Heat Recovery Steam Generator Market Outlook:

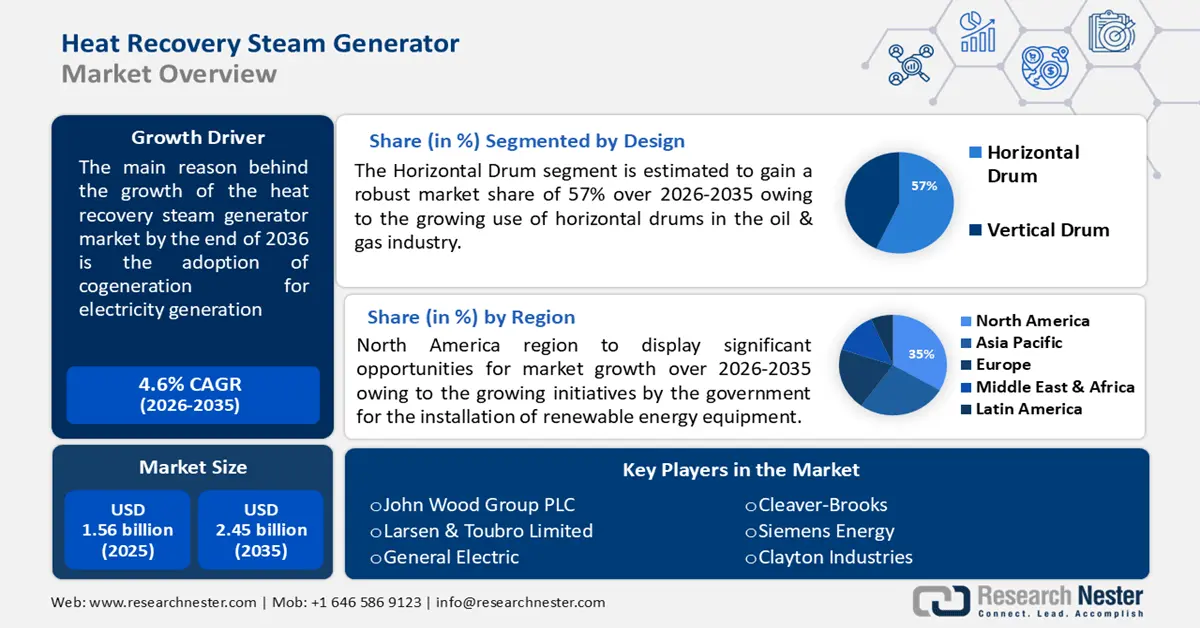

Heat Recovery Steam Generator Market size was over USD 1.56 billion in 2025 and is anticipated to cross USD 2.45 billion by 2035, witnessing more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of heat recovery steam generator is assessed at USD 1.62 billion.

In the power industry, there is a strong momentum towards cleaner energy sources. Carbon emissions and global warming are significantly exacerbated by the generation of electricity from thermal power plants, causing considerable damage to the environment. According to the World Nuclear Association, the combustion of fossil fuels for the production of electricity is responsible for more than 40% of energy-related carbon dioxide (CO2) emissions. Therefore, the adoption of cogeneration for electricity generation has led to a significant increase in renewable energy resources.

Key Heat Recovery Steam Generator Market Insights Summary:

Regional Highlights:

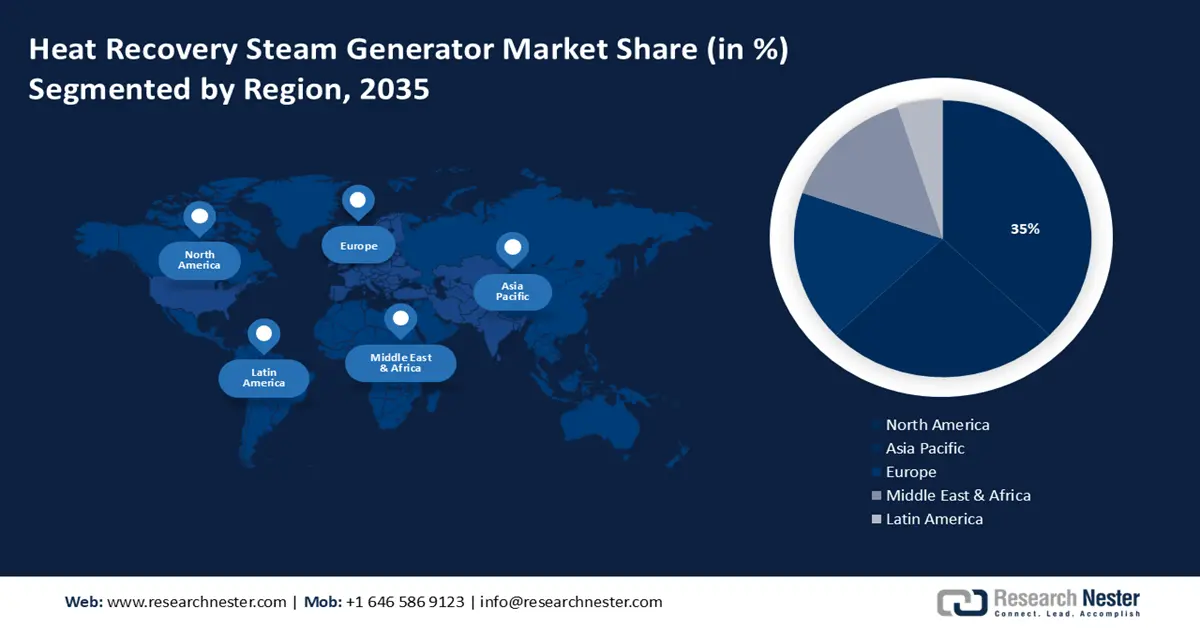

- North America heat recovery steam generator market will dominate around 35% share by 2035, driven by growing initiatives for renewable energy equipment installation.

Segment Insights:

- The horizontal drum segment in the heat recovery steam generator market is poised for substantial growth over 2026-2035, fueled by its efficiency in oil and gas applications.

- Cogeneration segment in the heat recovery steam generator market is projected to achieve significant growth by the forecast year 2035, driven by government support for cogeneration systems and fiscal incentives for CHP plants.

Key Growth Trends:

- Increased incorporation of combined cycle power plants

- Increased focus on reducing greenhouse gas emissions

Major Challenges:

- High initial investment

- Dependence on end-use industries

Key Players: John Wood Group PLC, Larsen & Toubro Limited, General Electric, Cleaver-Brooks, Siemens Energy, Babcock & Wilcox Enterprises Inc., Clayton Industries, John Cockerill, Sofinter S.p.A, Bharat Heavy Electricals Limited.

Global Heat Recovery Steam Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.56 billion

- 2026 Market Size: USD 1.62 billion

- Projected Market Size: USD 2.45 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Heat Recovery Steam Generator Market Growth Drivers and Challenges:

Growth Drivers

-

Increased incorporation of combined cycle power plants - In addition to producing 50% more electricity, the Combined Cycle Plant also uses the waste heat from the gas turbines to power a steam generator. In this process, a heat recovery steam generator is used to generate the primary component of energy extraction from gas turbines' exhaust gases.

As a result, adopting combined cycle electricity generation plants is more efficient than simple megawatt energy production. For instance, in March 2019, Chubu Electric Power Co., Inc., and Toshiba Energy Systems & Solutions Corporation achieved a power generation efficiency of 63.08% (lower heating value). -

Increased focus on reducing greenhouse gas emissions - Electricity demand, which has increased the production of electricity, has led to an increase in greenhouse gas emissions and global warming. Therefore, in the global scenario, strict regulations, government initiatives, and massive investments have been taken to reduce emissions.

The best and most reliable energy sources for the elimination of greenhouse gas emissions are combination cycle power plants and cogeneration. The heat recovery steam generator is an integral part of a combined cycle power plant, which uses the hot gas stream to recover its thermal energy. Therefore, demand is increasing at a faster pace for the use of combined cycle power plants to reduce GHG emissions, hence leading to the growth of heat recovery steam generator market. -

Growing deployment in commercial applications - It is expected that revenue will be generated from the commercial use of the heat recovery steam generator. For the operation of air conditioning systems in commercial infrastructures, such as shopping malls, heat-enhancing agents may be applied.

The financial contribution of governments to the expansion of infrastructure across their territory is also considered. For instance, in 2023, the federal government of the US allocated USD 81.5 billion to the states and spent USD 44.8 billion on infrastructure. Therefore, the growing investment in infrastructure is augmenting the heat recovery steam generator market growth.

Challenges

-

High initial investment - A series of heat exchangers, including economizers that allow water to be heated closer to saturation, superheaters capable of producing hot steam, and an evaporator for producing saturated steam are part of thermal recovery steam generators.

The system shall be subject to one or two more high-pressure circuits that increase the extraction rate to obtain maximum energy out of exhaust gas from a combustion turbine. The steam turbine's power output is increased by each added pressure level, which in turn increases the maintenance costs of the HRSG system. -

Dependence on end-use industries - Not all industries are a good fit for heat recovery steam generators. For example, the production of large amounts of high-temperature waste heat occurs in the cement, sulfuric acid, chemical, and cabin rotary kiln industries. This is where the full potential of heat recovery steam generators to increase energy savings may be realized.

Heat Recovery Steam Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.56 billion |

|

Forecast Year Market Size (2035) |

USD 2.45 billion |

|

Regional Scope |

|

Heat Recovery Steam Generator Market Segmentation:

Design Segment Analysis

Horizontal drum segment is set to capture over 57% heat recovery steam generator market share by 2035. The segment growth is impelled by the growing use of horizontal drums in the oil & gas industry. Higher tensile strength materials such as titanium, Cu-alloy, clad steel, and carbon steel are typically used to make horizontal drums.

