Digital Pathology Market Outlook:

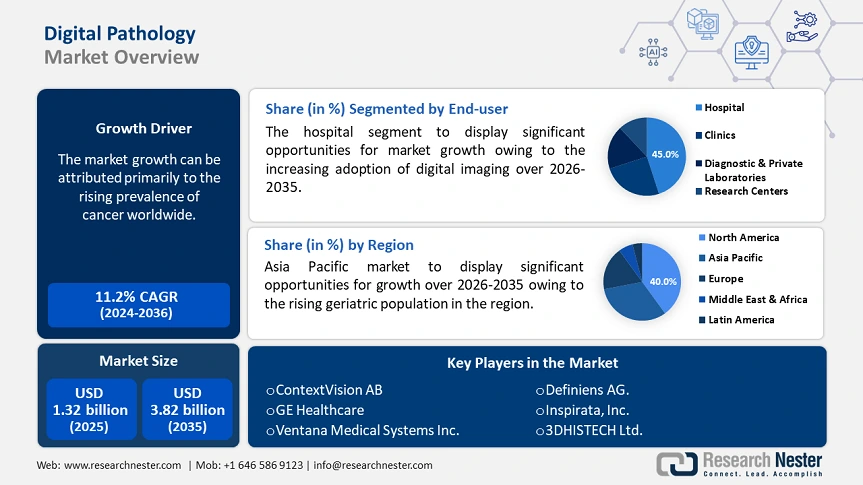

Digital Pathology Market size was over USD 1.32 billion in 2025 and is poised to exceed USD 3.82 billion by 2035, growing at over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital pathology is estimated at USD 1.45 billion.

Growth in the market is attributed primarily to the rising prevalence of chronic illnesses such as malignancy and cardiovascular disease (CVD) worldwide. In 2022, the worldwide number of new cases and deaths from cancer accounted for around 20.0 million and 10.0 million, respectively. Further, the figure of new cases each year is predicted to become 35.0 million by 2050 (World Health Organization). Thus, the need for more effective therapeutics, such as precision medicine, is gradually rising. During the development of such pharmacology products, efficient management of large-scale laboratory data is highly required, where digitalization has revolutionized the pace of workflow.

Moreover, the improved efficiency and streamlined operations influence several healthcare organizations and pharmaceutical pioneers to adopt solutions from the market. For instance, in January 2025, Mayo Clinic shared its plans for constructing a modernized division for its pathological operations to accelerate medical breakthroughs. The concept of the new Mayo Clinic Digital Pathology is backed by technical expertise & resources from NVIDIA, an integrated generative AI model from Aignostics, and its own platform architecture. Furthermore, the desire to attain enhanced scalability and cost-efficiency is pushing more healthcare giants to invest in such transformations.

Key Digital Pathology Market Insights Summary:

Regional Highlights:

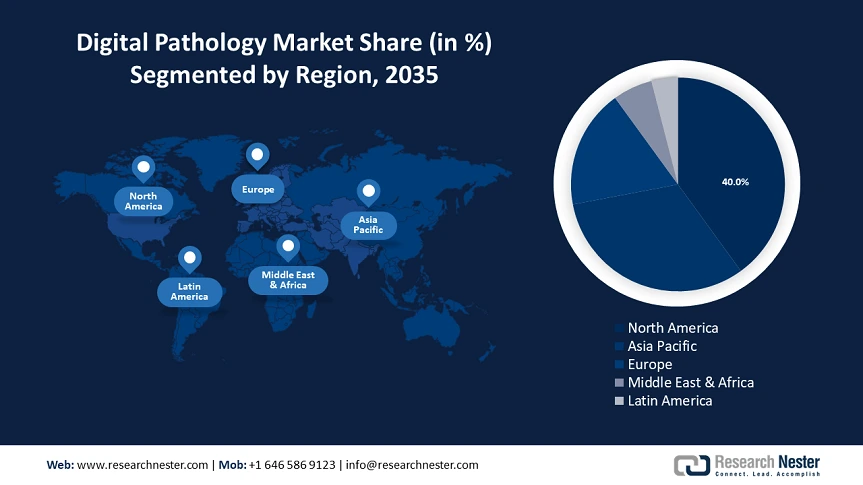

- North America leads the Digital Pathology Market with a 40.00% share, driven by aging population and ongoing clinical innovations in digital pathology, ensuring strong growth by 2035.

