Ethylene Dichloride Market Outlook:

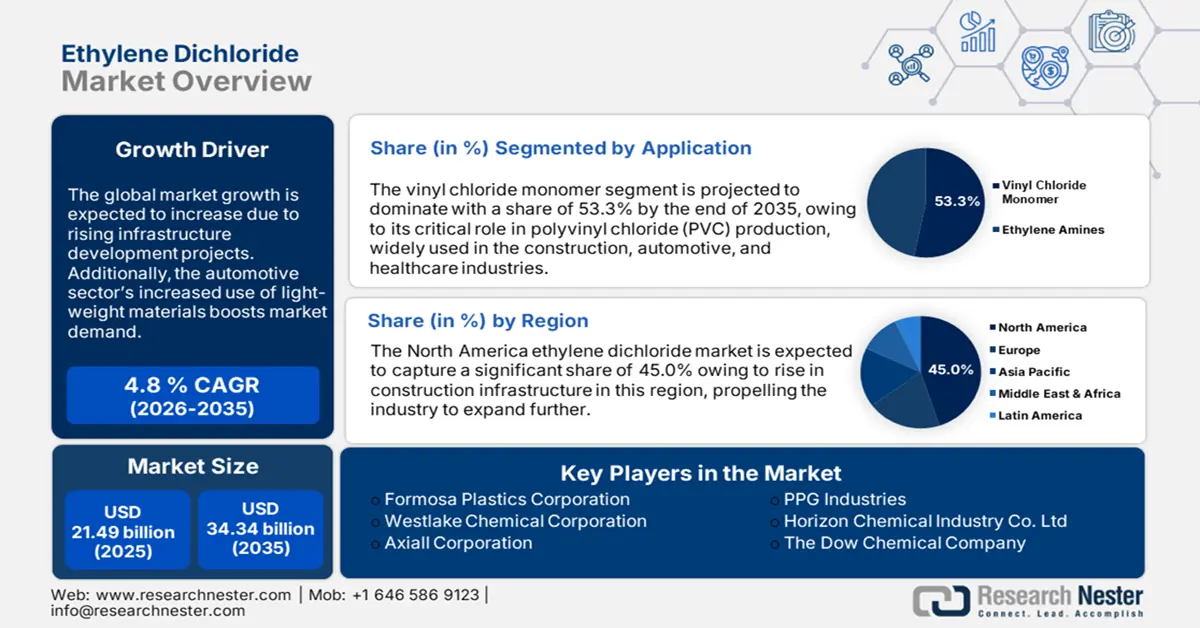

Ethylene Dichloride Market size was valued at USD 21.49 billion in 2025 and is set to exceed USD 34.34 billion by 2035, registering over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylene dichloride is estimated at USD 22.42 billion.

Ethylene dichloride is a key raw material in vinyl chloride monomer and polyvinyl chloride (PVC) production. 1-2-dichloroethane, popularly known as Ethylene dichloride (EDC) is an industrial VSLS, primarily used as a feedstock in the PVC production chain including pipes, fittings, and window profiles. Nolan Sherry and Associates' (NSA) analysis of EDC production comprising an assessment of downstream VCM and PVC products, discusses trade movements and other ethylene dichloride (EDC) market factors.

A detailed 2024 research states that VCM production uses ethylene and acetylene, which uses ethylene dichloride at a rolling ratio of 1.6 units EDC to VCM. The latter approach is widely prevalent in China, which makes the country’s EDC production comparatively modest than other key 115 economies. EDC production occurs at large volume worldwide and accounted for approximately 52,000 Gg in 2020, which was a 29% steep surge between 2002 and 2020. North America, Europe, and South, East and South-East Asia generated over 86% of the total EDC in 2020.

