Smart Sensors Market Outlook:

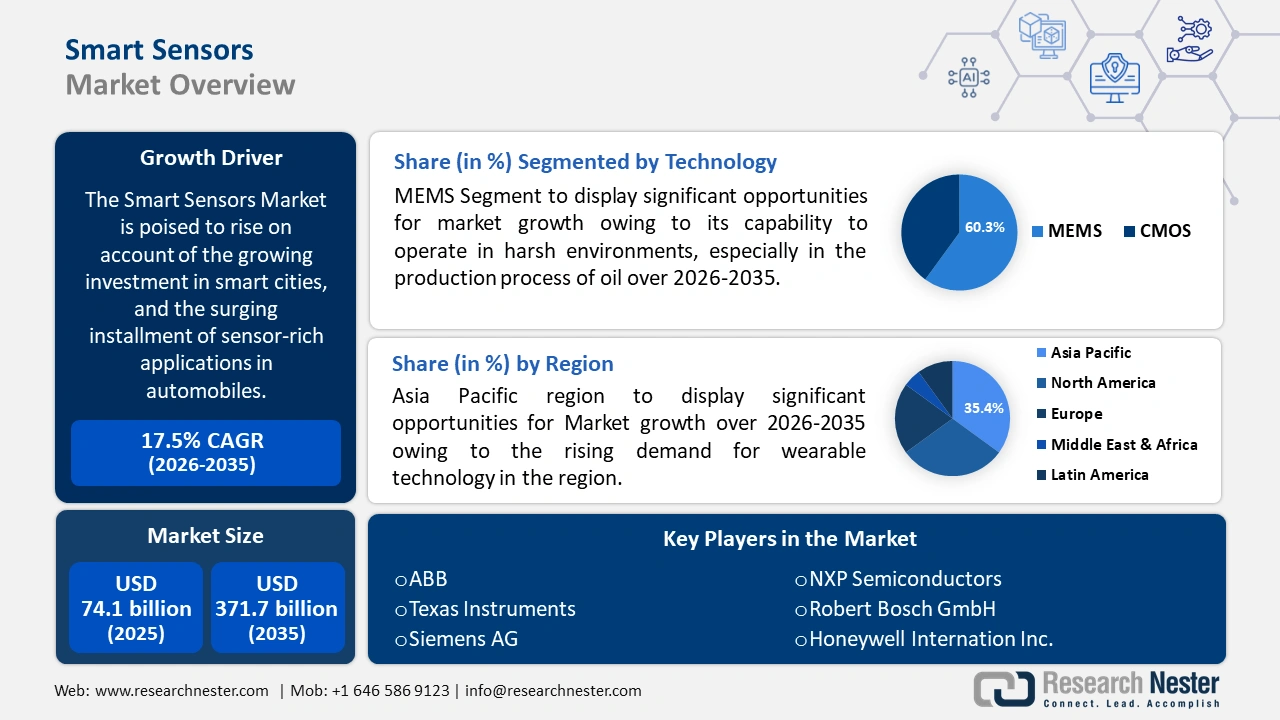

Smart Sensors Market size was valued at USD 74.1 billion in 2025 and is expected to reach USD 371.7 billion by 2035, registering around 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart sensors is evaluated at USD 85.77 billion.

The market is driven by surging government investment to develop smart cities with advanced technologies. Smart cities enhance city function and boost economic growth using data analytics, and smart technologies. As per the Indian Brand Equity Foundation, the smart cities mission has been allocated USD 268.43 million under the Interim Union Budget 2024-2025. Therefore, installing smart sensors in the city creates efficient product and service delivery systems for businesses and public sector.

Key Smart Sensors Market Insights Summary:

Regional Highlights:

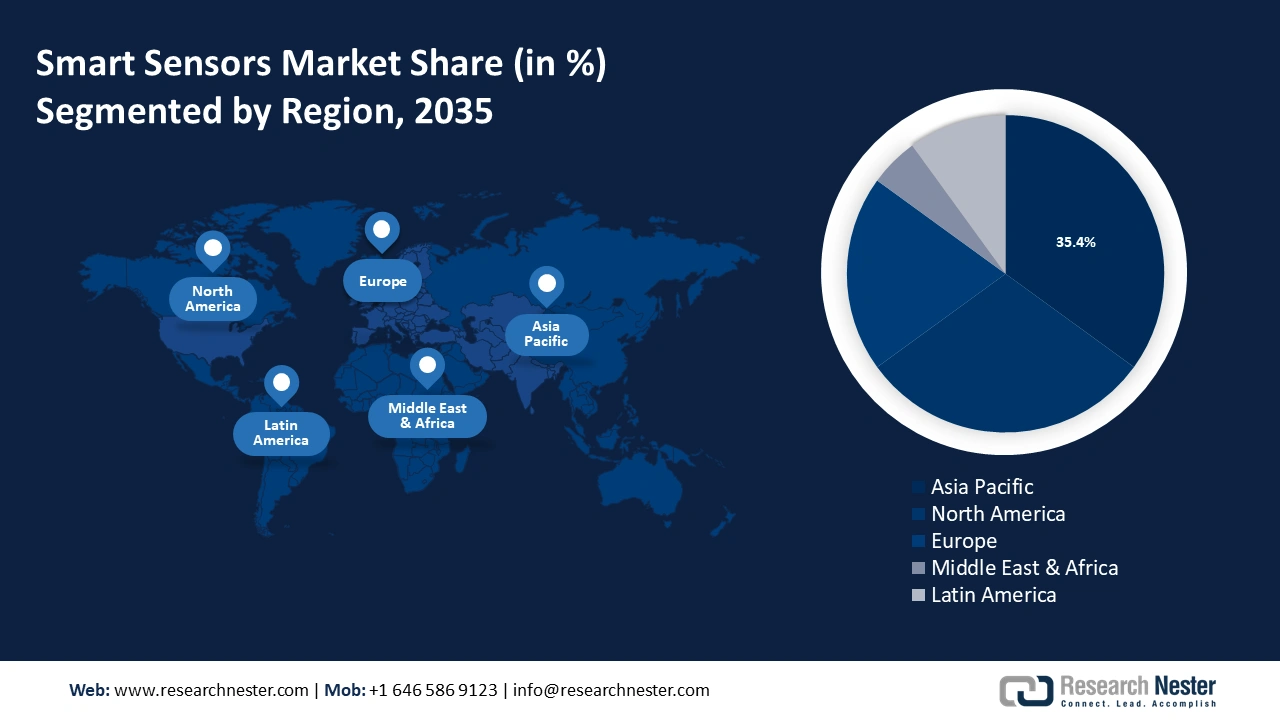

- The Asia Pacific smart sensors market will account for 35% share by 2035, driven by the growing adoption of wearable technology in this region.

Segment Insights:

- The mems technology segment in the smart sensors market is expected to achieve a 60.30% share by 2035, fueled by its efficiency and capability to operate in harsh environments.

- The pressure sensors segment in the smart sensors market is forecasted to achieve a 30.10% share by 2035, driven by rising adoption for efficiency and automation in production processes.

Key Growth Trends:

- Surging installation of sensor-powered applications in automobiles

- Growing trend of green building

Major Challenges:

- Growing competition among key players

- Rising cost of deploying smart sensors

Key Players: Analog Devices, Inc., STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., Infineon Technologies AG, Robert Bosch GmbH, Honeywell International Inc., Sensirion AG, TE Connectivity Ltd., Omron Corporation.

Global Smart Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.1 billion

- 2026 Market Size: USD 85.77 billion

- Projected Market Size: USD 371.7 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 17 September, 2025

Smart Sensors Market Growth Drivers and Challenges:

Growth Drivers

- Surging installation of sensor-powered applications in automobiles - Sensors play a crucial role in modern automobile design by serving different purposes. Car manufacturers bring new models to the market that are more fuel-efficient, safer, and comfortable to drive. One such innovation includes the development of sensors that enhance the effectiveness, dynamics, and emission performance of automotive engines, along with automobile braking, steering, and safety features.

On 9, January 2023, Henkel announced the launch of Loctite 3296 to expand its selection of active alignment adhesives specifically designed for ADAS sensors, which are crucial for accuracy and superior sensor dependability. The new product has high adhesion to aluminum and FR4, and it offers a very high cure depth after only a few seconds of exposure to UV light. - Growing trend of green building - The need for sustainable buildings along with technological advancements influence the emergency of smart sensors in green buildings. Sensors provide valuable information on energy usage patterns for monitoring, and optimizing energy in green buildings. According to the data published by the International Energy Agency (IEA) on 11 July 2023, 35% of the energy was consumed by building operations globally in 2022.

