Capsule Coffee Machine Market Outlook:

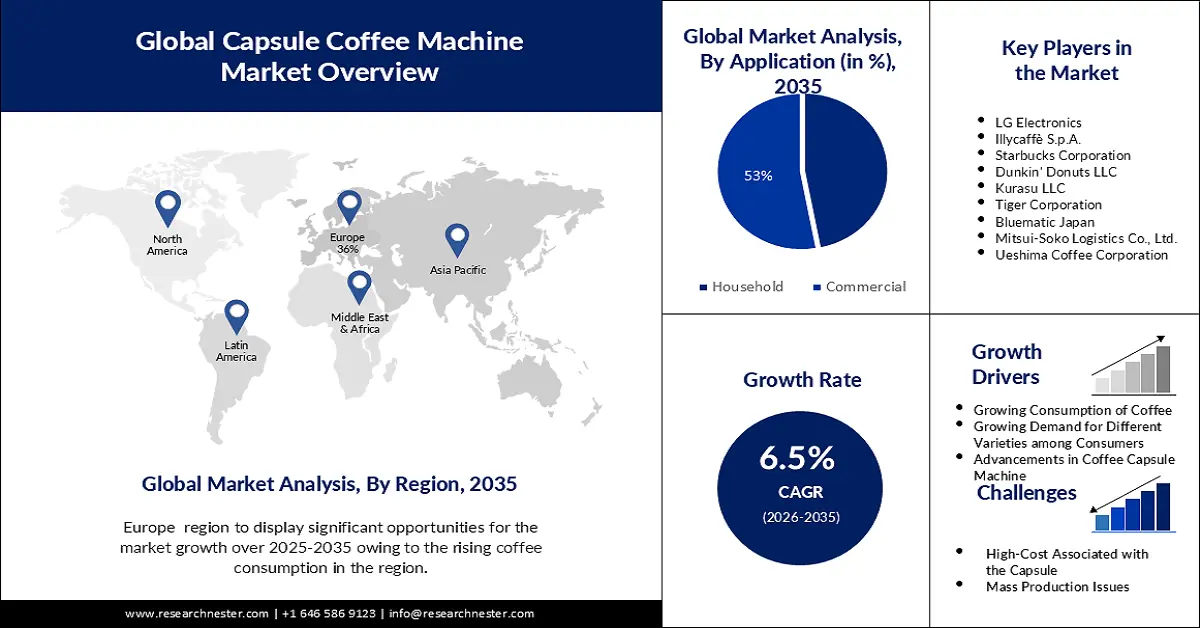

Capsule Coffee Machine Market size was over USD 3.37 billion in 2025 and is projected to reach USD 6.33 billion by 2035, witnessing around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of capsule coffee machine is assessed at USD 3.57 billion.

The market's expansion can be ascribed to rise in cafes and eateries around the world as well as the popularity of getting coffee out, both of which have prompted the installation of quick brewing equipment in the commercial sector for their customers. As per the United States Department of Agriculture, coffee consumption in China is projected to reach 6.3 million bags (60 kilograms) from 2024-25, showcasing a surge of nearly 150% in the last 10 years.

Furthermore, according to the International Coffee Organization (ICO, overall coffee production increased by 2.2%, which is 171.3 million 60-kg bags, from 2017 to 2022. Arabica production remained mostly steady, while production of Robusta increased by 4.3%. Additionally, the rise in home brewing culture and increasing disposable incomes are fuelling the adoption of capsule coffee machines. Partnerships between coffee brands and machine manufacturers have enhanced product visibility, while targeted marketing companies have expanded appeal.

The capsule coffee machine market players are aiming to strengthen their supply chain further. For instance, in July 2024, Nestle agronomists developed Star 4, a novel high-yielding Arabica coffee variety, using traditional brewing methods, with a taste of Brazilian coffee. The coffee is developed in response to the recent climate change modeling that suggests a decline of 50% of land suitable for growing Arabica coffee, by 2050. These modern innovations in addition to environmental concerns and efforts to reduce waste are prompting brands to use more sustainable coffee capsule-making processes.

