Agriculture Biologicals Market Outlook:

Agriculture Biologicals Market size was valued at USD 15.87 billion in 2025 and is set to exceed USD 48.42 billion by 2035, expanding at over 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agriculture biologicals is estimated at USD 17.56 billion.

The reason behind the growth is the rising demand for maintainable and organic substitutes of chemical-depended pesticides while production on a farm. For instance, The Food and Agriculture Organization of the United Nations (FAO) and the European Union (EU) assist in integrated pest management (IPM), which incorporates implementing mixed cropping and natural predators and biopesticides and rotation when it's possible. Many nations, most notably Indonesia, have tried to replace the usage of pesticides with substitute techniques like integrated pest management (IPM).

Key Agriculture Biologicals Market Insights Summary:

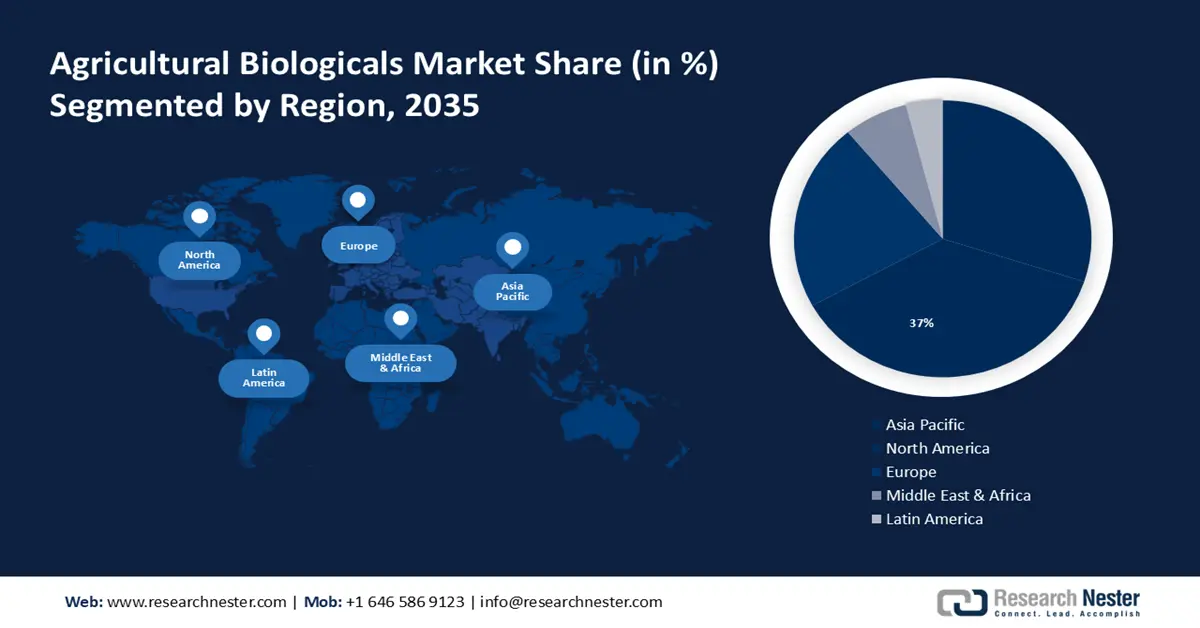

Regional Highlights:

- North America agriculture biologicals market achieves a 37% share by 2035, driven by rising awareness about organic product consumption in this region.

Segment Insights:

- The biopesticides segment in the agriculture biologicals market is expected to experience significant growth till 2035, fueled by increasing consumption by farmers to protect crops from damage.

- The cereals & grains segment in the agriculture biologicals market is projected to see robust growth till 2035, driven by the rising global production and usage of cereals and grains.

Key Growth Trends:

- Increasing global population and rising demand for high-quality crop yield

- More adoption of advanced technologies in crop yield

Major Challenges:

- Increasing cost of agriculture biologicals

- Challenge in accomplishing agriculture biologicals

Key Players: Novozymes A/S, Mapleton Agri Biotec, BASF SE, Syngenta Crop Protection AG, Symborg S.L., National Fertilizers Ltd., Lallemand Inc., Agricen, Sigma Agri-Science, LLC, Takara Bio Inc., GREEN EARTH INSTITUTE CO., LTD., IntegriCulture Inc., OriCiro Genomics, Inc., Spiber Inc.

