- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Government Regulation

- Competitive Landscape

- Allegion plc.

- ADT

- ASSA ABLOY

- ButterflyMX, Inc.

- Brivo Systems, LLC.

- Fujitsu

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls

- Kisi Inc.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nuki Home Solutions

- OPTEX GROUP CO., LTD.

- Robert Bosch GmbH

- SALTO Systems, S.L.

- Schneider Electric SE

- Market Share by Players

- Types of Authentication Services and (%) Share

- IC Card Manufacturers and (%) Share on Office

- Machine

- Ongoing Technological Advancements Investment Analysis

- Startup Analysis

- Country Level Analysis On Card Readers

- Use Case Analysis

- End-User Industry Analysis

- Recent Development

- Analysis of Strategic Initiatives Adopted by Key Players

- Merger and Acquisition Analysis

- Patent Analysis

- SWOT Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Regional Synopsis Value (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Offerings, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Country Level Analysis

- U.S.

- Canada

- Offerings, Value (USD Million)

- Overview

- Europe Market Outlook

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Country Level Analysis

- UK

- Germany

- France

- Italy

- Spain

- BENELUX

- Poland

- Russia

- Rest of Europe

- Offerings, Value (USD Million)

- Overview

- Asia Pacific Excluding Japan Market Outlook

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Country Level Analysis

- China

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Singapore

- New Zealand

- Rest of Asia Pacific excluding Japan

- Offerings, Value (USD Million)

- Overview

- Latin America Market Outlook

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Country Level Analysis

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Offerings, Value (USD Million)

- Overview

- Middle East & Africa Market Outlook

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Offerings, Value (USD Million)

- Hardware

- Electronic Locks

- Card Reader

- Biometric Readers

- Others

- Software

- Visitor Tracking

- Security Management

- Space Management

- Others

- Service

- Hardware

- End User, Value (USD Million)

- Government

- Residential

- Commercial

- Industrial

- Healthcare

- Military & Defense

- Transport & Logistics

- Others

- Country Level Analysis

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Offerings, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Access Control Market Outlook:

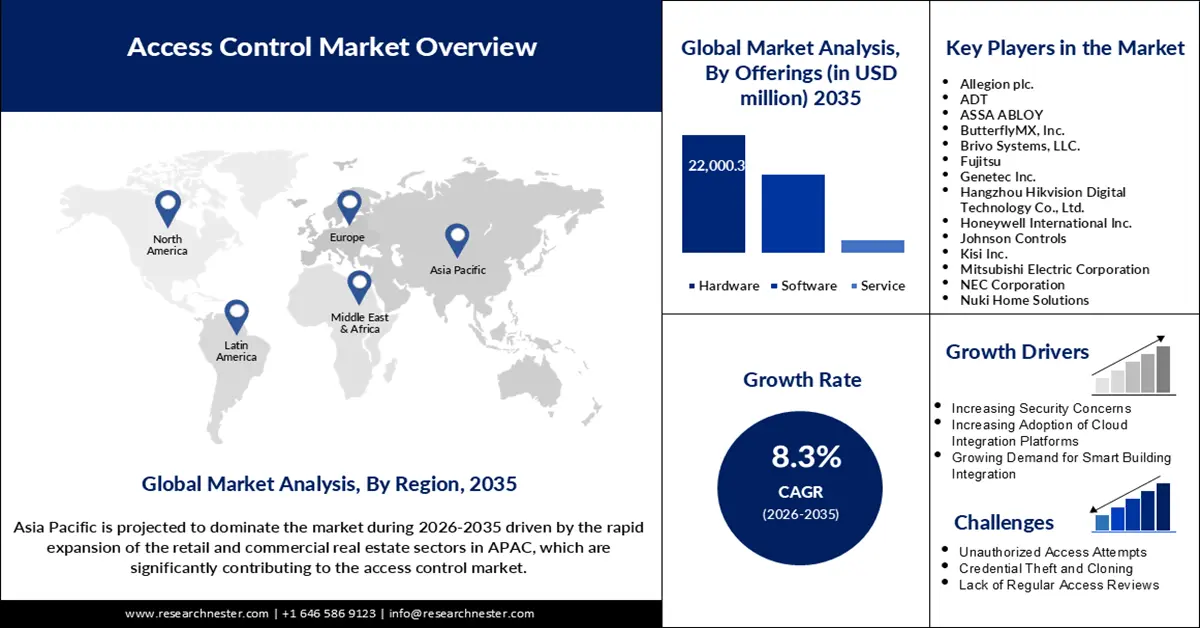

Access Control Market size was valued at USD 12.8 billion in 2025 and is set to exceed USD 28.41 billion by 2035, registering over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of access control is estimated at USD 13.76 billion.

