Crop Protection Chemicals Market Outlook:

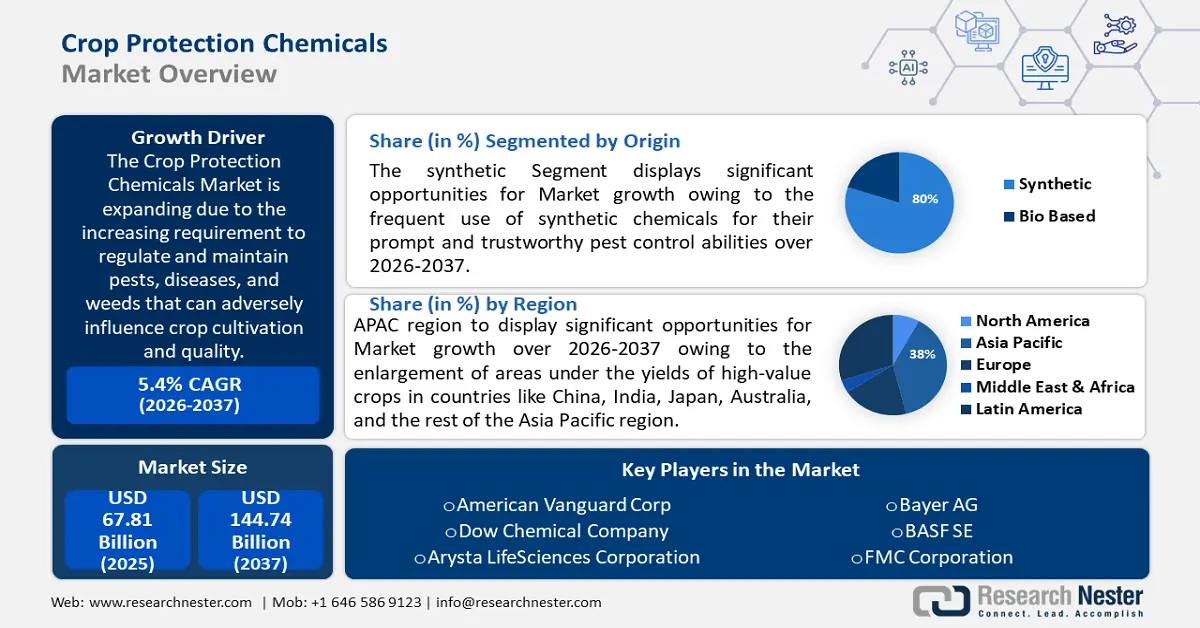

Crop Protection Chemicals Market size was over USD 67.81 billion in 2025 and is anticipated to cross USD 114.74 billion by 2035, growing at more than 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crop protection chemicals is assessed at USD 71.11 billion.

The main reason behind the expansion of the crop protection chemicals market share is the increasing requirement to regulate and maintain pests, diseases, and weeds that can adversely influence crop cultivation and quality. As stated in the United States Department of Agriculture’s (UNDOA) research, annually, bugs cause 20% to 40% of the world's crop yield to be lost. Every year, pests including weeds, plant diseases, and insects ruin more than 40% of the potential food supply globally.

Key Crop Protection Chemicals Market Insights Summary:

Regional Highlights:

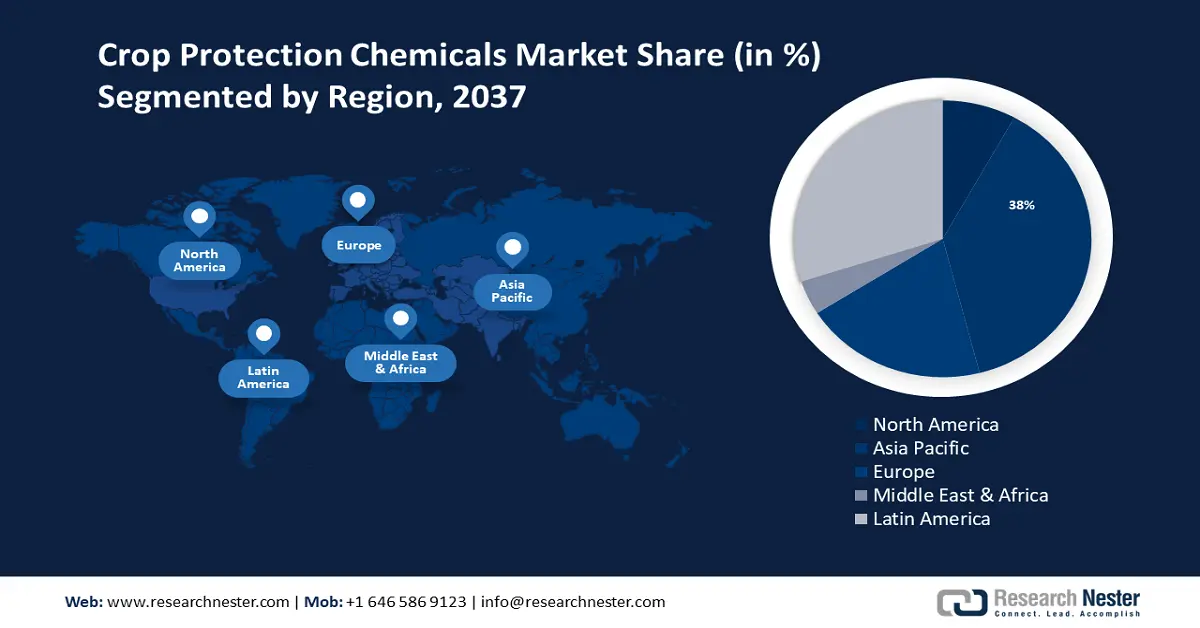

- Asia Pacific crop protection chemicals market will secure over 38% share by 2035, attributed to the enlargement of areas under high-value crops and smart farms to address food shortages.

- Latin America market will attain a 30% share by 2035, fueled by rising crop yields in Argentina and advancements in soybean cultivation in Brazil.

Segment Insights:

- The synthetic segment in the crop protection chemicals market is expected to achieve substantial growth till 2035, driven by the reliability and fast action of synthetic chemicals in pest control.

- The foliar spray segment in the crop protection chemicals market is projected to hold a 50% share by 2035, fueled by high efficiency and reduced nutrient loss from foliar application.

Key Growth Trends:

- Increasing pressure on crop cultivation

- Rising organic cropland field globally

Major Challenges:

- Pesticide residues contain toxic elements

Key Players: American Vanguard Corp, Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsDow Chemical Company, Arysta LifeSciences Corporation, Bayer AG, BASF SE, FMC Corporation, Corteva, Chr. Hansen Holding A/S, Bioworks Inc., Syngenta Group.

Global Crop Protection Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 67.81 billion

- 2026 Market Size: USD 71.11 billion

- Projected Market Size: USD 114.74 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Brazil

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Crop Protection Chemicals Market Growth Drivers and Challenges:

Growth Drivers

- Increasing pressure on crop cultivation - As the global population persists in increasing every year this further imposes pressure on crop yielding which as a definite outcome helps the crop protection chemicals market revenue to surge between 2024 to 2035.

The Food and Agriculture Organization (FAO) projects that by 2050, there will be 9.8 billion people on the planet, up from 7.55 billion in 2017. The demand for grain is predicted to rise at least 2.2 times between 1970 and 2020 (or 2.5 billion tons) to go along with this advancement. Naturally, farmers are inclined to different crop protection chemicals to optimize crop cultivation and confirm a persistent food supply to the world. - Rising organic cropland field globally - Global organic statistics and organic fertilizers are essential for tracking the effects of the initiatives of crop cultivation and have shown to be beneficial for programs involving international development cooperation as well as supporting plans for organic markets and agriculture. In 2022, the area dedicated to organic farming worldwide grew by more than 20 million hectares, reaching 96 million hectares.

The number of organic farmers increased significantly as well, to more than 4.5 million. In 2022, organic food sales were close to 135 billion euros (143 billion USD).

Organic farming makes up 1.5% of all cropland worldwide. Many nations, nevertheless, have much higher percentages. Liechtenstein (39 percent), Samoa (35 percent), and Austria (25 percent) have the highest percentages of organic farmland overall. Ten percent or more of all agricultural land is organic in sixteen different countries. - Rising implementation of genetic mode (GM) crops - Crop genetic modification is seen as a viable means of accomplishing the objectives of sustainable agriculture in the twenty-first century. Since people ceased migrating and depended on agriculture for survival, efforts have been made to enhance plants for food production.

Currently, more sophisticated molecular tools are being created than traditional approaches for the precise genetic modification of crops.

Challenges

- Pesticide residues contain toxic elements - Around the world, more than a thousand pesticides are used to prevent pests from destroying or harming food.

The characteristics and toxicological consequences of each pesticide vary, as a pesticide's toxicity is determined by its purpose as well as other elements. For instance, pesticides are typically more hazardous to people than herbicides. Depending on the dose that is, the amount of chemical to which an individual is exposed, the same chemical can have various effects. The method of exposure such as by eating, breathing, or direct skin contact can also affect the degree of toxicity. - Depending on the type of pesticide, there are possibilities of different health hazards for people worldwide. Some have an impact on the neurological system, including carbamates and organophosphates. Some could irritate the eyes or skin. Certain chemicals might cause cancer, and others might have an impact on the body's endocrine system or hormones.

