Posted Date : 11 December 2025

Posted by : Akshay Pardeshi

Remember the preliminary insurtech explosion, which was all about snappy applications, digital-first policies, and a steady mission to create disaster among conventional insurance giants. That was one wave, but at present the dust has successfully settled as the market has readily matured. But there lies a real question- What comes next? The upcoming growth wave will not be achieved by tech organizations merely dabbling in insurance, but by actual insurance companies that are able to adapt to technology and redefine the overall game. This will be a new chapter that demands a transition from simple consumer acquisition to intellectual prediction. The race has begun and is steadily moving beyond the hype to develop sustainability and profitable futures.

Therefore, buckle up, as we will be exploring certain strategies in this blog that will differentiate future leaders from being forgotten!

Ditch the One-Size-Fits-All: Why Personalization is Your New Premium Engine?

The digital quote game is no longer considered a differentiator, but in reality, it has emerged as the baseline. Current winners are the ones abolishing generic approaches for implementing hyper-personalized coverage. By adopting artificial intelligence (AI) and real-time data, insurance organizations can transform their service offering from an inert policy into a robust and value-based collaboration that can ensure premium growth and loyalty.

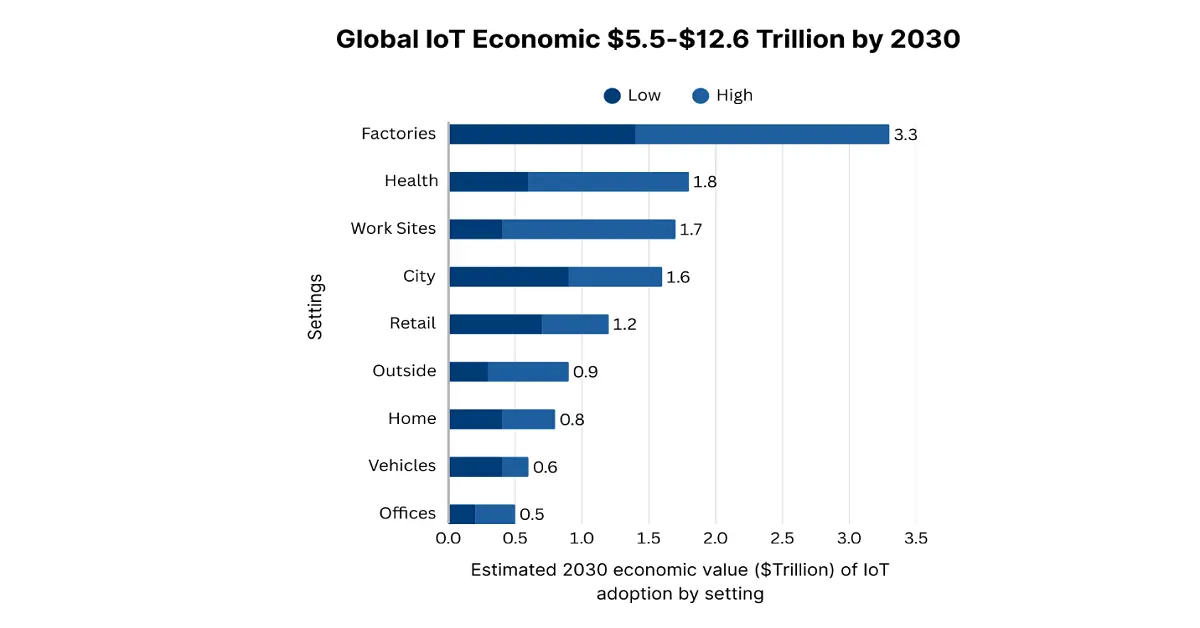

Through leveraging the Internet of Things (IoT) and telematics ensures gathering permissioned and real-time data. At present, the IoT market is continuing to gain increased importance due to automation in industries, expansion in 5G networks, Industry 4.0 integration, and overcoming complicated network contract management. According to the October 2024 NIST Government report, the international IoT economic value is projected to be valued from USD 5.5 trillion to USD 12.6 trillion by the end of 2030, which denotes a huge opportunity for the health insurance to adapt. Besides, the usage-based insurance (UBI) for ensuring automation is just the beginning, through which smart home sensors for property insurance and wearable data for life and health insurance will ensure healthy habits and revolutionize the insurance sector.

