Automotive Cybersecurity Market Outlook:

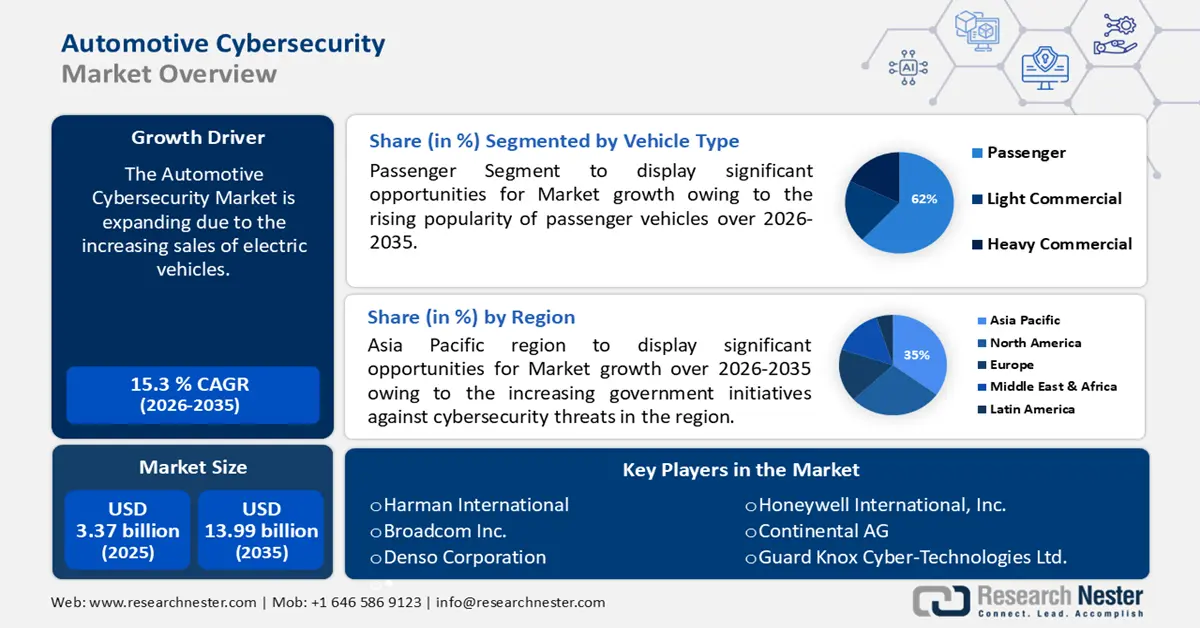

Automotive Cybersecurity Market size was over USD 3.37 billion in 2025 and is projected to reach USD 13.99 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive cybersecurity is evaluated at USD 3.83 billion.

The reason behind the expansion is the increasing sales of electric vehicles. EVs are becoming increasingly autonomous and networked and have various points of entry into electric vehicle (EV) charging systems, such as EV connectors, user terminals, Internet connections, and maintenance terminals, making them more vulnerable to cybersecurity attacks. As per the International Energy Agency, sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, a 35% annual rise.

Key Automotive Cybersecurity Market Insights Summary:

Regional Highlights:

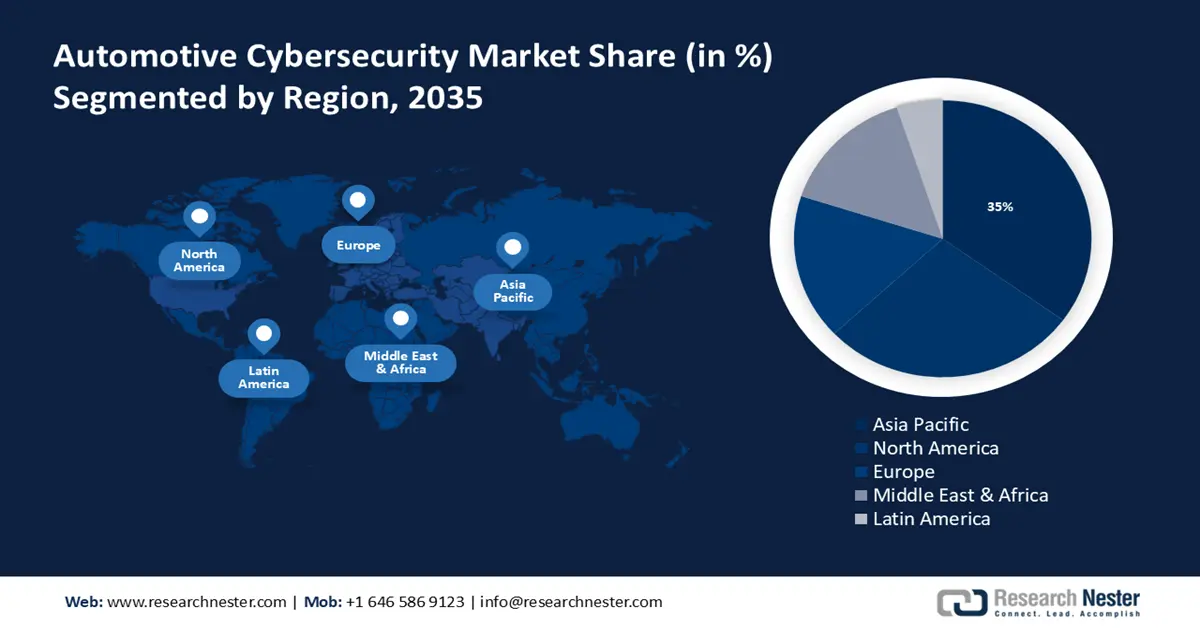

- Asia Pacific automotive cybersecurity market will dominate around 35% share by 2035, driven by government initiatives against cybersecurity threats and rising cyberattacks.

- North America market will exhibit massive growth from 2026 to 2035, driven by increasing personal disposable income and updated vehicle cybersecurity regulations.

Segment Insights:

- The passenger segment in the automotive cybersecurity market is forecasted to achieve a 62% share by 2035, driven by the rising popularity of passenger vehicles.

- The ice vehicles segment in the automotive cybersecurity market is expected to see substantial growth till 2035, driven by the rising production of ICE vehicles.

Key Growth Trends:

- Prevalence of data breaches in the automotive industry

- Advent of cloud applications

Major Challenges:

- Complexity associated with regulatory compliance

- Lack of standardized cybersecurity protocols

Key Players: Harman International, Broadcom Inc., Denso Corporation, Honeywell International, Inc., Continental AG, Guard Knox Cyber-Technologies Ltd., Robert Bosch GmbH.

Global Automotive Cybersecurity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.83 billion

- Projected Market Size: USD 13.99 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Automotive Cybersecurity Market Growth Drivers and Challenges:

Growth Drivers

- Prevalence of data breaches in the automotive industry - Since modern vehicles carry personal information such as GPS data, contact details, and even health information, data leaks have become a serious worry for automotive corporations, which may augment market demand for automotive cybersecurity.

As per a report published in 2023, data breaches are responsible for more than 35% of automobile cybersecurity incidents. - Advent of cloud applications - A new era of vehicle management has been brought about by cloud apps, which are also transforming the automotive sector, and are also known to be vulnerable to data breaches and cyber intrusions, leading to higher adoption of automotive cybersecurity solutions.

By 2025, more than 90% of enterprises are expected to be using cloud computing.

Challenges

- Complexity associated with regulatory compliance - Automobile manufacturers must implement cybersecurity measures to thwart cyber threats, according to the UNECE WP.29 Cybersecurity regulation, which comprises over 65 distinct cyber threats and vulnerabilities listed, and new car models have to comply with the rules, however, the automobile sector is confronted with significant obstacles, particularly as some original equipment manufacturers (OEMs) and suppliers bemoan the new laws' excessive generality.

Regulations about automotive cybersecurity can be complicated to maintain since it is a continuous effort rather than a one-time accomplishment. - Lack of standardized cybersecurity protocols- Automotive cybersecurity procedures are essential for defending automobiles against malevolent intrusions, however, the lack of industry-wide cybersecurity standards for the automotive supply chain presents a major challenge for OEMs and suppliers to establish clear guidelines.

Automotive Cybersecurity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 3.37 billion |

|

Forecast Year Market Size (2035) |

USD 13.99 billion |

|

Regional Scope |

|

Automotive Cybersecurity Market Segmentation:

Vehicle Type Segment Analysis

Passenger segment is predicted to capture automotive cybersecurity market share of around 62% by the end of 2035. The segment growth can be ascribed to the rising popularity of passenger vehicles. In wealthy nations, passenger cars are the most widely used form of transportation and have become increasingly popular among drivers in recent years due to the rising middle class and rising standards of life in emerging nations.

Attack surfaces increase as passenger vehicles connect to more networks, including the cloud (V2C), as a result, the need for automotive cybersecurity becomes increasingly evident since passenger safety and public health are seriously threatened by the possible hazards of vehicle hacking, which include the ability to disable or even crash a car.

