2 Ethyl Anthraquinone Market Outlook:

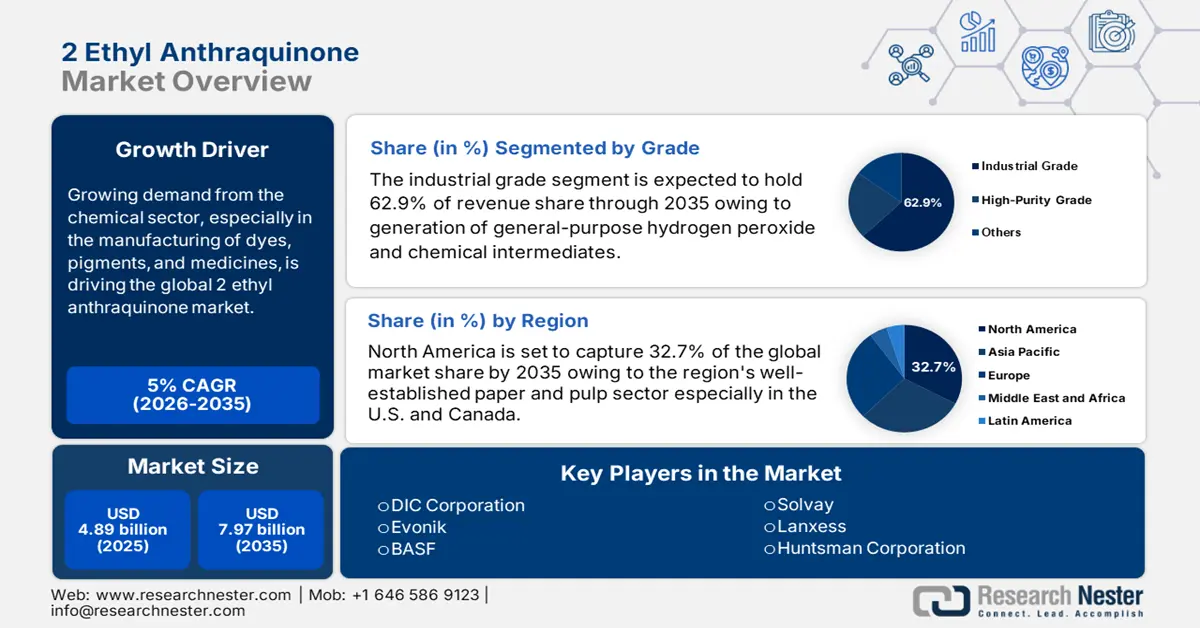

2 Ethyl Anthraquinone Market size was valued at USD 4.89 billion in 2025 and is likely to cross USD 7.97 billion by 2035, registering more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 2 ethyl anthraquinone is assessed at USD 5.11 billion.

The growing demand from the chemical sector, especially in the manufacturing of dyes, pigments, and medicines, is driving the global 2 ethyl anthraquinone market. According to a research compendium by the Department of Biotechnology, Ministry of Science and Technology, Government of India reported that in 2025, the global output of dyes and pigments is predicted to reach 9.0 million tons by volume, valued at USD 24.2 billion. An estimated 7.5 x 105 metric tons of various dyes were produced annually, and approximately 280,000 tons (i.e., 2–50%) of textile dyes were released into the effluents. Additionally, the market is expanding as a result of 2 ethyl anthraquinone increasing its use as an antioxidant and colorant in the construction and automotive industries.

The need for 2 ethyl anthraquinone has significantly increased due to advancements in the hydrogen peroxide manufacturing process. Catalyst efficiency improvements enable producers to maximize output and minimize waste, improving sustainability and cost-effectiveness. For example, according to a recent study by Tsinghua University, using an in situ manufactured Pd catalyst with an egg-shell shape improved hydrogenation efficiency to 35.5% and produced a space-time yield of 567.5 g H2O2 g Pd−1 h−1. Research and development initiatives aimed at enhancing 2 ethyl anthraquinone's performance and reusability as a catalyst are opening doors for its broad use. In addition to helping companies fulfill rising demand, these technical developments also support worldwide trends toward environmentally friendly and energy-efficient production techniques.