Crop Protection Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 67.81 billion |

|

Forecast Year Market Size (2035) |

USD 114.74 billion |

|

Regional Scope |

|

Crop Protection Chemicals Market Segmentation:

Origin Segment Analysis

The synthetic segment will hold around 80% crop protection chemicals market by through 2035. This advancement will be majorly poised due to the frequent use of synthetic chemicals for their prompt and trustworthy pest control abilities.

According to the Food and Agriculture Organization of the United States, currently, more than four million tonnes of pesticides are consumed annually worldwide. There are currently over 1,000 pesticides on the market worldwide, the majority of which are synthetic chemicals, which include chemical, microbiological, semi-chemical, and botanical pesticides.

Type Segment Analysis

The herbicides segment is anticipated to account for 40% market share during the forecast period. The current global pesticide usage is estimated at 2 million tons, of which 48% are herbicides, 30% are insecticides, 18% are fungicides, and 6% are other pesticides. The effectiveness and durability of herbicides as a weed control strategy will be enhanced by a greater understanding of their mechanisms and activities.

Mode of Application (Seed Treatment, Soil Treatment, Foliar Spray)

The foliar spray segment will dominate crop protection chemicals market share of more than 50% by 2035. The increasing and extensive use of foliar spray can assist this segment to augment the most during the planned period.

In line with recent research, an enormous amount of resources are lost when the standard macronutrients N, P, and K are applied to the soil. The percentages of loss are estimated to be 40-70%, 80-90%, and 50-90%, respectively. However, because of their small size (1-100 nm) and high specific surface area, foliage nano fertilizers have several advantages over conventional fertilizers, including controlled release, high nutrient consumption, low cost, and comparatively little environmental contamination.

Our in-depth analysis of the global crop protection chemicals market includes the following segments

|

Origin |

|

|

Type |

|

|

Formulation |

|

|

Mode of Application |

|

|

Crop |

|

|

Dosage Technique |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crop Protection Chemicals Market Regional Analysis:

APAC Market Insights

Asia Pacific region in crop protection chemicals market is poised to hold more than 38% revenue share by 2035. This advancement will be credited to the enlargement of areas under the yields of high-value crops and smart farms in countries like China, India, Japan, Australia, and the rest of the Asia Pacific region to curb the shortage of food in this region.

For instance, according to the International Production Assessment Division (IPAD), in an attempt to lessen the nation's dependency on imported food, Chinese officials have reclaimed more than 170,000 hectares (420,000 acres) of farmland since 2021.

China became more self-sufficient in grains by extending its agricultural lands and providing irrigation infrastructure to places that receive less rainfall. The National Bureau of Statistics (NBS) reports that in 2023, China's grain output reached a new high of 695.41 million tonnes, an increase of 1.3 percent year over year.

The growth of organic farms in India will lead to a continuous increase in the crop protection sector. According to the Indian Agricultural Association, food grain production in India grew from 177 million tons over the previous 20 years. Significant alterations have occurred in the production, consumption, and trade patterns within Indian agriculture in the past few decades.

Latin American Market Insights

By 2035, Latin America region in crop protection chemicals market is estimated to hold more than 30% share. Currently, South America accounts for more than half of global soybean output; yield expansion in both nations has been very minor, at less than 30%, despite increases in soybean harvested area of 160% in Brazil and 57% in Argentina.

There has been a rising crop yield in Argentina resulting in the market expansion during the forecast timeline. Argentina has about 56% of its agricultural acreage rented to local farmers by absentee landlords, according to Global Yield Gap Atlas.

The rising advancement in soybean cultivation will expand the crop protection industry. Brazil produces crops on 17% of its arable land, which accounts for more than 50% of the global soybean trade.

Crop Protection Chemicals Market Players:

- American Vanguard Corp

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Chemical Company

- Arysta LifeSciences Corporation

- Bayer AG

- BASF SE

- FMC Corporation

- Corteva

- Chr. Hansen Holding A/S

- Bioworks Inc.

- Syngenta Group

The majority of businesses are concentrating on expanding their footprints through strategic alliances and the construction of new facilities in developing and promising areas like Asia Pacific and Central & South America. This was done to provide possibilities throughout the area and enhance the industrial capabilities, efficiency, and supply chain. Multiple numbers of the leading companies in the worldwide crop protection chemical sector are investing in crop cultivation and some of those are

Recent Developments

- American Vanguard Company declared that OHP Inc., the foremost provider of technology-oriented solutions for greenhouse and nursery cultivation applications, has in agreement to befit the master distributor in U.S. non-crop markets of biological technologies created by Certis Biologicals.

- American Vanguard Corporation, over its completely owned ancillary AMVAC Chemical Corporation, declared the prolongation of their North American cooperation with NewLeaf Symbiotics of St. Louis. Developing further the deal declared in late 2022, AMVAC and NewLeaf will cooperate to bring creative biological solutions to numerous markets in main locations globally.

- Report ID: 6031

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crop Protection Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.