Home Appliances Market Outlook:

Home Appliances Market size was over USD 600.3 billion in 2025 and is anticipated to cross USD 1.03 trillion by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of home appliances is assessed at USD 630.01 billion.

This boost is anticipated by the slated demand for affordability, and the growth in the economic conditions, along with the continuously changing consumer lifestyle acts as a major growth driver for the rise in the appliances rental market share. According to a report by the World Economic Outlook in 2023, global growth is projected to fall to 2.9% in 2023 from 3.4 % in 2022 but is estimated to rise to 3.1% in 2024.

Key Household Appliances Market Insights Summary:

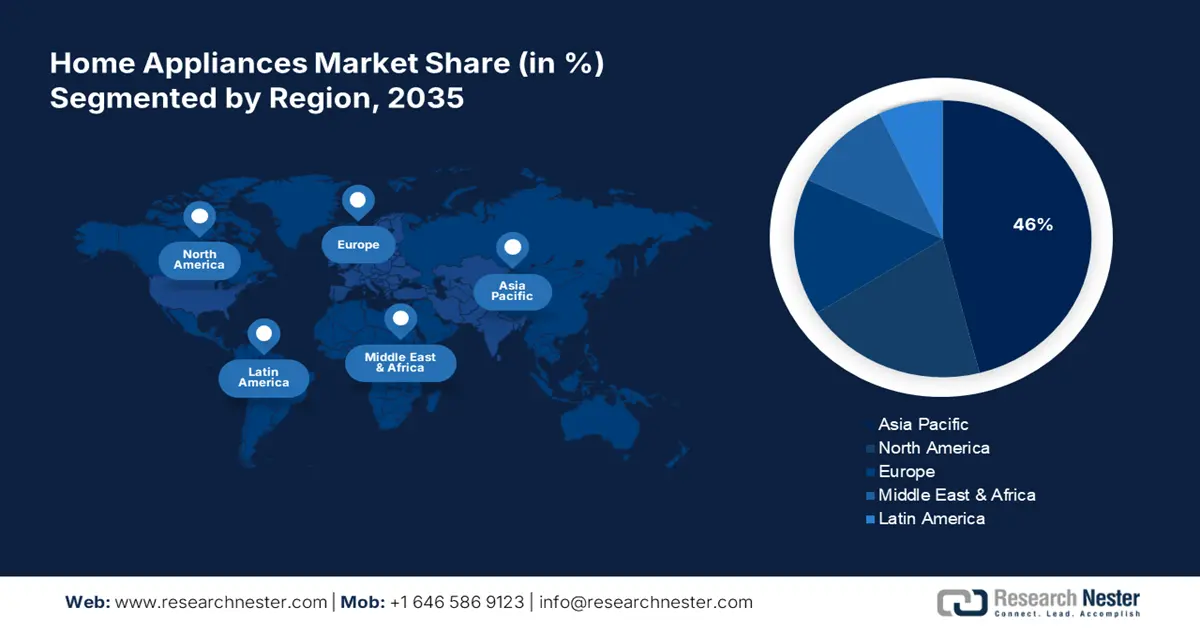

Regional Highlights:

- Asia Pacific home appliances market is expected to capture 46% share by 2035, driven by a surge in the working population demanding convenience in their busy lifestyle.

- North America market will experience huge CAGR during 2026-2035, driven by the increasing demand for the construction sector such as residential infrastructure.

Segment Insights:

- The cooktop segment in the home appliances market is anticipated to see substantial growth over 2026-2035, driven by demand for time-saving and clean cooking appliances.

- Brick & mortar segment in the home appliances market is expected to achieve a notable CAGR by the forecast year 2035, driven by exclusive offers and the presence of major retail stores.

Key Growth Trends:

- Rising urbanization

- Growth in environmental awareness

Major Challenges:

- Increasing number of accidents

- Shortage of raw materials

Key Players: Panasonic, Sharp Corporation, Samsung Electronics Co., Ltd., Midea Group Co., Ltd., LG Electronics Inc., Qingdao Haier Co., Ltd., AB Electrolux, Robert Bosch GmbH, Haier.

Global Household Appliances Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 600.3 billion

- 2026 Market Size: USD 630.01 billion

- Projected Market Size: USD 1.03 trillion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Home Appliances Market Growth Drivers and Challenges:

Growth Drivers

- Rising urbanization - With the lucrative global population along with the boosting economies, there is also a significant increase in urbanization, which boosts the demand for home appliances. According to a report by Our World Data in 2024, more than 4 billion people live in urban areas and the rates of urbanization have been increasing rapidly across all regions, as of 1800 less than 10% of people used to live in urban areas, impelled by which urbanization is expected to fuel incomes and is expected to shift away from the employment in agriculture.

- Growth in environmental awareness - As environmental concerns grow, so does the demand for sustainable practices, including the preference for appliances that are eco-friendly and energy-efficient. This is because appliance services reduce the use of resources and energy while providing access.