- Asia Pacific's Digital Pathology Market is forecasted to expand rapidly through 2035, driven by a large patient pool, government initiatives, and advancements in precision medicine.

Segment Insights:

- Hospitals segment are projected to hold a 45% share by 2035, driven by the adoption of advanced imaging and scanning technologies for faster service delivery.

- The education and training segment is anticipated to experience significant growth by 2035, driven by academia’s contributions to clinical advancements and government-backed medical research.

Key Growth Trends:

- Increasing number of laboratory tests performed worldwide

- Rapid adoption of AI tools in healthcare

Major Challenges:

- Significantly high initial expense

- Concerns about data security and privacy

- Key Players: ContextVision AB, Leica Biosystems Nussloch GmbH, GE Healthcare, Ventana Medical Systems Inc., Hamamatsu Photonics K.K., Apollo Enterprise Imaging Corporation, Xifin Inc., Definiens AG., Inspirata, Inc., 3DHISTECH Ltd., Hoffmann-La Roche AG, Proscia.

Global Digital Pathology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.32 billion

- 2026 Market Size: USD 1.45 billion

- Projected Market Size: USD 3.82 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Digital Pathology Market Growth Drivers and Challenges:

Growth Drivers

- Increasing number of laboratory tests performed worldwide: Besides the utility in drug development, the digital pathology market has an extensive application in diagnosis. Particularly, the use of automated data processing systems in analyzing potentially malignant tissues has significantly escalated the quality and accuracy of detection methods. On this note, a 2023 NLM review established a 6.1% higher specificity of AI in melanoma detection compared to the observation ability of a dermatologist. Such pieces of clinical evidence are encouraging more medical settings to digitalize their diagnostic facilities.

- Rapid adoption of AI tools in healthcare: As the shortage of trained medical professionals becomes a worldwide medical disparity, the need for highly capable technologies rises. The world is expected to witness a shortfall of over 11.0 million health workers by 2030: WHO. Particularly, the rapidly spreading trend of data-driven treatment approach, decision-making, and drug development is fostering a pre-established accepting culture for the market, encouraging involved institutions to invest in it. According to the World Economic Forum, the net global annual private investment in AI related to medical and healthcare was valued at USD 3.7 billion in 2023.

Challenges

- Significantly high initial expense: Implementing advanced solutions from the market requires a notable upfront investment, which often becomes prohibitive for small-to-medium enterprises (SMEs). Specifically, legacy systems may not support the optimum effectiveness of newly integrated high-resolution scanners, upgraded storage infrastructure, and AI tools. Moreover, facilities from underserved regions mostly fail in affording such solutions, restricting wide adoption in this field.

- Concerns about data security and privacy: Operating or utilizing commodities availed by the market involves sharing a large set of sensitive patient and institutional information. This comes with the heightened risk of data breaching, hindering compliance with stringent regulations such as HIPPA and GDPR. To mitigate this issue, a robust cybersecurity module is essential, adding unavoidable expenses to the operational budget and increasing financial disparity.

Digital Pathology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 1.32 billion |

|

Forecast Year Market Size (2035) |

USD 3.82 billion |

|

Regional Scope |

|

Digital Pathology Market Segmentation:

End user (Hospitals, Clinics, Diagnostic & Private Laboratories, Research Centers)

The hospital segment is anticipated to capture the largest market share of 45% in the global digital pathology market over the forecast period. The increasing adoption of cutting-edge imaging and scanning methodology in hospitals for faster service delivery and the growing number of hospital visits across the world are expected to augment segment growth. On this note, in October 2024, NYU Langone Health commenced the Digital Pathology Program to escalate diagnosis and patient care across the hospital network. Such initiatives promote the use of real-time tissue analysis and sustainable healthcare infrastructure, encouraging involved investors to engage their resources in this medical setting.

