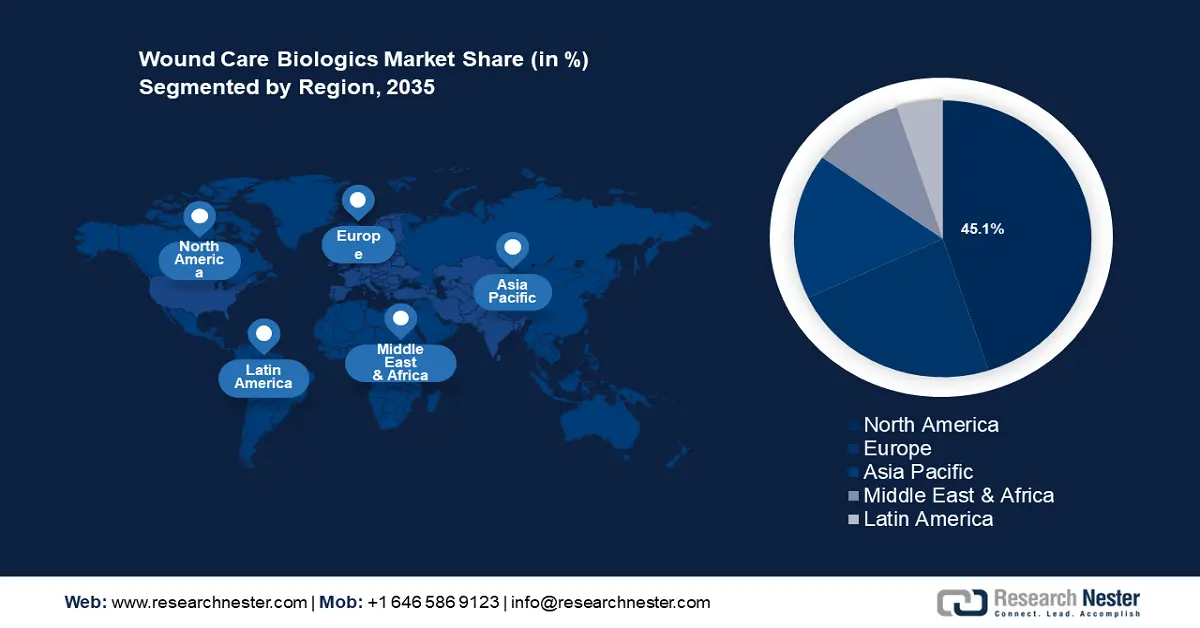

Wound Care Biologics Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 45% by 2035. This rise is poised to be encouraged by a growing number of wound care procedures. As a consequence, wound care biologics are expected to be a growing business, which encompasses topical treatments and skin grafts composed of bioengineered cells. Particularly, in 2022, more than 12,880,540 wound dressing procedures were carried out over North America.

One of the main causes of unintended death in the United States is burns, which is likely to augment market demand for wound care biologics. According to the American Burn Association’s Healthcare Cost and Utilization Project (HCUP) National Inpatient Sample (NIS), there are approximately 30,000 burn admissions per year (weighted estimates), representing 88.5 admissions per million lives per year.

In Canada, the market for wound care biologics is anticipated to expand since the prioritization of wound treatment is becoming more widely recognized among Canadian healthcare institutions.

European Market Insights

The Europe region is estimated to account for the second-largest revenue share in the wound care biologics market through 2035. Majority of European nations now have universal health coverage, making the health care industry one of the fast-growing regions in the world. More than 55% of prescription drug expenditures in the EU are paid for by mandatory or governmental insurance programs.

In Germany, a new wound dressing called Epicite Balance was introduced by JeNaCell in June 2023, an Evonik business, using hydro polymer called biosynthetic cellulose for creative uses in medical devices. he dressing is especially well-suited and adapted for the management of chronic wounds which impact around 1% of people in developed nations, particularly elderly patients.

Also, more than 20% of Italians out of the country's total population are said to suffer from chronic ulcers, leading to market expansion.