Aesthetic Devices Market Outlook:

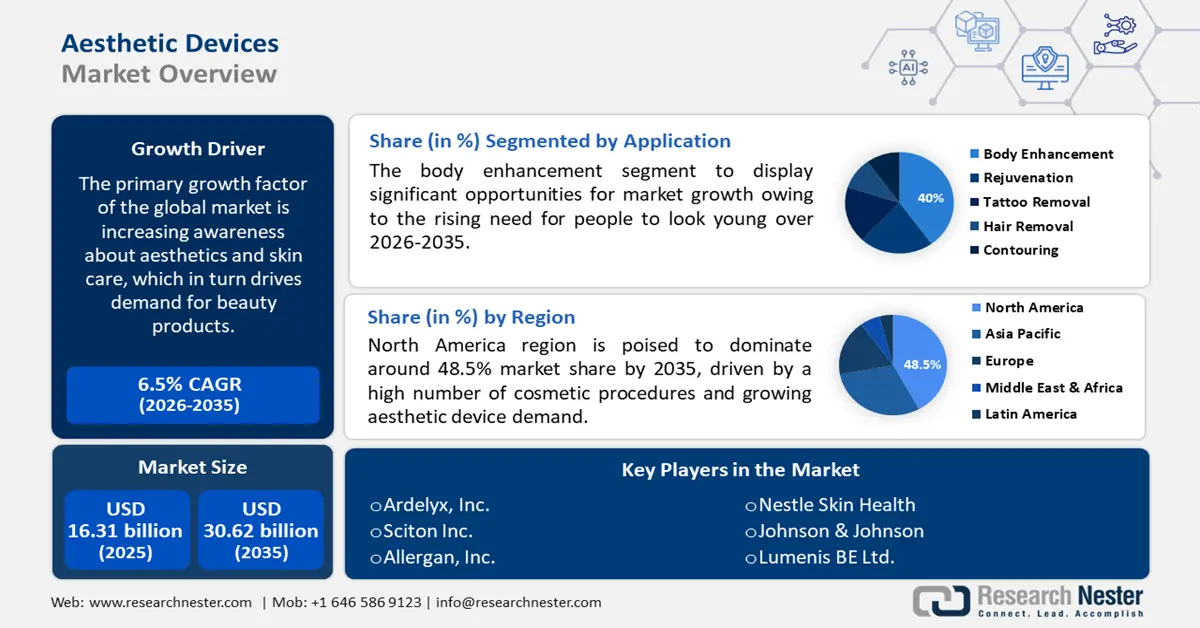

Aesthetic Devices Market size was over USD 16.31 billion in 2025 and is poised to exceed USD 30.62 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aesthetic devices is estimated at USD 17.26 billion.

The primary growth factor of the global market is increasing awareness about aesthetics and skin care, which in turn drives demand for beauty products. Additionally, technological advancements are helping to improve the quality of these products. This has led to increased adoption of aesthetic devices by individuals across all age groups. Skin problems including acne, dermatitis, sunburn, dermatitis, psoriasis, and others require treatment and thus propelling the market growth. According to the NIH, the rate of prevalence of acne vulgaris, lesions, and deep scars is 50.9% in women aged 20-29 years and 26.3% in women of age 40-49 years globally.

In addition to these, the increased prevalence of cosmetic treatments such as skin lifts, Botox, tissue regeneration, and others are fueling the market’s growth. The availability of these treatments has also increased as a result of increasing R&D, fueling additional growth in demand. As per the American Society of Plastic Surgeons, 3 million procedures of tissue fillers were performed, and 140,000 procedures of dermabrasion. Moreover, higher instances of hair loss, chipped teeth, and tattoo removal is expected to propel the market growth. The market for aesthetic devices is predicted to grow as more people choose these procedures to enhance their looks and raise their confidence.