As per the European Union, in the EU, there were 560 passenger automobiles on average for every 1,000 residents in 2022.

Propulsion Type Segment Analysis

The ICE vehicles segment in automotive cybersecurity market is set to garner substantial revenue in the coming years. The reason behind the growth of the segment can be attributed to the rising production of ICE vehicles. Contemporary ICE automobiles have a range of linked amenities installed, including WIFI connectivity, GPS navigation, and infotainment systems, and are also becoming more susceptible to cybersecurity threats, which may augment the adoption of automobile cybersecurity.

For instance, it was projected that China would produce approximately 22 million internal combustion engine (ICE) automobiles overall by 2030.

Offering Segment Analysis

The software segment is foreseen to generate a robust revenue share soon led by the rising integration of ADAS in vehicles. ADAS elements are being included by automakers to improve safety and give customers access to cutting-edge driver assistance resources by giving drivers real-time notifications and support. With the adoption of ADAS technologies, more than 20,840 deaths per year, or around 60% of all road deaths, might be prevented.

Smart automotive steering systems are essential for advanced driver assistance systems (ADAS) to function to incorporate functions like adaptive cruise control, automated emergency braking, and lane-keeping assistance, software and security integration to defend against unauthorized access, and maintain the integrity of communication networks, and shield antivirus software from any online dangers.

Our in-depth analysis of the automotive cybersecurity market includes the following segments:

|

Form |

|

|

Offering |

|

|

Application |

|

|

Security Type |

|

|

Approach |

|

|

Vehicle Autonomy |

|

|

Propulsion Type |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Cybersecurity Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 35% by 2035. The market expansion in the region is propelled by the increasing government initiatives against cybersecurity threats. The APAC area is witnessing a significant surge in cyberattacks in contrast to other parts of the world, therefore the government is taking actions that mostly address concerns related to national security, cyber security threat perceptions, and risks to vital information infrastructure.

For instance, to protect cars from cyberattacks, the Ministry of Road Transport and Highways (MoRTH) a ministry of the Government of India, has proposed standardizing Cyber Security and Management Systems (CSMS) requirements for passenger and freight carriers since it is imperative to implement laws that set strict automotive cybersecurity guidelines to guarantee that OEMs, automakers, and service providers in the connected vehicle ecosystem follow strong security protocols.

Additionally, on January 5, 2023, China published the "Auto data security compliance and practice guidance to maintain the safety and security of the autonomous vehicle industry, which emphasizes how crucial cybersecurity and data protection are to the creation of intelligent transportation systems.

Besides this, cloud computing, or simply "cloud," is quickly becoming popular in Japan, and this is good for the country's economy and society in many ways. As connected and automated guided vehicles become more common, automakers there have already begun working with cloud service providers, which may increase the demand for automotive cybersecurity.

North American Market Insights

The North American automotive cybersecurity market will also register a massive CAGR and will hold the second position led by the increasing personal disposable income. As a result, there is an increased ability to purchase cars, leading to robust demand for automobile cybersecurity in the region.

Regulations and best practices for vehicle cyber security are being released by the United States which addresses training, product development, incident response, and other cybersecurity-related topics. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States has updated its Cybersecurity Best Practices for the Safety of Modern Vehicles to encourage manufacturers of vehicles and equipment to review the guidance and decide whether to apply it to their particular systems.

In addition, cybersecurity and the safety of motor vehicles are shared in Canada by the commercial sector, all governmental levels, and individual citizens by staying up to date with how the automotive cyber landscape is changing to successfully manage and mitigate cyber security risks and related vulnerabilities.

Automotive Cybersecurity Market Players:

- NXP Semiconductors N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The automotive cybersecurity market is dominated by the top players who are making headway in the market by implementing several tactics, such as mergers and acquisitions, and new product development.

Recent Developments

- Harman International a global leader in connected car technology announced that its cybersecurity management system has received a certificate of conformity after being audited in conformance with ISO/SAE 21434:2021 which offers a framework for businesses to identify, evaluate, and manage cybersecurity risks for protecting automobiles and their occupants from possible cyberattacks and for encouraging industry-wide standards for automotive cybersecurity.

- Honeywell International, Inc. announced the acquisition of SCADAfence, to integrate its product line to improve their capacities and assist the clients in protecting themselves against ever-increasing cyber security threats.

- Report ID: 6095

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Cybersecurity Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.