Medication Management System Market Outlook:

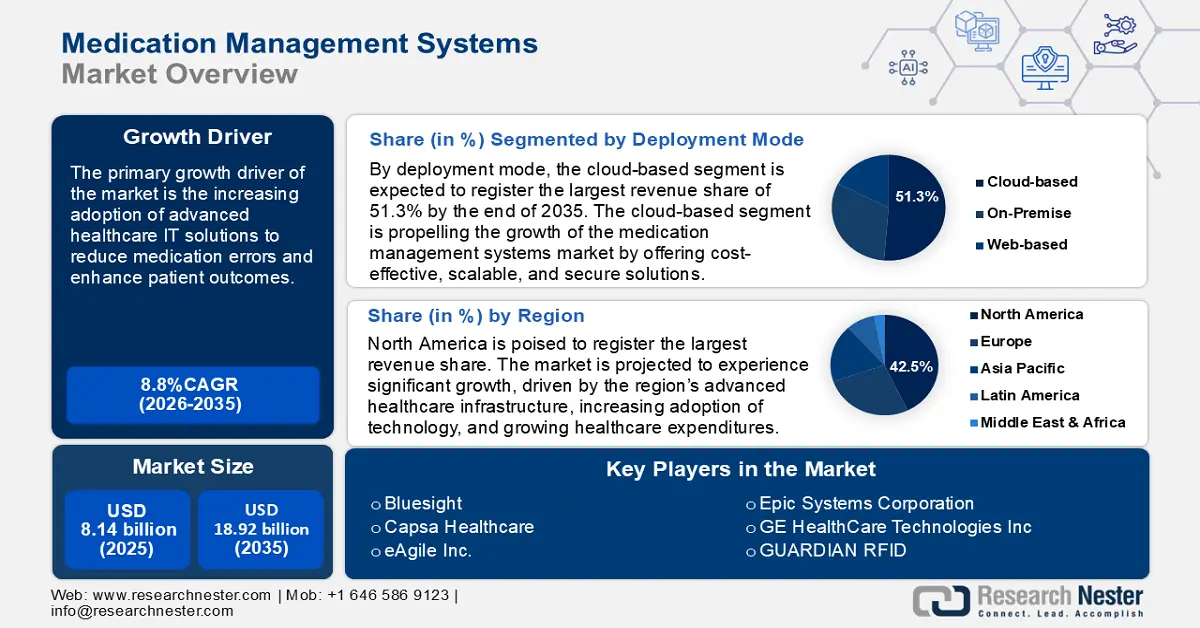

Medication Management System Market size was over USD 8.14 billion in 2025 and is poised to exceed USD 18.92 billion by 2035, witnessing over 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medication management system is evaluated at USD 8.78 billion.

The primary growth driver of the medication management system market is the increasing adoption of advanced healthcare IT solutions to reduce medication errors and enhance patient outcomes. According to the World Health Organization (WHO), medication errors cost the global healthcare system approximately USD 42 billion annually. Factors such as rising healthcare expenditure, a growing burden of chronic diseases, and the need for efficient medication administration are fueling demand for medication management system.

Key technologies such as Clinical Decision Support Systems (CDSS) and automated dispensing solutions play a significant role by ensuring accurate dosages, reducing drug interactions, and optimizing clinical workflows. Additionally, the shift toward cloud-based systems enhances data security, accessibility, and interoperability, making them highly desirable across healthcare settings.

Key Medication Management System Market Insights Summary:

Regional Highlights:

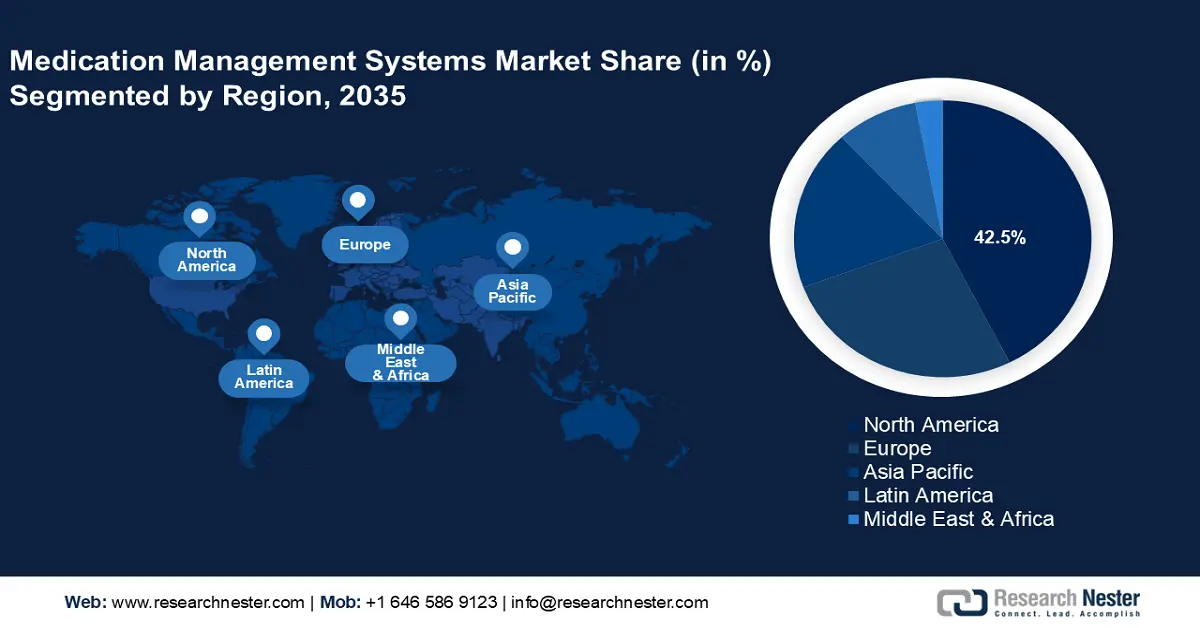

- North America holds a 42.50% share in the Medication Management System Market, propelled by advanced healthcare infrastructure, increasing technology adoption, and healthcare expenditures, ensuring strong growth through 2035.

Segment Insights:

- The Clinical Decision Support System segment is projected to hold around 27.5% market share by 2035, fueled by enhanced patient safety and clinical outcomes.

- Cloud-based deployment segment is anticipated to secure over 51.3% share by 2035, driven by its cost-effective and scalable infrastructure.

Key Growth Trends:

- Rising healthcare costs and focus on efficiency

- Prevalence of chronic diseases

Major Challenges:

- High implementation costs

- Limited awareness and skilled workforce

- Key Players: Bluesight, Capsa Healthcare, eAgile Inc., Epic Systems Corporation, GE HealthCare Technologies Inc., GUARDIAN RFID.

Global Medication Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.14 billion

- 2026 Market Size: USD 8.78 billion

- Projected Market Size: USD 18.92 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 14 August, 2025

Medication Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Rising healthcare costs and focus on efficiency: Global healthcare spending in 2021, reached a staggering USD 9.8 trillion according to the World Economic Forum. Escalating healthcare expenditure thus, creates a need for cost-effective solutions to manage resources more efficiently. Hospitals and healthcare providers are investing heavily in medication management system to reduce waste, avoid costly medication errors, and optimize workflows.

Automation in medical management systems is transforming healthcare by enhancing operational efficiency, reducing costs, and improving patient outcomes. Automated systems centralize tasks such as prescription verification, inventory management, and dose administration. This integration minimizes the need for manual interventions, freeing up healthcare professionals to focus on patient care. - Prevalence of chronic diseases: The prevalence of chronic diseases is a significant driver of the medication management system market as these conditions require complex and ongoing treatment regimens. Effective medication management is critical in ensuring adherence, minimizing errors, and optimizing outcomes for patients with chronic conditions such as diabetes, hypertension, and cardiovascular diseases. According to the WHO, chronic diseases are responsible for 71% of all deaths globally, with conditions such as cardiovascular disease, cancer, and diabetes being major contributors.

Patients with chronic diseases often manage multiple medications, increasing the risk of medication errors and adherence challenges. Medication management system such as automated reminders and CDSS help mitigate these concerns by improving adherence rates and reducing adverse drug events. - Hospital investments in IT systems: Hospitals are heavily investing in IT systems to streamline medication management processes, such as prescription handling, inventory management, and patient record integration. IT systems such as electronic health records (EHRs) and CDSS help hospitals reduce medication errors by providing real-time alerts for potential drug interactions, incorrect dosages, and contraindications. This supports better clinical outcomes and cost savings.

Also, hospitals are adopting IT systems to ensure compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and ISO standards. These systems improve data management and documentation, which are critical for audits and reporting.

Challenges

-

High implementation costs: The initial investment in medication management system, including hardware, software, and training, is substantial. This can be a barrier for smaller healthcare facilities or those in developing regions. Maintenance and regular updates also add to the ongoing costs, making it less accessible to resource-constrained organizations.

- Limited awareness and skilled workforce: In some regions, healthcare providers lack awareness about the benefits of medication management system or do not have the technical expertise to implement and operate them effectively. This can slow adoption, particularly in rural and underdeveloped areas.

Medication Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 8.14 billion |

|

Forecast Year Market Size (2035) |

USD 18.92 billion |

|

Regional Scope |

|

Medication Management System Market Segmentation:

Software (Clinical decision support system solutions, Inventory management & supply chain management software, Computerized physician order entry, Diversion medication management, Administration software, and Assurance system software)

The clinical decision support system (CDSS) segment is predicted to capture around 27.5% medication management system market share by the end of 2035. The market growth can be attributed to the ability of the system to enhance patient safety, improve clinical outcomes, and reduce healthcare costs. CDSS helps healthcare providers identify potential medication errors such as drug interactions, incorrect dosages, or allergies. The increasing adoption of EHRs and hospital information systems (HIS) has driven demand for CDSS as an integrated solution, ensuring seamless medication management and better decision-making in clinical settings. According to the Assistant Secretary for Technology Policy/Office of the National Coordinator for Health Information Technology (ASTP) in 2021, approximately four out of five office-based physicians (78%) and virtually all non-federal acute care hospitals (96%) had adopted a certified EHR. This represents a significant 10-year progress from 2011 when 28% of hospitals and 34% of physicians had implemented an EHR.

