemical Company, Arkema S.A.

Global Alcohol Ethoxylates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.21 billion

- 2026 Market Size: USD 7.46 billion

- Projected Market Size: USD 10.47 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Alcohol Ethoxylates Market Growth Drivers and Challenges:

Growth Drivers

- Growing Oil & Gas Sector- In the coming years, as more and more people are moving into cities worldwide, this sector is projected to expand further. India is consuming over 4 million BPD of oil per day by 2021.

- Rising Demand for Consumer Products- The demand for consumer goods containing alcohol ethoxylates, such as paints and coatings, dishwashing solutions, laundry detergents, and other cleaning products, is predicted to rise as the world's population expands. The average yearly cost of detergents, and soaps in the United States in 2020 was USD 75.53, and that cost rose to USD 80.49 per consumer unit in 2021, according to the Bureau of Labour Statistics.

- Increasing Awareness of Hygiene- The demand for cleaning solutions that contain alcohol ethoxylates has increased due to the significance of cleanliness and hygiene. According to the latest recent data, approximately 4 billion people used a sanitation service that was safely managed in 2020.

Challenges

- Slow Adoption Rate in Developing Nations- The availability of substitute materials is one of the primary problems anticipated to impede the market's expansion. For instance, in developing countries, substitutes for alcohol ethoxylate are being employed in the manufacture of household items.

- The market's expansion could be negatively impacted by changes in the price of raw materials.

- Too many restrictions imposed by the government could prevent the market from growing.

Alcohol Ethoxylates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 7.21 billion |

|

Forecast Year Market Size (2035) |

USD 10.47 billion |

|

Regional Scope |

|

Alcohol Ethoxylates Market Segmentation:

Application Segment Analysis

The cosmetics segment is anticipated to account for 53% share of the global alcohol ethoxylates market during the forecast period, due to the increasing demand for cosmetic items. The use of alcohol ethoxylate has significantly expanded due to the rising demand for cosmetics around the world. Additionally, there is a tendency towards using more environmentally friendly surfactants, such as alcohol ethoxylates, which are biodegradable and have less of an impact on the environment than some other surfactants, as a result of the need for sustainable and environmentally friendly cosmetics. By 2027, it is anticipated that the market for natural cosmetics would be worth approximately USD 54 billion.

End-User Industry Segment Analysis

By 2035, metal working segment is poised to account for around 28% ethoxylates market share. The chemical is frequently used in metal working fluids because of its outstanding performance in oil-based emulsions. For instance, a US federal body, the US Bureau of Labour Statistics, stated in April 2023 that there were 60032 establishments in the private sector producing fabricated metal products, up from 59265 establishments in the third quarter of 2022.

Our in-depth analysis of the global alcohol ethoxylates market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alcohol Ethoxylates Market Regional Analysis:

APAC Market Insights

The Asia Pacific alcohol ethoxylates market is projected to hold the largest share by 31% during the forecast period, owing to personal care industry's expansion. Since, they are a significant component of many personal care products, such as shampoos, soaps, and other cleaning agents, alcohol ethoxylates are highly sought-after in the region. According to the National Bureau of Statistics of China, household spending per person in China increased to USD 3,781.2 in 2021, a nominal increase of 13.6% over the previous year.

North America Market Insights

The North America market is estimated to hold 25% share of the alcohol ethoxylates market by the end of 2035, by the increased use of industrial cleaners. The demand for alcohol ethoxylates in the region is likely to rise along with the need for industrial cleansers. Additionally, industrial cleaners are widely used to clean and disinfect equipment, surfaces, and facilities in a range of businesses in the area, including manufacturing, food processing, and healthcare. In 2021, manufacturing accounted for 2.3 trillion USD, or 12.0% of the US GDP.

Alcohol Ethoxylates Market Players:

- Sasol Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC.

- BASF SE

- Nouryon Chemicals Holding B.V.

- Clariant AG

- Royal Dutch Shell plc

- Akzo Nobel N.V.

- The Dow Chemical Company

- Arkema S.A.

- Evonik Industries AG

Recent Developments

- December 2022: Clariant AG announced to expand its Care Chemicals facility, in order to increase the level of service it provides for customers in the home care, personal care, and industrial application sectors. Further, the company is expected increase the production capacity for its Ethylene Oxide Derivatives (EODs) and a wider range of chemicals.

- June 2021: Nouryon Chemicals Holding B.V. a global specialty chemicals leader, introduced a number of low-dioxane degreasers and cleaners to satisfy client demand for goods that are environmentally friendly and adhere to new US standards.

- Report ID: 4145

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alcohol Ethoxylates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.