Posted Date : 11 December 2025

Posted by : Akshay Pardeshi

Let us be honest with the phrase, regulatory compliance, which has never actually set the world on fire. For years, it has successfully conjured labyrinthine legal documents, images of dusty ledgers, and a team of stressed analysts, operating throughout the night. It has always been a world of thou shalt not, an essential evil, and a cost center. But all of a sudden, something changed overnight. An absolute and perfect explosion in data volumes, a storm of financial disasters, along with a digital evolution, pressured this steady sector to eventually look in the mirror. It did not just observe a rulebook, but witnessed a huge and untapped market for progression.

This particular blog comprises the story of regulatory technology, commonly known as RegTech! It is all about not only chaotic upheaval, but an industry that remained rooted in its central mission by ensuring transparency, security, and safety, while experiencing a tech-driven and radical metamorphosis. The blog is about how compliance has converted from a back-office burden to a tactical powerhouse.

The Unshakeable Roots: Why Regulation Will Always Be King

Before we appreciate the high-tech evolution of RegTech, it is essential to critically understand the immutable groundwork it has been built upon, regulation itself. The fundamental principles of regulation are not a transitory trend, but they are non-negotiable and permanent pillars of an operational worldwide economy. Rather than being made outdated by the aspect of technology, their significance has been enlarged in the current digital era.

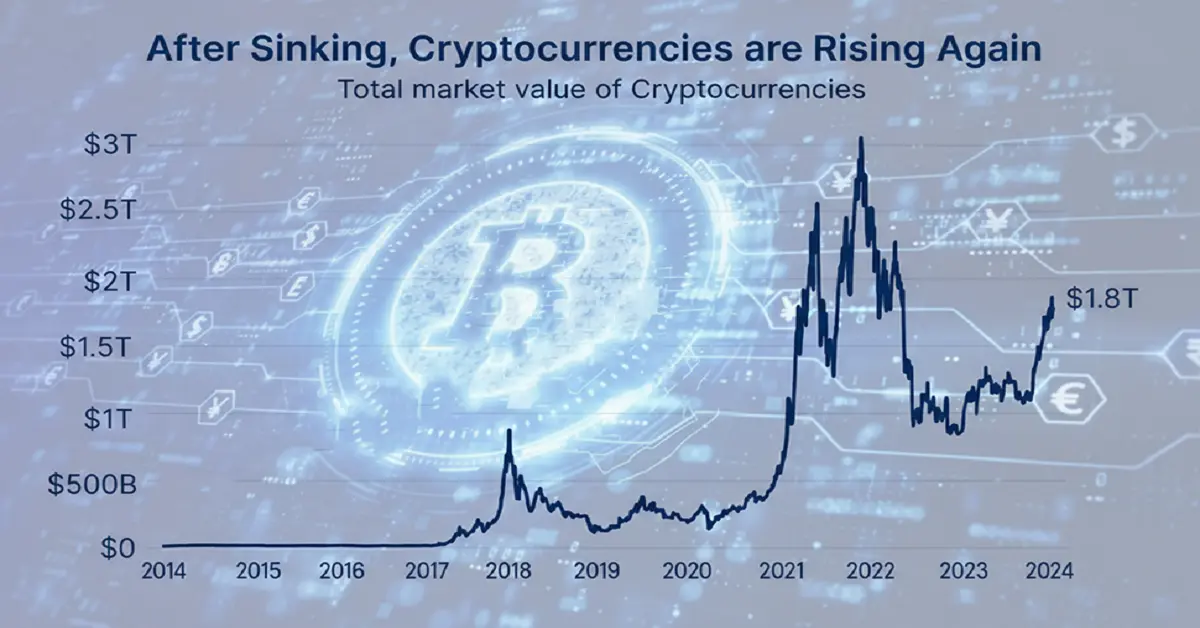

First and foremost is the trust factor, which is the ultimate currency! In the online scenery, filled with sophisticated scams and data breaches, the assurance that one’s personal information and money are secured and protected is the actual bedrock of overall financial activities. Without this, the digital economy will readily crumble under the weightage of risk and uncertainty. Then, there exists our increasingly associated world that has effectively developed unparalleled complications. Cross-border transactions and a surge in digital assets, such as remote work and cryptocurrency, have created an intricate international web of compliance demands. Therefore, attempting to navigate this maze with paper-based and manual processes is not sufficient, but utterly impossible. This complication, in turn, readily demands a sophisticated solution.