In addition, the adoption of appliance rental services is being driven by the growing awareness and promotion of environmental sustainability. According to a report by UNICEF in 2022, it showed that more than 73% of citizens are concerned about climate change and its negative impact on children's lives. - Increase in disposable income - The home appliances market grows as consumer buying power and disposable income rise. Consumers with higher income levels can now afford to buy bigger items that they may have put off because of budgetary concerns, like major equipment like refrigerators, washing machines, and dishwashers while having appliances rental option in their mind.

Furthermore, when disposable income rises, people tend to enhance their lifestyles and purchase more sophisticated or feature-rich appliances that provide convenience, energy efficiency, or smart capabilities. According to OCED, the average net wealth is estimated at USD 323,960, of which USD 30,490 is the net adjusted disposable income of an average in a year.

Challenges

- Increasing number of accidents - Gas and electricity are frequently used to power home appliances. In low- and middle-income countries, many devices are useless when they are fueled and energy is scarce while infrastructure is insufficient. Moreover, this can also cause dangerous radiation from these appliances, and short circuits as such devices run on electricity and have come to light. Smart appliance technical issues also cause emotional issues for customers as well. These could have terrible effects, such as fire, property loss, and harm to people. Consequently, worries over home appliance safety will hinder the industry's expansion.

- Shortage of raw materials - Shortages of raw materials can seriously hurt the home appliance sector in several ways. First, shortages or interruptions in the flow of essential resources, such as metals, polymers, and electronic components, can cause production delays and raise manufacturing costs for companies that make appliances. This might lead to decreased affordability and higher prices for customers, stifling demand.

Home Appliances Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 600.3 billion |

|

Forecast Year Market Size (2035) |

USD 1.03 trillion |

|

Regional Scope |

|

Home Appliances Market Segmentation:

Product

Cooktop segment is likely to account for around 31% home appliances market share by 2035 driven by the increasing demand for kitchen appliances for saving efforts, and time, and the need for clean cooking. According to a report by the International Energy Agency in 2023, it is estimated that due to a lack of clean cooking, more than 3.7 billion premature deaths occur annually, where children and women are at the highest risk.

Moreover, there is an increase in disposable income for improving the living standards which acts as a growth driver got the growth of the home appliances revenue globally. In addition, the constantly changing consumer behavior and higher convenience and flexibility. These appliances have low and sometimes no service and maintenance costs which also acts as a surge in the second hand small domestic appliances market demand while making them highly affordable.

Distribution Channel

The bricks & mortar segment in home appliances market is set to garner a notable CAGR and is likely to remain the second largest segment in the distribution channel of the home appliances landscape led by exclusive offers such as discounts and after-sale services, and the presence of several type stores that provide mortar and bricks such as Walmart, Target, and many more. According to a report in 2023, about 46% of retailers in North America have achieved double-digit revenue growth in 2021.

Additionally, there is a surge in the penetration of the internet and target marketing for promoting their companies and products due to which e-commerce is also in demand owing to digitization globally.

Our in-depth analysis of the home appliances market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Appliances Market Regional Analysis:

APAC Market Insights

Asia Pacific in home appliances market is anticipated to capture over 46% revenue share by 2035. The landscape's tremendous growth in the region is expected credited to the surge in the working population as they demand convenience in their busy lifestyle.

According to a report by the UN ESCAP in 2023, the working population in APAC has increased 4 times to 3.2 billion from 1950 to 2022.

China's ever-growing technologically advanced appliances and smart devices that are energy-efficient and increase in urbanization are expected to fuel the revenue share. According to a report in 2021, the spending on IT increased by 9.3%, it is projected that by 2035 the urbanization rate of China will cross 78%, estimated to be 66% in 2023.

There is a surge in the middle-income population in Japan for energy-efficient appliances in this region. According to a report in 2024, more than 6% of household are projected to earn less than 1 million Japanese yen.

North America Market Insights

The North American region will also encounter a huge influence on the home appliances market value during the forecast period and will account for the second position attributed to the increasing demand for the construction sector such as residential infrastructural.

In the United States, the growth in infrastructure projects, commercial structures, housing complexes, and many more is expected to grow the demand for the home appliances sector. According to the U.S. Department of Treasury, as the income increases, it is expected that there will be more infrastructure per capita investments as compared to lower-income states.

There is a growth in e-commerce for appliances such as smartphones, and tablets in Canada. According to a report in 2024, there has been an increase of about 1.1% in the e-commerce sector in Canada and 48% by 2028.

Home Appliances Market Players:

- Whirlpool

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Panasonic

- Sharp Corporation

- Samsung Electronics Co., Ltd.

- Midea Group Co., Ltd.

- LG Electronics Inc.

- Qingdao Haier Co., Ltd.

- AB Electrolux

- Robert Bosch GmbH

- Haier

The home appliances market size expansion is predicted that the top five companies would occupy about 21%. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Whirlpool- along with HelloFresh a meal kit company, and Total Quality Logistics (TQL) a logistics firm, expands its Feel-Good Fridge Program to provide refurbished refrigerators to food pantries and NGOs across the country.

- Panasonic- introduces Kid Witness News, a program that aims to raise awareness around United Nations Sustainable Development Goals by upskilling youth with digital storytelling and creating change advocates.

- Report ID: 6139

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Household Appliances Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.