The water is heated in vertically placed evaporator tubes, creating a natural and economical circulation effect, while the gas flow is horizontal. Its improved efficiency and 0% failure rate make it more advantageous for the refinery, and power generation sectors.

Application Segment Analysis

Cogeneration segment in the heat recovery steam generator market is poised to witness significant growth rate through 2035. The segment’s expansion can be attributed to the increase in governmental support for the deployment of cogeneration systems. For instance, a variety of fiscal and financial assistance methods have been implemented by the UK government to enhance the economics of developing and running CHP plants that have been partially or fully certified as "Good Quality" by the CHP Quality Assurance program.

Power Rating Segment Analysis

The >50-100 MW segment in the heat recovery steam generator market is estimated to observe lucrative CAGR till 2035. The segment is expanding because companies and international organizations are increasingly concerned about the environment, which has led them to adopt sustainability solutions like purchasing carbon credits or obtaining Renewable Energy Certificates. For instance, as stated by World Bank, an international organization announced ambitious ambitions to develop high-integrity global carbon businesses in which 15 countries will profit from the sale of carbon credits resulting from forest protection.

Our in-depth analysis of the heat recovery steam generator market includes the following segments:

|

Design |

|

|

Application |

|

|

Power Rating |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Heat Recovery Steam Generator Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 35% by 2035. The market growth in the region is also expected on account of growing initiatives by the government for the installation of renewable energy equipment. Heat recovery steam turbines are being installed in large numbers by American utilities in combined cycle plants and cogeneration sites across North America.

Heat recovery steam generator sales in the United States will continue to rise due to a strong renewable energy infrastructure and consumer demand for affordable, energy-efficient green energy alternatives. The US Department of Energy (DOE), the US Department of Agriculture, and the US Department of Interior are among the other government organizations that offer grants and loans. A number of US states further provide financial incentives to encourage and subsidize the building of renewable energy infrastructure.

According to a report by the US Department of Agriculture, the ongoing projects in 35 states and Puerto Rico would receive more than USD 194 million in loans and grants under REAP. The REAP program assists rural small business owners and agricultural producers in increasing their energy efficiency and utilizing renewable energy sources such as geothermal, solar, wind, and small hydropower.

APAC Market Insights

APAC region in heat recovery steam generator market is set to exhibit substantial CAGR during the forecast period, owing to the growing adoption of combined cycle power stations in the region. Another factor that is contributing to the growth of the market in this region is a rising demand for investment in renewable energy sources.

According to a report, the region invested approximately USD 48.2 billion in renewable energy sources. Countries in the Asia Pacific, such as China, Japan, and India, are constantly focusing on generating clean sources of energy while making substantial investments to reduce emissions. Therefore, demand will be driven by increasing investments in clean energy sources and the adoption of combined cycle power plants during the forecast period.

China's power usage has increased due to the country's growing population, swift economic expansion, extensive manufacturing sector, and large-scale migration to cities with central air conditioning. The Chinese government has announced plans to source energy from renewable sources in recognition of the country's long-term reliance on fossil fuels and its expanding need for electricity generation.

These plans prioritize advancements in energy management, photovoltaics, and battery technology. For instance, to increase its renewable energy capacity to roughly 3.9 terawatts by 2030—more than three times its 2022 total—China plans to construct more than 200 of these bases. China still uses fossil fuels to produce over 70% of its electricity because the built capacity for renewable energy is not keeping up with demand.

Heat Recovery Steam Generator Market Players:

- John Wood Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Larsen & Toubro Limited

- General Electric

- Cleaver-Brooks

- Siemens Energy

- Babcock & Wilcox Enterprises Inc.

- Clayton Industries

- John Cockerill

- Sofinter S.p. A

- Bharat Heavy Electricals Limited

Major corporations are making large investments in the integration of cutting-edge technologies for monitoring and optimizing. Investor interest and support have grown in original equipment manufacturing experience, monitoring, and pressure analysis in an HRSG. The need for heat recovery steam generators is also being driven by combined cycle plants' efforts in the development of a clean energy source.

Recent Developments

- Larsen & Toubro's Heavy Engineering business has launched the first Steam Generator (SG) for the indigenously manufactured 10 X 700 MWe PHWR Fleet Programme, 12 months ahead of schedule. With this, L&T has surpassed its previous milestone in Singapore manufacturing. SG is a heat exchanger that uses heat from a nuclear reactor core to turn water into steam.

- Technip Energies, the head of a consortium alongside GE Vernova and construction partner Balfour Beatty, has received a Letter of Intent from BP on behalf of NZT Power Limited for the implementation phase of the Net Zero Teesside Power project in the United Kingdom. It will be powered by an advanced GE Vernova 9HA.02 gas turbine, a steam turbine, a generator, and a Heat Recovery Steam Generator (HRSG), all of which will be integrated with a cutting-edge carbon capture plant based on Technip Energies' Canopy by T. ENTM solution and Shell CANSOLV® CO2 capture technology.

- Report ID: 6092

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.