Now, imagine the existence of micro-policies for specified events that can initiate an automatic payment process by utilizing pre-aged data triggers, such as a flight status API. This includes the absence of forms, waiting time, and ensuring a hassle-free process. Additionally, this sudden shift from underwriting loss to smoothly fulfilling a promise is indeed a powerful brand differentiator. This particular procedure also meets consumers at the exact point of their demand, eventually altering their insurance from a reluctant purchase into a value-packed and on-demand safety net. Therefore, these policies diminish the yearly and rigid renewal cycle, making the upcoming insurance sector more dynamic as well as event-driven.

Furthermore, the conventional questionnaire happens to be a blunt instrument! In this case, AI-based assessment successfully transfigures by effectively analyzing a capital of alternative and anonymized data from financial judicious indicators to property-driven telematics, all within the presence of strong safeguards. This leads to permitting a hyper-accurate and nuanced risk profile that operates far beyond crucial demographics. The result, therefore, is a win-win situation, where coverage tends to get extended to previous reliable and underserved markets, while providing true and fair premiums to low-risk consumers. This entire process is not just sophisticated, but a suitable and equitable system that generously rewards standard behavior, along with unlocking massive new pools pertaining to profitable business.

The Silent Sale: How to Win by Embedding Insurance into Life's Digital Flow

The golden era of websites for providing insurance differentiation is gradually fading. The upcoming growth wave is not just about grabbing the top spot on the digital shelf, but it is actually about remaining invisible and seamlessly woven into the customer journey fabric. Just think about it- people usually do not wake up with a sensational requirement to purchase insurance. Instead, they wake up needing to purchase a book, a dream vacation, a smartphone, or settle on the purchase of a private vehicle. Therefore, the future of the insurance demand is at a precise point of need, which is the realm of embedded insurance, further denoting a powerful and silent sale that diminishingly feels less like only a transaction and more like a value-added and natural service.

However, to win here, APIs are the most valuable asset, acting as silent workhouses that permit insurance products to be directly plugged into a partner’s platform. By developing flexible and robust APIs, insurers tend to enable e-commerce platforms to provide gadget coverage for checkout, a car dealership to represent a digital and perfect insurance policy, and a travel booking website to recommend flight cancellation processes. This is not just a distribution channel, but a legit transformation to a native feature from merely being an insurance.

To achieve this, technology is not the only option, but tactical collaboration is the ultimate key that deliberately unlocks this potential strategy. The objective here is to initiate alignment with existing and new brands that successfully cater to consumers’ confidence and trust during relevant situations. Besides, partnering with fintech applications for account opening ensures estate tech platforms during mortgage signing and healthcare providers for providing oxygen options. Meanwhile, the overall fintech activity is directly correlated with different nations’ per capita income since developed countries possess a higher rank in comparison to developing countries. Therefore, based on this aspect partnership is possible, which provides a gateway to attain pre-qualified and drastically diminished customer acquisition expenses.

Ultimately, the focus on a frictionless experience will be based on the winner-takes-all differentiator in the upcoming years. The overall process, including the initial offer to rapid purchase, along with future claims, should occur wholly within the partners’ ecosystem. The intention is to ensure an effortless insurance purchase by providing a warranty in the shopping cart with two clicks and no redirects or forms. This unmatched convenience is what transforms a hesitation moment into a confirmed and silent sale, which develops not on a customer base but with the existence of a loyal ecosystem.

Beyond the Usual Suspects: Unlocking Growth in the Markets Everyone Ignores

Let us be honest that the claim process is where insurance brands are truly broken or made. A frustrating, opaque, or slow process can rapidly undo years of market investment and brand development. On the contrary, seamless, fast, and empathetic claims witness does not resolve a claim, but pressures an unbreakable trust and develops a vocal and powerful advocate for brands. This denotes a critical moment of truth, which is a huge opportunity to transmit perception from observing insurance as a bitter purchase to valuing it as a reliable and essential partner.