Global Agriculture Biologicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.87 billion

- 2026 Market Size: USD 17.56 billion

- Projected Market Size: USD 48.42 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, India, Japan

- Emerging Countries: China, India, Brazil, Argentina, Mexico

Last updated on : 17 September, 2025

Agriculture Biologicals Market Growth Drivers and Challenges:

Growth Drivers

- Increasing global population and rising demand for high-quality crop yield - The need for agricultural products as fuel, feed, and food is rising quickly on a global scale. For many years, there has been an increasing demand for plant components. However, recent rises in the consumption of meat in developing nations and the rapid use of grain for the manufacture of biofuel in rich nations have put further strain on the world's grain supply.

According to the Global Agriculture Forum released in 2023, between 2009 and 2050, the world's population is predicted to increase by more than a third, or 2.3 billion people. - Increasing demand for crop protection chemicals - Pesticides, which are widely used to prevent pests in crops, are an integral aspect of agriculture and work to eradicate weeds, fungi, and insects that pose a harm to crop yield or health. Moreover, insecticides are used to control pest insects that might ruin crops, whilst herbicides are used to get rid of undesirable plants. Fungicides reduce the effects of fungal infections, which is essential for preventing the widespread spread of crop diseases.

For instance, for several years, there has been a steady increase in the average global corn yield of 4.9 tonnes/ha. This is possible because of the rising advancement in crop protection chemicals. - More adoption of advanced technologies in crop yield - The increasing advancement of technology in crop yield will increase the agriculture biologicals market expansion in this region.

There is proof that American farmers in 2023, agronomists, and breeders have increased production in the past. The average maize yield in the United States has grown throughout time, from around 1.6 tonnes/ha in the first part of the 20th century to about 9.5 tonnes/ha presently. The discovery and broad application of new agricultural technology, such as hybrid corn, synthetic fertilizers, and farm machinery, is what has led to this significant increase in output.

Challenges

- Increasing cost of agriculture biologicals - Compared to chemical-based pesticides, agricultural biological pesticides are more expensive because of lower competition, greater manufacturing costs, and restricted scalability, which restricts product application and slows the expansion of the market.

Agriculture biologicals might be more or less cost-effective depending on the size of the output. Adopting biological products may be more difficult for large-scale farms because of the greater upfront expenditures and logistical difficulties.

- Challenge in accomplishing agriculture biologicals - A significant obstacle to the development and contemporary adoption of agriculture biologicals has been the abundance of businesses offering "miracle" microbial treatments over the years, sometimes with questionable origins or quality.

Agriculture Biologicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 15.87 billion |

|

Forecast Year Market Size (2035) |

USD 48.42 billion |

|

Regional Scope |

|

Agriculture Biologicals Market Segmentation:

Crop Segment Analysis

Cereals & grains segment is estimated to dominate agriculture biologicals market share of over 37.4% by 2035. The rising production of cereals and grains globally will help this segment to have a massive revenue share by the end of 2035.

According to the Food and Agricultural Organization of United States (FAO) forecast in 2023, worldwide grain output from 2023 to 2024 will reach 2847 million tonnes, a new high and an increase of 1.2% above 2022 production. With an expected 2836 million tonnes, 2023-24 grain usage is likewise predicted to be 1.6% higher than 2022-2023 levels. A fractional decrease in rice use is mostly ascribed to the abundance of supply and cheaper costs compared to the previous season, which led to a larger utilization of wheat and coarse grains, particularly for feed purposes.

Product Segment Analysis

In agriculture biologicals market, biopesticides segment is anticipated to hold revenue share of over 57% by the end of 2035. This expansion will be noticed due to the increasing consumption of biopesticides by the farmers to protect their crops from damage.