Noting that EDC’s principal industrial-scale end-product i.e. PVC production is 40 million tonnes each year, with a y-o-y growth rate of 3%, indicating a corresponding demand for EDC, says the European Council of Vinyl Manufacturers (ECVM). The annual EDC volume in the U.S. was 12,750 Gg in 2020 and U.S.-Canada collectively surpassed 16500 Gg in the same year. Between 2014 and 2018, import for consumption and general import of EDC in the U.S. were equal, while in 2022 the U.S. emerged as the top exporter of 1,2-dichloroethane, which stood at USD 516 million. Ethylene dichloride is the 1557th most traded commodity out of 4648 products.

Rapid urbanization, particularly in Asia Pacific and Africa, is driving large-scale infrastructure projects, including residential, commercial, and industrial developments. This surge in construction activity is increasing the demand for durable, cost-effective, and versatile PVC-based materials, such as pipes, fittings, and window profiles. As a primary precursor to PVC production, ethylene dichloride benefits directly from this growing demand.

Key Ethylene Dichloride Market Insights Summary:

Regional Highlights:

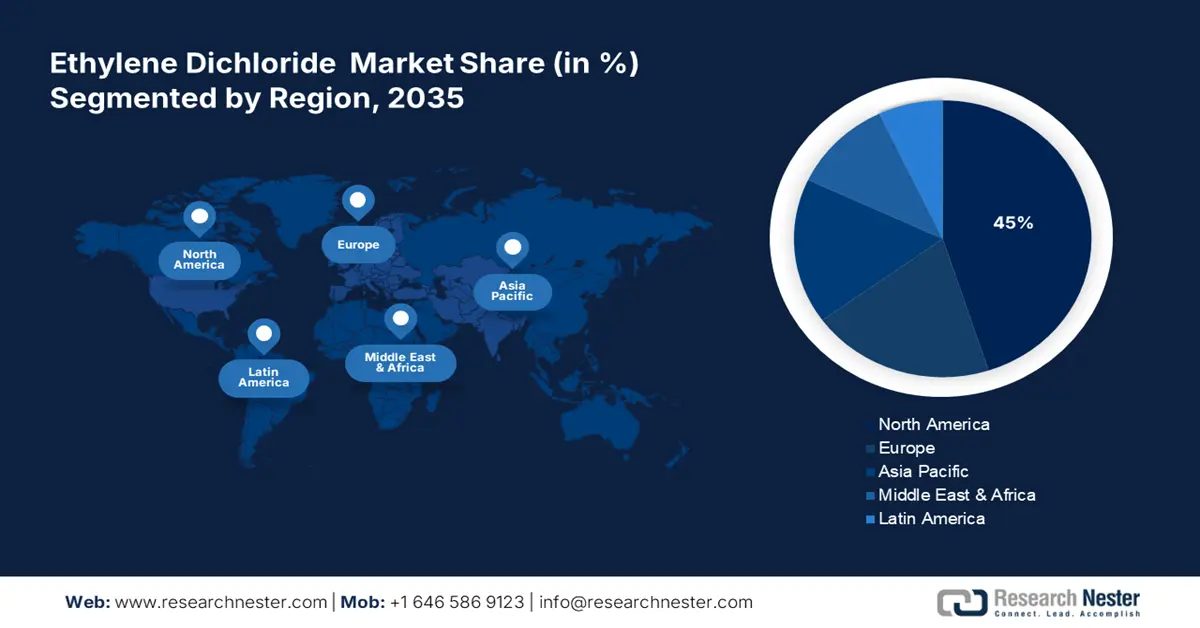

- North America leads the Ethylene Dichloride Market with a 45% share, fueled by rising PVC demand in construction and automotive sectors, ensuring robust growth through 2026–2035.

- Europe's ethylene dichloride market is expected to achieve lucrative growth through 2035, driven by innovation in low-emission technologies and healthcare sector demand.

Segment Insights:

- The Vinyl Chloride Monomer segment of the Ethylene Dichloride Market is anticipated to hold over 53.3% share by 2035, driven by its critical role in PVC production for construction, automotive, and healthcare industries.