The access control market is rapidly rising due to factors such as technological innovations, the rising demand for security systems, and the use of AI and cloud solutions. The market has been segmented by application into residential, commercial, industrial, and government segments, with new technologies such as biometric authentication and cloud-based access control systems. Suprema launched CLUe, a cloud integration platform for biometric access control in July 2024 for instance. This is in line with the current increasing need for scalable, centralized systems that promote security and efficiency in operations. Global governments are also enforcing policies to enhance digital security in order to foster access control market growth.

Furthermore, the increasing rate of globalization and the shift towards the development of smart cities are increasing the need for sophisticated access control systems. To meet these needs, governments have been pushing for the enhancement of digital infrastructure. In June 2024, Honeywell acquired Carrier Global Corporation’s Global Access Solutions business for USD 4.95 billion to expand its business. At the same time, smart city projects, other governmental programs, and regulatory requirements force companies to implement safe and compliant access management systems.

Key Access Control Market Insights Summary:

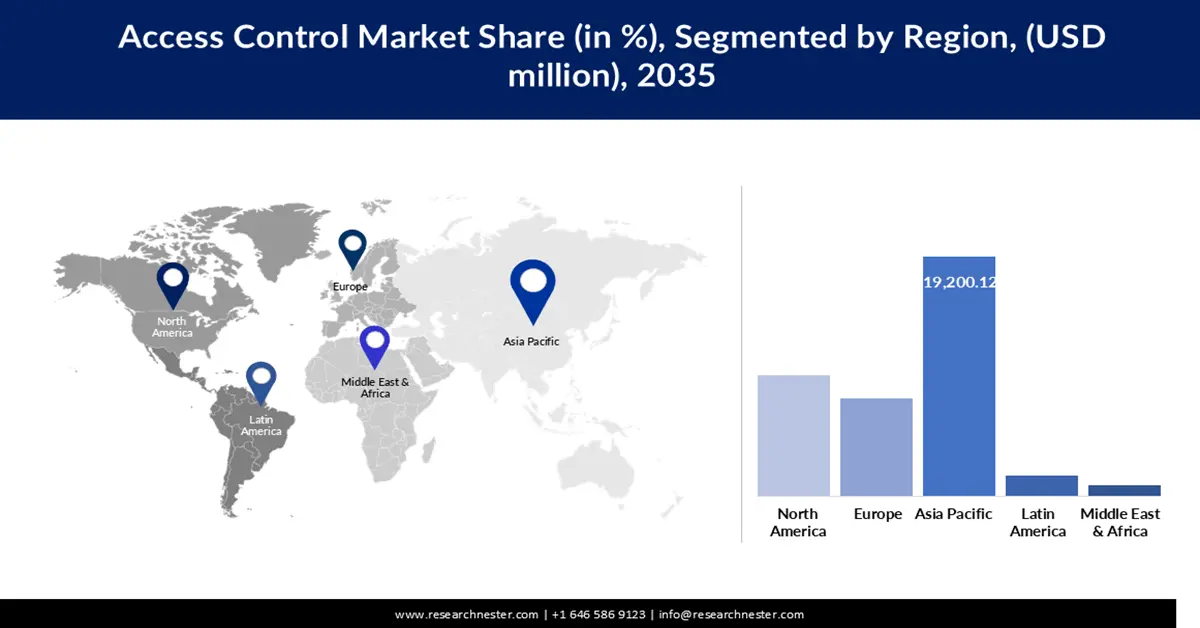

Regional Insights:

- The Asia Pacific Access Control Market is projected to command around 48.9% share by 2035, propelled by rapid urbanization and substantial government investments in smart city projects and digital networks.

- North America is expected to witness robust expansion through 2035, stimulated by continuous technological innovations in AI-driven and cloud-based access control systems.

Segment Insights:

- The Hardware segment is predicted to dominate with a 55.5% share by 2035, propelled by the increasing need for biometric scanners, access cards, and other physical equipment essential for advanced security infrastructure.

