Non Invasive Prenatal Testing Market Outlook:

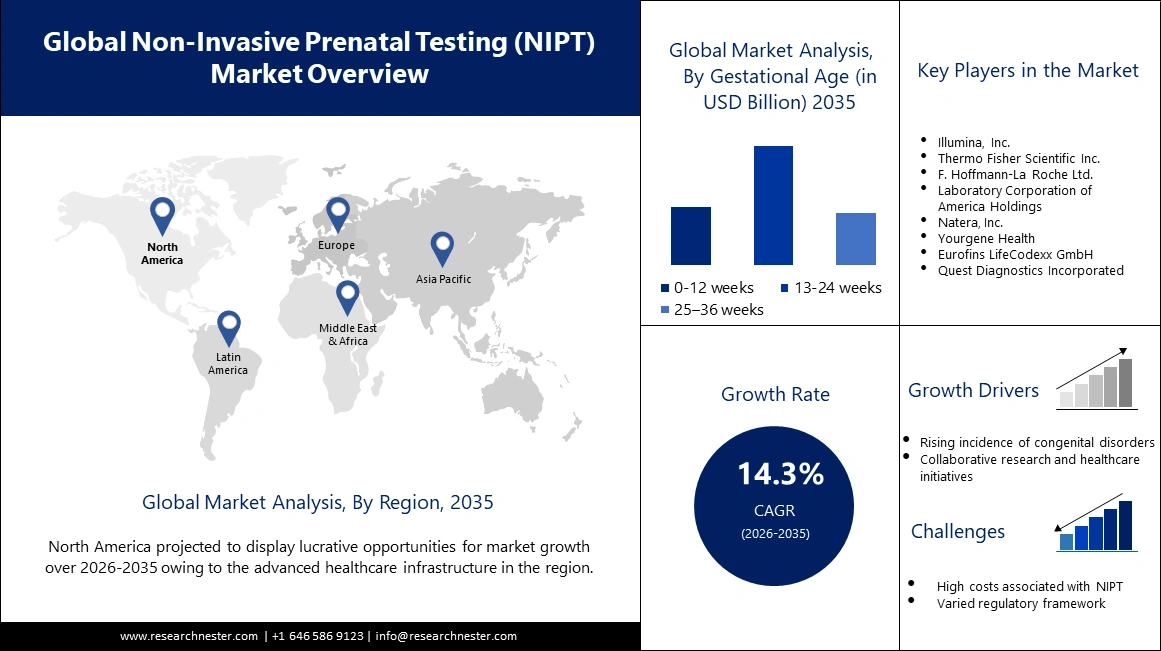

Non Invasive Prenatal Testing Market size was valued at USD 7.24 billion in 2025 and is set to exceed USD 27.56 billion by 2035, registering over 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non invasive prenatal testing is estimated at USD 8.17 billion.

This non invasive prenatal testing (NIPT) market growth can be attributed to the rise in maternal age, an increase in awareness of genetic disorders, and technological advancements in genomic sequencing. Individuals are looking forward to safer, accurate ways due to which NIPT emerged as a favored choice over the earlier risky invasive detection techniques. Major companies in the NIPT sector are displaying active investments in research and development activities for further improvement in their test capacities and geographic expansion.

One of the most recent advances taken place in the industry is from Invitae Corporation, an announcement in March 2024 stating that its new platform for NIPT, developed to present exhaustive coverage of rare genetic conditions, is expected to have greater accuracy for detecting common trisomy. This is another notable factor that companies are working to be competitive to continue to change to meet the needs of health providers, together with their patients.

The government and other regulatory bodies are also playing their role in boosting the NIPT market growth. There have been updates in the prenatal screening guidelines by many countries. This first-line option of screening is essential for envisaging high-risk pregnancies. For example, the UK National Health Service has been gradually introducing NIPT into its prenatal screening program. This is probably driven by growing attitudes toward NIPT; as per statistics from NHS, in 2023, around 65% of the eligible pregnant population in England had undergone NIPT testing. Moreover, increasing government initiatives to raise awareness about genetic disorders and improvement in access to prenatal care are further expected to drive the non invasive prenatal testing market in the upcoming years.

