Ethylene Dichloride Market Outlook:

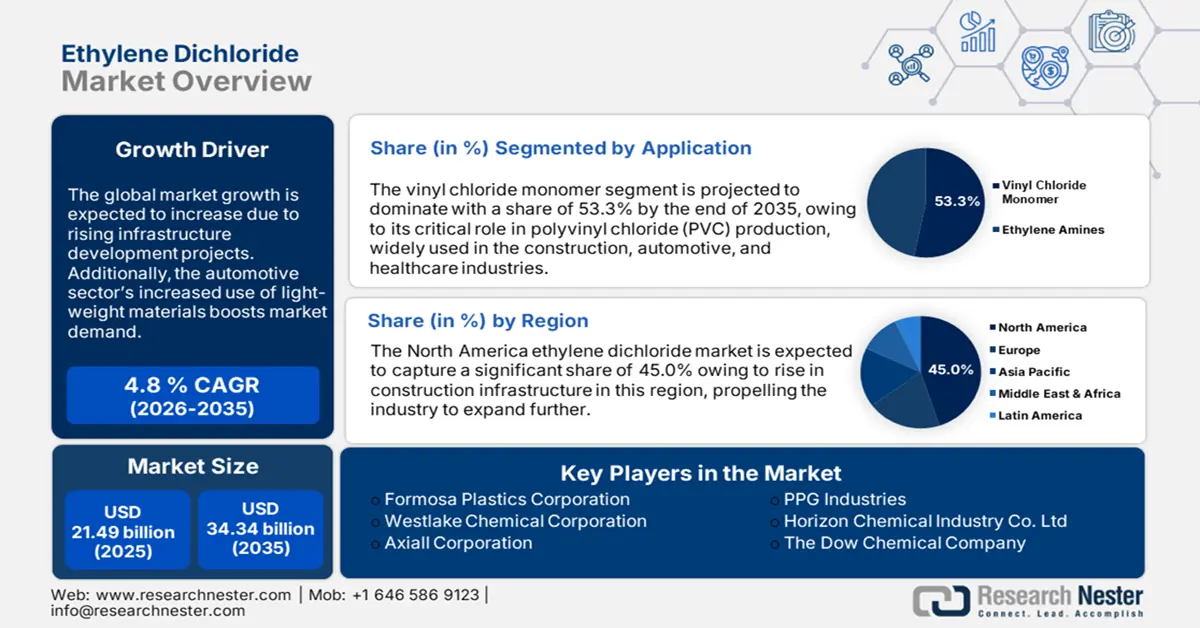

Ethylene Dichloride Market size was valued at USD 21.49 billion in 2025 and is set to exceed USD 34.34 billion by 2035, registering over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylene dichloride is estimated at USD 22.42 billion.

Ethylene dichloride is a key raw material in vinyl chloride monomer and polyvinyl chloride (PVC) production. 1-2-dichloroethane, popularly known as Ethylene dichloride (EDC) is an industrial VSLS, primarily used as a feedstock in the PVC production chain including pipes, fittings, and window profiles. Nolan Sherry and Associates' (NSA) analysis of EDC production comprising an assessment of downstream VCM and PVC products, discusses trade movements and other ethylene dichloride (EDC) market factors.

A detailed 2024 research states that VCM production uses ethylene and acetylene, which uses ethylene dichloride at a rolling ratio of 1.6 units EDC to VCM. The latter approach is widely prevalent in China, which makes the country’s EDC production comparatively modest than other key 115 economies. EDC production occurs at large volume worldwide and accounted for approximately 52,000 Gg in 2020, which was a 29% steep surge between 2002 and 2020. North America, Europe, and South, East and South-East Asia generated over 86% of the total EDC in 2020.

Noting that EDC’s principal industrial-scale end-product i.e. PVC production is 40 million tonnes each year, with a y-o-y growth rate of 3%, indicating a corresponding demand for EDC, says the European Council of Vinyl Manufacturers (ECVM). The annual EDC volume in the U.S. was 12,750 Gg in 2020 and U.S.-Canada collectively surpassed 16500 Gg in the same year. Between 2014 and 2018, import for consumption and general import of EDC in the U.S. were equal, while in 2022 the U.S. emerged as the top exporter of 1,2-dichloroethane, which stood at USD 516 million. Ethylene dichloride is the 1557th most traded commodity out of 4648 products.

Rapid urbanization, particularly in Asia Pacific and Africa, is driving large-scale infrastructure projects, including residential, commercial, and industrial developments. This surge in construction activity is increasing the demand for durable, cost-effective, and versatile PVC-based materials, such as pipes, fittings, and window profiles. As a primary precursor to PVC production, ethylene dichloride benefits directly from this growing demand.