Application (Tele-Consultation, Disease Diagnosis, Drug Discovery, Education & Training, Pathology Screening)

On the basis of applications, the education & training segment is predicted to show notable captivity in the digital pathology market by the end of 2037. The magnified contribution of academia in clinical advancements is garnering a strong position of this segment in this genre. The consistent participation of institutions in medical research, coupled with government affiliation, is empowering the penetration of pathological digitalization. Furthermore, the academic-industry alliance is forming an influential culture in this segment, inspiring them to deploy automated systems to increase productivity and workflow efficiency of laboratory activities.

Our in-depth analysis of the global digital pathology market includes the following segments:

|

|

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Pathology Market Regional Analysis:

North American Market Forecast

North America is expected to dominate the digital pathology market with a share of 40% throughout the analysed timeline. The region’s leadership is backed by aging citizens and ongoing clinical innovations. As per the Administration for Community Living, the proportion of people aged 65 and over in America was 17.3% of the total population in 2022, demonstrating a 34.0% increase in the volume of older people from 2012. The heightening participation in clinical trials is also testifying to the region’s position in this sector, where the U.S. ranked 1st in the race of trial registration across the world with a count of 186,497 from 1994 to 2024: WHO. Moreover, the combined effect of a large patient pool and medical findings is making this region a lucrative opportunity for global leaders.

The increasing R&D investments, continuous government support, and development in the MedTech industry are propelling acceptance of the U.S. market. The use of advanced technology in imaging and analytics has become more frequent than ever in this country, impelling the market revenue and investments. For instance, in March 2025, Proscia raised USD 50.0 million from U.S. funding led by a consortium of Insight Partners, AI Capital Partners, and Triangle Peak Partners. This capital influx was intended to accelerate the commercial and R&D momentum of its precision medicine AI portfolio.

APAC Market Forecast

Asia Pacific is poised to register the fastest CAGR in the digital pathology market over the discussed period. Several factors, including a large patient pool, government initiatives, excellence in precision medicine, focus on clinical trials, and the trend of digitalization, are contributing to the region’s pace of propagation. In this regard, the WHO mentioned that after the U.S., China, India, and Japan were holding leadership in clinical trials with 135747, 74031, and 65167 registrations, respectively, from 1994 to 2024. On the other hand, in November 2022, the Government of Australia allocated USD 750,000.0 in perinatal pathology. These events signify the investment opportunities and subsidiary funds supporting advancements in this category.

Technological advancements, particularly the strong emphasis on AI utility in the pharmaceutical industry, have made Japan the hub of innovation in the market. The upfront utilization of next-generation MedTech solutions in medicine discovery in this country is significantly stimulating growth in this field. As per estimations from the International Trade Administration, the industry of AI systems in Japan was valued at USD 4.5 billion in 2024, augmenting a year-on-year growth rate of 35.5% and reaching USD 7.3 billion by 2027. This is evidence of a wider scope of profitable business in this field.

Key Digital Pathology Market Players:

- ContextVision AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leica Biosystems Nussloch GmbH

- GE Healthcare

- Ventana Medical Systems Inc.

- Hamamatsu Photonics K.K.

- Apollo Enterprise Imaging Corporation

- Xifin Inc.

- Definiens AG.

- Inspirata, Inc.

- 3DHISTECH Ltd.

- Hoffmann-La Roche AG

- Proscia

Key players in the market are currently forming international partnerships to expand their territory overseas. For instance, in February 2024, Proscia founded a new partner alliance, Proscia Ready, realizing complete digitalization for pharmaceutical developers, diagnostic laboratories, and contractual service providers. New entrants are also putting their focus on leveraging the capabilities of their products in a broader range of applications. On this note, in March 2024, Philips partnered with AWS to increase the scalability of digital pathology through the integration of cloud capabilities. Simultaneously, in May 2024, Indica Lab introduced 4.0 versions of HALO, HALO AI, and HALO Link for researchers and pathologists. Such key players include:

Recent Developments

- In January 2025, Roche acquired 510(k) clearance from the FDA for its VENTANA DP 600 slide scanner. It was a milestone in commercializing its whole slide imaging system. This additional regulatory authorization also solidified the company’s presence in the U.S. digital pathology market.

- In October 2024, Proscia introduced two new drug development solutions for life sciences organizations, Concentriq Embeddings and the Proscia AI Toolkit. These solutions backed the digital pathology platform, accelerating the discovery and development of novel therapies and diagnostics.

- Report ID: 7491

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Pathology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.