Solar Cell Market Outlook:

Solar Cell Market size was valued at USD 158.82 billion in 2025 and is set to exceed USD 750.47 billion by 2035, expanding at over 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar cell is estimated at USD 182.83 billion.

The solar cell market is driven by the rising focus on renewable energy sources and mitigating greenhouse emissions from oil, coal, and gas. Photovoltaic (PV) modules currently render almost 4% of global electricity and collectively provide more than 300 gigawatts (GW) of power capacity. But to decarbonize the present energy systems, PV capacity must grow rapidly in the coming years, supplying approximately 40% of the electricity by 2050. To cater to the growing solar energy requirements, new technologies including sophisticated grid-edge controls are being developed to facilitate peak load mitigation, asset performance optimization, and value stream additions. The ongoing efforts to harvest and store solar energy effectively are projected to provide an impetus to the solar cell market.

Key Solar Cell Market Insights Summary:

Regional Highlights:

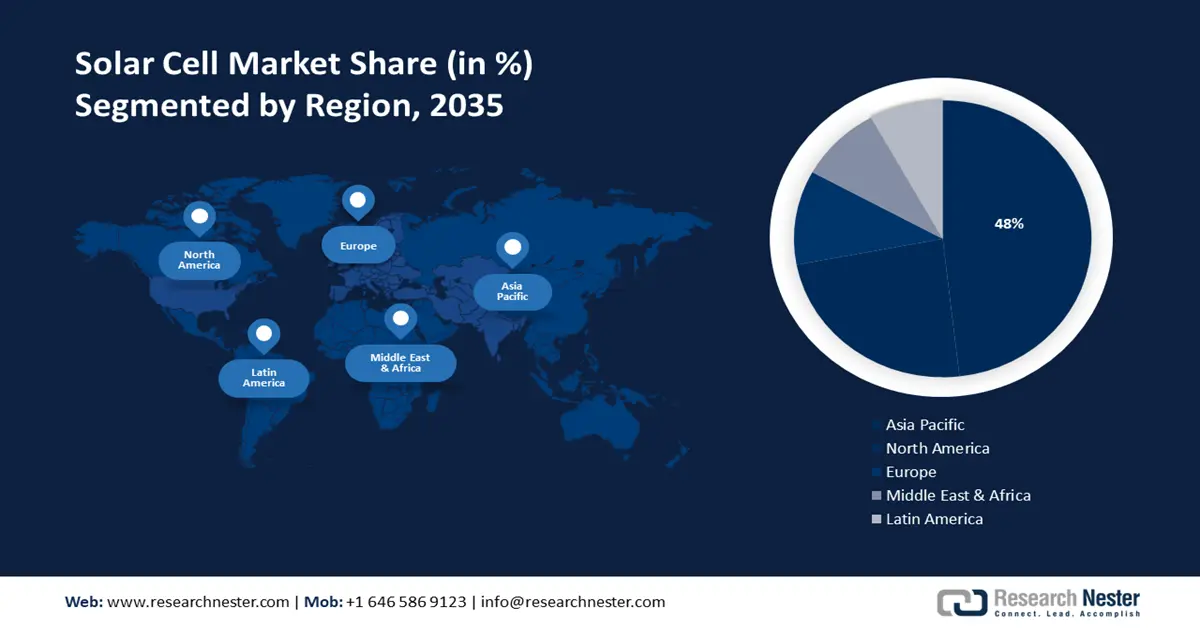

- The Asia Pacific solar cell market will account for 48% share by 2035, driven by the slated increase in aerospace and defense sectors using more PV energy.

- The North America market will secure considerable share by 2035, driven by the surge in energy demand and increased investment in renewable energy capacity.

Segment Insights:

- The monocrystalline segment in the solar cell market is expected to achieve significant growth till 2035, driven by increasing adoption in zero-emission infrastructures and commercial use.

- The crystalline segment in the solar cell market is anticipated to witness significant growth over the forecast period 2026-2035, attributed to integration into building roofs with smart mounting systems and high efficiency.

Key Growth Trends:

- Optimizing solar cell and storage assets with advanced monitoring & control (M&C) technologies

- Increasing government initiatives

Major Challenges:

- High initial cost

- Complexity in manufacturing

Key Players: Jinko Solar Co., Hanwha Qcells GmbH, Alps Technology Inc., GreenBrilliance Renewable Energy LLP, Hevel Energy Group, Indosolar Limited, Sharp Corporation, Suniva Inc., Tata Power Solar Systems Ltd., Panasonic Corporation.