However, to achieve this, notable insurtechs are adopting Zero-Touch claims for straightforward and small incidents. By integrating automation and AI, claims can be easily identified, approved, and paid out rapidly without the need for human intervention. This is not just an efficiency benefit, but a profound game-changer for consumer satisfaction, which in turn converts a conventional process into an effortless experience that is equivalent to being magical. Besides, technologies, such as computer vision and AI, are increasingly revolutionizing damage assessment. Based on this, consumers can simply utilize their respective smartphone camera to capture damage photos, be it just a dent or property harm.

Moreover, the actual evolution is heart-rending from being reactive to predictive, as well as proactive. By implementing IoT data from devices, including smart home sensors, insurtechs can easily combat claims altogether. Besides, a water leak sensor has the capability to successfully detect an issue before it emerges as a catastrophic flood, and the organization can rapidly alert the homeowner, as well as dispatch a suggested plumber. This eventually transforms the overall business model from simply identifying loss to actively delivering protection and peace of mind, thereby boosting the brand’s pivotal role as a forward-thinking and indispensable partner in customers’ lives.

The 2025 Point of View: The Path to Profitability and Increased Sales

The primary insurtech gold rush, which is highly fueled by venture capital, along with a blitzscale mentality, is currently over. By the end of 2025, the industry will comprise a brutal and essential Darwinian breakthrough, wherein disruptors will be separated from the disrupted. As stated in the June 2025 World Economic Form data report, the overall fintech sector is growing based on a 37% increase in customer enhancement, while there is a 40% surge in financial performance, followed by a 39% increase in revenue growth. Therefore, winners and survivors will be the ones effectively executing a standard pivot by ditching the growth-at-all-costs model for the focus on sustainable economic. This is not a minor strategic intention, but a wholly philosophical aspect, wherein efficient growth and profitability become the initial success metrics.

Gone are those days of fiery millions on making advertisements to purchase market share. The pathway to boosted sales will be developed on foundational and smart pillars. Embedded distribution will be the ultimate crown jewel for consumer acquisition, thereby permitting insurtechs to be available when needed. Moreover, growth will also be attributed to superior product-market fit through which winners will be able to focus on me-too auto reforms to develop advanced and high-margin products that can readily solve real-world and acute problems. Besides, the think-on-demand insurance for economic workers that automatically initiates payment addresses barriers that conventional insurers have successfully ignored.

Therefore, supporting this approach will result in a mastery of data-based personalization, and by incorporating alternative and AI data, insurtechs will effectively gain unprecedented accuracy in the pricing strategy. This deliberately enhances loss ratios, reduces risks, and permits fair premiums, which optimizes the customer lifetime value (LTV). Therefore, the ultimate mantra for 2025 is the aspect of capital efficiency, and insurtechs mastering this trifecta, including smart pricing, advanced products, and effective distribution, will witness growth but also cross the elusive chasm and convert into profitability. Besides, organizations adopting these will emerge as attractive and strategic targets that will readily define the future development of the overall industry.

The Futuristic Horizon: The Profitability Paradigm

Finally, looking out to the future, the profitable insurtech will appear to be less like a traditional insurance organization and more like a proactive risk management and data-driven platform. The aspect of profitability will be developed on three essential pillars, including predictive prevention, which comprises the widespread IoT integration to shift the core business model into combating loss. This will effectively modify and drastically diminish the highest cost facility by claiming payout. Secondly, the ecosystem play, which denotes that successful players will not only market policies, but will own consumers’ overall risk lifestyle. This will ensure a platform to make a connection between consumers and trustworthy service providers. Thirdly, AI-optimized everything, including processes and underwriting claims, to reduce operational overhead to previously unidentified levels.

Therefore, the insurtech that gains success in the near future will not be the one with the most attractive jingle. Instead, it will be the one that will be deeply integrated into consumers’ lives through partnerships, value-added services, and data that becomes a highly profitable, safe, and indispensable net.

Contact Us