Key 2 Ethyl Anthraquinone Market Insights Summary:

Regional Highlights:

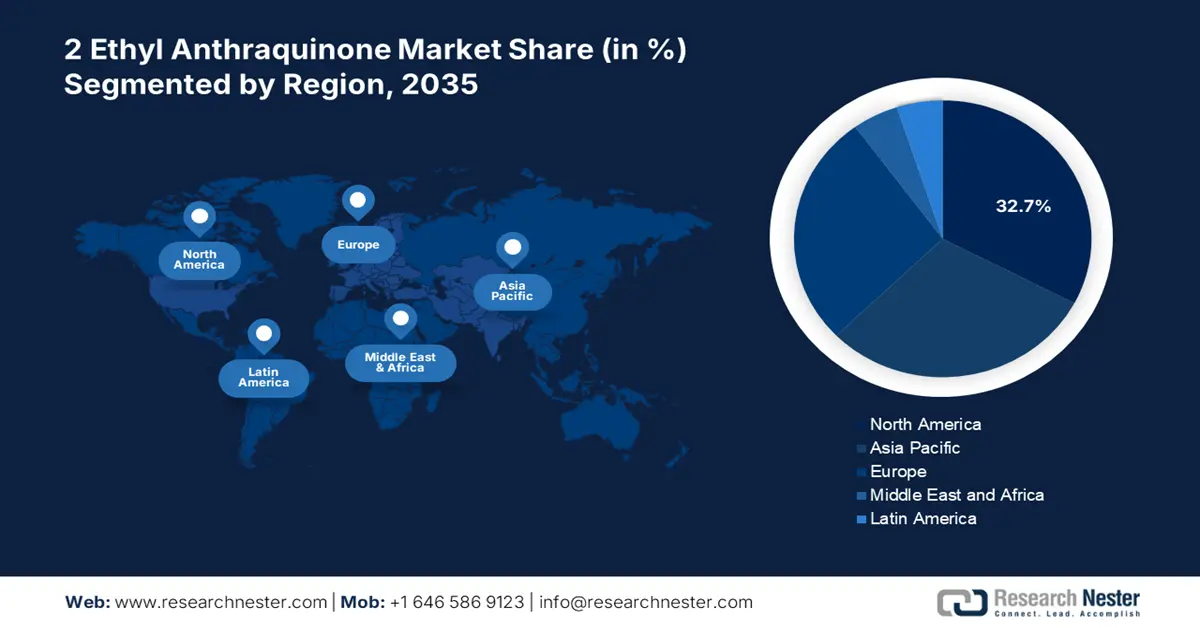

- North America dominates the 2 Ethyl Anthraquinone Market with a 32.7% share, driven by a well-established paper and pulp sector, especially in the U.S. and Canada, enhancing growth prospects through 2026–2035.

- Asia Pacific's 2 Ethyl Anthraquinone market is projected to maintain a stable CAGR through 2026–2035, attributed to fast industrialization and expanding manufacturing base in China, India, and Japan.

Segment Insights:

- The Hydrogen Peroxide Production segment is projected to hold a notable market share by 2035, fueled by increasing demand for eco-friendly bleaching and disinfection solutions.

- The industrial grade segment of the 2 Ethyl Anthraquinone Market is expected to exceed 62.9% share by 2035, driven by the expansion of the global paper and pulp industries.

Key Growth Trends:

- Increased investment in research and development

- Expansion of pharmaceutical and healthcare uses

Major Challenges:

- Expensive production and intricate manufacturing procedures

- Regulatory and environmental pressures

- Key Players: Jiangsu Honglin Chemical Co., Ltd., North China Pharmaceutical Group Corporation, DIC Corporation, Evonik, BASF, Solvay, Lanxess, Huntsman Corporation, Clariant AG.

Global 2 Ethyl Anthraquinone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.89 billion

- 2026 Market Size: USD 5.11 billion

- Projected Market Size: USD 7.97 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

2 Ethyl Anthraquinone Market Growth Drivers and Challenges:

Growth Drivers

- Increased investment in research and development: R&D efforts are expanding the potential applications of 2 ethyl anthraquinone in emerging sectors, such as specialty chemicals and advanced materials, broadening its market scope. Innovations in synthesis and production techniques are making the manufacturing process more cost-effective and environmentally friendly, increasing 2 ethyl anthraquinone market competitiveness.