Key Non Invasive Prenatal Testing (NIPT) Market Insights Summary:

Regional Highlights:

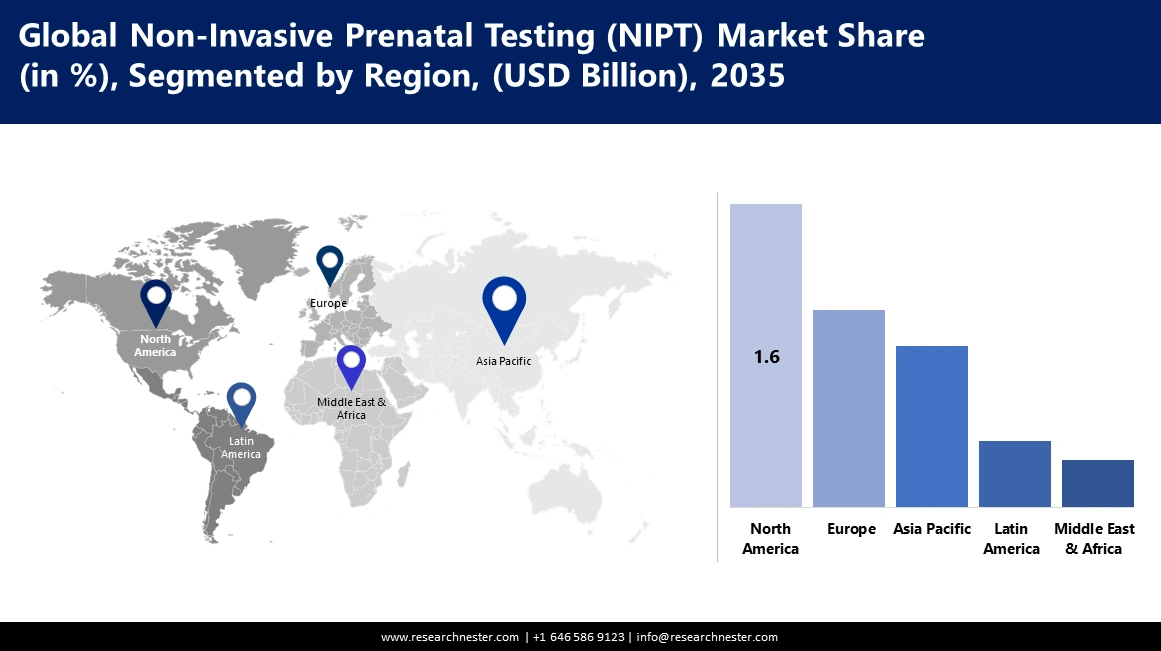

- The North America non invasive prenatal testing (NIPT) market will account for 37.30% share by 2035, driven by superior healthcare infrastructure, awareness, and good reimbursement policies.

Segment Insights:

- The 13-24 weeks segment in the non invasive prenatal testing market is projected to capture a 51.40% share by 2035, driven by the optimal detection window in the second trimester combined with other prenatal tests.

- The maternal cell-free dna segment in the non invasive prenatal testing market is expected to achieve lucrative growth till 2035, driven by technological advancements and improving reimbursement scenarios increasing accessibility.

Key Growth Trends:

- Increasing demand for non-invasive prenatal testing (NIPT)

- Rising incidence of congenital disorders

Major Challenges:

- Increasing demand for non-invasive prenatal testing (NIPT)

- Rising incidence of congenital disorders

Key Players: Illumina, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, and Natera, Inc.

Global Non Invasive Prenatal Testing (NIPT) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.24 billion

- 2026 Market Size: USD 8.17 billion

- Projected Market Size: USD 27.56 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Non Invasive Prenatal Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for non-invasive prenatal testing (NIPT)- The popularity of non-invasive prenatal testing is witnessing an uptick through collaborative research and strategic public-private partnerships. Initiatives that incorporate NIPT into healthcare programs at the national level have acted in recognition of its potential to revolutionize prenatal care. As per National Institute of Health (NIH), NIPT will be much safer compared to the invasive diagnostic procedures of chorionic villus sampling and amniocentesis, which includes a small but significant miscarriage risk (0.1–0.2%). According to the International Society for Prenatal Diagnosis, the NIPT uptake significantly increases, reaching more than 85% among pregnant women in some developed countries by 2023.

- Rising incidence of congenital disorders- Congenital disorders are among the major global health problems. According to the World Health Organization, in 2023, an estimated 265,000 newborn babies died during the neonatal period resulting from congenital anomalies. Congenital anomalies are disproportionately prevalent in low- and middle-income countries, with some studies estimating that up to 95% of cases of severe congenital disorders occur in these countries. This perhaps might result from unavailable health resources or prenatal screening.

