Anesthesia Drugs Market Outlook:

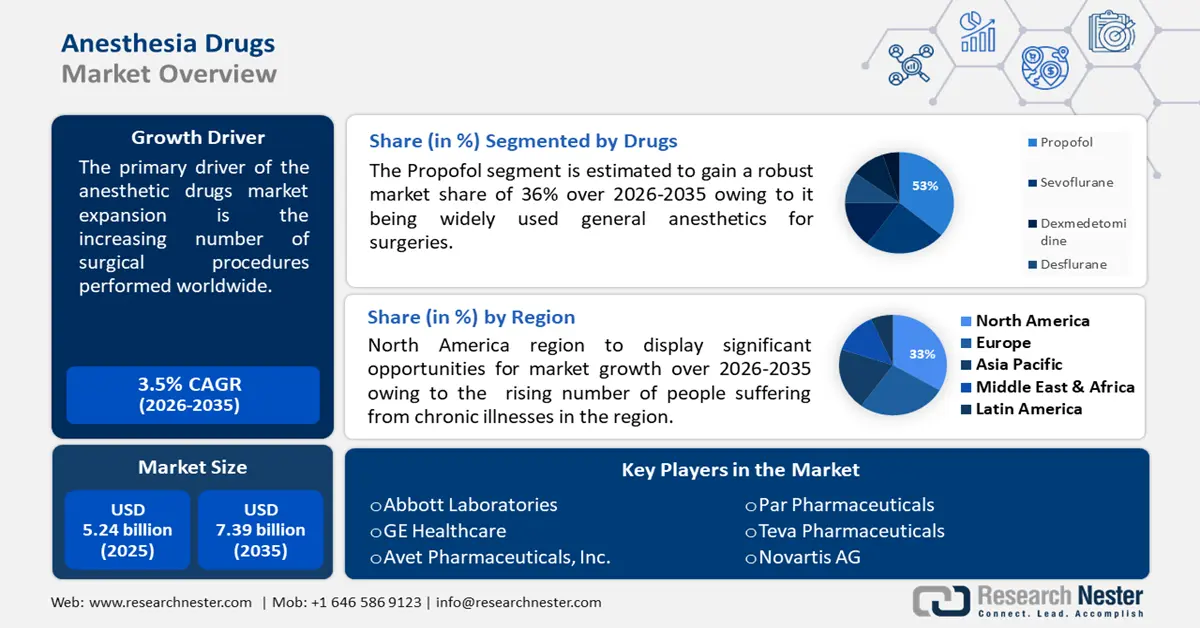

Anesthesia Drugs Market size was valued at USD 5.24 billion in 2025 and is set to exceed USD 7.39 billion by 2035, expanding at over 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anesthesia drugs is estimated at USD 5.41 billion.

The primary driver of the anesthetic drugs market expansion is the increasing number of surgical procedures performed worldwide. Over 310 million critical medical procedures are performed annually worldwide, with 40–50 million occurring in the US and 20 million in Europe.

In addition, both developed and developing countries are seeing increases in healthcare costs. In developing countries, underuse of public health care is a very common occurrence. Nonetheless, improving the healthcare infrastructure in underdeveloped countries has received more attention recently. In addition to building new healthcare facilities and renovating old ones, infrastructure for human capital development and training has been increased. Due to improved access to healthcare services and growing awareness of the benefits of timely surgical treatments, the number of surgeries performed globally has also increased.

Key Anesthesia Drugs Market Insights Summary:

Regional Highlights:

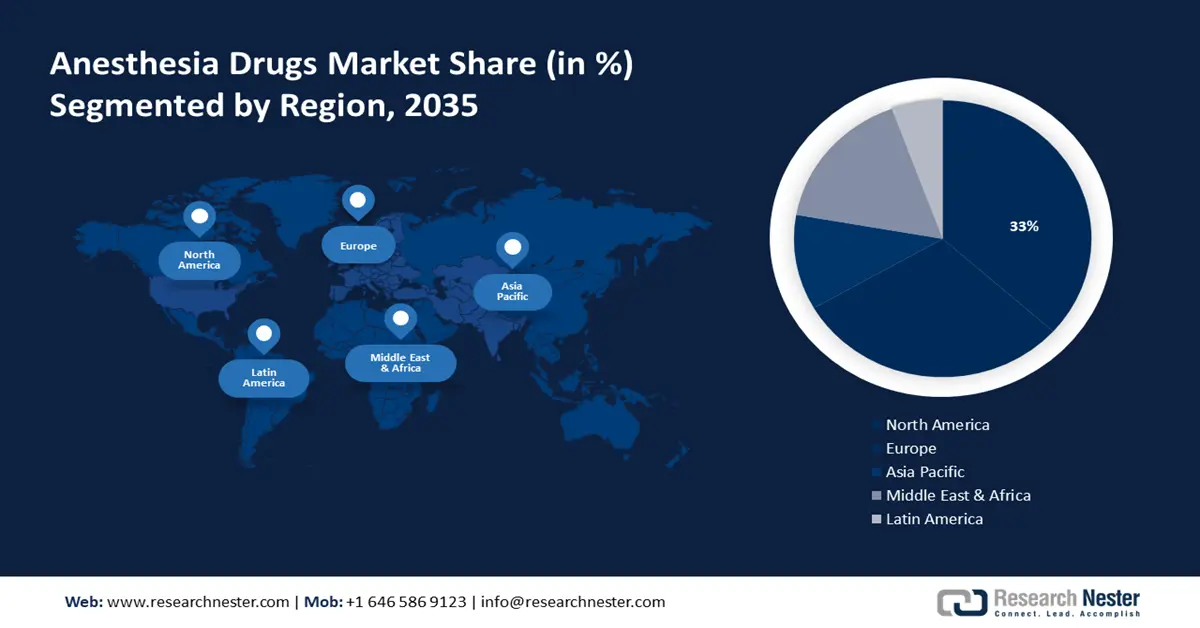

- North America anesthesia drugs market is growing steadily with a 33% share by 2035, driven by the rising incidence of chronic illnesses and cancer cases requiring surgical treatment.

Segment Insights:

- The propofol segment in the anesthesia drugs market is forecasted to capture a 36% share by 2035, driven by propofol’s wide use in surgeries and ICU sedation, including critical COVID-19 care.

- The general surgeries segment in the anesthesia drugs market is expected to attain a 30% share by 2035, attributed to rising surgeries, aging population, and advancements in anesthesia technology.

Key Growth Trends:

- Growing chronic illnesses fuel the industry

- Global aging trend increases market demand

Major Challenges:

- Growing chronic illnesses fuel the industry

- Global aging trend increases market demand

Key Players: Hikma Pharmaceuticals Plc, Abbott Laboratories, GE Healthcare, Aspen Pharmacare Holdings Limited, Avet Pharmaceuticals, Inc., Par Pharmaceuticals, Teva Pharmaceuticals, Novartis AG, Heron Pharmaceutical, Inc., Piramal Enterprises Limited.

Global Anesthesia Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.24 billion

- 2026 Market Size: USD 5.41 billion

- Projected Market Size: USD 7.39 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Anesthesia Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Growing chronic illnesses fuel the industry - An increase in the number of patients with long-term conditions like osteoarthritis, cancer, and cardiovascular disease is also propelling the expansion of the global anesthesia drugs market. The market expansion is also being aided by an increase in funding from public and private entities for the creation of pharmaceutical manufacturing divisions.

Surgical operations are frequently required for the diagnosis, treatment, or management of chronic disorders. As a result, there is a consistent need for general anesthetic medications. According to data issued by the World Health Organization in 2022, cardiovascular disease is the leading cause of death worldwide. Patients with atrial fibrillation, heart failure, or coronary artery disease are more likely to undergo open heart surgery. General anesthetic is used before the open-heart surgery. - Global aging trend increases market demand - It is predicted that the percentage of elderly individuals in need of various surgical procedures will rise sharply as the population ages. The need for procedures to treat age-related disorders is growing. A World Health Organization study published in October 2021 projects that by 2030, one in six individuals on the earth would be 60 years of age or older.

About 227,442 adults over 70 had cardiovascular procedures performed in April 2022, according to the Interactive Cardiovascular and Thoracic Surgery. The need for general anesthetic medications has surged due to this shift in demographics since older patients frequently need more involved treatments. - Better outcomes with precision medicine - The anesthesia drugs market growth for injectable is anticipated to be enhanced by the development of focused particular pharmaceuticals. The market is seeing a rise in the use of new and improved medications with quicker onset times and fewer adverse effects.

A brand-new benzodiazepine with an extremely short half-life is called remimazolam. It binds to the benzodiazepine binding site of the GABAA receptor to act as an anesthetic. Remimazolam has been shown in numerous studies to be a dependable and effective surgical sedative. The official licenses for remimazolam as a surgical sedative have been granted in China, Europe, and the US.

Challenges

- Adverse effects of injectable anaesthetic medications - Injectable anesthetic medications can cause several adverse effects, including elevated blood pressure and heart rate, respiratory depression, forgetfulness, and various sorts of hallucinations. Throughout the projection period, the market expansion for injectable anesthesia may be hampered by these side effects, low compliance rates with injectable anesthetic pharmaceuticals, the mortality rate associated with misuse of injectable anesthesia, and several other regulatory difficulties with injectable anesthesia drugs.