Key Growth Trends:

- Diverse end use applications

- Key focus of industry players on market consolidation

Major Challenges:

- Environmental regulations and emission standards

- Competition from alternative materials

- Key Players: Formosa Plastics Corporation, Westlake Chemical Corporation, Axiall Corporation, Occidental Petroleum Corporation.

Global Ethylene Dichloride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.49 billion

- 2026 Market Size: USD 22.42 billion

- Projected Market Size: USD 34.34 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Ethylene Dichloride Market Growth Drivers and Challenges:

Growth Drivers

-

Diverse end use applications: From automotive interiors, where PVC is valued for its durability and aesthetics, to medical IV bags, which require its flexibility and safety, the material’s broad utility spans diverse industries. Approximately 12-17% of the plastics used in the typical car today are made of PVC.PVC’s widespread applications in packaging, construction, and healthcare drive consistent demand, ensuring a sustained for ethylene dichloride market as a critical precursor in PVC production.

-

Key focus of industry players on market consolidation: The ethylene dichloride (EDC) market consolidation involves several strategies to strengthen key player positions, enhance operational efficiencies, and expand regional presence to gain a larger revenue share. Vertical integration of upstream ethylene and chlorine production, and downstream PVC production allows an efficient supply chain management. In June 2021, Abu Dhabi National Oil Company (ADNOC) and Reliance Industries Limited partnered to implement vertical integration of EDC and PVC manufacturing facility in Ruwais, Abu Dhabi. The strategic agreement capitalizes on the industry-wide demand for critical raw materials, by leveraging the respective strengths of both entities.

Challenges

-

Environmental regulations and emission standards: Stricter environmental regulations aimed at reducing greenhouse gas emissions and hazardous by-products during ethylene dichloride production have increased compliance costs. Governments globally are mandating cleaner production technologies, forcing manufacturers to invest in costly upgrades or face penalties, which affects profitability.

-

Competition from alternative materials: The growing preference for alternative materials, such as bioplastics and metals, in certain applications poses a threat to PVC and by extension, ethylene dichloride demand. These alternatives are often marketed as more environmentally friendly, aligning with consumer and regulatory preferences.

Ethylene Dichloride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 21.49 billion |

|

Forecast Year Market Size (2035) |

USD 34.34 billion |

|

Regional Scope |

|

Ethylene Dichloride Market Segmentation:

Application (Vinyl Chloride Monomer, Ethylene Amines)

By the end of 2035, vinyl chloride monomer segment is estimated to account for ethylene dichloride market share of more than 53.3%. The segment’s growth is owing to its critical role in polyvinyl chloride (PVC) production, widely used in the construction, automotive, and healthcare industries. The rising demand for durable, cost-effective, and lightweight materials drives PVC consumption, boosting VM demand. Additionally, advancements in ED production technologies enhance efficiency, supporting VM supply. Emerging economies' infrastructure development and urbanization further fuel this segment’s growth by increasing PV requirements for pipes, windows, and fittings.

End user (Construction, Automotive, Packaging, Furniture, Medical)

By end user, the construction segment is estimated to dominate the ethylene dichloride market. The segment is due to its extensive use in producing polyvinyl chloride (PVC), a key material in pipes, fittings, and building materials. Over 50%of all PVC produced is utilized in buildings for things like plumbing and siding. Rapid urbanization and infrastructure development, particularly in emerging economies, drive demand for durable and cost-effective materials like PVC. Additionally, ED’s role in manufacturing vinyl products, such as windows and flooring, further supports growth. Rising investments in green buildings and smart infrastructure also fuel the segment’s expansion.

Our in-depth analysis of the global ethylene dichloride (EDC) market includes the following segments:

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Dichloride Market Regional Analysis:

North America Market Statistics

North America ethylene dichloride market is estimated to hold revenue share of over 45% by the end of 2035. The construction industry in North America significantly drives EDC demand, as it is a key raw material in polyvinyl chloride production The region’s ongoing infrastructure projects and housing developments require PVC for pipes, windows, and siding, boosting EDC consumption. In the first quarter of 2023, there were over 919,000 construction establishments in the US, thus boosting the ethylene dichloride industry.