CDSS ensures compliance with clinical guidelines and regulatory standards, which is increasingly critical for healthcare providers globally. This makes it an essential part of modern medication management system. Additionally, CDSS plays a significant role in managing chronic conditions by providing evidence-based recommendations. This has led to increased adoption, especially in regions with high chronic disease prevalence.

Deployment Mode (Cloud-based, On-premise and Web-based)

By 2035, cloud-based segment is estimated to capture over 51.3% medication management system market share. The cloud-based segment is propelling the growth of the medication management system market by offering cost-effective, scalable, and secure solutions. Cloud-based systems reduce the need for costly on-site infrastructure, which includes hardware, servers, and maintenance personnel. Healthcare providers benefit from lower initial capital investments and more predictable subscription-based pricing models. This is particularly attractive for smaller healthcare facilities or those with limited resources.

Cloud-based systems allow real-time access to patient medication data across multiple locations. This enables better collaboration among healthcare providers, ensuring that treatment plans are cohesive and accurate. Moreover, these systems promote interoperability, which is critical in integrated healthcare settings.

Our in-depth analysis of the medication management system market includes the following segments:

|

Software |

|

|

Deployment Mode |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medication Management System Market Regional Analysis:

North America Market Forecast

North America industry is likely to account for largest revenue share of 42.5% by 2035, The market is projected to experience significant growth, driven by the region’s advanced healthcare infrastructure, increasing adoption of technology, and growing healthcare expenditures. According to the United States Centers for Medicare and Medicaid Services in 2022, U.S. health-care spending increased by 4.1% reaching USD 4.5 trillion. The growing demand for cloud-based medication management solutions and the expansion of Medication Therapy Management (MTM) programs further fuel market growth.

In the U.S. hospitals are major contributors to the market growth as they invest in medication management system to improve efficiency, reduce medication errors, and streamline workflows. The shift towards automated solutions, such as computerized physician order entry (CPOE) and automated dispensing systems, is also boosting medication management system market demand, with CDSS systems predicted to grow at the fastest pace.

Additionally, the U.S. healthcare system’s robust infrastructure and emphasis on patient safety and efficiency are central to driving the adoption of these systems, making it one of the largest and fastest-growing medication management system market globally.

In Canada, the medication management system market is experiencing significant growth, primarily driven by advancements in healthcare IT, an increase in chronic diseases, and government initiatives promoting healthcare digitization. The rising demand for healthcare services and the growing burden of chronic conditions, such as diabetes and cardiovascular diseases, are contributing to the need for better medication management solutions in hospitals and pharmacies.

Europe Market Analysis

The medication management system market in Europe is expected to experience notable growth driven by the adoption of technology in healthcare, the integration of electronic systems being a significant contributor. The demand for solutions such as Electronic Medication Administration Records (eMAR) and CPOE is rising due to the need to improve patient safety, reduce medication errors, and ensure better medication adherence.

Germany is renowned for its high-quality healthcare system, which prioritizes patient safety and care excellence. This commitment encourages the adoption of advanced systems to enhance medication accuracy and efficiency. The country’s healthcare system is also influenced by stringent regulations set by authorities like the Federal Institute for Drugs and Medical Devices (BfArM), which ensures that healthcare providers meet high standards for medication management. Systems that help ensure compliance with these regulations, such as precise medication tracking and documentation, are therefore in high demand.

In the UK, there is an increasing demand for healthcare IT solutions, particularly in light of rising healthcare costs, and the growing focus on patient safety. The UK’s National Health Service (NHS) has been actively incorporating medication management system to streamline operations and enhance safety protocols, aiming to reduce medication errors, improve patient outcomes, and enhance operational efficiency.

Key Medication Management System Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bluesight

- Capsa Healthcare

- eAgile Inc.

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- GUARDIAN RFID

- Impinj, Inc.

- MCKESSON CORPORATION

- Oracle Corporation

- Ubie, Inc.

Key players are driving growth by advancing technological solutions, expanding medication management system market reach, and addressing the increasing demand for efficient and safe medication administration. Major key players are also forming strategic alliances to expand their product offerings.

Here are some key players in the medication management system market:

Recent Developments

- In February 2024, GUARDIAN RFID, a global pioneer in inmate monitoring systems and officer experience platforms, announced that it has joined the Amazon Web Services (AWS) Partner Network (APN) and the AWS Public Sector Partner (PSP) Program. The APN is a global network of AWS Partners who use programs, knowledge, and resources to develop, market, and sell customer solutions. The PSP Program assists AWS Partners in growing their public sector business by aligning with AWS public sector sales, marketing, funding, capture, and proposal criteria.

- In March 2023, Ubie, a global healthcare AI platform that works at the intersection of patients, providers, and life sciences to guide everyone to better care, announced the launch of Checkup, a platform designed to assist patients in tracking and improving their conditions by recording key measurements, providing reminders for medications and doctor appointments, and facilitating communication with their providers.

- Report ID: 6718

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medication Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.