Security Paper Market Outlook:

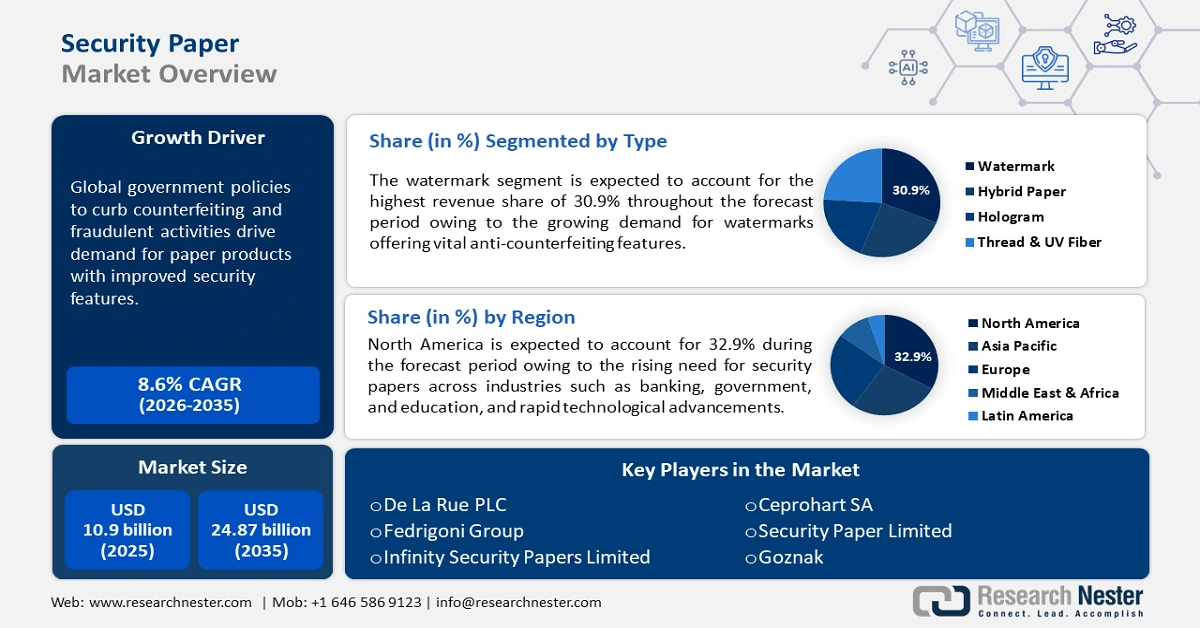

Security Paper Market size was valued at USD 10.9 billion in 2025 and is likely to cross USD 24.87 billion by 2035, expanding at more than 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of security paper is assessed at USD 11.74 billion.

Global government policies to curb counterfeiting and fraudulent activities drive demand for paper products with improved security features. Security papers with characteristics such as holograms, watermarks, and security threats are in high demand in industries dealing with legal documents, currencies, and certificates. This governmental push encourages investment in research and development of additional security features by ensuring continued market demand and innovation in security paper technology.

The industry is also being driven by the rise in tourism, raising the need for passports and visas. According to the European Travel Commission, the Middle East, Africa, and Asia Pacific are expected to see significant increases in inbound tourist visitor growth in 2021, with percentages of 6%, 5.2%, and 4.7%, respectively. This rising tourism across the globe is in turn expected to increase the sales of security papers in the coming years.

Key Security Paper Market Insights Summary:

Regional Highlights:

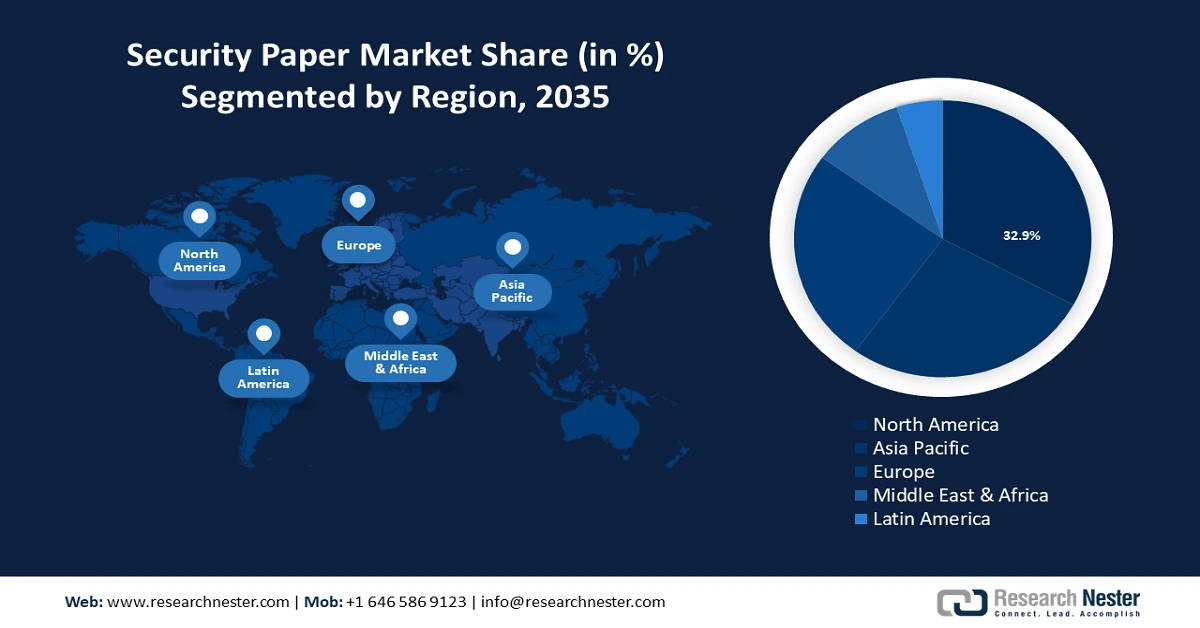

- North America holds a 32.90% share in the Security Paper Market, with increased identity theft and fraud cases increasing demand, driving sustained growth through 2035.

- The Asia Pacific region is anticipated to maintain a stable CAGR in the Security Paper Market from 2026 to 2035, driven by rising demand for security features and expanding tourism industry.

Segment Insights:

- The Currency/Bank Notes segment is projected to hold significant share by 2035, fueled by the need to combat rising counterfeit currency incidents globally.

- The Watermark segment is projected to secure a 32.3% market share by 2035, fueled by growing demand for anti-counterfeiting measures across various applications.

Key Growth Trends:

- Growing product piracy and counterfeiting

- Rising efforts to reduce the misuse of important documents

Major Challenges:

- Rising shift towards digital solutions

- High production costs and advancements in counterfeiting techniques

- Key Players: De La Rue PLC, Fedrigoni Group, Infinity Security Papers Limited, Ceprohart SA, and Drewsen Specialty Papers GmbH & Co. KG.

Global Security Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.9 billion

- 2026 Market Size: USD 11.74 billion

- Projected Market Size: USD 24.87 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 14 August, 2025

Security Paper Market Growth Drivers and Challenges:

Growth Drivers

-

Growing product piracy and counterfeiting: The usage of identity cards, passports, and certificate forgeries has increased in recent years. However, this can also result in piracy and counterfeiting of these products. The amount of counterfeit goods traded globally is massive. The unlawful global trade in items that are counterfeit or pirated reached USD 464 billion in 2019, which represents 2.5% of global trade. Furthermore, one of the main reasons for the rise in security paper in the banking industry is the increase in fraud related to financial services like bank checks and counterfeit currency notes.

-

Rising efforts to reduce the misuse of important documents: The growing use of security papers has made it possible for organizations, people, and government agencies to prevent the misuse of important documents. Additionally, manufacturers work with companies to create bespoke papers with a range of features and types, including UV fibers, thread, holograms, and watermarks. Hybrid paper is one example of technological innovations emerging as key market growth drivers. The key producers are concentrating on creating extremely secure technologies and adding them to their range of products.

Challenges

-

Rising shift towards digital solutions: The demand for secure papers in sectors is steadily shrinking as a result of the move to digital platforms for financial and interpersonal transactions, lessening the need for physical documents, especially in the developed regions.

-

High production costs and advancements in counterfeiting techniques: Security papers are expensive to produce due to the need for advanced technologies such as watermarks, holograms, and chemical treatments. This is a key factor expected to hamper overall security paper market growth during the forecast period. Moreover, counterfeit techniques are evolving which is putting continuous pressure on manufacturers to update and enhance its security features.