In 2020, a report by the NLM indicated an 8% increase in the global burden of congenital disorders since 2010. This growing need for accessible and accurate prenatal testing methods is expected to boost non invasive prenatal testing market growth in developing economies.

Challenges

-

High cost of non-invasive prenatal testing (NIPT)- The high cost of non-invasive prenatal testing (NIPT) remains a significant barrier to widespread adoption, particularly in developing countries. Despite technological advancements, the financial burden of these tests continues to limit accessibility for many expectant parents.

An article published in the American Journal of Obstetrics and Gynecology shows that these out-of-pocket costs of NIPT vary from USD 100 at the lowest quote, ranging up to as high as USD 2,000 under various insurance coverage and provider policies within the United States itself. As a result, the price variability creates inequities in access and influences some major decisions with wide implications for prenatal care. - Regulatory landscape and health considerations- The regulatory framework for NIPT varies hugely across different countries or regions. On one hand, a strict and regulated environment is conducive to ensuring the quality of testing and patient safety; on the other hand, it definitely will bring challenges to the access to the non invasive prenatal testing market and the innovation speed. For example, the FDA established in late 2022 a risk-based framework with which to regulate NIPT in a way that could simplify premarket reviews but also uphold their excellent standards. As a consequence, the implementation of the In Vitro Diagnostic Regulation (IVDR) in Europe has led to an escalation in the requirements for the validation of NIPT-market surveillance.

Non Invasive Prenatal Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 7.24 billion |

|

Forecast Year Market Size (2035) |

USD 27.56 billion |

|

Regional Scope |

|

Non Invasive Prenatal Testing Market Segmentation:

Gestational Age Segment Analysis

13-24 weeks segment is poised to account for non invasive prenatal testing market share of more than 51.4% by the end of 2035. The segment is leading as detection in the second trimester provides an optimal window between detection and test accuracy. This timeframe is also easily combined with other crucial prenatal screening tests, such as ultrasound and serum screening for alpha-fetoprotein.

A recent development related to this was by Illumina, Inc. in January 2024 when they launched VeriSeq NIPT Solution v2. This new solution enables the test to detect partial deletions and duplications of all chromosomes with the test, greatly enhancing its power to recognize a wider range of genetic anomalies during these critical weeks from 13-24.

Method Segment Analysis

The maternal cell-free DNA segment in non invasive prenatal testing market is projected to grow at lucrative CAGR through 2035. The growth of the segment is propelled by technological advancements that extend the testing capabilities to whole genome sequencing for the detection of microdeletions and sex chromosomal abnormalities. Increasing product launches and improving reimbursement scenarios also contribute to NIPT market growth and both, directly and indirectly make these tests accessible to a larger population.

As per a report from the National Institutes of Health in August 2023, the adoption rate for cfDNA-based NIPT is over 75% among pregnant women in high-income countries. This represents an increase of 15% from that reported in 2022 and outlines the acceptance and integration of NIPT into standard prenatal care protocols. To tap into the opportunity, companies are launching various innovative tests.

For example, in March 2024, Roche announced the launch of its HARMONY prenatal test with expanded capabilities. Innovations like these from companies enable extra rare chromosomal conditions, allowing more inclusively rounded insight into fetal health during pregnancy.

Our in-depth analysis of the global non invasive prenatal testing market includes the following segments:

|

Gestational Age |

|

|

Pregnancy Risk |

|

|

Method |

|

|

Technology |

|

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non Invasive Prenatal Testing Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 37.3% by 2035.The reasons behind this growth are superior, more developed healthcare infrastructure, better awareness about advanced techniques in medications, and good reimbursement policies. Moreover, increasing maternal age, better acceptance of prenatal screening methods, and continuous technological innovations will boost the market expansion.

The United States non invasive prenatal testing market is anticipated to grow at substantial CAGR till 2035. Market growth is further fueled by guidelines from organizations such as the American College of Obstetricians and Gynecologists, which recommended NIPT for all pregnancies in 2023—expanding its base of users for NIPT services. Better insurance coverage also drives higher accessibility: the report indicates over 70% of private insurance plans now cover NIPT, up from 55% in 2021. There is an increase in competition and innovations in the market, with companies designing AI-driven NIPT platforms in 2024 that give higher accuracy and faster results.