Moreover, investments in green chemistry are driving the development of sustainable production methods, aligning with global trends toward reduced environmental impact. According to a survey report commissioned by the Green Chemistry & Commerce Council (GC3) 2021 reported that 84% of industry respondents raised their investment in green chemistry product R&D over the last five years, and 98% expect to continue doing so in the next five years. More than 58% of respondents predict that sales will be much higher in the same period. - Expansion of pharmaceutical and healthcare uses: The pharmaceutical and healthcare sectors are mostly accountable for the rising demand for hydrogen peroxide and, consequently, 2 ethyl anthraquinone. Hydrogen peroxide is commonly used as a sterilizing agent in medical equipment and institutions, particularly in the wake of the COVID-19 pandemic's increased awareness of hygiene. Its application in the production of disinfectants and sanitizers has also become more significant. The growing global healthcare infrastructure and increased investments in pharmaceutical manufacture are two major drivers driving the need for 2 ethyl anthraquinone, a critical component in the production of hydrogen peroxide.

Challenges

- Expensive production and intricate manufacturing procedures: Complex chemical synthesis is required for the manufacturing of 2 ethyl anthraquinone, necessitating sophisticated infrastructure and technical knowledge. Production costs are significantly increased by the high cost of raw materials and energy-intensive manufacturing processes. These operating expenses make it difficult for small and medium-sized manufacturers in particular to remain profitable. Furthermore, the requirement for strict quality control and high-purity output makes production even more difficult and restricts the ability of new market entrants to scale their operations.

- Regulatory and environmental pressures: Manufacturers in the 2 ethyl anthraquinone market are facing mounting pressure to adhere to strict environmental laws as the emphasis on environmental sustainability grows globally. Hazardous chemicals are used in the industrial process, and improper handling of these compounds can pollute the environment. The operational load is increased by adherence to laws like the European Union's REACH system and comparable laws in other areas. Many manufacturers may find it difficult to make the significant investment in cleaner technology required to comply with these laws.

2 Ethyl Anthraquinone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 4.89 billion |

|

Forecast Year Market Size (2035) |

USD 7.97 billion |

|

Regional Scope |

|

2 Ethyl Anthraquinone Market Segmentation:

Grade (Industrial Grade, High-Purity Grade, Others)

The industrial grade segment is set to capture over 62.9% 2 ethyl anthraquinone market share by 2035. The dominance of the industrial grade segment is supported by the expansion of the worldwide paper and pulp industries as well as the manufacturing of chemicals. For instance, approximately 1.6% of the paper and paperboard produced worldwide comes from the Indian paper industry. The nation is home to more than 650 paper mills that use a variety of raw resources to produce different kinds of paper. As the nation's GDP has increased, so too has the consumption of various paper grades. Furthermore, the market is dominated by industrial-grade 2 ethyl anthraquinone owing to its low cost and wide range of applications in general-purpose industrial processes.

Application (Hydrogen Peroxide Production, Dyes & Pigments, Chemical Intermediates, Pharmaceutical Production, Others)

Based on the application, the hydrogen peroxide production segment in 2 ethyl anthraquinone market is likely to hold a notable share by the end of 2035. The main use of 2 ethyl anthraquinone is in the synthesis of hydrogen peroxide, which is an essential step in the anthraquinone process. The hydrogen peroxide level of products that consumers purchase for household usage is typically around 3%. The segment dominance is driven by the expanding trends for hydrogen peroxide in industries including chemical synthesis, water treatment, and pulp and paper. This segment's 2 ethyl anthraquinone market expansion is further supported by the focus on environmentally friendly bleaching and disinfection solutions. Furthermore, the market demand for 2 ethyl anthraquinone is rising due to the growing use of hydrogen peroxide in sophisticated oxidation procedures for wastewater treatment. Due to its extensive use in environmentally friendly bleaching, disinfection, and advanced oxidation processes, hydrogen peroxide manufacturing dominates the market.

