Packaging Automation Market Outlook:

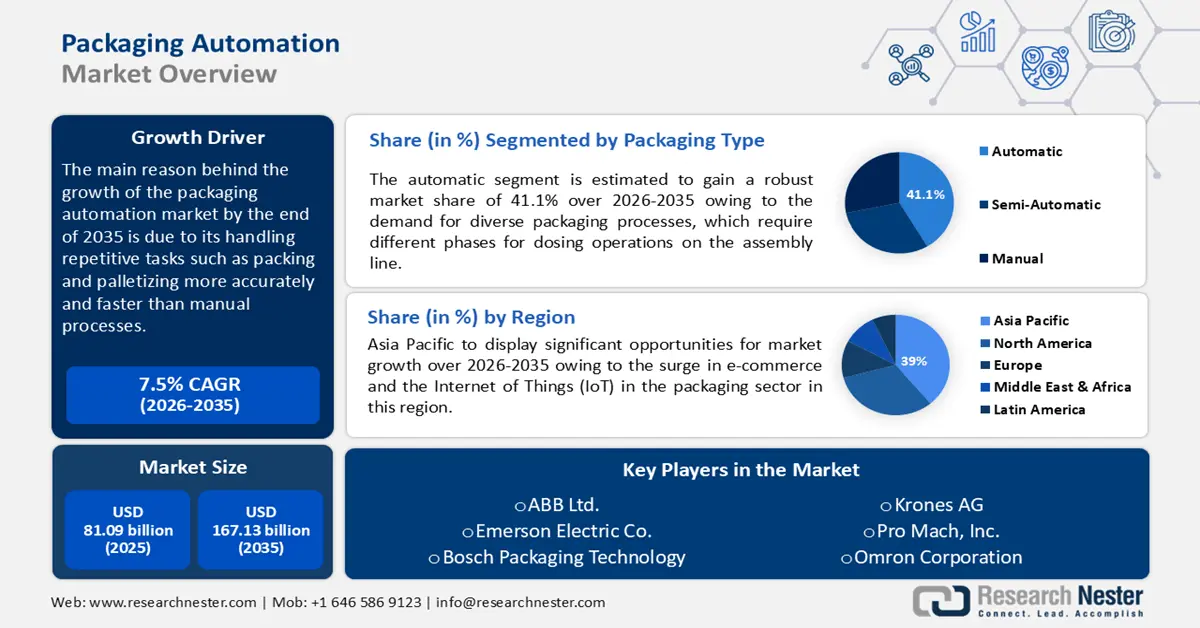

Packaging Automation Market size was valued at USD 81.09 billion in 2025 and is expected to reach USD 167.13 billion by 2035, registering around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of packaging automation is evaluated at USD 86.56 billion.

The demand for automated packaging is fostered predominantly by the boom in e-commerce. According to the International Trade Administration 2023, the global e-commerce market size is expected to surpass USD 5.5 trillion by 2027 with a growth rate of 14.4%.

Every level of the e-commerce process pipeline, including primary and secondary packing, labeling, and product tagging and marking offers a scope for packaging automation market adoption. The suppliers and manufacturers supporting industrial automation are loosening their grip on traditional assembly lines and embracing software subscription-based product packaging models. Products are becoming more personalized for end users, and companies are branching into new arenas of technology. Repetitive and challenging tasks in warehousing are becoming strategic points of the fulfillment process, where the adoption of automation is eliminating monotonous, tactical, and ergonomically harmful activities.

Key Packaging Automation Market Insights Summary:

Regional Highlights:

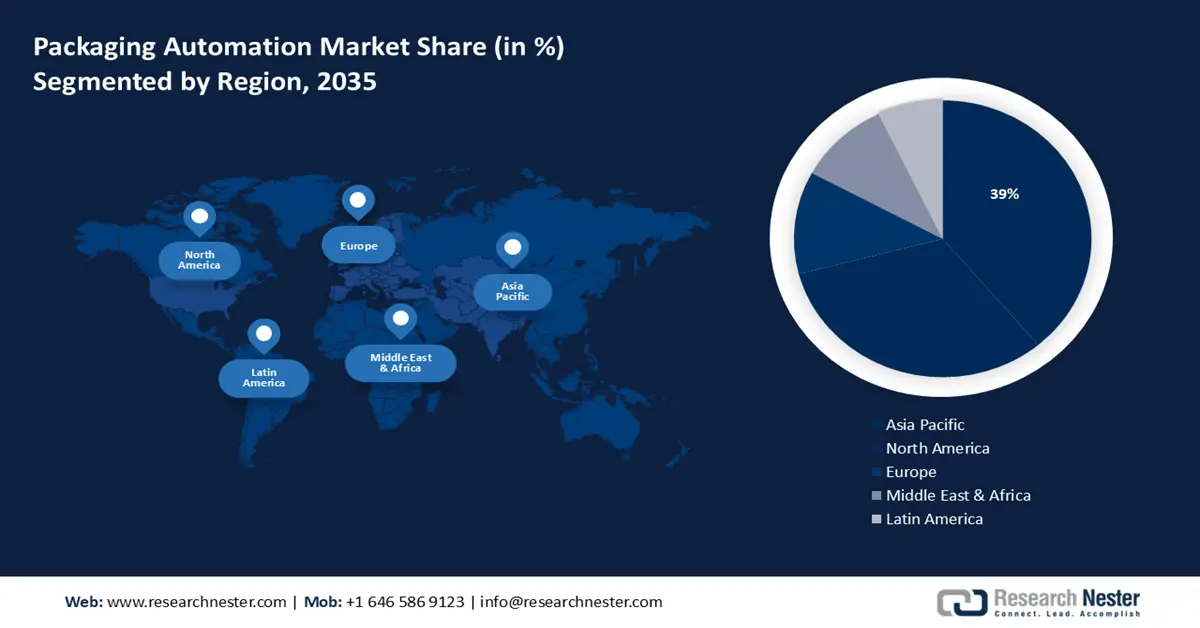

- The Asia Pacific packaging automation market will secure over 39% share by 2035, driven by a surge in e-commerce and IoT adoption in the packaging sector.

- The North America market will register substantial growth during the forecast timeline, driven by increasing penetration of automation in multiple industries such as cosmetics, pharmaceuticals, and food & beverages.

Segment Insights:

- Automatic segment in the packaging automation market is projected to achieve 41.10% growth by the forecast year 2035, driven by the demand for diverse packaging processes requiring different dosing operations on assembly lines.

Key Growth Trends:

- Optimizing CapEx using end-of-line packaging automation

- Demand for green warehousing and sustainability

Major Challenges:

- High maintenance cost

Key Players: Kirin Holdings, Videojet, Schneider Electric SE, Rockwell Automation, Inc., ABB Ltd., Emerson Electric Co., Bosch Packaging Technology, Krones AG, Pro Mach, Inc. Omron Corporation.

Global Packaging Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 81.09 billion

- 2026 Market Size: USD 86.56 billion

- Projected Market Size: USD 167.13 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, Malaysia, Vietnam

Last updated on : 17 September, 2025

Packaging Automation Market Growth Drivers and Challenges:

Growth Drivers

- Optimizing CapEx using end-of-line packaging automation: Companies have been emphasizing on improving intralogistics, primarily the automation of picking and sortation activities. This has provided an impetus to the throughput by saving labor costs and time. However, for optimal operations of assembly lines and logistic chains, end-of-line has emerged as a key focus area for companies. Packaging automation in end-of-line operations creates a pathway to optimal capital expenditures and an opportunity for return on investment (ROI) in periods that are shorter than those of popular automation investments, including picking and sorting. End-of-line packaging automation plays a significant role in intralogistics comprising of palletizing, loading, and shipping. It prevents bottlenecks by limiting the accumulation of goods at pack stations more than packers can reasonably handle.

Box sealing and automated height-reduction avoid wastage of packaging materials, thereby, saving logistic costs. End-of-line automation has cascading benefits and potentially improves CapEx through efficiencies in packaging, labor, material, throughput, and shipping costs, thus paving a path for scalability, sustainability, and ROI. Key players have identified this trend and have significantly fueled their expenditure in mergers and acquisitions. For instance, in June 2024, Pacteon Group acquired Descon Integrated Conveyor Solutions, an integrated conveyor systems provider for the food and beverage sector. This is expected to strengthen Pacteon’s end-of-line packaging automation equipment portfolio, while Descon will leverage the combined strengths to maintain its brand identity. - Demand for green warehousing and sustainability: Warehousing costs energy and hefty resources. Climate control, lighting, and other operations are all part of the equation that add up to total resource usage. Most of the packaging companies are striving to save on the bottom line and reduce ecological footprints, which makes green logistics an indispensable part of their sustainability strategy. Storage, retrieval, production, packaging, shipping, palletizing, and last-mile delivery are key components of green warehousing and logistics. In large assembly lines, complex tasks such as picking and placing have become partially or fully automated owing to breakthroughs in machine learning and computer vision.

The advent of Industry 4.0 has led to the newer use cases of these technologies and a positive impact on the environmental carbon footprint. For example, fitting packaging robotization in the circular economy by applying automated volume reduction, large volumes of packages can be accommodated in pallets has reduced carbon footprint. The UN Sustainable Development Guidelines (SDGs) outline ESG strategies and provide necessary policies to regulate the packaging automation market. This has fostered the innovation of flexible automation solutions for logistics companies. In 2023, Falcon Plastics announced their R&D efforts to develop a Universal Robot UR10e, end-of-arm tooling, and auxiliary equipment for auto bagging.