Global Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 158.82 billion

- 2026 Market Size: USD 182.83 billion

- Projected Market Size: USD 750.47 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Solar Cell Market Growth Drivers and Challenges:

Growth Drivers

- Optimizing solar cell and storage assets with advanced monitoring & control (M&C) technologies - As the focus on rendering solar asset monitoring and control matures, stakeholders are realizing the value of data and the insights that enable the discovery of opportunities for new value streams at reduced risk. Technology innovation in M&C of solar energy storage includes the integration of AI and data analytics. For instance, in June 2024, Stem and Arizona Electric Power Cooperative (AEPCO) collaborated to launch a 40-megawatt hour (MWh) energy storage system and a 20-megawatt (MW) PV system. The M&C system integrates Stem’s Athena, an AI-driven unified platform to operate and monitor solar energy storage. It is set to transform the renewable energy sector for both consumers and prosumers. Front-of-the-meter (FTM) facilitators, asset owners, generator operators, and behind-the-meter (BTM) commercial and industrial (C&I) prosumers are adopting digital solutions for solar asset management. This has further allowed C&I prosumers to gain insights on electric vehicle (EV) charging capacity, demand response participation, program incentives, and cost savings.

The growing need for an interactive grid to support the operations of decentralized renewable assets is fostering the demand for M&C solutions for FTM and BTM solar plus storage projects. Advanced M&C solutions create interconnected networks of smarter energy assets that are more reliable, which achieves grid parity and the goal of a clean energy transition. According to the U.S. Energy Information Administration (EIA), solar and battery storage will make up 81% of the country’s electric-generating capacity by the end of 2024. Its annual utility-scale solar installation spike is from 18.4 GW in 2023 to 36.4 GW in 2024. As the number of deployments increases, distributed energy resources (DER) portfolios are at risk of growing piecemeal due to the disparate M&C solutions available in the fragmented solar and storage hardware and software market. However, rising standardization in solar energy management and decreasing operations and maintenance (O&M) costs are projected to create growth opportunities for entrants. The solar and storage M&C has emerged as a key trend in the solar cell market and has a growing list of competitive industry players including Trimark, Stem, and Huawei Technologies. - Increasing government initiatives - To accelerate the implementation of renewable energy projects the U.S. federal and state governments have implemented legislative plans. In March 2021, the Biden administration released a spending plan citing the aim to decarbonize the U.S. Economy and minimize solar costs by 60% in the next 10 years. According to the Carbon Neutrality Coalition and the Energy & Climate Intelligence Unit, 137 countries have committed to carbon neutrality by 2050. Furthermore, the U.S. Department of Energy 2024 announced an opportunity for Solar Energy Supply Chain Incubator funding, that will provide USD 38 million for RD&D projects.

Additionally, governments frequently offer financial incentives to lower the cost of purchasing and installing solar panels through tax breaks or refunds. Through these incentives, the upfront cost of solar installations is effectively reduced, making them more affordable for individuals and businesses. The goals of the government, including lowering greenhouse gas emissions and halting climate change, are in line with ecological principles. - Demand for enhanced performance and efficiency - The need for improved energy sources is growing in several industries worldwide. The U.S. Energy Information Administration in 2023 estimated that energy imports in the country increased to 21.47 quads in 2022 as compared to previous years. As a result, producers are always developing new technologies for solar cells to provide better performance and efficiency. In addition, increased efficiency maximizes energy output while also making the best use of the available space, making solar installations more feasible for a range of uses.

Challenges

- High initial cost - Purchasing and installing solar panels can be expensive, particularly for small-scale and residential users. The price of solar cells, inverters, mounting systems, wiring, and installation labor are all included in this upfront cost, due to which businesses or individuals might refrain from using solar energy. Even though it may ultimately prove to be more cost-effective in the long run, the use of solar energy might result in long-term electricity bill savings, there is a chance that this will prolong the payback period of the initial investment.

- Complexity in manufacturing - Depending on the location and ambient temperature, solar panels can typically convert 15–22% of the sun's energy into useful energy. A home may be operated on 22% of the usable energy available during a blackout or overnight. The three main types of PV panels are thin-film, monocrystalline, and polycrystalline silicon. Because they are made of the best silicon out of the three, monocrystalline silicon panels are the most efficient type of panel. It's not easy to find PV panels with higher efficiency without wanting to spend more money. To produce solar energy, engineers and scientists are working to increase the efficiency of the cells and lower the cost of production.

Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 158.82 billion |

|

Forecast Year Market Size (2035) |

USD 750.47 billion |

|

Regional Scope |

|

Solar Cell Market Segmentation:

Material Segment Analysis

The crystalline segment in solar cell market is predicted to grow at a significant growth rate during the forecast period. The segment's tremendous growth rate can be boosted by their integration into building roofs with the use of smart mounting systems, which replace roof sections while maintaining the structural integrity of the building. A report by Research Nester in 2023 predicted that by 2025, about 57% of homes will have a smart home device in the U.S. Additionally, this kind of integration offers great efficiency without requiring major investments.