Key Capsule Coffee Machine Market Insights Summary:

Regional Highlights:

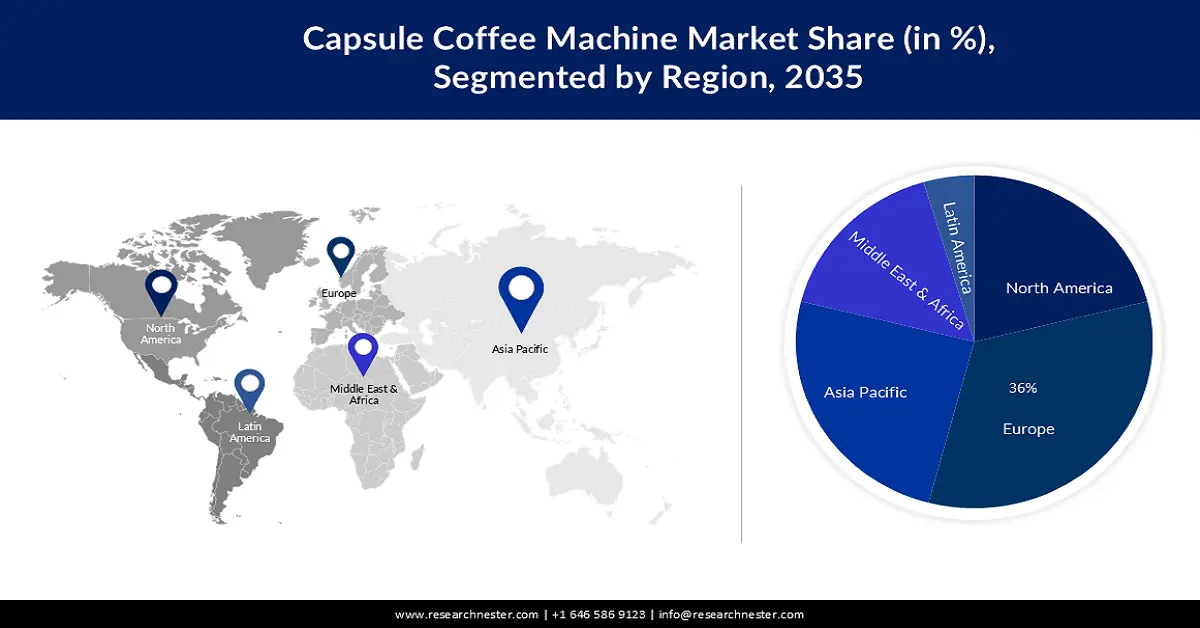

- Europe capsule coffee machine market will hold around 36% share by 2035, driven by rising coffee consumption, changing flavor preferences, and the increasing demand for premium and specialty beverages.

- Asia Pacific market will secure 28% share by 2035, driven by growing customer awareness of technologically advanced products, along with rising coffee consumption trends in India and China.

Segment Insights:

- The commercial segment in the capsule coffee machine market is expected to capture a 53% share by 2035, driven by rising café demand and innovations like QuickChill brewing technology.

- The drip filter segment in the capsule coffee machine market is expected to achieve a 48% share by 2035, fueled by affordability, ease of use, and rising interest in home-brewed specialty coffee.

Key Growth Trends:

- Growing varieties of good-quality coffee will boost the capsule coffee machine market size

- Advancements in coffee capsule machines

Major Challenges:

- Environmental issues

- High-cost associated with the capsule

Key Players: Nestle Nespresso S.A., LG Electronics, Illycaffè S.p.A., Starbucks Corporation, Dunkin' Donuts LLC, Barista Coffee, Nescafé Dolce Gusto, Keurig Dr.Pepper, Bazarta.

Global Capsule Coffee Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.57 billion

- Projected Market Size: USD 6.33 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Italy, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Capsule Coffee Machine Market Growth Drivers and Challenges:

Growth Drivers

- Growing varieties of good-quality coffee will boost the capsule coffee machine market size: According to the British Coffee Association, in November 2020, Bazarta which is a well-known coffee grinder manufacturing company, observed sales growth by 70% since the start of the COVID-19 pandemic. In April 2024, Nestlé experts developed a very high-quality arabica, using advanced data science methods, that has greater resilience to disease or drought, as well as flavor or aroma characteristics. In the commercial sector, such as cafes and restaurants, growing consumer knowledge of variety and specialized beverages is considerably influencing consumption decision-making.

- Advancements in coffee capsule machines: Due to the rising demand from consumers with shorter wait times, coffee shops are using capsule coffee machines more frequently. The capsule machine technology is continuously expanding with new features, creative concepts, and applications to offer higher quality and capacity, as well as low energy usage and minimal maintenance costs. For instance, Nespresso in November 2022, announced the launch of paper-based home compostable capsules which are sustainable and retro-compatible with Nespresso Original machines. This technological advancement is anticipated to increase the product's penetration in the commercial and residential markets.

Challenges

- Environmental issues: Coffee capsules contain plastic and aluminum, making them unrecyclable. Despite recycling efforts, aluminum, and plastic capsule packaging end up in the trash. The aluminum industry generates over 1.1 billion tonnes of CO2 emissions annually. As a result, landfills currently make up a significant portion of this world, adding to the capsule coffee machine market drawbacks.