FalconPlastics aims to automate repetitive tasks such as bagging and heat sealing. The collaborative robot and automatic bagging machine are estimated to accomplish a low footprint. The automation has showcased promising results by improving packaging efficiency from 35% to 77% and reduced production run time from 200 to 80 days. Similar ongoing innovations is anticipated to diversify collaborative application of the packaging automation market.

Challenge

- High maintenance cost: The cost of equipment will substantially increase as a result of the integration of cutting-edge technologies and the hiring of skilled labor. Furthermore, because these machines are used continuously and regularly, proper and periodic maintenance may be required, which could result in extra costs. Additionally, the implementation of more stringent government laws about worker safety when utilizing automated packaging solutions may also impede the uptake of the product.

Packaging Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 81.09 billion |

|

Forecast Year Market Size (2035) |

USD 167.13 billion |

|

Regional Scope |

|

Packaging Automation Market Segmentation:

Packaging Type Segment Analysis

Automatic segment is set to dominate around 41.1% packaging automation market share by the end of 2035. The segment growth is augmented by the demand for diverse packaging processes, which require different phases for dosing operations on the assembly line. A report published in 2024 estimated that automation might fuel the growth of productivity worldwide by 0.8-1.4% per year. At least one function is fully automated in 31% of businesses. Automation is used by 76% to standardize daily processes, 58% to report data, and 36% to comply with regulations.

End user Segment Analysis

The food & beverages segment in the packaging automation market is expected to be the fastest-growing, with a size of about USD 7.2 trillion in 2023 attributed to the boosting demand for food packaging equipment, that can do tasks such as stuffing, sealing, wrapping, and scripting, while ensuring durability. Increasing demand for on-the-go food such as soft drinks globally will act as a growing factor for this sector. Additionally, packaging automation is also used by soft drink manufacturers for packaging and brand enhancement, to ensure superior printing quality. This makes products stand out on the packaging automation market and improves their shelf appeal. This will also increase the demand for beverage packaging market in the forecast years.

Our in-depth analysis of the packaging automation market includes the following segments:

|

Product Type |

|

|

Packaging Type |

|

|

End user |

|

|

Automation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Packaging Automation Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 39% by 2035. The growth in the region is credited to the surge in e-commerce and the Internet of Things (IoT) in the packaging sector in the region. International Trade Administration in 2024 predicted that APAC will dominate the B2B market with a revenue share of 80% by 2026.

Consumer spending in China has shown a tremendous increase along with fueled packaging requirements, this is propelled to be a growing factor for the packaging automation industry in this country. A report by The State Council of China in January 2024, estimated that the final consumption expenditure contributed 82.5% of China's economic growth annually, up 43.1% between 2022 and 2024.

There has been an increasing consumption of retail foods in Japan. USDA Foreign Agricultural Service in 2023 predicted that the sales of retail food and beverages in 2022 would be USD 327 billion. This will act as a growing factor for the fast food market value in the coming years.

North America Market Insights

North America region is projected to register substantial growth through 2035 owing to the increasing penetration of automation in several industries such as cosmetics, pharmaceuticals, food and beverages, and many more. A recent report by Research Nester in 2024 estimated that 94% of businesses carry out time-consuming, repetitive tasks. 66% of knowledge workers report higher productivity led by automation.

The United States has shown a reduction in skilled labor availability in various industries, which demands automation in this country. According to the U.S. Chamber of Commerce, the participation of the labor force decreased by approximately 1% to 62.7% from 2020 to 2024.

Canada improved their packaging materials which can be recycled and sustainable. According to the Canada Plastic Pact (CPP) 2024, the plastic packaging recycling rate increased to 20% in 2022 from 12% in 2019.

Packaging Automation Market Players:

- Kirin Holdings

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Videojet

- Schneider Electric SE

- Rockwell Automation, Inc.

- ABB Ltd.

- Emerson Electric Co.

- Bosch Packaging Technology

- Krones AG

- Pro Mach, Inc.

- Omron Corporation

Predictive maintenance using AI is anticipated as the future of the packaging industry. AI-based sensors for real-time monitoring of assembly lines, packaging, and logistics, AI-powered route-optimization algorithms, and overall improvements in equipment effectiveness (OEE) are likely to emerge as the next big trends. The market players are increasing their investments in predictive maintenance to gain a competitive edge and strengthen their position in the global packaging automation market.

Recent Developments

- In March 2024, to ensure secure warehouse management, minimize errors, and streamline operations, Videojet introduced its 9560 PL pallet labeling system. The system can process 120 pallets per hour and cover up to three pallet sides.

- In February 2024, Kirin Holdings-owned Bell's Brewery in the United States is investing over $2 million in packaging automation to boost variety pack production.

- Report ID: 6343

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Packaging Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.