- The absence of healthcare facilities in developing nations and isolated locations, as well as the dearth of anesthesia physicians and certified anesthesia nurses per capita, is predicted to be a growth inhibitor for the anesthesia drugs market.

- High costs for branded drugs and procedures will prevent market from growing during the forecast period.

Anesthesia Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 5.24 billion |

|

Forecast Year Market Size (2035) |

USD 7.39 billion |

|

Regional Scope |

|

Anesthesia Drugs Market Segmentation:

Drugs

The propofol segment is estimated to hold 36% share of the global anesthesia drugs market by 2035. Among the most widely used general anesthetics for surgeries, propofol is also utilized as a sedative in the intensive care unit (ICU) for patients in critical care, particularly those with COVID-19. It is employed in the beginning and continuation of general anesthesia, procedural sedation, etc.

The use of Fresenius Propoven 2% emulsion to sustain sedation in COVID-19 patients in need of mechanical breathing was approved by the US Food and Drug Administration in June 2020. Its lipophilic nature and quick onset of action with little adverse effects make it a popular choice for surgical procedures. Anesthesiologists frequently employ propofol, together with anxiolytics and analgesics, to promote sleep while allowing patients to continue breathing on their own at lower dosages. Additionally, refractory-grade epileptics can be treated with propofol. In adult patients, propofol is often used in ventilation-based sedation procedures when other drugs are not working. Furthermore, in the intensive care unit (ICU), propofol is utilized as a primary anesthetic to provide patients with deep drowsiness while they are hooked up to ventilators.

Application

Based on application, the general surgeries segment in the anesthesia drugs market is predicted to hold the largest revenue share of about 30% during the projection period. Over the projected period, a large growth in the market will be seen. The market is being pushed by the number of surgeries rising, the population being older and having more chronic illnesses, and improvements in anesthesia technology. According to data from the American Society of Plastic Surgeons (ASPS), 16.3 million cosmetic minimally invasive treatments and around 1.8 million cosmetic surgical operations were carried out in the US in 2019.

Our in-depth analysis of the anesthesia drugs market includes the following segments:

|

Drug Class |

|

|

Application |

|

|

Drugs |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anesthesia Drugs Market Regional Analysis:

North America Market Insights

Anesthesia drugs market in the North America region, amongst the market in all the other regions, is anticipated to hold the largest with a share of about 33% by the end of 2035. The market for anesthetic drugs is now dominated by the United States and is expected to remain so for some decades to come. In America, the number of people suffering from chronic illnesses is rising. To treat more than half of them, surgery is required.

In the United States, the incidence of cancer has dramatically increased during the past few decades. There were just over 16.9 million cancer survivors in the United States as of January 2019, according to data from the National Cancer Institute. By 2030, there will probably be 22.2 million cancer survivors globally. The growing incidence of cancer is expected to lead to an increase in the frequency of procedures because cancer surgery offers a great chance for a cure for many tumors, especially when the cancer is limited.

European Market Insights

The European region will also encounter huge growth for the anesthesia drugs market over the forseen period and will hold the second position owing to the pharmaceutical and medical industries have grown dramatically as a result of investments and the building of new hospitals and medical facilities in this region.

The anesthesia drugs market in Germany is still growing quickly due to the nation's rapidly developing healthcare system and expanding economy. The nation's requirement for anesthetic drugs has been significantly impacted by the introduction of new and improved anesthetic delivery techniques.

Anesthesia Drugs Market Players:

- Hikma Pharmaceuticals Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- GE Healthcare

- Aspen Pharmacare Holdings Limited

- Avet Pharmaceuticals, Inc.

- Par Pharmaceuticals

- Teva Pharmaceuticals

- Novartis AG

- Heron Pharmaceutical, Inc.

- Piramal Enterprises Limited

Recent Developments

- GE Healthcare was granted the FDA pre-market clearance (PMA) to, a multinational healthcare and medical technology business with headquarters in the United States, for its End-tidal (Et) control software, which is used to provide general anesthesia on the Aisys CS2 Anesthesia Delivery System. In addition to the benefits low-flow anesthesia provides for hospitals and the environment, the device has direct control over the end-tidal concentration, which reflects the medication level in the patient's blood.

- Hikma Pharmaceuticals PLC introduced midazolam injectable pouches containing 0.9% sodium chloride (NaCl) in dosages of 50 mg/50 mL and 100 mg/100 mL. In the US, the medication is authorized for continuous intravenous infusion for sedating adults, children, and newborns who are ventilated and oxygen-deprived during anesthesia or therapy in a critical care setting.

- Report ID: 5842

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anesthesia Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.