The automotive industry’s shift toward lightweight materials to improve fuel efficiency boosts PVC demand for car interiors, wiring insulation, and trim. The U.S. automotive sector’s recovery and the rise of electric vehicles making 12% of total sales as of June 2024, further support ethylene dichloride consumption. Growing emphasis on sustainability drives innovations in PVC recycling and the production of eco-friendly materials. This creates additional demand for ethylene as a key raw material, aligning with regulatory pressures for greener solutions.

Focus on sustainable development encourages the use of recyclable and eco-encourages the use of recyclable and eco-friendly materials in Canada. EDC-derived PVC is integral to green building practices and sustainable packaging, aligning with environmental policies and consumer preferences. In all, 210,668 construction jobs, or 17% of all construction jobs in Canada in 2018, were tied to green buildings. Additionally, innovations in vinyl-based applications, such as healthcare equipment and advanced packaging solutions, drive ethylene dichloride demand. Canada, investment in R&D and adoption of cutting-edge technologies enhance the versatility and appeal of ethylene dichloride market.

Europe Market Analysis

Europe is predicted to generate lucrative revenue from the ethylene dichloride market by the end of 2035. The region has a well-established chemical industry and its focus on innovation contributes to improved ethylene dichloride production processes. Investments in energy-efficient and low-emission technologies ensure the market’s competitiveness and compliance with stringent environmental regulations. The EU's ultimate energy consumption in 2022 was 23.3% higher than the 2030 target and 1.9% lower than the 2020 aim. Moreover, ethylene dichloride is crucial in producing vinyl-based medical products, such as IV bags and tubing. Increasing healthcare investments and demand for high-quality medical supplies drive this segment’s growth in Europe.

Germany automotive industry, particularly its shift toward electric vehicles (EVs). According to the Federal Statistical Office, 88 percent more EVs were produced in 2021 than were in the previous year. is a significant driver. PVC, made using EDC, is essential in lightweight vehicle components, interiors, and wiring, aligning with the industry’s focus on efficiency and innovation.

With increasing e-commerce activities and demand for durable, flexible packaging materials, PVC’s usage is growing. Ethylene's contribution to PVC production supports the expansion of this segment in the UK. Furthermore, the country has a robust chemical manufacturing industry that leverages advanced technologies to enhance the efficiency of ethylene dichloride production. This fosters innovation in downstream applications, ensuring steady ethylene dichloride market growth.

Key Ethylene Dichloride Market Players:

- Olin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Formosa Plastics Corporation

- Westlake Chemical Corporation

- Axiall Corporation

- Occidental Petroleum Corporation

- PPG Industries

- Horizon Chemical Industry Co. Ltd

- The Dow Chemical Company

Key companies are dominating the ethylene dichloride market through vertical integration, ensuring control over feedstock supply like ethylene and chlorine. Their global manufacturing presence enables efficient distribution and resilience against regional disruptions. By leveraging advanced production technologies and investing in R&, these players enhance product quality, reduce costs, and comply with stringent environmental regulations, solidifying their market leadership. Some of the prominent players in the ethylene dichloride (EDC) market include:

Recent Developments

- In December 2024, PPG stated that it had successfully sold American Industrial Partners (AIP), an industrial investor, all of its architectural coatings’ operations in the United States and Canada for a USD 550 million transaction value.

- In January 2023, Olin Corporation and Mitsui & Co., Ltd. announced the establishment of Blue Water Alliance JV, LLP and the start of BWA's operations. In order to give suppliers and customers in the chlor-alkali sector the best and most independent solution for procurement, sales, and logistics.

- Report ID: 6804

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylene Dichloride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.