Acrylic Laminates Market Outlook:

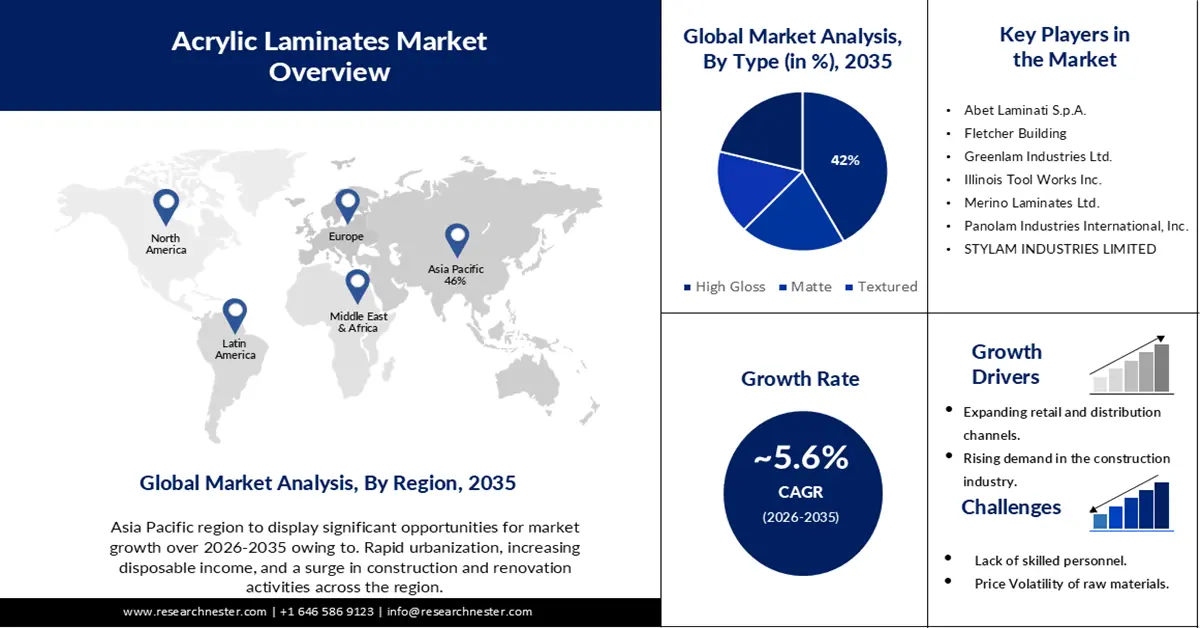

Acrylic Laminates Market size was over USD 2.45 billion in 2025 and is poised to exceed USD 4.22 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acrylic laminates is estimated at USD 2.57 billion.

Acrylic Laminates owing to their versatility, offer a wide spectrum of colors, textures, and designs These laminates provide a durable, cost-effective alternative to natural materials like wood, stone, or metal, catering to diverse design preferences. Their adaptability and ability to mimic various surfaces while maintaining durability drive their popularity in interior design, furniture, and architectural applications. Acrylic laminate’s resistant to scratches, moisture, and stains, coupled with their ease of maintenance, make them a preferred choice, meeting the demand for visually appealing, long-lasting surfaces across residential, commercial, and industrial sectors.

Further, technological advancements have led to the development of improved acrylic laminates with better quality, enhanced durability, and innovative designs. Manufacturers are investing in research and development to introduce new textures, patterns, and finishes, attracting more consumers and thus propelling the market’s growth.

Key Acrylic Laminates Market Insights Summary:

Regional Insights:

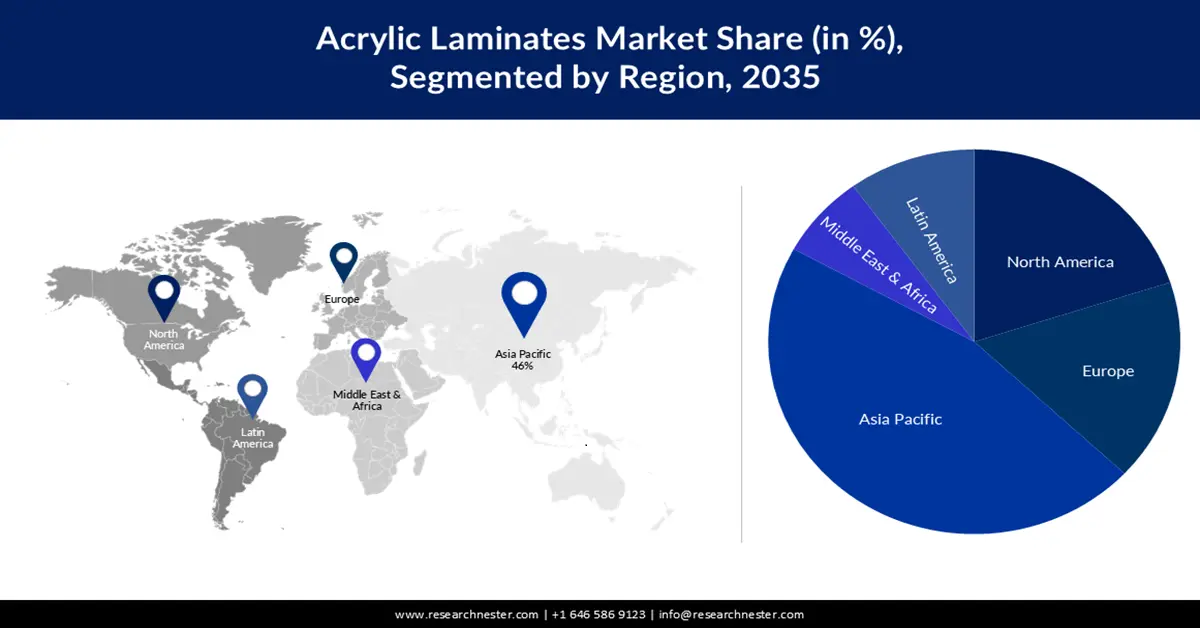

- By 2035, the Asia Pacific region is projected to command a 46% share of the acrylic laminates market, supported by expanding construction activity and rising interior design adoption across rapidly urbanizing economies.

- North America is anticipated to secure a notable share by 2035, underpinned by escalating renovation cycles and growing consumer preference for durable, low-maintenance surfacing solutions.

Segment Insights:

- The high gloss segment in the acrylic laminates market is expected to capture 42% share by 2035, bolstered by its premium finish, broad design flexibility, and suitability for high-traffic commercial environments.

- The furniture and cabinet segment is projected to dominate the market through 2026–2035, fueled by extensive utilization across residential, commercial, and industrial applications owing to its durability and cost-effectiveness.

Key Growth Trends:

- Rising Demand in Construction and Interior Design

- Expanding Retail and Distribution Channels

Major Challenges:

- Price Volatility of Raw Materials

- Concerns about the environmental impact of laminate manufacturing strain the market’s growth.

Key Players: Meraki PVC, Abet Laminati S.p.A., Fletcher Building, Greenlam Industries Ltd., Illinois Tool Works Inc., Merino Laminates Ltd., Panolam Industries International, Inc., STYLAM INDUSTRIES LIMITED, Royal Crown, ARPA INDUSTRIALE S.p.A.

Global Acrylic Laminates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.45 billion

- 2026 Market Size: USD 2.57 billion

- Projected Market Size: USD 4.22 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Vietnam, Mexico, Indonesia

Last updated on : 26 November, 2025

Acrylic Laminates Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Demand in Construction and Interior Design- The increasing demand for aesthetically appealing surfaces in residential and commercial spaces has significantly boosted the acrylic laminates market. Acrylic laminates offer a wide range of colors, textures, and designs, making them popular choices for interior designers and architects.

-

Expanding Retail and Distribution Channels- Increased accessibility through expanding retail networks, online retail, and distribution channels has widened the market reach for acrylic laminates. This enhanced availability has made these products more accessible to consumers across various regions. According to our analysis, online retail will account for a total of 21.15 % of overall retail sales, which in turn would have positive effects on the market.