Key Aesthetic Devices Market Insights Summary:

Regional Highlights:

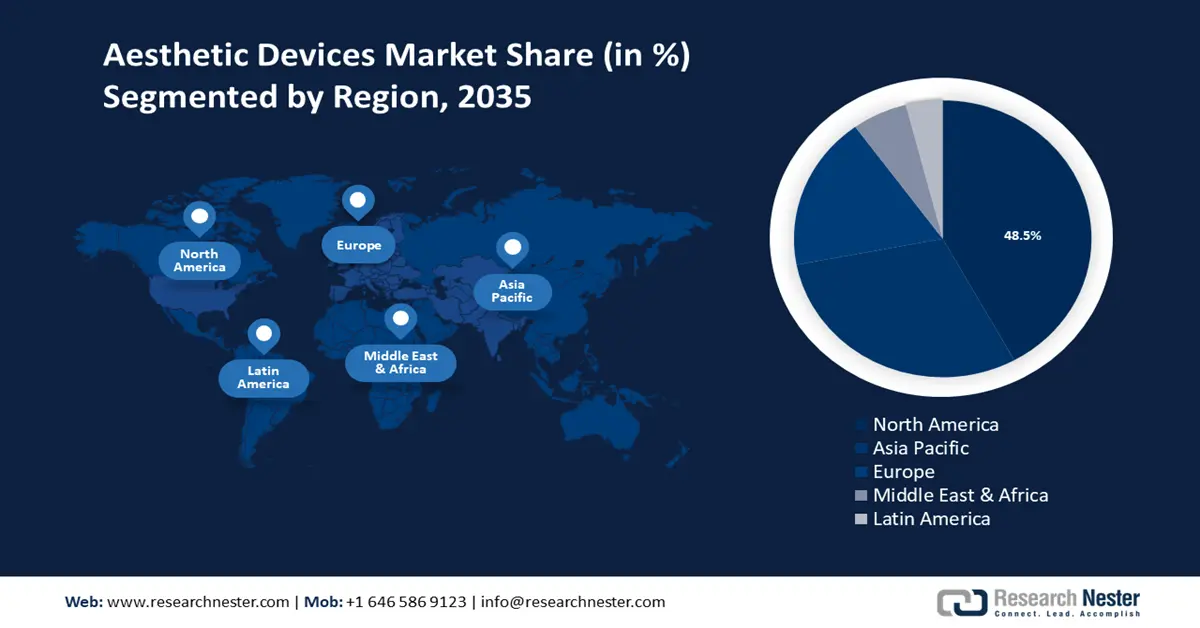

- North America aesthetic devices market will dominate over 48.5% share by 2035, driven by a high number of cosmetic procedures and growing aesthetic device demand.

Segment Insights:

- The body enhancement segment in the aesthetic devices market is projected to hold the largest share by 2035, fueled by rising demand for cosmetic surgeries and body-enhancement procedures.

- The hospitals segment in the aesthetic devices market is forecasted to gain a significant share by 2035, attributed to patient preference for minimally invasive procedures and hospitals’ financial strength.

Key Growth Trends:

- Rising Popularity of Minimally Invasive Surgery

- Surge in Practices of Cosmetic Surgery

Major Challenges:

- Rising Popularity of Minimally Invasive Surgery

- Surge in Practices of Cosmetic Surgery

Key Players: Alma Lasers, Ardelyx, Inc., Sciton Inc., Allergan, Inc., Nestle Skin Health, Johnson & Johnson, Lumenis BE Ltd., Solta Medical, Sanuwave Health Inc., Candela Corporation, Cynosure, Inc.

Global Aesthetic Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.31 billion

- 2026 Market Size: USD 17.26 billion

- Projected Market Size: USD 30.62 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Aesthetic Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Popularity of Minimally Invasive Surgery - Minimally invasive procedure has an advantage over other surgery, they are, less painful, shows the good result, are less intrusive, and has quicker healing. This makes the treatment with minimal invasion popular among the patients, and it is anticipated to increase the growth of the global aesthetic devices market over the forecast period. In the United States, nearly 18 million aesthetic surgeries were done in the year 2019, out of which around 16 million were minimally invasive procedures.

-

Surge in Practices of Cosmetic Surgery - People’s disapproval of their skin, looks, or the aging effects is making them go for cosmetic enhancement and practice aesthetic surgery. In 2020, around 10 million surgical procedures and about 14 million non-surgical cosmetics were performed, globally.