Source: Council on Foreign Relations, 2024

Finally, the impression of the 2008 financial crisis continues to exist. It has served as a permanent and brutal lesson on the catastrophic consequences of reactive compliance and insufficient oversight. In addition, there has been the occurrence of a paradigm shift, wherein robust compliance and proactive risk management are no longer considered as optional cost facilities, but non-negotiable and fundamental demands for overcoming systemic disaster.

Therefore, RegTech did not emerge to create a disbalance in this regulatory framework; instead, it came into existence as the crucial tool to strengthen and preserve it. This simply became too digital, complex, and fast for legacy systems to administer. RegTech’s genius dwells in its duality, and its roots are definitely planted in the unchanging and unstable principle of regulatory integrity, while its branches have reached the sky through progression. Therefore, it is the flawless fusion of agile technology and steadfast rules.

The Great Pivot: Cloud, AI, and the Tools of Transformation

The transformation of RegTech from a back-office and chunky function into a strategic and dynamic powerhouse has not been triggered by a solo eureka moment. Instead, it was the robust conjunction of different transformative technologies. This collaboration permitted RegTech to emerge beyond humble automation, which effectively raced up current manual tasks into a predictive and intelligent partner, constituting the ability to redefine the compliance nature. Besides, this aspect was successfully built on three technological pillars, including predictive analytics, artificial intelligence, and the cloud.

The initial shift was the sector’s transition to the software-as-a-service (SaaS) model, accompanied by the adoption of cloud computing, which was the essential and initial step leading to success. In this regard, the July 2023 IBEF report indicated that the SaaS market in India accounts for 7% to 10% of the global market, with a 20% increase, thereby suitable for the RegTech industry. Prior to this, compliance technology was largely dominated by on-premise and expensive software installations that were priced in the millions and took several years to implement. Besides, by providing compliance tools as a subscription-based service, which was delivered through the internet, RegTech providers enabled suitable accessibility.

All of a sudden, a small-scale fintech startup was able to leverage similar sophisticated abilities as an international bank without the need for upfront investment. This model has also unveiled unparalleled scalability, thereby permitting an organization’s compliance facility to extend smoothly along with its overall business. Additionally, it also gained agility, and in a period, where the latest regulations, such as Europe’s MiCA for sweeping ESG rules can appear overnight, the cloud has readily enabled providers to boost updates to their overall clients. This, in turn, has effectively ensured instant complaint for users, diminishing the error-prone and frantic scramble of physical updates and deliberately modifying the speed at which compliance be gained.

Furthermore, if the provided cloud enables a flexible and strong backbone, then AI, along with machine learning, emerges to be the central nervous system of the overall operation. AI uplifted RegTech from conducting simple responsibilities to execute complicated cognitive functions. Besides, in the case of fraud detection and anti-money laundering (AML), legacy systems appeared to be inefficient, thus generating false positives that misused millions of analyst hours. By contrast, AI models tend to learn from historical data, as well as network behaviors, allowing them to recognize suspicious activities with suitable accuracy. This permitted experts to concentrate on their respective skills and investigate actual threats.

Moreover, the most innovative revolution of RegTech is its jump from being reactive to predictive. Integrating the processing ability of AI-based analytical and cloud prowess, modernized tools are able to anticipate upcoming challenges. Besides, regulatory change management (RCM) platforms utilize Natural Language Processing (NLP) to effectively scan different legal documents, regulatory bodies, and international news sources. They not only developed a new rule, but also interpreted its meaning by cross-referencing it with an organization’s operations and specific reforms, and ensured standard insights regarding the adaptability. Further, these systems analyzed massive internal transaction data through predictive risk modeling, with the intention of recognizing risk patterns. Therefore, this shift not only prevents cost violations but readily transforms compliance into a tactical asset from a cost center that protects the business.

From Niche to Necessity: Validating the RegTech Revolution

The extraordinary transformation of RegTech from merely a niche concept to a crucial industry is not anecdotal; it is effectively validated by robust market data. The industry’s massive growth has served as the final testament to its tangible success, which is necessary in the modernized financial ecosystem. This data-based evidence has provided proof that RegTech is resolving the real issue for businesses across different nations.