The NIPT market in Canada is set to register healthy growth during the forecast period, driven by integration within provincial healthcare systems. The market also trends toward localized testing, reducing reliance on U.S. labs. To fill the demand gap, companies are expanding their roots to Canada via mergers and acquisitions.

For example, in July 2024, Quest Diagnostics announced a definitive agreement to acquire LifeLabs, a trusted provider of community laboratory tests for millions of Canadians. The acquisition is valued at approximately CAD 1.35 billion, including net debt. This development not only enhances accessibility to NIPT testing but also supports the development of local expertise and infrastructure for advanced prenatal diagnostics in Canada.

APAC Market Insights

Asia Pacific non invasive prenatal testing market size is poised to grow significantly through 2035. This expansion is driven by the increasing maternal age across the region, leading to a higher incidence of chromosomal aneuploidies in infants.

Furthermore, improved and developed healthcare infrastructure also acts as a driver to access such advanced prenatal screening techniques for Asia Pacific. A key development that supports this trend is the increasing collaboration among regional and global players in the NIPT space. For instance, in October 2023, BGI Genomics partnered with one of the major healthcare providers in Singapore to establish a NIPT laboratory, further fanning growth demand in Southeast Asia.

China offers the highest market potential, driven by its large population and rapidly improving healthcare sector. The cultural emphasis on prenatal care, coupled with investment that it is funneling into biotechnology, creates fertile ground for the NIPT market to grow.

India’s non-invasive prenatal testing (NIPT) industry is driven by various social, economic, and technological factors. With the increase in DISC (Double Income, Single Child) families in urban areas, people have increased investments in prenatal care. This is likely to boost the adoption of advanced screening methods like NIPT, calling investments from companies.

For instance, in August 2022, Bengaluru-based genetic diagnostics company MedGenome raised USD 50 million for a minority stake led by Novo Holdings. This followed a round led by LeapFrog Investments and Sofina. Further, the market is being further witnessing a rise in adoption of vitro fertilization techniques, thereby fueling the demand for comprehensive prenatal testing.

Non Invasive Prenatal Testing Market Players:

- Centogene N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CRIFM Prenatal Medical Clinic

- Eurofins LifeCodexx GmbH

- MedGenome Labs Ltd.

- NIPT Hiro Clinic

- FALCO biosystems Ltd.

- Biora Therapeutics,Inc.(Progenity,Inc.)

- F. Hoffmann-La Roche Ltd.

- Illumina Inc.

- Laboratory Corporation of America Holdings.

- Natera Inc.

- Myriad Women’s Health, Inc.

- QIAGEN

- Quest Diagnostics

- CooperSurgical, Inc.

The competitive outlook for the NIPT market is marked by rapid innovation and strategic collaborations aimed at enhancing testing capabilities and market reach. Key players like Natera, Illumina, and Roche are leading the charge, developing advanced technologies that offer greater accuracy and a broader range of genetic screenings.

Companies are now working toward enhancing accessibility for the end user and integrating Non-Invasive Prenatal Testing (NIPT) into routine prenatal care as consumer demand for comprehensive prenatal testing increases in the competitive market. Here is a list of key players operating in the global market:

Recent Developments

- In September 2023, Yourgene Health plc launched the Yourgene MagBench Automated DNA Extraction Instrument and Kit. Available in Asia Pacific and the Middle East, this cost-effective solution enhances cell-free DNA extraction for Yourgene’s Sage 32 NIPT Workflow. It allows clinical labs to deliver efficient and precise non-invasive prenatal testing (NIPT) services.

- In April 2023, CANTOGENE launched CentoGenome, a comprehensive Whole Genome Sequencing tool for the diagnosis of Rare and Neurodegenerative Diseases such as spinal muscular atrophy, Gaucher disease, and susceptibility to Parkinson's disease.

- In August 2022, at the Canaccord Genuity 42nd Annual Growth Conference in Boston, Natera, Inc. announced it had initiated the FDA pre-submission process for its Panorama non-invasive prenatal test (NIPT) through the Q-Sub process.

- In May 2022, General Electric Company, GE Healthcare, invested approximately USD 50 million in an Israeli startup called Pulsenmore. Pulsenmore is enabling expecting parents to trace their pregnancy at home by self-scan.

- Report ID: 6309

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non Invasive Prenatal Testing (NIPT) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.