- The Commercial segment is anticipated to hold around 21.8% revenue share by 2035, owing to the rising focus on reliable and efficient access control solutions in offices, retail spaces, and entertainment facilities.

Key Growth Trends:

- Technological advancements in biometric systems

- Rising urbanization and smart city projects

Major Challenges:

- Cybersecurity concerns

- Integration challenges with legacy systems

Key Players: Allegion plc., ADT, ASSA ABLOY, ButterflyMX, Inc., Brivo Systems, LLC., Fujitsu, Genetec Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Johnson Controls, Kisi Inc., Mitsubishi Electric Corporation, NEC Corporation, Nuki Home Solutions, OPTEX GROUP CO., LTD., Robert Bosch GmbH, SALTO Systems, S.L., Schneider Electric SE.

Global Access Control Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.8 billion

- 2026 Market Size: USD 13.76 billion

- Projected Market Size: USD 28.41 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 10 September, 2025

Access Control Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in biometric systems: The use of biometric systems in combination with artificial intelligence and machine learning is rapidly changing the access control industry. In September 2024, Suprema launched the Bio-Station 3, which is a contactless facial recognition terminal for post Covid-19 security. These innovations enhance usability, minimize contact, and provide better precision. Biometrics is mostly used in healthcare, commercial, and industrial applications where security and fast access are vital, which makes biometrics one of the essential elements of the current access control systems.

- Rising urbanization and smart city projects: Increased population density and expanding urban areas are demanding better security systems in homes and other buildings. Most governments across the globe are funding smart city initiatives where access control systems are critical to security and regulation. For instance, in March 2024, HammerTech launched its access control services in the UK and Ireland focusing on the construction industry as the sector increased the focus on site security. This is because digital infrastructure is in line with the current development of cities, thus boosting access control market growth.

- Increased adoption of cloud-based solutions: Cloud based access control systems are becoming the most used due to their ability to scale up, their affordability, and the ease of management. The access control market participants are moving towards cloud integration to have better multi-site management and avoid complexity in the infrastructure. These solutions find their application in organizations that need the flexibility of managing their workforce while at the same time having the option for centralized control; this makes them popular across industries. Cloud adoption is also in line with the trends in remote workforce management and the increase of operations across multiple locations.

Challenges

- Cybersecurity concerns: With the advancement of cloud and IoT integration, access control systems are at a higher risk of being attacked. One of the major challenges is the risk of data breaches and unauthorized access, especially in industries that deal with sensitive information. Since the systems should be protected to safeguard the data and gain consumers’ confidence, the companies have to spend a lot of money, which is a significant burden for start-ups.

- Integration challenges with legacy systems: One of the biggest challenges for companies is the ability to integrate modern access control systems with the existing infrastructure. It is a common challenge that many companies have to invest a significant amount and deal with many technical issues to adopt new technologies. The other challenge is the fact that there are many ways of ensuring interoperability without necessarily having to stop work in the process.

Access Control Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 12.8 billion |

|

Forecast Year Market Size (2035) |

USD 28.41 billion |

|

Regional Scope |

|

Access Control Market Segmentation:

Offerings Segment Analysis

Hardware segment is predicted to dominate access control market share of over 55.5% by 2035. This growth is supported by the increasing need for biometric scanners, access cards, and other physical equipment that are required to build the security infrastructure. For example, Hikvision released the new advanced access control products that are associated with video intercom and alarm systems in July 2024. These developments underline the importance of this segment in providing effective and real security products. Also, the growing implementation of hardware solutions in critical applications such as banking and government establishments contributes to the growth of this segment.

End user Segment Analysis

In access control market, commercial segment is anticipated to account for revenue share of around 21.8% by 2035, due to the increasing focus on reliable and efficient access control in offices, retail outlets, and entertainment facilities. In July 2024, Tour24 collaborated with ButterflyMX to enhance property access in multifamily real estate to increase effectiveness and residents’ satisfaction. This trend is in line with the increasing use of smart access systems to improve the quality of tenants' and visitors’ experience. Furthermore, the growing use of access control in coworking spaces and malls shows that the commercial sector needs flexible and expandable solutions.

Our in-depth analysis of the global market includes the following segments:

|

Offerings |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Access Control Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific access control market is projected to dominate revenue share of around 48.9% by the end of 2035. The dominance is attributed to high population density, which has been urbanized at a rapid rate, and increased technological innovation. The governments in the region are also spending a lot of resources on smart city projects and digital networks, which in turn increases the demand for sophisticated access control systems. For example, OTPless raised USD 3.5 million in 2024 to offer a new kind of mobile authentication in which WhatsApp will be used instead of OTPs to improve the security and convenience of the system. These developments make the region an important hub for innovation and growth of the global access control market.