Crystalline silicon cells have the potential to achieve energy conversion efficiencies of 18–22% when tested under typical operating conditions, which will promote the technology's adoption. Reduced energy losses and resistance to boron-oxygen defects are two other advantages of N-type cells, which will support the growth of the crystalline silicon material industry. This trend has accelerated the demand for solar panel mounting structures as well.

Technology Segment Analysis

Monocrystalline segment is likely to dominate around 28.2% solar cell market share by the end of 2035, driven by their increasing demand in commercial and residential as they provide more than 20% commercial efficiency. Furthermore, increasing awareness regarding the infrastructure with zero-emission acts as a growing factor for the solar cell sector. According to the Global Infrastructure Hub in 2023, the private investments globally in green infrastructure are increasing and were propelled to be about 60% of their total private investment in 2021.

Our in-depth analysis of the global solar cell market includes the following segments:

|

Material |

|

|

Technology |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 48% by 2035. The market expansion in the region is expected on account of the slated increase in the aerospace industry along with defense as they use more PV energy. A report by Boeing Aircraft in 2023, estimated that by 2042 the airline fleet growth rate would be 6.9% as compared to the airline traffic growth of 9.5%. Presently, Southeast Asia represents the largest exporter of solar cell and module supply to the U.S. The products have demonstrated the expected quality, compliance, and economy necessary to underwrite warranties for U.S. consumers.

China is presently the predominant player in the solar cell and storage supply chains. In China, there has been an increase in urbanization and industrialization which demand more PV panels in highways and residential complexes. The State Council of China published a report in 2022 stating that the urbanization rate crossed 60% in 2019, while in 2021 this rate surpassed 64.72% in this country. This also augments demand for solar PV mounting systems during the forecast period.

The increasing infrastructure development in Japan acts as a growing factor for the solar cell market expansion. According to the World Bank, with a population of 1.6% of the global population in 2021, Japan continues to lead in terms of rapid development in the modern age.

North America Market Insights

In solar cell market, North America region is projected to capture considerable revenue share by 2035 credited to the surge in energy demand. A report by the U.S. Energy Information Administration in 2023 stated that renewable energy consumption and production had made records in 2022, crossing 13% (13.18 quads and 13.40 quads respectively.

In the United States, there has been an increase in government campaigns and investments aimed at raising awareness about the use of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power. the U.S. can and is breaking free from an overreliance on imports while building a resilient and equitable U.S. solar and storage manufacturing base.

As a direct result of the Inflation Reduction Act (IRA), a new influx of investments in domestic solar modules, inverters, trackers, racking capacity, solar ingot, and cell capacity has been observed. The IRA will be instrumental in facilitating the U.S. solar industry’s domestic solar harvesting goal of 50 gigawatts (GW) by 2030. The IRA has led to a series of announcements for new manufacturing capacity including 16 GW of ingots and wafers, 16 GW of cells, 47 GW of new modules, nearly 9 GW of inverters, and 100 GWh of battery manufacturing. Furthermore, over 20,000 tons of annual domestic polysilicon capacity will attract a multitude of investments in racking and tracker expansion.

Canada is predicted to have a high electricity demand which encourages collaboration with the energy & power sector. Hence, this factor is estimated to impact the overall growth of the solar cell market in Canada. According to a report in 2023, the energy consumption in Canada tremendously increased to 8585 petajoules from 2022 to 2021.

Solar Cell Market Players:

- Jinko Solar Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hanwha Qcells GmbH

- Alps Technology Inc.

- GreenBrilliance Renewable Energy LLP

- Hevel Energy Group

- Indosolar Limited

- Sharp Corporation

- Suniva Inc.

- Tata Power Solar Systems Ltd.

- Panasonic Corporation

Most of the solar cell companies are continuously collaborating, expanding, and adopting joint venture strategies to strengthen their position in the solar cell market revenue share. Moreover, they are investing in research and development to improve the efficiency of solar cells. By promoting clean energy and reducing carbon footprints, they attract environmentally friendly consumers and investors.

Some of the key players include:

Recent Developments

- In August 2022, Hanwha Qcells GmbH acquired about 66% of Hanover-based LYNQTECH GmbH. The goal of Hanwha Q Cells acquisition was to strengthen its position as a comprehensive supplier of clean energy solutions for end users, both residential and commercial.

- In May 2022, Jinko Solar Co. signed a dirtributionn agreement with Aldo Solar, as it will receive the newest N-Type ultra-efficiency photovoltaic Tiger Neo modules from JinkoSolar, the leading provider of solar energy products in the country with a market share of over 30% in the Distributed Generation category.

- Report ID: 6291

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.