For those looking to substantiate these claims with real data, key metrics are sourced from industrial leaders. According to a report published by the World Economic Forum in March 2022, through regulatory technology, at present, 70% of total processes for introducing the newest businesses are conducted online within an hour. Besides, this process is strictly engaged with public and private partnerships 2.0 (PPP 2.0) to enable designing with partners, and developing strong confidence in the market. In addition, the aspect of stakeholder capitalism ensures shared responsibilities and equity across different regulators and stakeholders to implement capitalism principles by creating long-lasting values.

Moreover, to ensure champion-based trust through RegTech, there exists a demand for suitable communication to diminish asymmetries and produce buy-in to the new system. This includes trusted personnel, such as community activists, senior private leaders, and public officials, who can gain access to comprehensive demographics to drive the adoption. Besides, radical user centricity includes user adoption through conventional products and services that are centered around standard semantics, reference points, design thinking, and international policy coordination. This results in boosting user experiences, not only based on efficiency but also from a supply perspective. Therefore, through RgTech, agile strategies in software development are apt, since there has been a radical transition, which has successfully emerged while catering to customers’ issues over a wide-ranging vision.

The InsurTech Boom: A Case Study in RegTech-Enabled Growth

The InsurTech industry provides the perfect scenario to effectively illustrate the symbolic and powerful relationship between innovation, which is Insurtech, and regulation, denoting RegTech. Besides, there has been an outstanding surge in RegTech, while the 2025 valuations are not only niche digital applications and marketing. Instead, it denotes that an effective portion of this achievement is directly driven by the unseen and silent revolution taking place under the surface, which indicates the sophisticated RegTech integration. This partnership determines that strong compliance is the ultimate engine that ensures profitable and scalable growth instead of creating a hindrance.

Further, this development is multifaceted, firstly owing to frictionless onboarding, which is governed by RegTech-based identity verification and digital KYC, thereby revolutionizing consumer acquisition. In addition, the ability to bind, verify, and quote a policy within minutes has dramatically enhanced conversion rates by overcoming paperwork-heavy and conventional obstacles that have caused suitable consumers to drop their applications. Secondly, RegTech is the actual key to ensuring personalization by providing a compliant framework, which is essential to use data from IoT, wearables, and telematic devices safely. This, in turn, allows InsurTechs to develop tailored and dynamic policies that tend to cater to consumer requirements, thereby effectively achieving new market segments and justifying premium pricing.

Thirdly, the growth is fundamentally profitable through automated compliance tools for detecting fraud, sanction screening, and report reductions in operational expenses that have conventionally devoured profit margins. This efficacy permits InsurTechs to provide a competitive pricing strategy, while significantly maintaining suitable profits by achieving the sector’s traditional grail. Finally, a mountable RegTech ensures the liveliness for expanding confidence into the latest verticals, such as pet insurance or cyber. Regarding this, the compliance structure has adapted to the newest products by eliminating the urge to create a new administrative team for each and every venture. In short, RegTech is not only the anchor supporting InsurTechs, but it is actually the silent engine that ensures efficacy, trust, and scalability.

The Road Ahead: Roots and Wings

The RegTech evolution is considered a continuous journey, and not just an accomplished destination. There is already expansion in the frontier into complex and new territories that need unusual capabilities. Supervisory technology, also known as Suptech, observes regulators by implementing innovative analytics for actual market monitoring, which in turn has necessitated sophisticated compliance tools from financial infrastructures. Besides, the ESG aspect represents a huge data collection, along with challenges, which is a task suitable for RegTech’s auditable and automated frameworks. Simultaneously, an upsurge in DeFi, along with crypto, depends on RegTech to ensure the transparency, security, and legitimacy essential for mainstream incorporation.

To conclude, this forward-thinking path perfectly compresses RegTech’s actual duality, and it continues to remain rooted in the timeless aspects of consumer protection and integrity, while increasing wings through cloud and AI technology. Additionally, it has significantly converted into its most powerful enabler from a perceived inhibitor. This has proved that a robust administrative foundation is not actually a cage, but the required bedrock for creating an inclusive, safe, and efficient financial system.

Contact Us