- High-cost associated with the capsule: Capsule coffee machines often come with high costs due to the proprietary nature of their capsules, locking users into purchasing expensive branded pods. Over time, this dependency significantly increases the cost of coffee compared to traditional brewing methods. This also limits user flexibility in choosing coffee options, adding to the overall cost.

Capsule Coffee Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 3.37 billion |

|

Forecast Year Market Size (2035) |

USD 6.33 billion |

|

Regional Scope |

|

Capsule Coffee Machine Market Segmentation:

Type Segment Analysis

The drip filter segment in the capsule coffee machine market is anticipated to hold a share of 48% during the forecast period. Drip filter machines are well-liked by both coffee connoisseurs and casual customers as they provide a straightforward and practical brewing process. Their broad use has been facilitated by their simplicity of use and reliable outcomes. The affordability of drip filter devices is another factor promoting the market expansion. Drip filter machines have become a popular option for individuals looking for a high-quality cup of coffee without the need for complicated brewing methods as a result of the growing interest in specialty coffee and home brewing.

Application Segment Analysis

The capsule coffee machine market from the commercial segment is expected to hold a share of 53% by 2035. Quick brewing machines are being used more frequently to meet the demands of busy and on-the-go customers as the number of cafes and restaurants has significantly increased in countries including France, Italy, India, and more. In March 2024, Keurig Dr.Pepper launched the first Keurig brewer to offer breakthrough QuickChill Technology. The first brewing is hot, intending to extract full flavor, followed by a flash for chilling the coffee to a refreshing temperature, in less than three minutes, serving the commercial need.

Our in-depth analysis of the global capsule coffee machine market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Capsule Coffee Machine Market Regional Analysis:

European Market Insights

Europe capsule coffee machine market is poised to account for the largest revenue share of 36% by 2035. The market revenue is driven by rising coffee consumption and changing flavor preferences. The market is also further driven by an increasing number of consumers willing to pay high costs for premium and specialty beverages as well as K-Cups, as seen in cafes, small roasters, and baristas. As per a report, 3,323 thousand tonnes of coffee, or 32% of the world's total consumption, were consumed in Europe in 2021.

Germany is the largest coffee-consuming country, and importer in Europe, with coffee being a staple in daily life. In 2021, Germany accounted for 34% of total imports in the region which were sourced directly from producing countries, forming an approximate 1.1 million tonnes valued at USD 2.68 billion. Additionally, innovations including capsule coffee machines are shaping modern consumption trends.

APAC Market Insights

Asia Pacific region is expected to account for a 28% share of the global capsule coffee machine market during the forecast period. These capsule machines are sold on a large scale in the region due to growing customer awareness of technologically advanced products. Due to evolving cultural trends and rising propensity for coffee consumption, developing nations like India and China are anticipated to contribute to the expansion of the regional market.

India capsule coffee machine market is expanding as consumer preferences shift toward convenience and premium coffee experiences. Factors such as rising working-class population, dual-income households, and increasing exposure to global coffee trends are driving growth. In April 2024, Nestle India launched NESPRESSO coffee and machines through the NESPRESSO boutique in Delhi.

Capsule Coffee Machine Market Players:

- Nestle Nespresso S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Electronics

- Illycaffè S.p.A.

- Starbucks Corporation

- Dunkin' Donuts LLC

Companies in the capsule coffee machine market are introducing eco-friendly capsules and energy-fficient machines to address environmental concerns. Additionally, targeted marketing, subscription models, and personalized solutions are also being used to enhance customer engagement and build brand loyalty. These strategies aim to meet evolving consumer preferences and drive market growth.

Recent Developments

- In November 2024, Barista Coffee extended its product offering by announcing the launch of coffee capsules and machines, intended to be used for home-brewing. The strategy was aimed at meeting the rising consumer demand for at-home, high-quality coffee for convenience.

- In September 2023, LG Electronics unveiled its first-ever capsule coffee machine, DUOBO by LG Labs. LG Labs is LG’s new marketing platform established to deliver experimental and innovative product and service experiences to its customers. DUOBO revolutionizes the coffee brewing process with features and technologies that deliver outstanding convenience and delicious, personalized flavor.

- In November 2022, Nescafé Dolce Gusto launched Neo, the brand's next-generation coffee machines and pods. Neo combines high quality, cutting-edge technology, and sustainability to create the ultimate coffee shop-at-home experience. In a Nestlé first, Neo's new range of coffee pods are paper-based, home-compostable, and use 70% less packaging than current capsules.

- Report ID: 2703

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Capsule Coffee Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.