- Rising integration of cloud in smart sensors - The emphasis on Internet of Things-based technology is expanding as a consequence of its inventive and cutting-edge applications. These advanced sensors have become important for a wide range of Internet of Things applications, improving performance and enabling well-informed decision-making. For instance, Infineon Technologies AG, On 26 October 2022, launched the XENSIV connected sensor kit, a new IOT sensor platform for development, and prototyping of customized IOT solutions.

Challenges

- Growing competition among key players - Several big companies offer a wide range of goods & services that intensify the competition in the market. As a result, SMEs or startups are finding it difficult to create a dominating presence in the industry. Additionally, these competitors are investing significantly in new and high-tech products, that render it harder for SMEs to maintain their competitiveness. Therefore, this issue is expected to restrain the market expansion.

- Rising cost of deploying smart sensors - The energy needed by the sensors and wireless network leads batteries to have limited lifespans causing them to drain out quickly. Additionally, this limitation necessitates the use of technologies including intelligence systems or networks for signal analysis that usually hold huge costs. Hence, the factor is anticipated to impede the market growth.

Smart Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 74.1 billion |

|

Forecast Year Market Size (2035) |

USD 371.7 billion |

|

Regional Scope |

|

Smart Sensors Market Segmentation:

Sensor Type Segment Analysis

Pressure sensors segment is poised to dominate smart sensors market share of over 30.1% by 2035. This growth can be impelled by the increasing adoption of pressure sensors for boosting efficiency, and automation of the production processes. According to Research Nester’s analysis, more than 45 % of businesses across the globe are planning to automate their repetitive tasks by 2024. Moreover, HVAC systems have also recognized the importance of pressure sensors, as they provide accurate measurement of pressure levels and alarm the system when maintenance is required.

Technology Segment Analysis

In smart sensors market, MEMS segment is estimated to dominate revenue share of over 60.3% by 2035. The growing use of this technology allows the sensor to operate effectively by enabling it to maintain a significant amount of information in a split second.

Moreover, this technology is also set to have capability to operate in harsh environments, which is why its adoption is growing significantly in the oil industry. Hence, the surging production of oil is anticipated to observe exponential growth in the market. U.S. Energy Information Administration, reported that in 2022 over 80.75 million barrels of crude oil were produced in 98 countries.

Our in-depth analysis of the global market includes the following segments:

|

Sensor Type

|

|

|

Technology |

|

|

Component

|

|

|

Industry Vertical

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Sensors Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 35% by 2035. The growing adoption of wearable technology is the major factor driving market expansion in this region.

Moreover, the China market for smart sensors is also set to have notable growth in this region owing to the growing adoption of smart sensors in the healthcare sector. Further, China's conventional care model makes it problematic to cope with the growing demand for home care by the elderly owing to the country's increasing aging population and lack of accessible care resources. Based on this foundation, China has launched smart technology-based home digital health solutions.

Additionally, the India market is also anticipated to surge owing to the penetration of the internet.

Also, the market in Japan is predicted to rise on account of the rising demand for robotics from various manufacturing industries.

North American Market Insights

The North America smart sensors market is anticipated to flourish between the years 2024 and 2035, owing to the growing per capita income in this region. For instance, the U.S. discretional income boosted in March to about USD 20881 billion from approximately USD 20717 billion in February of 2024. Therefore, the population in this region spends more on consumer electronics and other advanced technologies.

Furthermore, the U.S. market is also experiencing a huge adoption of electric vehicles with the surging environmental awareness among people. Also, many key players in the field of automotive are working towards enhancing the features of electric vehicle which is additionally driving market growth in this region.

Moreover, with the growing emphasis on Industry 4.0 in Canada, the market in this nation is set to notice a rise in its revenue.

Smart Sensors Market Players:

- Elliptic Laboratories ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Henkel AG & Co. KGaA

- Siemens AG

- Honeywell International Inc.

- Texas Instruments

- ABB

- STMicroelectronics

- NXP Semiconductors

- Robert Bosch GmbH

- Infineon Technologies AG

The smart sensors market consists of several key players who are actively working and collaborating toward advancing their technologies. Some of them include:

Recent Developments

- December 15, 2020: Tuya Smart and NISSHO announced the agreement to work collaboratively to grow the local smart home sector and market the interior design-focused TOLIGO smart home product line in Japan.

- February 6, 2024: Sony Semiconductor Solutions Corporation, TSMC, Toyota Motor Corporation, and DENSO Corporation announced funding into Japan Advanced Semiconductor Manufacturing, Inc.

- Report ID: 6261

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.