Our in-depth analysis of the global 2 ethyl anthraquinone market includes the following segments:

|

Grade |

|

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

2 Ethyl Anthraquinone Market Regional Analysis:

North America Market Forecast

In 2 ethyl anthraquinone market, North America region is predicted to dominate over 32.7% revenue share by 2035, owing to the region's well-established paper and pulp sector, especially in the U.S. and Canada. It is anticipated that the rising need for paper packaging will increase demand for 2 ethyl anthraquinone, supporting market expansion over the projection period. Additionally, the detergent sector has seen tremendous expansion, which is anticipated to increase demand for 2 ethyl anthraquinone and, in turn, drive market expansion. For instance, according to the U.S. Bureau of Labor Statistics (BLS), the average annual expenditure for all consumer units in 2023 was USD 77,280, which represents a 5.9% rise from 2022. Average income before taxes increased by 8.3% during the same period, while the Consumer Price Index for All Urban Consumers (CPI-U) increased by 4.1%.

The U.S. dominates the region because to its thriving industrial and chemical sectors, which use hydrogen peroxide extensively for chemical synthesis, water treatment, and bleaching pulp and paper. The vast bulk of hydrogen peroxide generated in the country is used to bleach fabrics, remove ink from recycled paper, and bleach paper products. These activities collectively account for around 65% of household consumption. Canada also contributes by using hydrogen peroxide more frequently in medical and environmental applications. Furthermore, there is a growing need for hydrogen peroxide for sterilization and disinfection applications in the Canada’s pharmaceutical and healthcare industries. Environmental laws that support environmentally friendly chemical processes also encourage the use of 2 ethyl anthraquinone.

APAC Market Analysis

Asia Pacific in 2 ethyl anthraquinone market is expected to experience a stable CAGR during the forecast period due to the fast industrialization and expanding manufacturing base in nations like China, India, and Japan. Significant demand is driven by the growth of the paper, textile, and chemical industries in the region. In 2021, China's hydrogen peroxide sector generated 12.35 million tons and accounts for more than 40% of global hydrogen peroxide production, ensuring its crucial position in the 2 ethyl anthraquinone supply chain.

The growing demand for 2 ethyl anthraquinone market in India is expected to support the country's market progress. The primary forces behind the expansion are growing end use sector demand and rapid industrialization. Most of the major companies in the sector are focusing on different areas and growing their presence by building factories, warehouses, and research and development facilities. In 2020–21, India's per capita research and development expenditure reached a current PPP of USD 42.0.

In China, the need for 2 ethyl anthraquinone has been the increase in demand for paper for packaging applications. The environmentally favorable oxidizing capabilities of hydrogen peroxides make them useful in a variety of industries, including wastewater treatment, mining, paper and pulp, oxidative chemical synthesis, and textiles. The pulp and paper industries have utilized almost 34% of its total production as a bleaching agent, while the textile industry has used it to wash wool and cotton fiber. The production of H2O2 is therefore the subject of an important scientific project. For instance, in September 2024, a contract was reached by Evonik and Steinbeis Papier to deliver carbon-neutral hydrogen peroxide (H2O2) from Evonik for the manufacturing of recycled paper. In keeping with the company's aggressive sustainability plan, Steinbeis Papier will be able to further cut emissions throughout its value chain by using this Way to GO2-certified H2O2.

Key 2 Ethyl Anthraquinone Market Players:

- Weifang Fengyi Chemical Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jiangsu Honglin Chemical Co., Ltd.

- North China Pharmaceutical Group Corporation

- DIC Corporation

- Evonik

- BASF

- Solvay

- Lanxess

- Huntsman Corporation

- Clariant AG

Major players in the fiercely competitive 2 ethyl anthraquinone market supply goods and services to both domestic and foreign consumers. For a dominant position in the global 2ethyl anthraquinone market, major players are using several strategies in research and development, product innovation, and end-user launches.

Here are some leading players in the 2 ethyl anthraquinone market:

Recent Developments

- In November 2024, Solvay signed a contract to license its cutting-edge hydrogen peroxide technology to North Huajin Refining and Petrochemical Company (North Huajin) for the production of 300 kilotons of propylene oxide annually at its facility in Panjin (Liaoning Province, China) with a planned launch in 2026.

- In April 2024, Evonik announced that it is now providing customers in Europe with hydrogen peroxide that is carbon neutral. Hydrogen peroxide (H2O2) is sold with a so-called "Way to GO2" certificate, which has been made possible by an independently certified method. Their value chain's Scope 3 emissions are decreased when consumers use the approved hydrogen peroxide. The acquisition of these certificates in turn contributes to the continuous, sustainable evolution of Evonik's peroxide manufacturing process.

- Report ID: 6988

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

2 Ethyl Anthraquinone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.