The growth of India market is being fueled by smart city projects supported by the government and the use of biometrics. In 2024, the company introduced its facial recognition-based access solutions to the India access control market, particularly in the commercial market. The requirement of secure access in IT parks, residential complexes, and public infrastructure is also increasing which fuels the market growth in the region.

China dominates the Asia Pacific access control market due to its strong manufacturing industry and high usage of AI in security systems. In December 2023, Dahua Technology launched its new intelligent access control terminals with deep learning, improving the recognition and control in access control. As China is one of the most rapidly growing countries and pays much attention to smart city construction, it is one of the lucrative countries in the market.

North America Market Insights

North America region is likely to observe significant growth till 2035, due to technological advancements in access control systems. In June 2024, Control iD partnered with Paravision to launch the iDFace Max, a new generation access control solution with the latest facial recognition technology, which is another sign of the increasing interest of the region in AI technologies. Also, in March 2023, Kisi Inc. unveiled video-based features to its cloud-based access control solution with video intercom integration, which provides a significant boost to integrated access management systems. These trends, coupled with the increasing trend of using smart building technologies, further enhance the market growth.

The U.S. is the leading country in the North America access control market due to the high investment in artificial intelligence-based security systems. In 2024, HID Global enhanced its manufacturing to include advanced biometric readers to meet the increasing needs of the commercial and government markets. In particular, the increase in smart city projects and the modernization of infrastructure is stimulating the use of innovative access control systems, which strengthens the country’s position in the market.

The access control market in Canada is driven by the rising adoption of advanced security systems in homes and other commercial establishments. In October 2023, Swiftlabs signed a deal with TELUS to connect access control devices based on the IoT into smart homes to improve security and provide comfort to consumers. Some of the government projects aimed at enhancing secure public infrastructure and increasing the use of cloud-based access control solutions also play a role in Canada’s development in the North America access control market.

Access Control Market Players:

- Allegion plc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ADT

- ASSA ABLOY

- ButterflyMX, Inc.

- Brivo Systems, LLC.

- Fujitsu

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls

- Kisi Inc.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nuki Home Solutions

- OPTEX GROUP CO., LTD.

- Robert Bosch GmbH

- SALTO Systems, S.L.

- Schneider Electric SE

The access control market is competitive with major players such as Allegion plc., ADT, ASSA ABLOY, ButterflyMX, and Genetec Inc. These companies are investing in innovation, strategic alliances, and acquisitions as a way of enhancing their market presence. Other important players, including Honeywell International Inc., NEC Corporation, and Fujitsu Limited are also using their technological know-how to come up with integrated access management systems.

In September 2024, Genetec Inc. released a new I/O module in collaboration with STid in its access control systems. The module is certified to the highest level of cybersecurity for clients in the European Union. It is built for secure and flexible integration within enterprise systems. This addition strengthens Genetec’s high-assurance access control products portfolio. The new module also guarantees adherence to the rigid set of cybersecurity rules. Such strategic initiatives indicate the competitive landscape where the firms try to meet emerging security threats and serve a wide range of customers.

Here are some leading companies in the access control market:

Recent Developments

- In September 2024, Johnson Controls, a global leader in smart, healthy, and sustainable buildings, announced the launch of C CURE Cloud. This innovative platform delivers scalable, cloud-native security solutions for businesses of all sizes. It simplifies security management, reduces operational complexity, and enhances flexibility.

- In June 2024, Bosch introduced its Mobile Access solution, offering digital entry options to users. This system eliminates the need for physical identification like plastic cards. Fully integrated with Bosch’s Access Management System, it ensures streamlined operations. Users can access buildings securely via their mobile devices, enhancing flexibility. The solution also reduces the ecological impact of traditional access systems.

- In April 2024, VIVOTEK announced its integration partnership with Kisi Inc., a leader in access control solutions. This collaboration enhances security and access management for both organizations' clients. The partnership integrates VIVOTEK’s advanced surveillance technology with Kisi’s access control systems. This creates a unified security ecosystem tailored for businesses and enterprises. The solution emphasizes both convenience and cutting-edge security innovation.

- Report ID: 4803

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Access Control Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.