The FAO projects that during the next 20 years, the global population will increase by 39%, reaching 9.1 billion people by 2050. It will be essential to raise global food production by 60% in order to fulfill all of this demand. This scenario is developed in a short and medium-term setting that is heavily impacted by the adverse impacts of climate change and how it affects agriculture, among other things, by increasing warmth or lack of water.

Our in-depth analysis of the global market includes the following segments:

|

Crop |

|

|

Product |

|

|

Application |

|

|

End-Use Industry |

|

|

Source |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agriculture Biologicals Market Regional Analysis:

North American Market Insights

North America industry is expected to account for largest revenue share of 37% by 2035. This growth will be noticed mainly due to rising awareness about organic product consumption in this region. According to USDA ERS, growing customer demand for foods produced organically has given producers new market options and is changing the organic food sector.

The market for agriculture biologicals has expanded in the U.S. as a result of the rising government initiatives to empower the production of organic food. The U.S. Department of Agriculture (USDA) is strengthening the market for domestically farmed organic commodities and supporting producers pursuing organic certification, according to a statement made on 10th May 2023 by Agriculture Secretary Tom Vilsack.

The Canadian agriculture biological sector will grow mainly due to the rising investment in organic food and organic flavors. A new analysis from Export Development Canada estimated that in 2020, Canadians spent almost USD 7 billion on organic food.

APAC Market Insights

The Asia Pacific agriculture biologicals market will have a significant expansion through 2035. The presence of the traditional agriculture industry in the APAC region will drive the market of agriculture biologicals in this region. According to the Asia-Pacific Association of Agricultural Research Institute (APAARI) published in the year 2023, APAC produced and consumed more than 90% of the world's rice, 70% of vegetables, 60% of seed cotton, and 45-50% of cereals, oil seeds, and pulses. It is a key provider of most essential food and agricultural commodities.

Agriculture biologicals are especially in actual demand in China, driven by the increasing population in this country and the requirement for grain in this region. Even while China will no longer hold the title of the most populated nation in the world, the UN projects that in 2022, its population will reach 1.426 billion.

In Japan, agriculture biologicals will encounter massive growth because of the quick advancement in biotechnology. Moreover, its growth is mostly attributable to Japan's capacity for quick adaptability and profitably utilizing newly acquired knowledge and talents.

The agriculture biologicals sector will also be huge in India due to the increasing number of organic farmers in this country. The Economic Survey 2022-23 estimates that there are 4.43 million organic farmers in India at the moment. Over the following three years, 10 million farmers are to be assisted in switching to natural farming under the Union Budget 2023-2024.

Agriculture Biologicals Market Players:

- CBF China Bio-Fertilizer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novozymes A/S

- Mapleton Agri Biotec

- BASF SE

- Syngenta Crop Protection AG

- Symborg S.L.

- National Fertilizers Ltd.

- Lallemand Inc.

- Agricen

- Sigma Agri-Science, LLC

Due to the constant innovation by major companies in the agriculture biologicals area to meet the changing demands of contemporary agriculture, the agriculture biologicals market is expanding significantly. Among the major companies in the market are:

Recent Developments

- BASF SE and Vivagro, a forward-thinking French provider of agroecological solutions signed a distribution deal for a novel product named Essen'ciel—which is intended for the agricultural markets of Italy and Spain in July 2023. Made with sweet orange essential oil, Essen'ciel has several uses as an all-natural acaricide, fungicide, and pesticide. A wide range of organic applications, such as vine grapes, vegetable crops, berries, decorative crops, industrial crops, and arboriculture, have received regulatory permission for the use of this novel biostimulant substance.

- Syngenta Crop Protection AG in January 2022 purchased NemaTrident and UniSpore, two of Bionema Limited's cutting-edge bioinsecticides. By offering clients supplemental and additional technologies for the effective and sustainable management of insect pests while addressing problems connected to pest resistance, these state-of-the-art biocontrol solutions constitute a substantial addition to Syngenta's arsenal.

- Report ID: 6191

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agriculture Biologicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.