Security Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 10.9 billion |

|

Forecast Year Market Size (2035) |

USD 24.87 billion |

|

Regional Scope |

|

Security Paper Market Segmentation:

Type (Hybrid Paper, Watermark, Hologram, Thread & UV Fiber)

The watermark segment in the security paper market is projected to gain about 32.3% share through 2035. Security paper with watermarks offers vital anti-counterfeiting features. When paper is manufactured, it incorporates special patterns or motifs that are visible when held up to light, guaranteeing authenticity. Multi-tone and digital watermarks are examples of advanced approaches that improve security by incorporating hidden elements that can only be detected in certain situations. These techniques support document integrity by preventing unauthorized replication and protecting confidential data in areas such as money, certificates, and legal papers. Watermark technology is developing at a rapid pace to reduce global counterfeiting attempts.

Application (Currency/Bank Notes, Legal & Government, Passport & Visa, Identity Card, Certificate, Bank Documents, Medical Report & Prescription, Transportation & Logistics)

The currency/bank notes segment in the security paper market is likely to hold a significant share during the forecast period owing to the need for security papers in banks to combat the rising incidence of counterfeit money in both developed and developing nations. The rising population across the globe has led to increased currency in circulation, resulting in the need for more security papers for currencies and banknotes. Other factors such as government initiatives and regulations to reduce currency fraud, high dependency on cash in many countries, and rapid advancements in security features. In November 2021, Germany’s security paper and banknote manufacturer, Louisenthal received an International Security Award 2021 for its RollingStar Lead foil stripe for the Bank of Azerbaijan’s 50 Manat note.

Our in-depth analysis of the security paper market includes the following segments

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Security Paper Market Regional Analysis:

North America Market Analysis

North America industry is predicted to account for largest revenue share of 32.9% by 2035. These watermarks offer visual verification, which is essential for official papers, financial records, and transcripts from educational institutions. By incorporating distinct identifiers, cutting-edge methods like digital watermarks increase security even further. This guarantees adherence to strict regulatory requirements and protects against counterfeit risks that are common in the area.

The need for secured documents has grown as a result of a sharp rise in identity theft and fraud cases in the United States. The number of identity theft and fraud reports increased by 45% to 4.8 million in 2020 from 3.3 million in 2019, as reported by the Federal Trade Commission (FTC). Due to the rise in identity-related crimes, security paper is being used more often in passports, driver's licenses, and social security cards, among other identifying papers. The rapid adoption of advanced features such as RFID and biometric integration in documents, investments by government and financial institutions to update the security of physical currency and other documents are other factors expected to boost security paper market growth in the U.S.

Asia Pacific Market Analysis

Asia Pacific security paper market is expected to experience a stable CAGR during the forecast period owing to rising demand for security features such as holograms and watermarks embedded during the printing stage of banknotes, passports, and stamps and the expanding tourism industry. China, India, Japan, and South Korea are some of the largest revenue-generating countries in the Asia Pacific.

The security paper market in China is expanding rapidly, fueled by strict government laws designed to stop the sale of counterfeit goods. The demand for secure documents such as currencies, certificates, and official documents is driven by the nation's growing economy and rising administrative requirements. The market landscape is further shaped by technological developments in anti-counterfeiting features and a growing emphasis on sustainable practices. Manufacturers are concentrating on creative solutions to satisfy regulatory standards and customer expectations.

The security paper market in South Korea is growing as a result of the rising need for safe documents in both local and foreign activities. The nation's technological prowess propels innovation in features such as RFID integration and holograms that prevent counterfeiting, serving a variety of industries, including, finance, government, and education. Stricter regulatory compliance encourages the use of cutting-edge security measures to thwart fraud and identity theft.

Key Security Paper Market Players:

- Giesecke+Devrient

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- De La Rue PLC

- Fedrigoni Group

- Infinity Security Papers Limited

- Ceprohart SA

- Drewsen Specialty Papers GmbH & Co. KG

- Security Printing and Minting Corporation of India Limited

- Real Casa De La Moneda

- Security Paper Limited

- Goznak

The global security paper market is highly competitive, comprising of key players operating at global and regional levels. In order to apply cutting-edge technologies such as holograms and magnetic microwires, major market companies are putting up the necessary production infrastructure and investing heavily in R&D initiatives. Here are some leading players in the security paper market:

Recent Developments

- In November 2023, De La Rue partnered with C3i Europe to combine digital and physical security solutions through the integration of PURETM, IZON, and Traceology technologies. Through strong measures against counterfeiting and maintaining brand integrity across international marketplaces, this cooperation seeks to boost brand protection tactics.

- In July 2022, Giesecke+Devrient (G+D) announced the acquisition of Valid USA's payment and identification solutions division to boost growth in the US, one of the biggest payment and identification markets in the world.

- Report ID: 6553

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Security Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.