- Advancement in the Technology of Aesthetic Devices - Growing technology is always the need of an hour, and it provides ample treatment options for the patients and creates growing space for aesthetic devices as well. Therefore, it is anticipated to increase the growth of the global aesthetic devices market. In April 2019, Legend Pro+, an RF thermal skin regeneration technology, was launched to boost the formation of collagen and elastin fibers, it firms the skin by performing skin stimulation.

- Increasing Number of People with Distorted Tooth - The problems such as distorted teeth or broken teeth have a significant effect on the aesthetic beauty of the face. The cases of teeth problems among the population are rising, and it is predicted to boost the market’s growth. According to the World Health Organization, globally 530 million children have caries in the primary teeth, and 2 billion people are living with the crumbling of their permanent teeth.

- Rise in Problems of Hair Loss and Scalp-Related Issues - Hair loss issues among the population are rising owing to pollution, degraded water quality, lack of nutrition, and others. In 2020, globally every 13th person is having hair transplantation, worldwide and the volume of male patients is about 5 times higher than females.

Challenges

-

Expensive Treatment of Aesthetic Surgery - Instead of fixing the problems, many times aesthetic surgery might lead to serious issues such as the overdose of hormones, distortion of facial features, and in some cases can even lead to death. Any sort of aesthetic treatment or surgery involves risk as well. This fear of malfunction is likely to hamper the market growth. According to statistics from the ANN (Aesthetic Neural Network), more than $9 billion was spent on cosmetic plastic surgery in 2020.

-

Lack of Adequate Insurance and Reimbursement Policy

- Risk of Malfunctions and Facial Distortion due to Cosmetic Surgery

Aesthetic Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 16.31 billion |

|

Forecast Year Market Size (2035) |

USD 30.62 billion |

|

Regional Scope |

|

Aesthetic Devices Market Segmentation:

Application

The body enhancement segment is anticipated to hold the largest market size by the end of 2035, owing to the rising need for people to look young, have uplifted bodies, and achieve the desired look is prompting them to do body enhancement by opting plastic surgery, liposuction, breast implants, and others. In 2019, nearly 2 million breast enhancements were performed, followed by around 11 million plastic surgery, over 1 million liposuctions, and about 1 million eyelid surgery.

End-user

The hospital segment is expected to garner a significant share. This market's growth can be attributed to rising patient preference for minimally invasive cosmetic surgeries in hospitals. Moreover, the increasing adoption of new and advanced products by hospitals owing to better financial capacity is further projected to rise the segment’s growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aesthetic Devices Market Regional Analysis:

North America region is poised to dominate around 48.5% market share by 2035, owing to the high frequency of facial and dental malformations, rising numbers of people choosing cosmetic surgery products, and a growing number of cosmetic procedures with such a big patient base in North America. There are around 3700 dermatologists active in the United States. In 2020, more than 15 million cosmetic procedures were performed in America. According to the AAFPRS survey released in March 2022, there were approximately 1.4 million surgical and non-surgical procedures performed in the United States in 2021, an increase of 40% from the procedures performed in 2020. Additionally, according to the ISAPS survey published in December 2021, 860,718 aesthetic operations, including 456,489 surgical procedures and 404,229 non-surgical procedures, were carried out in Mexico in 2021.

Aesthetic Devices Market Players:

- Alma Lasers

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ardelyx, Inc.

- Sciton Inc.

- Allergan, Inc.

- Nestle Skin Health

- Johnson & Johnson

- Lumenis BE Ltd.

- Solta Medical

- Sanuwave Health Inc.

- Candela Corporation

- Cynosure, Inc.

Recent Developments

-

Lumenis, Inc. announced the launch of new skin rejuvenation technology, Legend Pro+, the technology facilitates treatments with less pain and quicker recovery treatments. The results provided by Legend Pro+ are immediate and long-lasting.

-

Sanuwave Health, Inc. announced the distribution agreement with Kingdom Brother, to accelerate the development and distribution of cosmetic treatment devices and wound care products in Southeast Asia region.

- Report ID: 3851

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aesthetic Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.