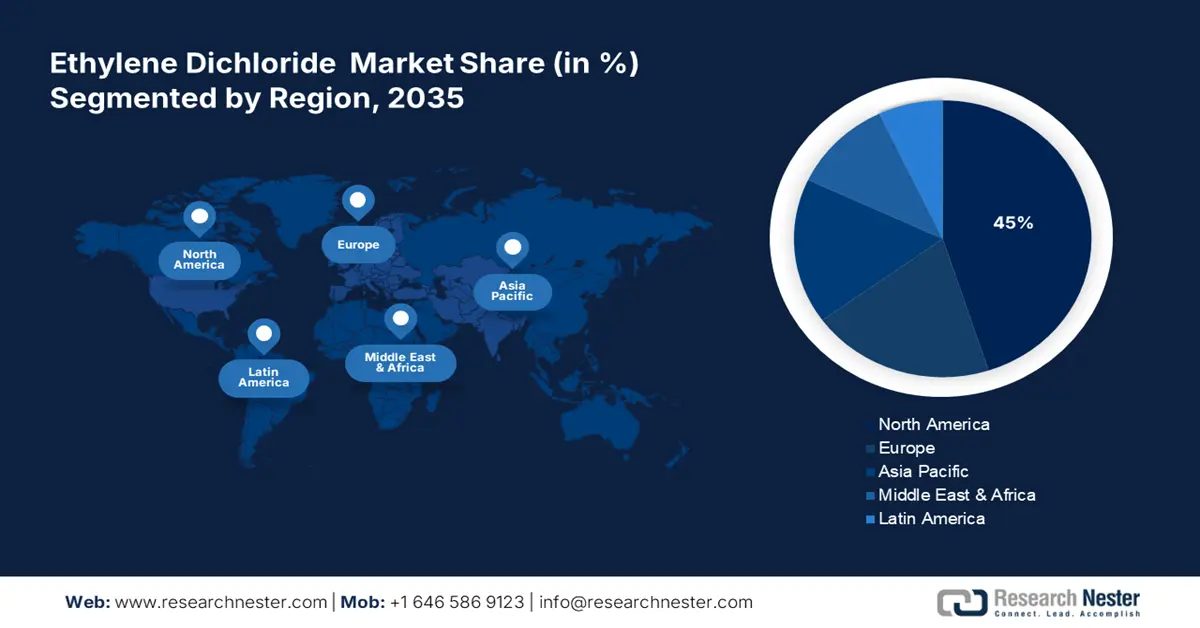

Ethylene Dichloride Market Regional Analysis:

North America Market Statistics

North America ethylene dichloride market is estimated to hold revenue share of over 45% by the end of 2035. The construction industry in North America significantly drives EDC demand, as it is a key raw material in polyvinyl chloride production The region’s ongoing infrastructure projects and housing developments require PVC for pipes, windows, and siding, boosting EDC consumption. In the first quarter of 2023, there were over 919,000 construction establishments in the US, thus boosting the ethylene dichloride industry.

The automotive industry’s shift toward lightweight materials to improve fuel efficiency boosts PVC demand for car interiors, wiring insulation, and trim. The U.S. automotive sector’s recovery and the rise of electric vehicles making 12% of total sales as of June 2024, further support ethylene dichloride consumption. Growing emphasis on sustainability drives innovations in PVC recycling and the production of eco-friendly materials. This creates additional demand for ethylene as a key raw material, aligning with regulatory pressures for greener solutions.

Focus on sustainable development encourages the use of recyclable and eco-encourages the use of recyclable and eco-friendly materials in Canada. EDC-derived PVC is integral to green building practices and sustainable packaging, aligning with environmental policies and consumer preferences. In all, 210,668 construction jobs, or 17% of all construction jobs in Canada in 2018, were tied to green buildings. Additionally, innovations in vinyl-based applications, such as healthcare equipment and advanced packaging solutions, drive ethylene dichloride demand. Canada, investment in R&D and adoption of cutting-edge technologies enhance the versatility and appeal of ethylene dichloride market.

Europe Market Analysis

Europe is predicted to generate lucrative revenue from the ethylene dichloride market by the end of 2035. The region has a well-established chemical industry and its focus on innovation contributes to improved ethylene dichloride production processes. Investments in energy-efficient and low-emission technologies ensure the market’s competitiveness and compliance with stringent environmental regulations. The EU's ultimate energy consumption in 2022 was 23.3% higher than the 2030 target and 1.9% lower than the 2020 aim. Moreover, ethylene dichloride is crucial in producing vinyl-based medical products, such as IV bags and tubing. Increasing healthcare investments and demand for high-quality medical supplies drive this segment’s growth in Europe.

Germany automotive industry, particularly its shift toward electric vehicles (EVs). According to the Federal Statistical Office, 88 percent more EVs were produced in 2021 than were in the previous year. is a significant driver. PVC, made using EDC, is essential in lightweight vehicle components, interiors, and wiring, aligning with the industry’s focus on efficiency and innovation.

With increasing e-commerce activities and demand for durable, flexible packaging materials, PVC’s usage is growing. Ethylene's contribution to PVC production supports the expansion of this segment in the UK. Furthermore, the country has a robust chemical manufacturing industry that leverages advanced technologies to enhance the efficiency of ethylene dichloride production. This fosters innovation in downstream applications, ensuring steady ethylene dichloride market growth.