- Growth in Real Estate and Renovation Activities- The growth of the real estate sector, coupled with an increasing trend of renovation and remodeling activities in both residential and commercial sectors, has positively impacted the acrylic laminates market. These laminates offer cost-effective solutions for giving spaces a fresh and modern look

Challenges

-

Price Volatility of Raw Materials- Fluctuations in the prices of raw materials used in manufacturing acrylic laminates, such as acrylic resins and pigments, can impact production costs. This volatility can lead to challenges in maintaining competitive pricing and stable profit margins.

-

Concerns about the environmental impact of laminate manufacturing strain the market’s growth.

- Lack of skilled labor is a stand as a challenge.

Acrylic Laminates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 2.45 billion |

|

Forecast Year Market Size (2035) |

USD 4.22 billion |

|

Regional Scope |

|

Acrylic Laminates Market Segmentation:

Type Segment Analysis

The high gloss segment is anticipated to hold 42% share of the global acrylic laminates market by 2035. Due to the high-quality finish, durability, and versatility of high gloss acrylic laminates. These laminates are used in various applications, such as furniture, cabinets, countertops, and wall paneling. Owing to its properties, high gloss acrylic laminates are used in commercial buildings or public spaces, which experience high footfall. These laminates are available in a wide range of colors and finishes, thus allowing designers and architects to choose from a variety of options to match their design preferences.

Application Segment Analysis

The furniture and cabinet segment in the acrylic laminates market is set to garner the majority of revenue share over the forecast period. Its extensive use in residential, commercial, and industrial settings. Furniture applications, including tables, cabinets, and shelves, drive significant demand for acrylic laminates owing to their durability, versatility, and appeal. In residential spaces, acrylic laminates are widely employed for kitchen cabinets, wardrobes, and other furniture due to their ability to mimic various textures and materials at a more affordable cost. In commercial and industrial settings, the use of acrylic laminates in office furniture, retail displays, and institutional furnishings further bolsters this segment’s prominence. The adaptability, durability, and cost-effectiveness of acrylic laminates in furniture applications position it as the largest segment within the market.

Our in-depth analysis of the global acrylic laminates market includes the following segments:

|

Type |

|

|

Application |

|

|

End- User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrylic Laminates Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 46% by 2035,. Rapid urbanization, increasing disposable income, and a surge in construction and renovation activities across countries like China, India, Japan, and Southeast Asian Nations have significantly propelled the market. The region’s burgeoning population has led to rising demand for modern infrastructure and interior design solutions, where acrylic laminates play a crucial role. Moreover, the versatility, durability, and cost-effectiveness of acrylic laminates have made them increasingly popular in both residential and commercial applications.

North American Market Insights

The North American acrylic laminates market has witnessed steady growth attributed to several factors. The region's robust construction industry, coupled with a surge in renovation and remodeling activities in residential and commercial spaces has been a significant driver for acrylic laminates. US expenditure reached a record USD 1.4 trillion in 2020. Consumer preferences for durable, low maintenance and visually appealing surfaces have increased the demand for acrylic laminates in applications such as kitchen cabinets, countertops, furniture, and wall panels. Additionally, the market has seen innovation in acrylic laminate manufacturing, with an emphasis on creating products that mimic the look and feel of high-end materials like natural wood and stone. Despite facing challenges related to competition from other surfacing materials and fluctuations in raw material costs, manufacturers have been leveraging technology to enhance product quality, durability, and design options, catering to the evolving demands of the region, as sustainability concerns gain prominence, efforts toward eco-friendly production processes have also been a focus, contributing to the market’s growth and sustainability.

Acrylic Laminates Market Players:

- Meraki PVC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abet Laminati S.p.A.

- Fletcher Building

- Sappi

- Greenlam Industries Ltd.

- Illinois Tool Works Inc.

- Merino Laminates Ltd.

- Panolam Industries International, Inc.

- STYLAM INDUSTRIES LIMITED

- Royal Crown

- ARPA INDUSTRIALE S.p.A

Recent Developments

- March 2021- The reputable interior products brand Meraki Laminates Industries Pvt Ltd introduced its first "made in India" folder. By making this change, the business began producing acrylic laminates with a 1.5 mm standard thickness.

- October 2023- Abet Laminati launched its new collection at the SICAM in Pordenone, Italy. The exhibit showcases more than 400 sample tiles from the color collection and other samples from the Metalli collection.

- Report ID: 5482

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrylic Laminates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.